Will Medicare pay for a nursing home stay?

Patrick Hanis. In order for a nursing home stay to be covered by Medicare, you must enter a Medicare-approved "skilled nursing facility" or nursing home within 30 days of a hospital stay that lasted at least three days. The care in the nursing home must be for the same condition as the hospital stay.

How long does Medicare pay for skilled nursing facility care?

Medicare pays up to 100 days of skilled nursing facility (SNF) care each benefit period in a skilled nursing facility. If you require skilled nursing facility care for more than 100 days within a benefit period, you will be required to pay out of pocket.

How long can you stay in a nursing home on Medicaid?

Medicaid can help cover memory care units and nursing home stays beyond 100 days, though. Can older people rely on Medicare to cover nursing home costs? No, older adults should not rely on Medicare to cover nursing home costs.

How long does Medicare pay for inpatient rehab?

Medicare pays inpatient rehabilitation at a skilled nursing facility (commonly known as an SNF) for up to 100 days if the patient meets certain criteria. How Long Does Medicare pay for rehab?

Does Medicare pay for the first 30 days in a nursing home?

If you're enrolled in original Medicare, it can pay a portion of the cost for up to 100 days in a skilled nursing facility. You must be admitted to the skilled nursing facility within 30 days of leaving the hospital and for the same illness or injury or a condition related to it.

What is the 100 day rule for Medicare?

Medicare pays for post care for 100 days per hospital case (stay). You must be ADMITTED into the hospital and stay for three midnights to qualify for the 100 days of paid insurance. Medicare pays 100% of the bill for the first 20 days.

How many days will Medicare pay 100% of the covered costs of care in a skilled nursing care facility?

Medicare covers up to 100 days of care in a skilled nursing facility (SNF) for each benefit period if all of Medicare's requirements are met, including your need of daily skilled nursing care with 3 days of prior hospitalization. Medicare pays 100% of the first 20 days of a covered SNF stay.

What is the average time a person stays in a nursing home?

Across the board, the average stay in a nursing home is 835 days, according to the National Care Planning Council. (For residents who have been discharged- which includes those who received short-term rehab care- the average stay in a nursing home is 270 days, or 8.9 months.)

What happens when you run out of Medicare days?

For days 21–100, Medicare pays all but a daily coinsurance for covered services. You pay a daily coinsurance. For days beyond 100, Medicare pays nothing. You pay the full cost for covered services.

What will Medicare not pay for?

Generally, Original Medicare does not cover dental work and routine vision or hearing care. Original Medicare won't pay for routine dental care, visits, cleanings, fillings dentures or most tooth extractions. The same holds true for routine vision checks. Eyeglasses and contact lenses aren't generally covered.

Can Medicare benefits be exhausted?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

What can a nursing home take for payment?

We will take into account most of the money you have coming in, including:state retirement pension.income support.pension credit.other social security benefits.pension from a former employer.attendance allowance, disability living allowance (care component)personal independence payment (daily living component)

What is the 3 day rule for Medicare?

The 3-day rule requires the patient have a medically necessary 3-consecutive-day inpatient hospital stay. The 3-consecutive-day count doesn't include the discharge day or pre-admission time spent in the Emergency Room (ER) or outpatient observation.

What is the average age of a patient client in a long-term care facility?

About 91 percent were 65 years and older, and 46 percent were 85 years and older.

What is the leading cause of death in nursing homes?

Pneumonia and related lower respiratory tract infections are the leading cause of death among nursing home residents. This is also a big reason behind transfers to the hospital.

What are the 3 most common complaints about nursing homes?

What Are the Three Most Common Complaints About Nursing Homes?Slow Response Times. By far, the most common complaint in many nursing homes is that staff members are slow to respond to the needs of residents. ... Poor Quality Food. ... Social Isolation. ... When Complaints Turn into a Dangerous Situation.

How long does Medicare pay for nursing home care?

If a patient has been in the hospital for three days, then enters a nursing home, Medicare will pay for this care. During the first 20 days a person is in a nursing home, care is paid 100%. The following 80 days will be partially paid, but there is a $ 157.50 co-pay each day.

How much does it cost to go to a nursing home after Medicare ends?

Nursing home care can easily cost over $450 a day. If rehabilitation is involved, it can be even more expensive.

What to do if you don't have a medicap policy?

Make sure to have a supplemental insurance policy, also known as a “Medigap” policy, in place and to encourage any loved one who is in rehab to continue as much as possible. If you don’t have one of these policies, make sure to see an elder law attorney as soon as possible to find out what you can do to sign up for one.

Does Medicare cover supplemental insurance?

However, there is a catch. Medicare only pays if the patient meets certain guidelines in regard to rehabilitation.

How long does it take to transfer assets to Medicaid?

The transfer of assets must have occurred at least five years before applying to Medicaid in order to avoid the program's lookback period.

What age can you transfer Medicaid?

Arrangements that are allowed include transfers to: 13 . Spouse of the applicant. A child under the age of 21. A child who is permanently disabled or blind. An adult child who has been living in the home and provided care to the patient for at least two years prior to the application for Medicaid.

What is Medicaid?

Medicaid is a federal program administered at the state level that's designed to provide medical care assistance for low-income individuals and families and people with disabilities. Medicaid is separate from Medicare, which is a federal program that pays certain healthcare expenses for individuals ages 65 and older.

What is a Medicaid lookback period?

The Medicaid lookback period is a period of time (typically five years) in which any transfers of assets to family members may be subject to scrutiny for Medicaid eligibility. If it's determined that you specifically transferred assets during the lookback period in order to qualify for Medicaid, this can affect the benefits for which you're eligible.

What is Medicaid for seniors?

Medicaid is for individuals and families living on a limited income; many seniors use it to pay for long-term care in nursing homes.

How much does Medicare pay for 2020?

For the next 100 days, Medicare covers most of the charges, but patients must pay $176.00 per day (in 2020) unless they have a supplemental insurance policy. 3 . These rules apply to traditional Medicare. People on Medicare Advantage plans likely have different benefits 4 5 .

When was medicaid created?

Medicaid was created in 1965 as a social healthcare program to help people with low incomes receive medical attention. 1 Many seniors rely on Medicaid to pay for long-term nursing home care. “Most people pay out of their own pockets for long-term care until they become eligible for Medicaid.

Original Medicare and Nursing Home Benefits

In Your Guide to Choosing a Nursing Home or Other Long-Term Services & Supports, the Centers for Medicare & Medicaid Services (CMS) says that if you have Original Medicare, a majority of your nursing home care expenses will not be covered.

Nursing Home Costs with Medicare

With Original Medicare, your expected costs related to skilled nursing home care depend largely upon how long you need the care.

Medicare Advantage Nursing Home Benefits

If you have Medicare Advantage—also known as Medicare Part C—or any other type of Medicare-approved health insurance plan, the CMS says that the individual plan dictates whether any nursing home care coverage is provided and, if so, to what extent.

Medicare Prescription Drug Coverage and Nursing Home Care

When in a skilled nursing facility that is Medicare approved, prescription drug coverage is typically provided via Medicare Part A, according to the CMS.

Other Nursing Home Coverage Options

There are a few additional ways to get help with growing nursing home costs beyond the limited expenses Medicare agrees to pay.

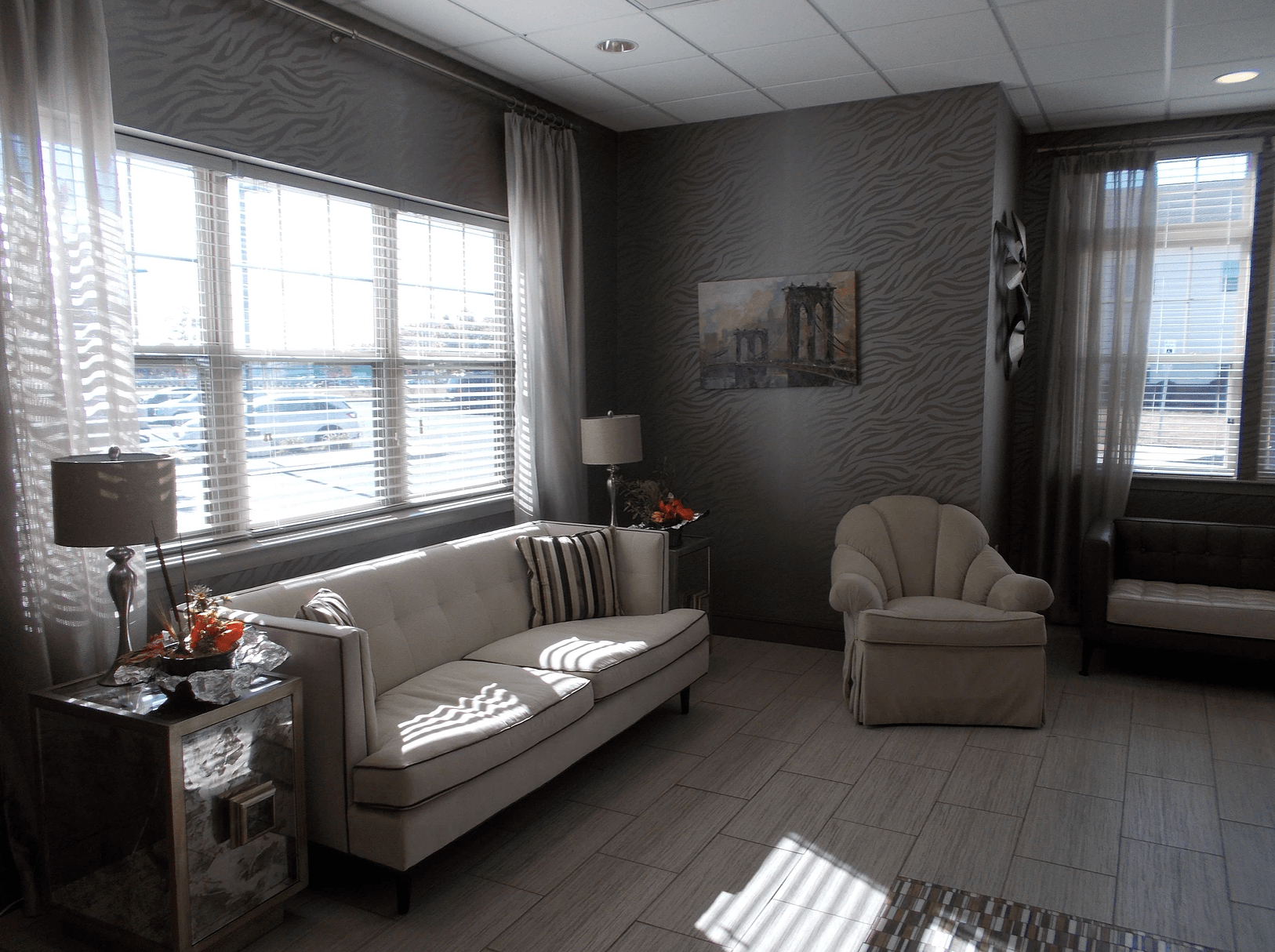

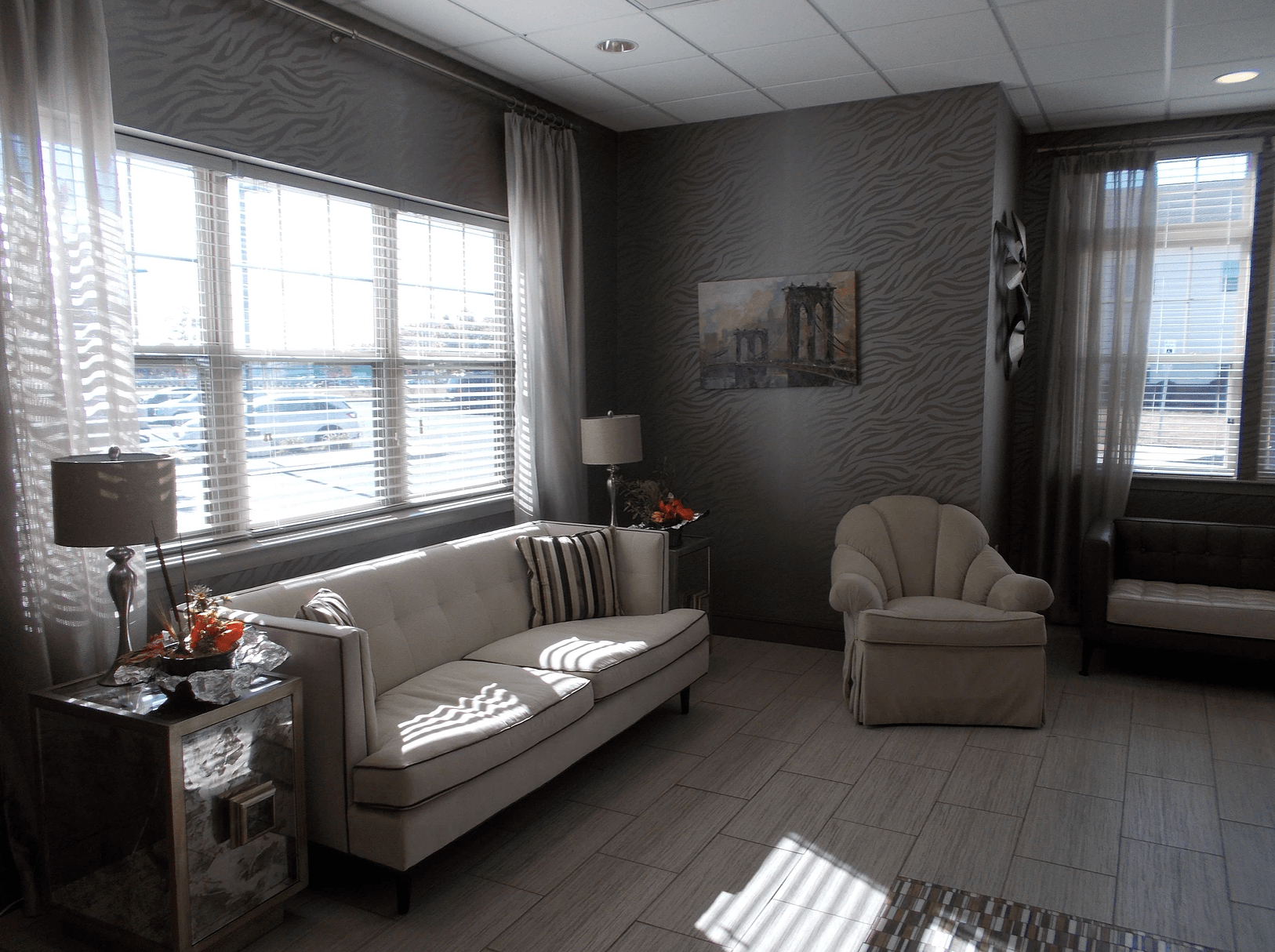

Finding the Right Nursing Home for You

To find and compare Medicare-certified nursing homes in your area, Medicare.gov offers an online search based on where you live.