How Long Should You Keep Medicare Summary Notices?

- Medicare generally recommends that you keep notices for 1 to 3 years. It’s extremely unusual that Medicare would follow...

- Tax purposes are generally a good index for document retention. In most cases, the IRS can’t audit you after 3 years...

- For your own sake, do what you’re comfortable with. Anything that helps track...

How long should you keep Medicare EOB?

May 30, 2019 · Certainly, they need to be kept while the medical services that are summarized on the forms are in the process of payment by Medicare and supplemental insurance policies. After that, it is your call. One suggestion, storage space permitting, is to save medical payment records for three to six years as you would tax deduction records.

How long can you stay in a hospital with Medicare?

Feb 02, 2022 · How long should you keep your Medicare Summary Notices in your possession? The majority of experts advise keeping your Medicare summary notices for one to three years after they are sent. At the absolute least, you should maintain them until Medicare and supplementary insurance have completed their payments for the medical services specified.

How long to keep Medicare statements after death?

Feb 02, 2022 · How long should you keep your Medicare Summary Notices in your possession? The majority of experts advise keeping your Medicare summary notices for one to three years after they are sent. At the absolute least, you should maintain them until Medicare and supplementary insurance have completed their payments for the medical services specified.

How long do you need to keep Medicare statements?

Dec 13, 2021 · Most experts recommend saving your Medicare summary notices for one to three years. At the very least, you should keep them while the medical services listed are in the process of payment by Medicare and supplemental insurance. How long should you keep medical statements? Medical Bills How long to keep: One to three years.

Do I need to shred Medicare summary notices?

When the time comes to dispose of the hardcopy of your MSN's, treat this information as valuable personal information that needs to be protected. There are unscrupulous people who will steal your identity and use your Medicare information. Please shred your old MSN to protect your identity.Sep 30, 2012

How long should you keep Medicare explanation of benefits?

Unlike medical bills, EOBs should be kept from three to eight years after your procedure, or indefinitely if you have a reoccurring condition.Oct 4, 2019

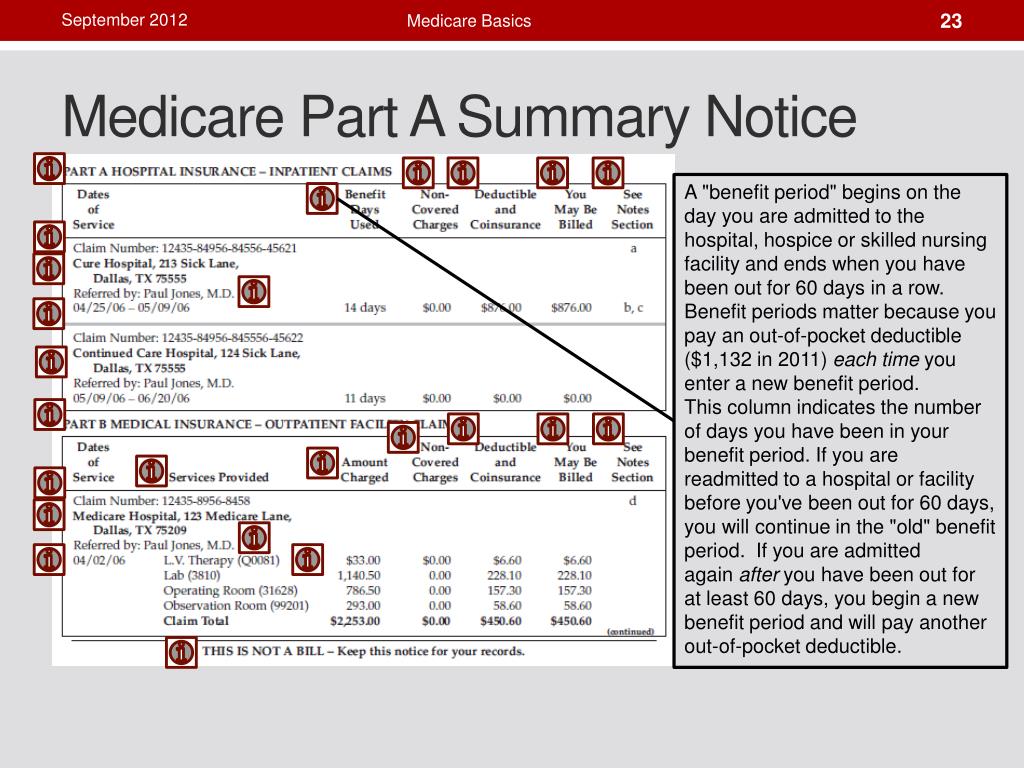

What is a Medicare Summary Notice?

It's a notice that people with Original Medicare get in the mail every 3 months for their Medicare Part A and Part B-covered services. The MSN shows: All your services or supplies that providers and suppliers billed to Medicare during the 3-month period. What Medicare paid. The maximum amount you may owe the provider.

Can I see my Medicare Summary Notice Online?

Log into (or create) your Medicare account. Select "Get your Medicare Summary Notices (MSNs) electronically" under the "My messages" section at the top of your account homepage.

What do you need to keep for 7 years?

Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return. Keep records indefinitely if you do not file a return.Feb 25, 2022

How long should you keep monthly statements and bills?

Key TakeawaysMost bank statements should be kept accessible in hard copy or electronic form for one year, after which they can be shredded.Anything tax-related such as proof of charitable donations should be kept for at least three years.More items...

Does Medicare send a year end statement?

A Medicare benefit tax statement is mailed each year between December and January. It shows Medicare Part A as qualifying healthcare coverage, meaning Part A meets the Affordable Care Act rules for health insurance.Aug 31, 2020

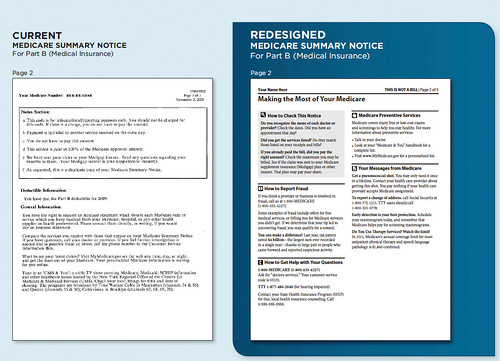

Can you go paperless with Medicare?

Medicare has been improving its paperless billing options, and you can now choose to receive your Medicare Summary Notices and the Medicare & You handbook electronically.

What is a valid Medicare statement?

A Medicare Summary Notice (MSN) is the statement that shows all the services or supplies billed to Medicare on your account, how much of the bill Medicare paid and how much you still owe the provider or supplier.

Does Medicare have a yearly deductible?

Medicare deductibles are reset each year and the dollar amount may be subject to change. Both Medicare Parts A and B have deductibles that must be met before Medicare starts paying. Medicare Advantage, Medigap and Part D plans are all sold by private insurance companies that set their own deductibles.

Do I have a deductible with Medicare?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

How do I get a copy of my Medicare statement?

If you have lost your MSN or you need a duplicate copy, call 1-800-MEDICARE or go to your account on www.mymedicare.gov.

What Is a Medicare Summary Notice?

A Medicare summary notice is a letter that people with Original Medicare receive every three months. This is a claims statement, not a bill.

Why Understanding Your Medicare Statement is Important

Your Medicare summary notice can help you monitor your out-of-pocket costs and ensure you were properly billed for the services you received.

The Different Parts of a Medicare Summary Notice

You’ll receive a Medicare summary notice for both Part A and Part B. Each page contains specific information.

How to Request a Medicare Summary Notice

You will automatically receive your Medicare summary notice in the mail every three months. You do not need to request it.