Full Answer

When does Medicare start paying for inpatient care?

After you pay this amount, Medicare starts covering the costs. Days 1 through 60. For the first 60 days that you’re an inpatient, you’ll pay $0 coinsurance during this benefit period. Days 61 through 90. During this period, you’ll pay a $371 daily coinsurance cost for your care.

How long does Medicare pay for rehab?

When you enter a skilled nursing facility, your stay (including any rehab services) will typically be covered in full for the first 20 days of each benefit period (after you meet your Medicare Part A deductible).

How does Medicare benefit period work?

A benefit period begins the day you are admitted to the hospital. Once you have reached the deductible, Medicare will then cover your stay in full for the first 60 days. You could potentially experience more than one benefit period in a year.

What happens when you use up your 60 days of Medicare?

Once you use up your 60 days, you’ll be responsible for all costs associated with inpatient stays that last longer than 90 days. An estimated 40 percent of people with Medicare require post-acute care after a hospital stay – for example, at a skilled nursing facility.

What happens when your Medicare runs out?

For days 21–100, Medicare pays all but a daily coinsurance for covered services. You pay a daily coinsurance. For days beyond 100, Medicare pays nothing. You pay the full cost for covered services.

How Long Will Medicare cover?

You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

What is the 100 day rule for Medicare?

Medicare pays for post care for 100 days per hospital case (stay). You must be ADMITTED into the hospital and stay for three midnights to qualify for the 100 days of paid insurance. Medicare pays 100% of the bill for the first 20 days.

How many days will Medicare pay 100% of the covered costs of care in a skilled nursing care facility?

20 daysSkilled Nursing Facility (SNF) Care Medicare pays 100% of the first 20 days of a covered SNF stay. A copayment of $194.50 per day (in 2022) is required for days 21-100 if Medicare approves your stay.

Does Medicare run out?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

Can I lose my Medicare benefits?

Summary: In most cases, you won't lose your Medicare eligibility. But if you move out of the country, or if you qualify for Medicare by disability or health problem, you could lose your Medicare eligibility.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What are lifetime reserve days in Medicare?

Original Medicare covers up to 90 days of inpatient hospital care each benefit period. You also have an additional 60 days of coverage, called lifetime reserve days. These 60 days can be used only once, and you will pay a coinsurance for each one ($778 per day in 2022).

Does Medicare cover ICU costs?

(Medicare will pay for a private room only if it is "medically necessary.") all meals. regular nursing services. operating room, intensive care unit, or coronary care unit charges.

What is the 3 day rule for Medicare?

The 3-day rule requires the patient have a medically necessary 3-consecutive-day inpatient hospital stay. The 3-consecutive-day count doesn't include the discharge day or pre-admission time spent in the Emergency Room (ER) or outpatient observation.

Does Medicare pay for the first 30 days in a nursing home?

If you're enrolled in original Medicare, it can pay a portion of the cost for up to 100 days in a skilled nursing facility. You must be admitted to the skilled nursing facility within 30 days of leaving the hospital and for the same illness or injury or a condition related to it.

What can a nursing home take for payment?

We will take into account most of the money you have coming in, including:state retirement pension.income support.pension credit.other social security benefits.pension from a former employer.attendance allowance, disability living allowance (care component)personal independence payment (daily living component)

Does Medicare Cover Hospice?

Yes, Medicare will cover hospice, if you meet qualifications to receive the benefits. These include:

How Long Will Medicare Pay for Hospice?

Hospice care is for patients who have a life expectancy of six months or less given the current progression of their illness. Typically, Medicare’s initial hospice benefit is broken down into two 90-day benefit periods. If hospice care is still needed after six months, patients can be re-certified for an unlimited number of 60-day benefits.

Does Medicare pay for hospice in a skilled nursing facility?

Yes, it will. However, it’s important to remember that Medicare does not cover room and board associated with living full-time in a skilled nursing facility or nursing home.

How Can I Maximize My Medicare Benefits?

There are several things you must know to help you maximize your Medicare benefits. These include:

Lower Cape Fear LifeCare Never Refuses Care Based on Ability to Pay

As a non-profit hospice, we understand the difference that proper care can make in the lives of our patients and their families. That’s why Lower Cape Fear LifeCare never refuses anyone care, regardless of their ability to pay.

How long does a person have to be on Medicare to get hospice?

Medicare recipients who have Original Medicare Part A, are eligible for the hospice benefit if they have certification from their physician that their life expectancy is no more than six months. Patients must also sign a statement saying they choose hospice care rather than curative treatment for their illness.

How long does hospice care last?

After the initial six-month period, hospice care can continue if the medical director, or a doctor of the hospice facility, re-certifies that the patient is terminally ill. Medicare gives coverage for hospice care in benefit periods. Initially, a patient can receive hospice care for two 90-day benefit periods.

How much does hospice cost?

The final cost depends on the level of care that is necessary. At home care usually runs around $150.00 per day, and general inpatient care is about $500.00 per day.

When was hospice first created?

Since 1967 when modern hospice care was first created, it has provided comfort and an improved quality of life for people who are facing the final phase of a life-limiting illness. For those who are no longer seeking curative treatment, hospice care provides pain and symptom relief, as well as emotional and spiritual support for ...

Can you decline hospice care?

It is also possible for patients to decline the hospice benefit after care has begun but have the right to sign up for it again at any time . If a beneficiary has a Medicare Advantage plan, hospice care is covered by Original Medicare insurance Part A and there may be additional benefits which depend on what the individual policy offers.

Does Medicare cover hospice care?

In the United States, the Medicare provides coverage for hospice care that takes place at an inpatient facility or in the patient’s home. If you, a family member, or someone in your care is facing a terminal prognosis, you will need information on hospice care and your Medicare coverage. Medicare Coverage for Hospice Care.

Can hospice care be terminated?

Basically, patients have the right to terminate hospice care at any time. If it is terminated, they sign a form declaring the date the care ends. If you, or someone you love is coping with a terminal illness, having all the essential information about hospice care will help relieve some of the stress.

How much does Medicare pay for rehab?

After you meet your deductible, Medicare can pay 100% of the cost for your first 60 days of care, followed by a 30-day period in which you are charged a $341 co-payment for each day of treatment.

How long does Medicare rehab last?

Standard Medicare rehab benefits run out after 90 days per benefit period. If you recover sufficiently to go home, but you need rehab again in the next benefit period, the clock starts over again and your services are billed in the same way they were the first time you went into rehab. If your stay in rehab is continuous, ...

How much is Medicare deductible for 2021?

In 2021, this amounts to $1,484 that has to be paid before your Medicare benefits kick in for any inpatient care you get. Fortunately, Medicare treats your initial hospitalization as part ...

How long can you stay in rehab?

You can apply these to days you spend in rehab over the 90-day limit per benefit period. These days are effectively a limited extension of your Part A benefits you can use if you need them, though they cannot be renewed and once used, they are permanently gone.

Does Medicare cover skilled nursing?

Because skilled nursing is an inpatient service, most of your Medicare coverage comes through the Part A inpatient benefit. This coverage is automatically provided for eligible seniors, usually without a monthly premium. If you get Medicare benefits through a Medicare Advantage plan, your Part A benefits are included in your policy.

Does Medicare Supplement cover out of pocket expenses?

A Medicare Supplement plan can pick up some or all of the deductible you would otherwise be charged, assist with some Part B expenses that apply to your treatment and potentially cover some additional out-of-pocket Medicare costs.

Does Medicaid cover rehab?

Medicaid is a joint federal-state health insurance program that helps millions of people with limited means to pay for healthcare, which can include the costs of rehab that Medicare doesn’t cover.

How long does Medicare Advantage last?

Takeaway. Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of the facility for at least 60 days.

What is Medicare benefit period?

Medicare benefit periods mostly pertain to Part A , which is the part of original Medicare that covers hospital and skilled nursing facility care. Medicare defines benefit periods to help you identify your portion of the costs. This amount is based on the length of your stay.

How much coinsurance do you pay for inpatient care?

Days 1 through 60. For the first 60 days that you’re an inpatient, you’ll pay $0 coinsurance during this benefit period. Days 61 through 90. During this period, you’ll pay a $371 daily coinsurance cost for your care. Day 91 and up. After 90 days, you’ll start to use your lifetime reserve days.

How long does Medicare benefit last after discharge?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days after being discharged, the benefit period ends. Keep reading to learn more about Medicare benefit periods and how they affect the amount you’ll pay for inpatient care. Share on Pinterest.

What facilities does Medicare Part A cover?

Some of the facilities that Medicare Part A benefits apply to include: hospital. acute care or inpatient rehabilitation facility. skilled nursing facility. hospice. If you have Medicare Advantage (Part C) instead of original Medicare, your benefit periods may differ from those in Medicare Part A.

Why is it important to check deductibles each year?

It’s important to check each year to see if the deductible and copayments have changed, so you can know what to expect. According to a 2019 retrospective study. Trusted Source. , benefit periods are meant to reduce excessive or unnecessarily long stays in a hospital or healthcare facility.

How much is Medicare deductible for 2021?

Here’s what you’ll pay in 2021: Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60.

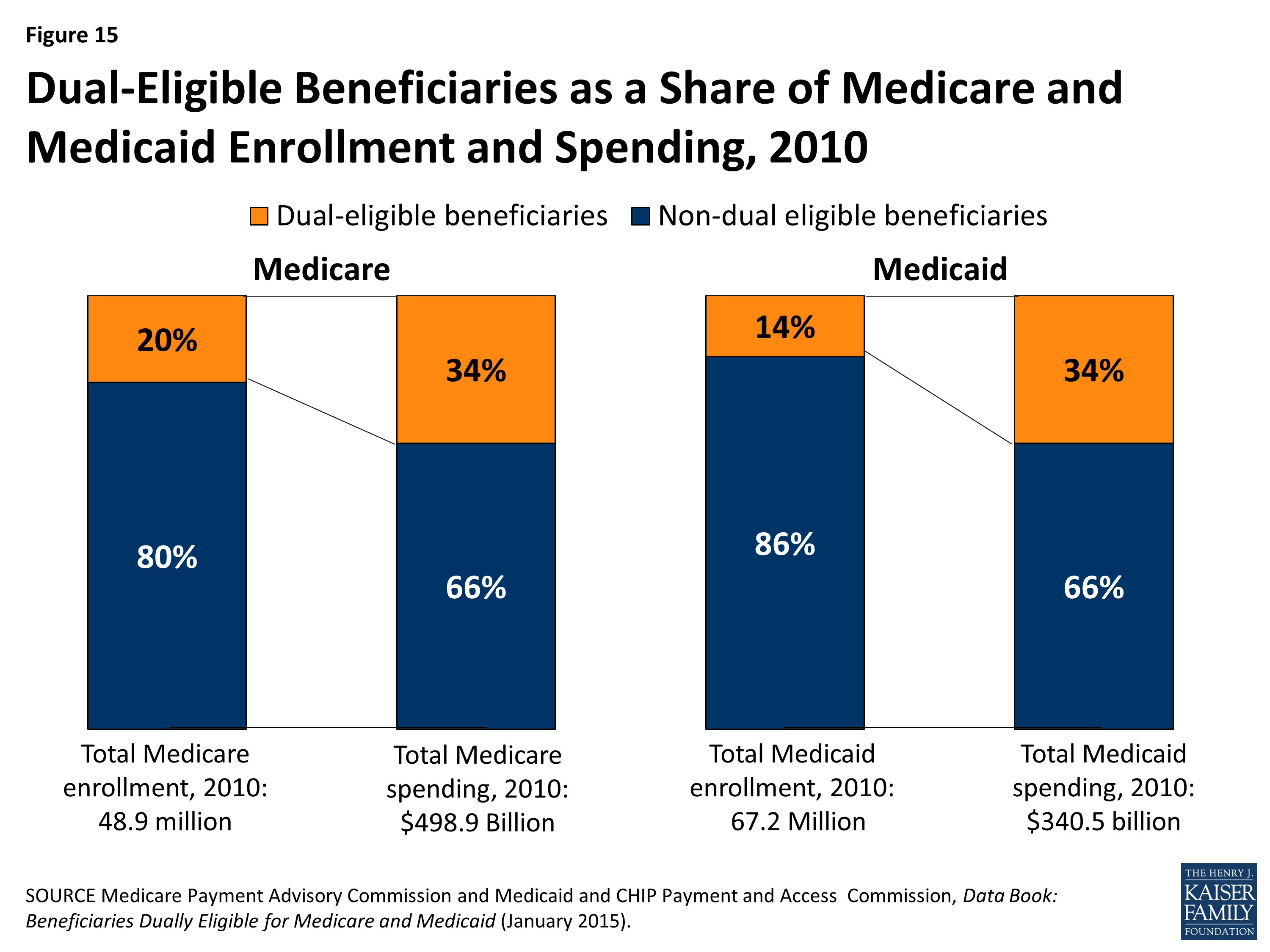

How much is Medicare payroll tax?

Medicare payroll taxes account for the majority of dollars that finance the Medicare Trust Fund. Employees are taxed 2.9% on their earnings, 1.45% paid by themselves, 1.45% paid by their employers. People who are self-employed pay the full 2.9% tax.

How much did Medicare spend in 2016?

In 2016, people on Original Medicare (Part A and Part B) spent 12% of their income on health care. People with five or more chronic conditions spent as much as 14%, significantly higher than those with none at 8%, showing their increased need for medical care. 9.

What is the source of Medicare trust funds?

The money collected in taxes and in premiums make up the bulk of the Medicare Trust Fund. Other sources of funding include income taxes paid on Social Security benefits and interest earned on trust fund investments.

What is the CMS?

As the number of chronic medical conditions goes up, the Centers for Medicare and Medicaid Services (CMS) reports higher utilization of medical resources, including emergency room visits, home health visits, inpatient hospitalizations, hospital readmissions, and post-acute care services like rehabilitation and physical therapy .

Why is the Department of Justice filing suit against Medicare?

The Department of Justice has filed law suits against some of these insurers for inflating Medicare risk adjustment scores to get more money from the government. Some healthcare companies and providers have also been involved in schemes to defraud money from Medicare.

How long will a 65 year old live on Medicare?

A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average, until 84.0. A women who turned 65 on the same date could expect to live, on average, until 86.5.

Does Medicare cover hearing aids?

As it stands, many people argue that Medicare does not cover enough. For example, Medicare does not cover the cost of corrective lenses, dentures, or hearing aids even though the most common things that happen as we age are changes in vision, dental health, and hearing.

How long does Medicare cover hospital care?

Depending on how long your inpatient stay lasts, there is a limit to how long Medicare Part A will cover your hospital costs. For the first 60 days of ...

How many reserve days do you get with Medicare?

Medicare limits you to only 60 of these days to use over the course of your lifetime, and they require a coinsurance payment of $742 per day in 2021. You only get 60 lifetime reserve days, and they do not reset after a benefit period or a calendar year.

What is the Medicare donut hole?

Medicare Part D prescription drug plans feature a temporary coverage gap, or “ donut hole .”. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs. Once you and your plan combine to spend $4,130 on covered drugs in 2021, you will enter the donut hole. Once you enter the donut hole in 2021, you ...

How much is Medicare Part A deductible in 2021?

You are responsible for paying your Part A deductible, however. In 2021, the Medicare Part A deductible is $1,484 per benefit period. During days 61-90, you must pay a $371 per day coinsurance cost (in 2021) after you meet your Part A deductible.

What happens if you spend $6,550 out of pocket in 2021?

After you spend $6,550 out-of-pocket on covered drugs in 2021, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

What is Medicare Part B and Part D?

Medicare Part B (medical insurance) and Part D have income limits that can affect how much you pay for your monthly Part B and/or Part D premium. Higher income earners pay an additional amount, called an IRMAA, or the Income-Related Monthly Adjusted Amount.

What is Medicare Advantage Plan?

When you enroll in a Medicare Advantage plan, it replaces your Original Medicare coverage and offers the same benefits that you get from Medicare Part A and Part B.

/https:%2F%2Fblogs-images.forbes.com%2Fthumbnails%2Fblog_12%2Fpt_12_36979_o.jpg%3Ft%3D1339770856)