What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

How do you add Part B to Medicare?

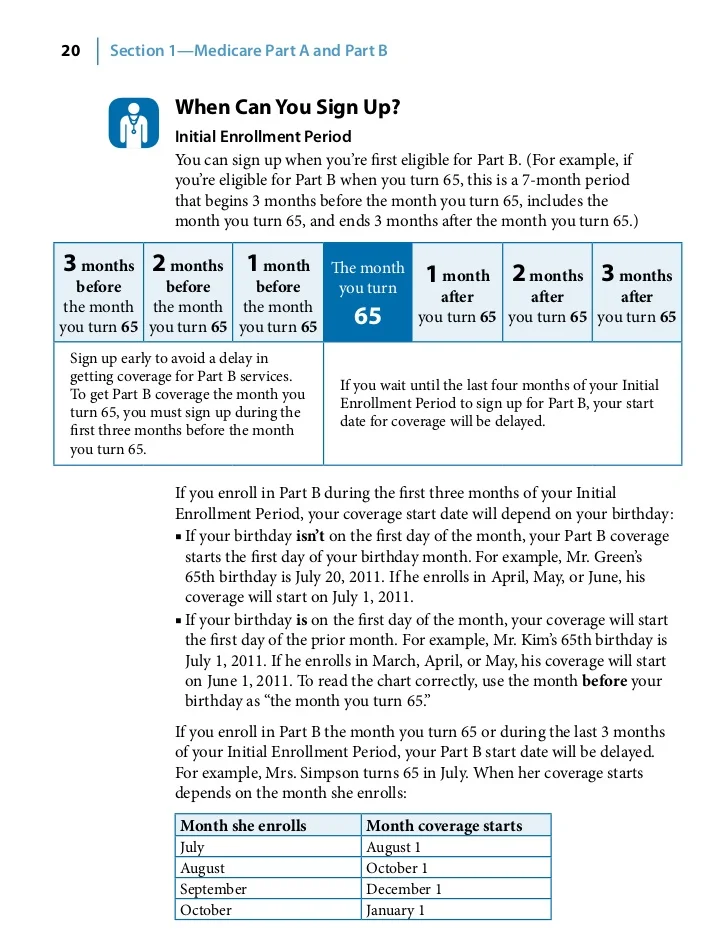

You can sign up for Medicare Part B during the following enrollment periods:

- The Initial Enrollment Period (IEP) for Part B, when you’re first eligible for Medicare. ...

- The General Enrollment Period (GEP), which runs from January 1 to March 31 of each year. ...

- While you’re still covered by the employer or union group health plan

How much does Part B insurance cost?

Part B costs: What you pay 2021: Premium $170.10 each month (or higher depending on your income). The amount can change each year. You’ll pay the premium each month, even if you don’t get any Part B-covered services.

Does Medicaid pay for Part B premium?

Does Medicaid pay for Medicare premiums? Medicaid pays Part A (if any) and Part B premiums. Medicaid pays Medicare deductibles, coinsurance, and copayments for services furnished by Medicare providers for Medicare-covered items and services (even if the Medicaid State Plan payment does not fully pay these charges, the QMB is not liable for them).

How long does it take for Medicare Part B to be approved?

You can also call the Social Security Administration at 1-800-772-1213 or go to your local Social Security office. It takes about 45 to 90 days to receive your acceptance letter after submitting your Medicare application.

Does Medicare Part B have to start on the first of the month?

You will have a Medicare initial enrollment period. If you sign up for Medicare Part A and Part B during the first three months of your initial enrollment period, your coverage will start on the first day of the month you turn 65.

Can Medicare Part B be added at any time?

Special Enrollment Period If you are eligible for the Part B SEP, you can enroll in Medicare without penalty at any time while you have job-based insurance and for eight months after you lose your job-based insurance or you (or your spouse) stop working, whichever comes first.

Can I choose the start date for Medicare Part B?

You can't always pick the date you want to start Part B coverage because the start date depends on what type of enrollment period you sign up in and when during the enrollment period you apply.

How do I add Medicare Part B?

Contact Social Security to sign up for Part B:Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). ... Call 1-800-772-1213. ... Contact your local Social Security office.If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Does Medicare start the month of your birthday?

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.)

Can I delay Medicare Part B if I am still working?

Once you enroll in any part of Medicare, you won't be able to contribute to your HSA. If you would like to continue making contributions to your HSA, you can delay both Part A and Part B until you (or your spouse) stop working or lose that employer coverage.

What is the Part B late enrollment penalty?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Do you have to enroll in Medicare Part B every year?

Do You Need to Renew Medicare Part B every year? As long as you pay the Medicare Part B medical insurance premiums, you'll continue to have the coverage. The premium is subtracted monthly from most people's Social Security payments. If you don't get Social Security, you'll get a bill.

Can Medicare Part B be backdated?

This process allows individuals to request immediate or retroactive enrollment into Part B and the elimination of late enrollment penalties from the Social Security Administration (SSA).

What documents do I need to apply for Medicare?

What documents do I need to enroll in Medicare?your Social Security number.your date and place of birth.your citizenship status.the name and Social Security number of your current spouse and any former spouses.the date and place of any marriages or divorces you've had.More items...

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Exact Answer: Up to 30 days

The Medicare application can be applied to online websites. The application process is quite easy. The process of application will not ask for many documents in major steps. The applicants may not have to sign in any documents while applying for the Medicare part B. The application doesn’t charge any fees (Application fees) from the applicant.

Why It Take This Long To Get Medicare Part B After Applying?

The Medicare application takes time for approval and before that, no one is eligible to enjoy the benefits. There are certain rules, regulations, and procedures to be followed while applying for Medicare part B. If someone has all the information in the favour of the application and satisfies the eligibility criteria.

Conclusion

The time for the medicare part B would be around 30 days. The individuals should know about the enrollment (deadlines). Checking and learning all the eligibility criteria is vital. Avoiding any misrepresentation of information would call for a fair application process.

Exact Answer: Up To 30 Days

The Medicare application can be applied to online websites. The application process is quite easy. The process of application will not ask for many documents in major steps. The applicants may not have to sign in any documents while applying for the Medicare part B. The application doesnt charge any fees from the applicant.

When Does My Coverage Start

When and how you enroll for a Medicare plan impacts when your coverage begins. Your benefits may not start until three months after you apply.

When Will I Receive My Medicare Card

Once enrolled, youll receive a red, white, and blue Medicare card. This provides your Part A and Part B benefits.

Who Qualifies For Medicare Extra Help

You will automatically qualify for Medicare Extra Help if you have Medicare and also meetany of these conditions:

Medicare Part D Costs After Medicare Extra Help By Marital Status

Income up to or at the federal poverty level: $0 deductible, $1.30 copay for generic drugs, and $4.00 copay for brand-name drugs up to the out-of-pocket threshold $0 for either drug type above the out-of-pocket threshold

What Doesnt Medicare Part B Cover

Medicare Part B doesnt cover every possible medical expense. Heres a partial list of what Part B doesnt generally cover.

When Will My Medicare Coverage Start

When you choose to apply for Medicare will affect your effective date.

How long do you have to enroll in Social Security if you are not collecting?

All beneficiaries will have an Initial Enrollment Period for both Part A & Part B. This period begins three months before the month you turn 65th birthday and ends three months after.

How much does Part B cover?

Part B will cover 80% of your medical expenses once you’ve met the annual deductible. You must pay the monthly premium for Part B. Most beneficiaries will pay the standard monthly premium. Those in a higher income bracket will pay more. In 2021, the Part B premium is $148.50 a month. If you receive Social Security, Railroad Retirement Board, ...

What is Medicare Part B 2021?

Updated on April 7, 2021. Medicare Part B is the medical portion of Original Medicare. This includes coverage for services provided by your doctors that are preventive and medically necessary.

What is covered by Part B?

Part B provides coverage for a mixture of outpatient medical services. This includes coverage for preventive vaccines, cancer screenings, annual lab work, and much more. It will cover preventive services in addition to specialist services. Part B even covers services for mental healthcare, durable medical equipment that your doctor finds medically ...

How much is the Part B premium for 2021?

In 2021, the Part B premium is $148.50 a month. If you receive Social Security, Railroad Retirement Board, or Office of Personnel Management benefit payments, your Part B premium will be deducted from your monthly check. Part B has an annual deductible of $203. This deductible can slightly increase each year.

What does Part B cover?

Part B even covers services for mental healthcare, durable medical equipment that your doctor finds medically necessary. Also, Part B will cover some services you receive while in the hospital. This includes surgeries, diagnostic imaging, chemotherapy, and dialysis if you obtain drugs while at the hospital, it will also provide coverage for those.

How much is Part B deductible?

Part B has an annual deductible of $203. This deductible can slightly increase each year. If you don’t receive Social Security, you could get a monthly bill from Medicare. They have an online payment option called Easy Pay for those with a MyMedicare account.

When do you have to take Part B?

You have to take Part B once your or your spouse’s employment ends. Medicare becomes your primary insurer once you stop working, even if you’re still covered by the employer-based plan or COBRA. If you don’t enroll in Part B, your insurer will “claw back” the amount it paid for your care when it finds out.

How long can you delay Part B?

You can delay your Part B effective date up to three months if you enroll while you still have employer-sponsored coverage or within one month after that coverage ends. Otherwise, your Part B coverage will begin the month after you enroll.

What is a SEP for Medicare?

What is the Medicare Part B Special Enrollment Period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse’s current job. You usually have 8 months from when employment ends to enroll in Part B. Coverage that isn’t through a current job – such as COBRA benefits, ...

What is a Part B SEP?

The Part B SEP allows beneficiaries to delay enrollment if they have health coverage through their own or a spouse’s current employer. SEP eligibility depends on three factors. Beneficiaries must submit two forms to get approval for the SEP. Coverage an employer helps you buy on your own won’t qualify you for this SEP.

What to do if your Social Security enrollment is denied?

If your enrollment request is denied, you’ll have the chance to appeal.

How much is the penalty for Part B?

Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers.

What happens if you don't get Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

How long do you have to sign up for Medicare after leaving your job?

Even though you have up to eight months after leaving your job to sign up for Medicare and avoid a penalty, you could face expensive coverage gaps if you're 65 or older and you choose to continue your employer's coverage through COBRA — a federal law that allows you to keep your benefits temporarily — rather than sign up for Medicare. ...

What happens if you don't sign up for Medicare?

If you don't sign up for Medicare when you leave your job, you could end up with big coverage gaps and big bills.

How long do you have to wait to sign up for Medicare?

If you wait more than eight months , you may have to pay a lifetime penalty of 10 percent of the cost of Part B for every 12 months you should have been enrolled in Medicare but were not. You'll also have to wait until the next general enrollment period to sign up for Medicare, which runs from January through March with coverage starting July 1.

When does Medicare become primary?

If you keep your coverage through COBRA, Medicare becomes the primary coverage when you turn 65. This rule also applies to people who work for companies with fewer than 20 employees, with a few exceptions, and those who have retiree health insurance. The rules for coordinating Medicare with COBRA can be confusing because COBRA looks exactly like ...

Is Medicare the same as Cobra?

The rules for coordinating Medicare with COBRA can be confusing because COBRA looks exactly like your employer's health insurance — you can go to the same doctors, the coverage is the same, and any money you've spent toward the deductible for the year still counts. But as soon as you leave your job, Medicare becomes your primary coverage ...

Is Medicare considered primary insurance?

If you're 65 or older and you or your spouse work for a company with 20 or more employees, your job-based insurance is considered your primary coverage, and Medicare is secondary. People 65 or older can get into trouble when they leave their job and continue their employer's coverage through COBRA (Consolidated Omnibus Budget Reconciliation Act), ...

Is Medicare primary or secondary?

But as soon as you leave your job, Medicare becomes your primary coverage and COBRA is secondary. If you haven't signed up for Medicare, you could face expensive coverage gaps. The problem: Even though COBRA coverage looks exactly like your employer's coverage, Medicare rules don't see it that way. As soon as you leave your job ...