Can you delay Medicare Part B without penalty?

If you don’t qualify to delay Part B, you’ll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date.

When do I have to pay the Part B penalty?

Your Initial Enrollment Period ended December 2016. You waited to sign up for Part B until March 2019 during the General Enrollment Period. Your coverage starts July 1, 2019. Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B.

What happens if I don’t sign up for Medicare Part B early?

If you’re new to Medicare and don’t sign up for Part B when you’re first eligible, you may end up having to pay the Part B late enrollment penalty. The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible.

How do I avoid Medicare Part B penalty?

If you don't qualify to delay Part B, you'll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date.

Can you add Medicare Part B at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

Can Medicare Part B be backdated?

This process allows individuals to request immediate or retroactive enrollment into Part B and the elimination of late enrollment penalties from the Social Security Administration (SSA).

Can I add Medicare Part B later?

Once you have signed up to receive Social Security benefits, you can only delay your Part B coverage; you cannot delay your Part A coverage. To delay Part B, you must refuse Part B before your Medicare coverage has started.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What is a special enrollment period for Medicare Part B?

8 monthsWhat is the Medicare Part B special enrollment period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse's current job. You usually have 8 months from when employment ends to enroll in Part B.

Is there a grace period for Medicare premiums?

Under rules issued by the Centers for Medicare and Medicaid Services (CMS), consumers will get a 90-day grace period to pay their outstanding premiums before insurers are permitted to drop their coverage.

Why was my Medicare Part B Cancelled?

Depending on the type of Medicare plan you are enrolled in, you could potentially lose your benefits for a number of reasons, such as: You no longer have a qualifying disability. You fail to pay your plan premiums. You move outside your plan's coverage area.

What is the Part B late enrollment penalty?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

What is the cost of Medicare Part B for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

Does Medicare Part B premium change every year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

How is the Medicare Part B penalty calculated?

The Medicare Part B penalty increases your monthly Medicare Part B premium by 10% for each full 12-month period you did not have creditable coverage. The penalty is based on the standard Medicare Part B premium, regardless of the premium amount you actually pay.

What is the late enrollment penalty for Medicare Part B?

Medicare Part B enrollment is complicated, and the wrong decision can leave you without health coverage for months – and lead to lifetime premium p...

Can I get a Part B penalty waived?

People make Medicare enrollment errors for a variety of reasons, and equitable relief is not available for all of them. If you find yourself withou...

How do I appeal a Medicare Part B penalty?

You’ll want to document as much information as possible about when someone from the government told you not to take Part B. This can include the da...

How long do you have to sign up for Part B?

You may qualify for a Special Enrollment Period when your employer coverage ends if you meet these qualifications. You’ll have eight months to sign up for Part B without penalty.

When do you get Medicare card?

You will be enrolled in Original Medicare (Parts A & B) automatically when you turn 65. You’ll get your Medicare card in the mail. Coverage usually starts the first day of your 65th birthday month.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What to talk to a retiree about Medicare?

Speak with your retiree plan administrator about the benefits and costs of your plan as well as other coverage choices you have once you’re on Medicare.

What percentage of Medicare pays for outpatient care?

Medicare Part B pays 80 percent of outpatient health care costs and 100 percent for many preventive services. But it pays to think carefully about when to sign up. Here’s why. Part B comes with a monthly premium. You could save money if you delay enrollment.

How long does a person pay 10% of Part A premium?

Individual pays an additional 10% of Part A premium each month for 4 years.

When do you get your disability insurance?

Coverage usually starts the first day of the 25th month you receive disability benefits. You may delay Part B and postpone paying the premium if you have other creditable coverage. You’ll be able to sign up for Part B later without penalty, as long as you do it within eight months after your other coverage ends.

How much is the penalty for Medicare Part B?

For each 12-month period you delay enrollment in Medicare Part B, you will have to pay a 10% Part B premium penalty, unless you have insurance based on your or your spouse’s current work (job-based insurance) or are eligible for a Medicare Savings Program (MSP) .

How much is the Part B penalty for 2021?

Since the base Part B premium in 2021 is $148.50, your monthly premium with the penalty will be $252.45 ($148.50 x 0.7 + $148.50). Note: Although your Part B premium amount is based on your income, your penalty is calculated based on the base Part B premium. The penalty is then added to your actual premium amount.

Do you have to pay Medicare premium penalty every month?

In most cases, you will have to pay that penalty every month for as long as you have Medicare. If you are enrolled in Medicare because of a disability and currently pay premium penalties, once you turn 65 you will no longer have to pay the premium penalty.

How Can I Avoid the Medicare Part B Penalty?

If you’re turning 65, you can enroll in Part B during your Initial Enrollment Period. Your IEP begins three months before your birth month and ends three months after your birth month. This means that if your 65th birthday is June 15th, you can enroll between March 1st and September 30th.

How to avoid Medicare Part B late enrollment penalty?

How to Avoid the Medicare Part B Late Enrollment Penalty. The best way to avoid Part B penalties is to plan ahead. You have several Medicare options to choose from, including Original Medicare plus a Medigap Plan. MedicareFAQ can help you through these decisions by answering your questions and helping you prepare for Medicare.

What if I Don’t Sign Up for Part B because I Have Other Health Insurance?

If you have health insurance through your employer, your spouse’s employer, or a union, you can keep your coverage. You won’t have to pay a penalty for waiting to sign up for Part B. But, if you lose your coverage or stop working for that employer, the clock begins to tick.

What happens if you don't sign up for Medicare Part B?

Medicare Part B Late Enrollment Penalty. If you’re new to Medicare and don’t sign up for Part B when you’re first eligible, you may end up having to pay the Part B late enrollment penalty. The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying ...

What is the late enrollment penalty?

The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying it every month for as long as you have Part B.

How long do you have to wait to enroll in Part B?

If you then retire at age 67, you can avoid a penalty by signing up for Part B during your eight-month SEP. If you instead decide to wait until age 70 to enroll, you will pay a 30% penalty every month. 10% for every 12-month period you delayed.

How much is the Part B penalty?

The Part B penalty increases your monthly Part B premium by 10% for each full 12-month period you waited before signing up. The penalty is based on the standard Part B premium, regardless of the premium amount you actually pay.

What is the late enrollment penalty for Medicare Part B?

Part B premiums increase 10 percent for every 12-months you were eligible for Part B but not enrolled. People who delay Part B because they were covered through their own or a spouse’s current job are exempt from this penalty, and can generally enroll in Part B without any delays.

When does the Part B enrollment period start?

They don’t qualify for the Part B Special Enrollment Period and can’t enroll in Part B until the next General Enrollment Period (GEP), which runs from January to March of each year, with Part B coverage beginning that July.

How much does Part B premium increase?

Part B premiums increase 10 percent for every 12-months you were eligible for Part B but not enrolled. People who delay Part B because they were covered through their own or a spouse’s current job are exempt from this penalty, and can generally enroll in Part B without any delays.

What to include when someone tells you not to take Part B?

This can include the date and time of your conversation or phone call, the name of the person you spoke with, and what you did as a result of the information you were given.

Can you get a penalty for delaying Medicare enrollment?

Key takeaways. The penalty for delaying enrollment in Medicare Part B is an increased premium. Beneficiaries can get a Part B penalty waived if their enrollment delay was the result of bad advice from the government. To file an appeal, you’ll need to provide details about the bad advice – including when you received it.

Can you ask to be enrolled in Part B?

You can ask to be enrolled in Part B with a retroactive effective date if bad advice caused you to have a gap in coverage. If you do this, you’ll need to pay Part B premiums for the entire time you want to be enrolled. Alternatively, you can ask to have the Part B penalty waived and just be enrolled going forward.

Can I get a Part B penalty waived?

People make Medicare enrollment errors for a variety of reasons, and equitable relief is not available for all of them.

How long do you have to notify Social Security about Medicare Part B?

If you are covered under an employer group health plan and wish to delay Medicare Part B you should notify Social Security. You also need to make a note to contact Social Security at least 60 days before you plan on leaving your employer group health plan and tell them to begin your Medicare Part B benefits.

Does Medicare cover 80% of medical expenses?

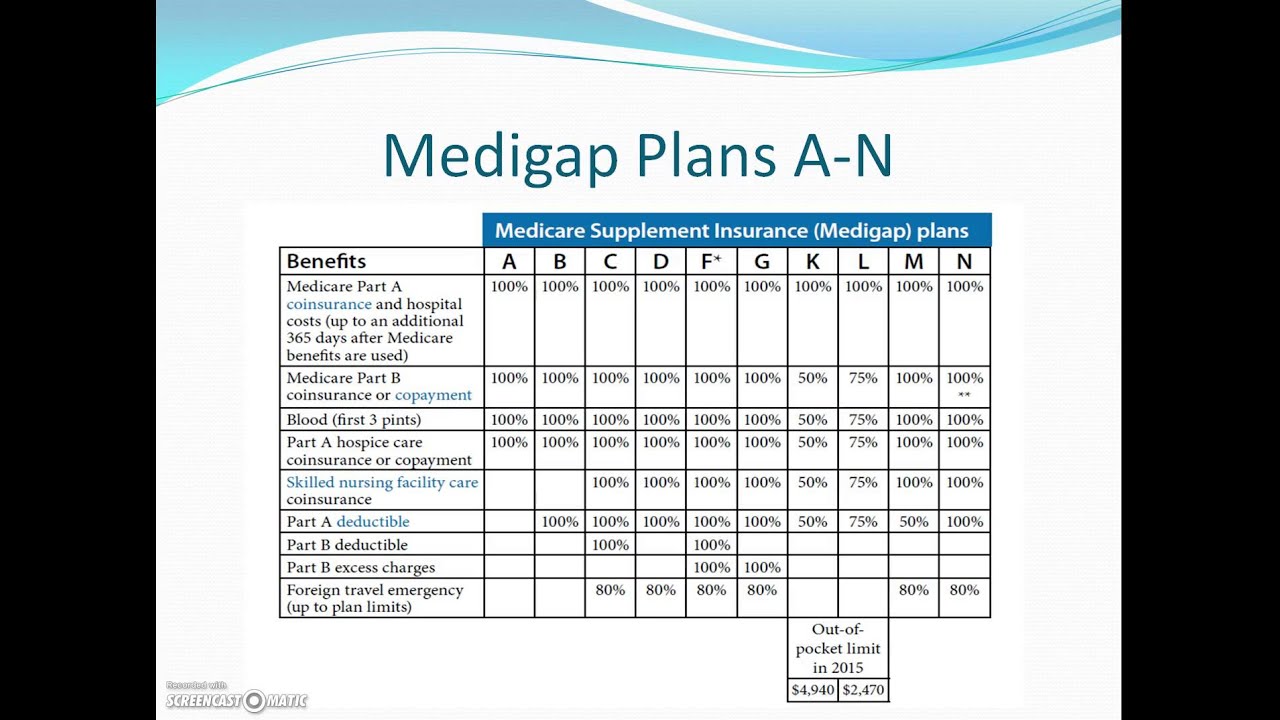

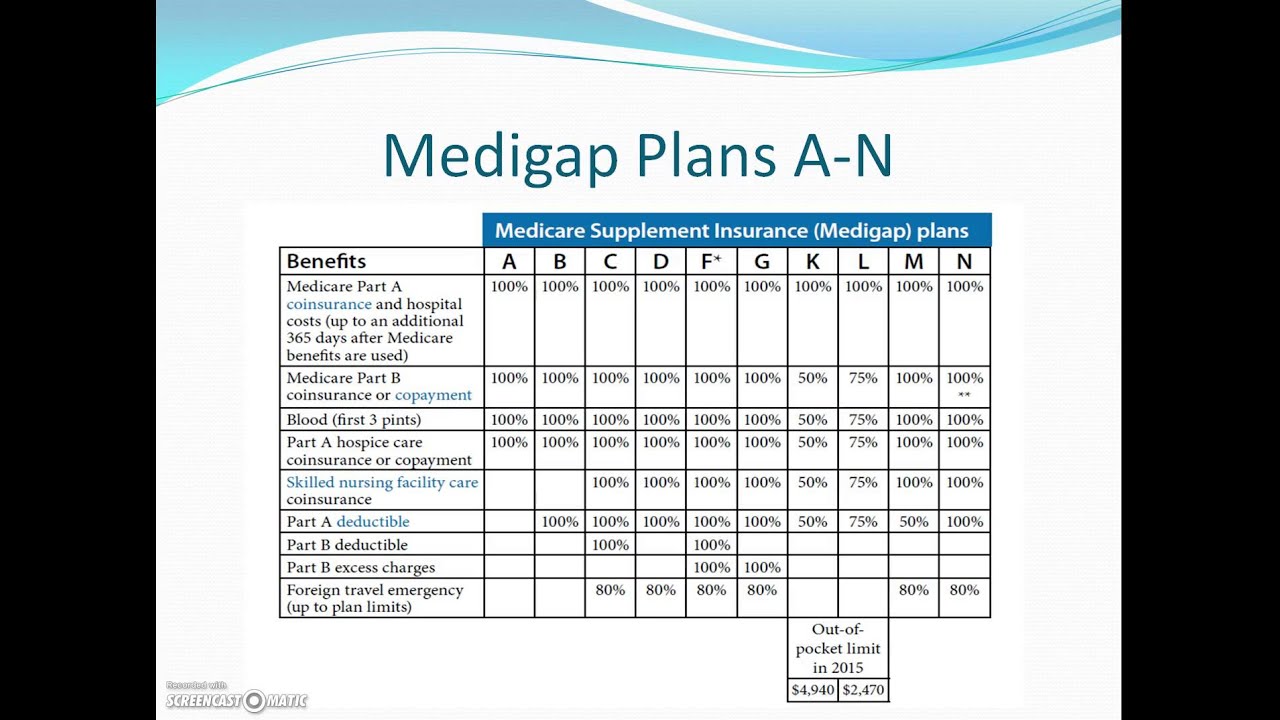

Medicare covers less than 80% of your medical costs and most people will purchase a Medigap plan to fill the holes in Medicare. You must have Medicare Part A and Part B in place before you can purchase a supplement plan.

Is Medicare enrollment automatic at age 65?

For most people, the Medicare enrollment process is automatic. About 3 months before you turn 65 you should receive a “Welcome to Medicare” packet along with your Medicare cards. If you decide to delay Medicare Part B (or Part A) you should contact the Social Security Administration. Delaying Part A means you will also delay receiving Social Security so think twice before postponing your Medicare Part A.

How much is the penalty for a delay in Part B?

The law says that a 10 percent penalty is imposed "for each full 12-month period" that people delay enrolling in Part B when eligible to do so (unless they have group health insurance from their own or their spouse's current employer). If the delay is less than 12 full months, the penalty should not apply.

When does the Part B penalty clock start?

In all these circumstances, the Part B penalty clock starts ticking at the beginning of the month after your IEP expires. If you have individual health insurance the penalty clock starts ticking at the beginning of the month after your IEP expires.

How old do you have to be to sign up for Part B?

You can usually delay signing up for Part B beyond age 65 without risking late penalties if:

How long is a Part B delay?

So the delay is considered to be a full 12 months (April 1 through March 31), and you must pay a 10 percent late penalty on all future Part B premiums.

How long is the IEP enrollment delay?

For you, the enrollment delay was officially seven months (Sept. 1 through March 31), so you won't incur a late penalty. Here's a different example showing how the late penalty can hit. Say your IEP expires at the end of March and you sign up for Part B the following January during the GEP. That's an actual enrollment delay of only 10 months.

What happens if you miss the March 31 deadline?

Missing each March 31 deadline means another full 12-month delay and a further 10 percent late penalty. For example, delaying enrollment by five years results in a 50 percent penalty — in other words, you'd permanently pay half as much again for the same coverage.

When does my IEP expire?

If you turn 65 and are not covered by group insurance provided by an employer for whom you or your spouse is still working: Your deadline comes at the end of your seven-month initial enrollment period (IEP), which expires at the end of the third month following the month in which you turn 65. For example, if your 65th birthday is in July, your IEP ends October 31.

What happens if you don't sign up for Part B?

Also, be aware that if you don’t sign up for Part B during your eight-month window, the late penalty will date from the end of your employer coverage (not from the end of the special enrollment period), said Patricia Barry, author of “Medicare for Dummies.”.

How long does it take to enroll in Medicare if you stop working?

First, once you stop working, you get an eight-month window to enroll or re-enroll. You could face a late-enrollment penalty if you miss it. For each full year that you should have been enrolled but were not, you’ll pay 10% of the monthly Part B base premium.

What happens if you don't follow Medicare guidelines?

And if you don’t follow those guidelines, you might end up paying a price for it. “You could be accruing late-enrollment penalties that last your lifetime,” said Elizabeth Gavino, founder of Lewin & Gavino in New York and an independent broker and general agent for Medicare plans.

How much Medicare will be available in 2026?

For those ages 75 and older, 10.8% are expected to be at jobs in 2026, up from 8.4% in 2016 and 4.6% in 1996. The basic rules for Medicare are that unless you have qualifying insurance elsewhere, you must sign up at age 65 or face late-enrollment penalties. You get a seven-month window to enroll that starts three months before your 65th birthday ...

How long does it take for Medicare to restart?

For those who may cycle in and out of the workforce and therefore in and out of workplace insurance: Each time you lose the coverage, the eight-month window restarts, said a spokesman for the Centers for Medicare and Medicaid Services.

Why do people sign up for Medicare at 65?

While most people sign up for Medicare at age 65 because they either no longer are working or don’t otherwise have qualifying health insurance, the ranks of the over-65 crowd in the workforce have been steadily growing for years. And in some cases, that means employer-based health insurance is an alternative ...

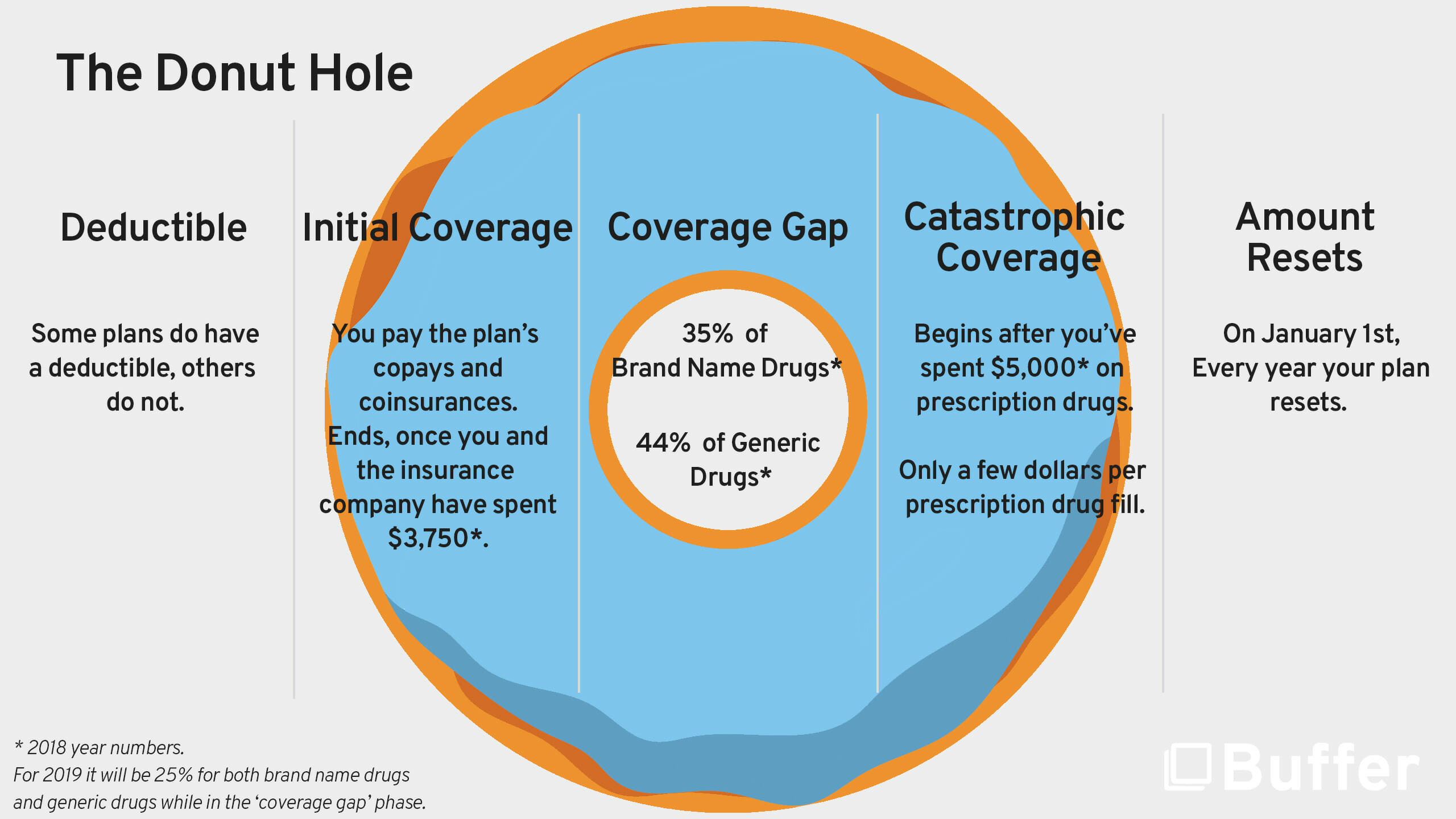

How long do you have to have Part D coverage?

You also must have Part D coverage — whether as a standalone plan or through an Advantage Plan — within two months of your workplace coverage ending, unless you delayed signing up for both Part A and B. If you miss that window, you could face a penalty when you do sign up.

What happens if you don't sign up for Part B?

If you don’t sign up for Part B during this time, or enroll and drop out later on, you’ll incur a late penalty if you do finally enroll in Part B while still under age 65. The late penalty is an additional 10 percent of the Part B premium for each full year that you were without Part B when you were eligible for it.

When do you lose Medicare if you turn 65?

At the end of the month before the month in which you turn 65, you lose your entitlement to Medicare based on disability. At the beginning of the month you turn 65, your entitlement to Medicare based on becoming 65 begins. In other words, you get a second initial enrollment period.