When should I sign up for Medicare Part D?

When to apply for Medicare Part D If you don’t have creditable drug coverage or health insurance from a current employer, the best time to sign up for Part D is during your 7-month initial enrollment period (IEP) to avoid penalties.

How long do I have to choose a part D plan?

In this situation, you have an initial election period to choose a Part D plan that lasts for seven months – the month you turn 65 plus three months on each side of the turning 65 month. After that initial election period, if you have not signed up for a plan, the late enrollment penalty begins (see below for how that penalty is applied).

What happens if you don’t sign up for Medicare Part D?

First and foremost, Medicare has a “late enrollment penalty” for not signing up for Part D when you are first eligible. For many people, this initial eligibility is when you turn 65 and start Medicare.

How long does a Medicare Part D IEP last?

Your Part D IEP is usually the same as your Medicare IEP: the seven-month period that includes the three months before, the month of, and the three months following your 65th birthday. For example, let’s say you turn 65 in May. Your IEP runs from February 1 to August 31.

Is there a grace period for Medicare Part D?

A person enrolled in a Medicare plan may owe a late enrollment penalty if they go without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more after the end of their Initial Enrollment Period for Part D coverage.

Can you enroll in Medicare Part D at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

When should I sign up for Part D coverage?

If you don't have creditable prescription drug coverage, the best time to sign up for a Part D plan is during the seven-month initial enrollment period surrounding your 65th birthday — even if you don't take any daily prescriptions now.

Is it too late to change Medicare Part D plan?

If you are in traditional Medicare, you can switch Part D plans or switch to a Medicare Advantage plan during the Medicare Open Enrollment period that runs from October 15 through December 7; you cannot use the Medicare Advantage Open Enrollment period (from January 1 to March 31) unless you are enrolled in a Medicare ...

How do I avoid Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

Is Medicare Part D optional or mandatory?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don't take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

What is the Part D penalty?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $. 10 and added to your monthly Part D premium.

Can I cancel my Part D plan anytime?

A. You can quit Part D during the annual open enrollment period (which is for enrolling and disenrolling) that runs from October 15 to December 7.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

When does Part D start?

Your IEP runs from February 1 to August 31. The date when your Part D coverage begins depends on when you sign up: Enrolling during the first three months of the IEP means coverage begins the first day of the fourth month.

What happens if you turn 65 and have Medicare?

Are eligible for Extra Help. Note: If you are enrolled in Medicare because of a disability and currently pay a premium penalty, once you turn 65 you will no longer have to pay the penalty.

How long does an IEP last?

Your Part D IEP is usually the same as your Medicare IEP: the seven-month period that includes the three months before, the month of , and the three months following your 65th birthday. For example, let’s say you turn 65 in May. Your IEP runs from February 1 to August 31.

When is the best time to sign up for Part D?

If you don’t have creditable drug coverage or health insurance from a current employer, the best time to sign up for Part D is during your 7-month initial enrollment period (IEP) to avoid penalties. Under your IEP, you have a 7-month window that opens 3 months before you turn 65 and closes at the end of the 3rd month following your birthday month.

What do you need to know before enrolling in a Part D plan?

The most important preparation you can do before finding a Part D plan is recording information about your medications.

How long does an open enrollment period last?

Typically a SEP lasts for 63 days.

How does dosage affect Part D?

Your dosage can affect your final cost or enact certain plan restrictions depending on the Part D plan. The frequency of the medication. The number of pills you take also affects the cost, so double check how often you take your medication and write it down. Once you have these recorded, you’ll be able to compare plans, apples-to-apples.

Is Medicare Part D a good program?

Although Medicare is not without its faults, one thing is clear: Medicare Part D has been a successful program. With nearly 70% of all beneficiaries enrolled in Part D, this optional add-on to Original Medicare is a popular way to lower drug costs. 1. But before diving into the deep end of Part D plans, you’ll want to perform due diligence ...

How long do you have to sign up for a Part D plan?

In this situation, you have two months after the group coverage ends to sign up for a Part D plan.

How long does Medicare Part D last?

In this situation, you have an initial election period to choose a Part D plan that lasts for seven months – the month you turn 65 plus three months on each side of the turning 65 month.

What is the penalty for Medicare Part D late enrollment?

If you wait longer, the penalty will be higher. The penalty is 1% per month that you don’t have a plan.

What is Medicare Part D?

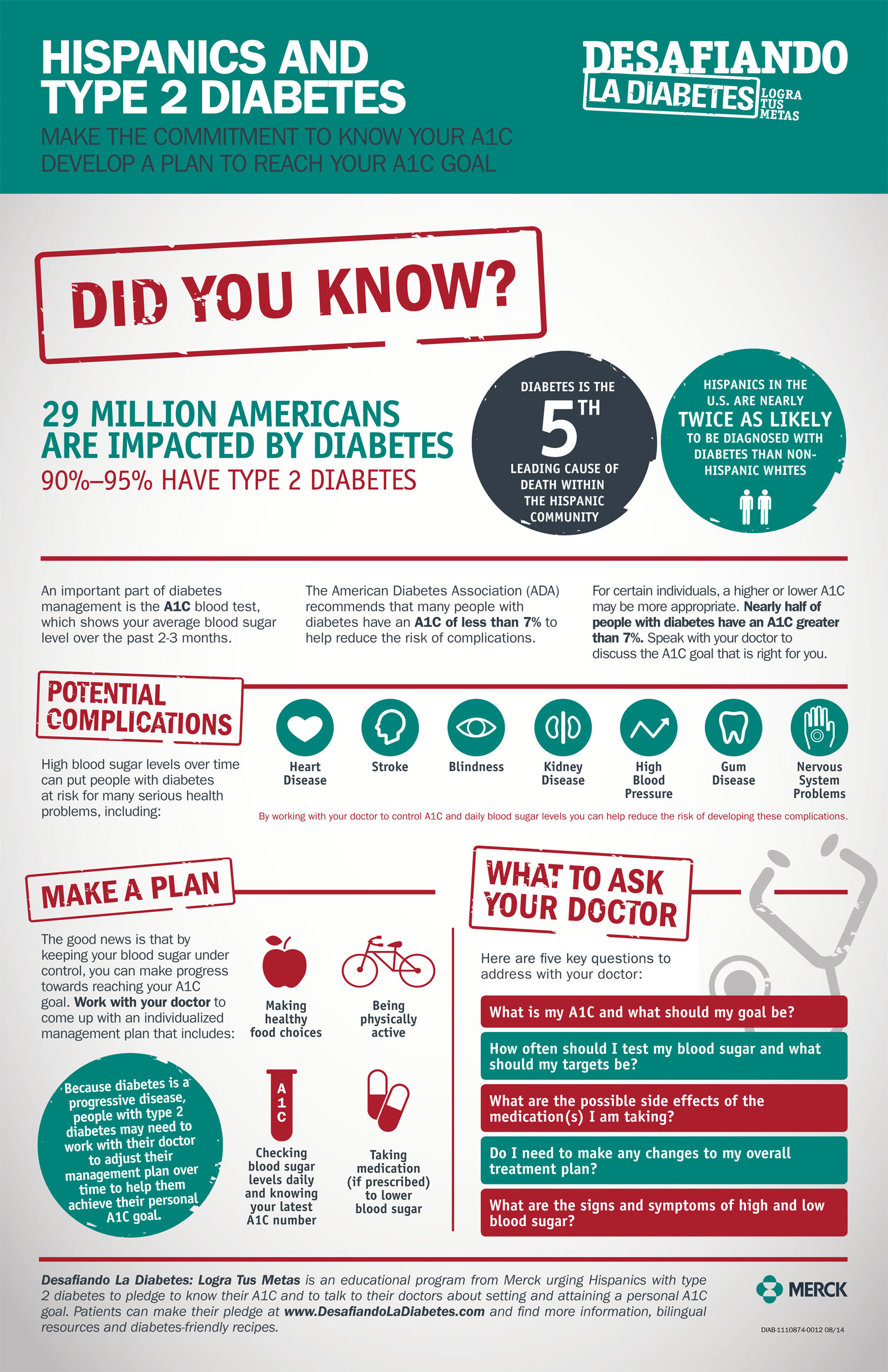

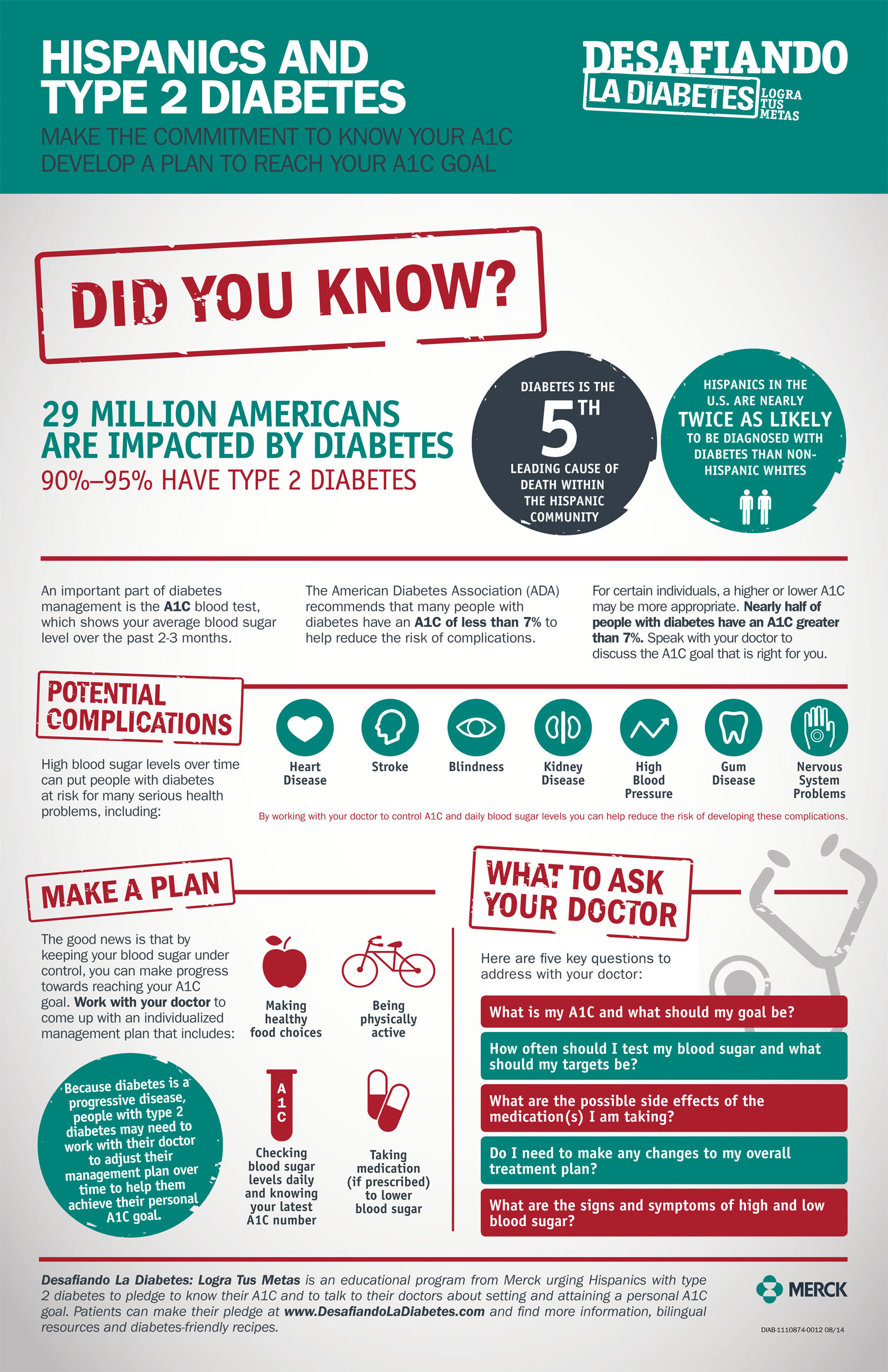

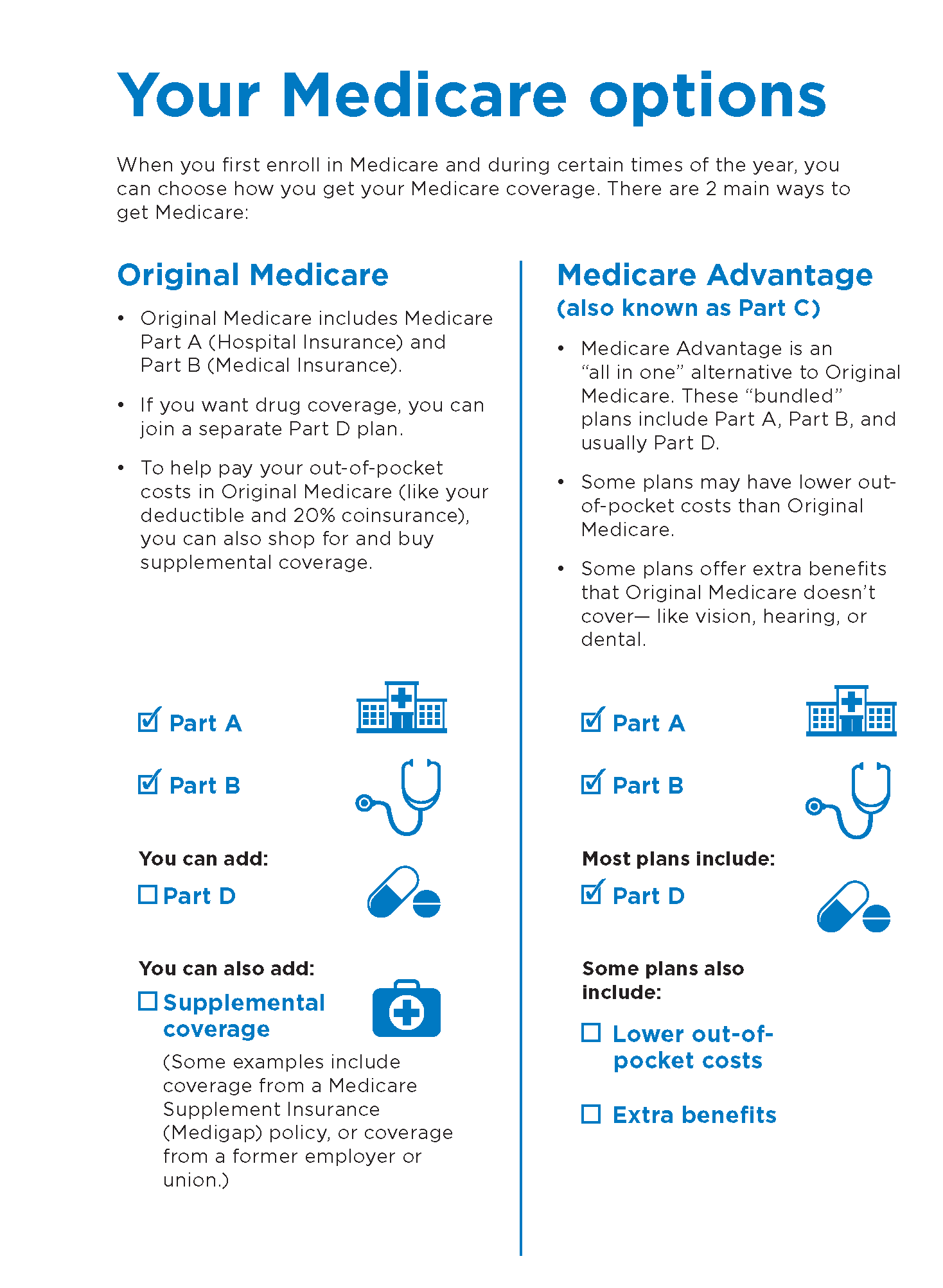

Medicare Part D is the part of Medicare that covers prescription drugs. “Original” Medicare (Part A and Part B) does not provide any coverage for prescription drugs. All prescription drug coverage for Medicare beneficiaries is provided through Medicare Part D ( How to Compare Part D Plans ). So, the question we often get from people turning 65 ...

What happens if you don't sign up for Medicare Part D?

What Are the Implications of Not Signing up for Part D When You Are First Eligible? First and foremost, Medicare has a “late enrollment penalty” for not signing up for Part D when you are first eligible. For many people, this initial eligibility is when you turn 65 and start Medicare. In this situation, you have an initial election period ...

How much is the penalty for not having a Medicare plan?

The penalty is 1% per month that you don’t have a plan. The 1% per month is multiplied by the “national base beneficiary premium” – for 2018, this is $35.02. For example, if you turned 65 in April of 2015, have no other drug coverage, and enrolled in a Part D plan to start 1/1/18, your penalty would start after your initial election period expired ...

How much is Part D insurance?

As you can see in the example above, the Part D penalty can be significant. With Part D premiums (for 2018) starting at around $15 in most states, most people find it beneficial to have at least minimal Part D coverage when they start with Medicare, even if their medication needs are non-existent. If you are someone who does use prescription drugs, ...

How Do I Sign up for Medicare Part D?

Medicare Part D plans are sold by private insurance companies, and plan availability and benefits can vary based on where you live.

When Can I Sign Up for Medicare Part D?

There are three times during which you may be able to sign up for a Medicare Part D plan .

Who Is Eligible for Medicare Part D?

Before enrolling in a Medicare Part D plan, you should check to make sure you are eligible.

How Much Does It Cost for Medicare Part D?

According to data from the Centers for Medicare & Medicaid Services (CMS), the average premium for a standalone Medicare Part D plan (PDP) in 2022 is $48 per month. 1

How do I Apply for Medicare Extra Help?

Some beneficiaries with limited financial resources may qualify for the Medicare Extra Help program. This program helps PDP enrollees pay for their plan premiums, coinsurance, deductibles and prescription costs.

How Else Can You Get Drug Coverage Through Medicare?

A Part D plan is not the only way to secure Medicare coverage for prescription drugs.

Can I Sign Up for Medicare Part D and a Medicare Supplement Plan?

You can have both a Medicare Part D prescription drug plan and a Medicare Supplement Insurance (Medigap) plan at the same time.

How long does it take to enroll in Part D?

This includes three months prior to your 65th birthday, the month of your birthday and then three months after your 65th birthday. Failing to enroll within this time period, also known as the initial enrollment period, means that you may face a late enrollment penalty if you choose to add Part D coverage at a later date.

Why is Medicare important?

Enrolling in Medicare is an important step for many people in protecting their health and their finances as they age. The Medicare program assists millions of seniors and certain individuals with qualifying disabilities, and without Medicare, some Americans would struggle to afford the cost of healthcare and related expenses.