How long does Medicare pay for hospital costs?

Once the deductible is paid fully, Medicare will cover the remainder of hospital care costs for up to 60 days after being admitted. If you need to stay longer than 60 days within the same benefit period, you’ll be required to pay a daily coinsurance.

How much does Medicare pay for each benefit period?

In Original Medicare, for each benefit period, you pay: For days 1–20: You pay nothing for covered services. Medicare pays the full cost. For days 21–100: You pay up to $170.50 per day for covered services. Medicare pays all but the daily coinsurance. For days beyond 100: You pay the full cost for services. Medicare pays nothing.

How long does Medicare pay for skilled nursing care?

Where these five criteria are met, Medicare will provide coverage of up to 100 days of care in a skilled nursing facility as follows: the first 20 days are fully paid for, and the next 80 days (days 21 through 100) are paid for by Medicare subject to a daily coinsurance amount for which the resident is responsible.

What are Medicare reserve days and how do they work?

In Original Medicare, these are additional days that Medicare will pay for when you're in a hospital for more than 90 days. You have a total of 60 reserve days that can be used during your lifetime. For each lifetime reserve day, Medicare pays all covered costs except for a daily coinsurance.

What is Medicare benefit period?

Medicare benefit periods mostly pertain to Part A , which is the part of original Medicare that covers hospital and skilled nursing facility care. Medicare defines benefit periods to help you identify your portion of the costs. This amount is based on the length of your stay.

How long does Medicare benefit last after discharge?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days after being discharged, the benefit period ends. Keep reading to learn more about Medicare benefit periods and how they affect the amount you’ll pay for inpatient care. Share on Pinterest.

How much coinsurance do you pay for inpatient care?

Days 1 through 60. For the first 60 days that you’re an inpatient, you’ll pay $0 coinsurance during this benefit period. Days 61 through 90. During this period, you’ll pay a $371 daily coinsurance cost for your care. Day 91 and up. After 90 days, you’ll start to use your lifetime reserve days.

What facilities does Medicare Part A cover?

Some of the facilities that Medicare Part A benefits apply to include: hospital. acute care or inpatient rehabilitation facility. skilled nursing facility. hospice. If you have Medicare Advantage (Part C) instead of original Medicare, your benefit periods may differ from those in Medicare Part A.

How much is Medicare deductible for 2021?

Here’s what you’ll pay in 2021: Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60.

How long does Medicare Advantage last?

Takeaway. Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of the facility for at least 60 days.

How long can you be out of an inpatient facility?

When you’ve been out of an inpatient facility for at least 60 days , you’ll start a new benefit period. An unlimited number of benefit periods can occur within a year and within your lifetime. Medicare Advantage policies have different rules entirely for their benefit periods and costs.

How many days in a lifetime is mental health care?

Things to know. Inpatient mental health care in a psychiatric hospital is limited to 190 days in a lifetime.

What are Medicare covered services?

Medicare-covered hospital services include: Semi-private rooms. Meals. General nursing. Drugs as part of your inpatient treatment (including methadone to treat an opioid use disorder) Other hospital services and supplies as part of your inpatient treatment.

How many days of inpatient care is in a psychiatric hospital?

Inpatient mental health care in a psychiatric hospital is limited to 190 days in a lifetime.

Who approves your stay in the hospital?

In certain cases, the Utilization Review Committee of the hospital approves your stay while you’re in the hospital.

How many days can you use Medicare in one hospital visit?

Medicare provides an additional 60 days of coverage beyond the 90 days of covered inpatient care within a benefit period. These 60 days are known as lifetime reserve days. Lifetime reserve days can be used only once, but they don’t have to be used all in one hospital visit.

How long does Medicare Part A deductible last?

Unlike some deductibles, the Medicare Part A deductible applies to each benefit period. This means it applies to the length of time you’ve been admitted into the hospital through 60 consecutive days after you’ve been out of the hospital.

What is the Medicare deductible for 2020?

Even with insurance, you’ll still have to pay a portion of the hospital bill, along with premiums, deductibles, and other costs that are adjusted every year. In 2020, the Medicare Part A deductible is $1,408 per benefit period.

What to do if you anticipate an extended hospital stay?

If you or a family member anticipate an extended hospital stay for an underlying health condition, treatment, or surgery, take a look at your insurance coverage to understand your premiums and to analyze your costs.

How much does Medicare Part A cost in 2020?

In 2020, the Medicare Part A deductible is $1,408 per benefit period.

What is Medicare Part A?

Medicare Part A, the first part of original Medicare, is hospital insurance. It typically covers inpatient surgeries, bloodwork and diagnostics, and hospital stays. If admitted into a hospital, Medicare Part A will help pay for:

How long do you have to work to qualify for Medicare Part A?

To be eligible, you’ll need to have worked for 40 quarters, or 10 years, and paid Medicare taxes during that time.

How long does Part A pay for mental health?

If you're in a psychiatric hospital (instead of a general hospital), Part A only pays for up to 190 days of inpatient psychiatric hospital services during your lifetime.

What is Medicare Part A?

Mental health care (inpatient) Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. covers mental health care services you get in a hospital that require you to be admitted as an inpatient.

How much is Medicare coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). In Original Medicare, these are additional days that Medicare will pay for when you're in a hospital for more than 90 days.

What is coinsurance for a day?

Coinsurance is usually a percentage (for example, 20%). per day of each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

When does the benefit period end?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins.

How much is original Medicare deductible?

Your costs in Original Medicare. $1,484. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. for each. benefit period.

Can you have multiple benefit periods in a general hospital?

for mental health services you get from doctors and other providers while you're a hospital inpatient. Note. There's no limit to the number of benefit periods you can have when you get mental health care in a general hospital. You can also have multiple benefit periods when you get care in a psychiatric hospital.

How many days do you have to be in hospital to qualify for Medicare?

Having days left in your benefit period. Having a qualifying hospital stay of three inpatient days. Your doctor determining that you need daily skilled care.

How long does Medicare cover nursing home care?

What parts of nursing home care does Medicare cover? Medicare covers up to 100 days at a skilled nursing facility. Medicare Part A and Part B cover skilled nursing facility stays of up to 100 days for older people who require care from people with medical skills, such as sterile bandage changes.

What parts of nursing home care does Medicare not cover?

Medicare doesn’t cover most aspects of nursing home care. This includes custodial needs, such as bathing, eating or moving around. It also doesn’t cover room and board for any long-term nursing home stay, including hospice care or the cost of a private room. Lastly, Medicare won’t cover your skilled nursing facility stay if it’s not in an approved facility, so it’s important to know what institutions it has approved in your area.

What is covered by Medicare Advantage?

Some of the specific things covered by Medicare include: A semiprivate room. Meals. Skilled nursing care. Physical and occupational therapy. Medical social services. Medications. Medical supplies and equipment. However, if you have a Medicare Advantage Plan, it’s possible that the plan covers nursing home care.

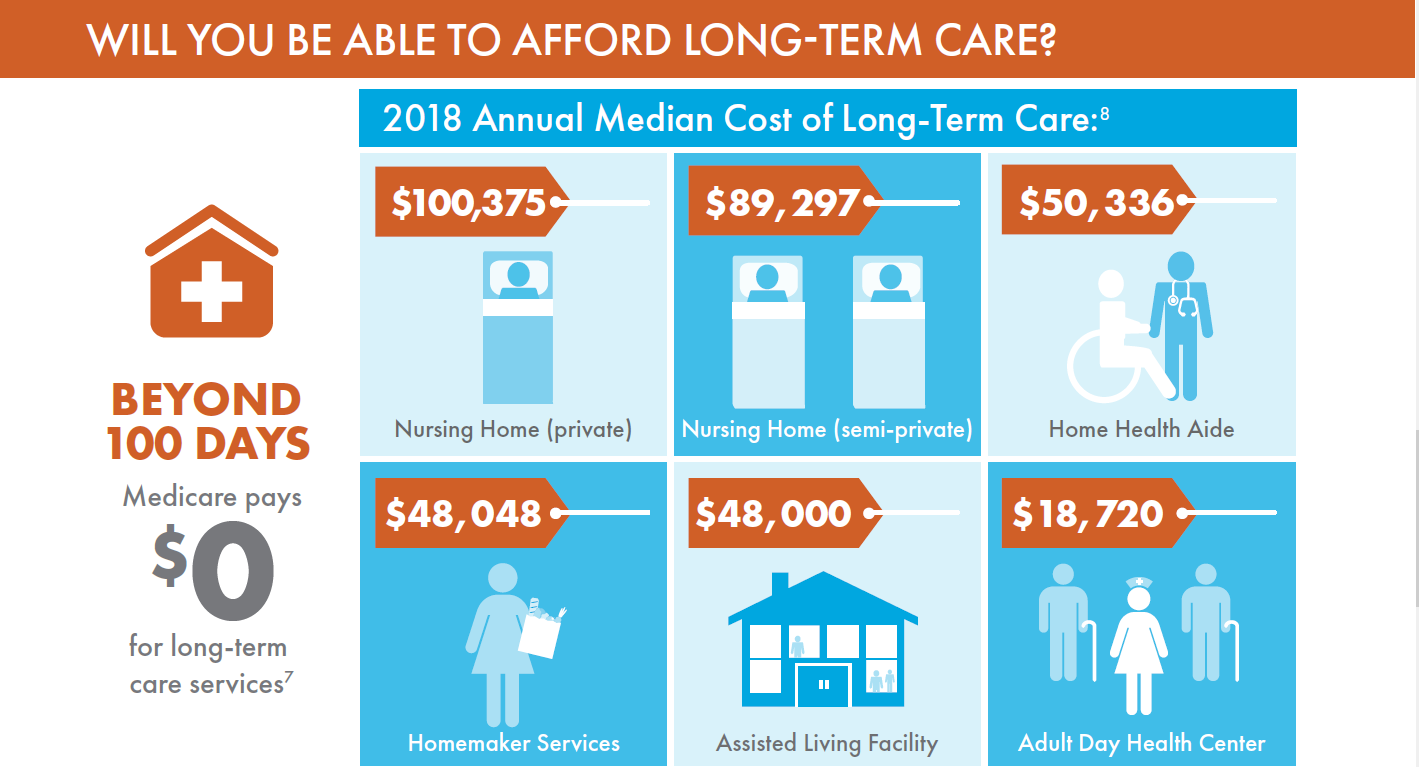

How much does a nursing home cost?

On average, annual costs for nursing homes fall between $90,000 and $110,000, depending on whether you have a private or semi-private room. This can burn through your personal funds surprisingly quickly. It’s best to pair your personal funds with other financial aid to help you afford nursing home care.

How long does functional mobility insurance last?

Most policies will also require you to pay out of pocket for a predetermined amount of time, usually between 30 and 90 days, before coverage kicks in.

Does long term care insurance cover nursing home care?

Similar to regular health insurance, long-term care insurance has you pay a premium in exchange for financial assistance should you ever need long-term care. This insurance can help prevent you from emptying your savings if you suddenly find yourself needing nursing home care. However, it’s important to note that these policies often have a daily or lifetime cap for the amount paid out. When you apply, you can choose an amount of coverage that works for you.

How many days of care does Medicare cover?

Where these five criteria are met, Medicare will provide coverage of up to 100 days of care in a skilled nursing facility as follows: the first 20 days are fully paid for, and the next 80 days (days 21 through 100) are paid for by Medicare subject to a daily coinsurance amount for which the resident is responsible.

How long does Medicare cover skilled nursing?

But beware: not everyone receives 100 days of Medicare coverage in a skilled nursing facility. Coverage will end within the 100 days if the resident stops making progress in their rehabilitation (i.e. they “plateau”) and/or if rehabilitation will not help the resident maintain their skill level.

What happens when Medicare coverage ends?

Written notice of this cut-off must be provided. When Medicare coverage is ending because it is no longer medically necessary or the care is considered custodial care, the health care facility must provide written notice on a form called “Notice ...

What to do if your Medicare coverage ends too soon?

If you believe rehabilitation and Medicare coverage is ending too soon, you can request an appeal. Information on how to request this appeal is included in the Notice of Medicare Non-Coverage. Don’t be caught off-guard by assuming your loved one will receive the full 100 days of Medicare.

What is skilled nursing in Medicare?

Medicare Part A Skilled Nursing Facility coverage is generally available to qualified individuals 65 years of age or older and individuals under age 65 who have been disabled for at least 24 months who meet the following 5 requirements: 1) the resident requires daily skilled nursing or rehabilitation services that can be provided only in a skilled nursing facility; 2) the resident was hospitalized for at least 3 consecutive days, not counting the day of discharge, before entering the skilled nursing facility; 3) the resident was admitted to the facility within 30 days after leaving the hospital; 4) the resident is admitted to the facility to receive treatment for the same condition (s) for which he or she was treated in the hospital; and 5) a medical professional certifies that the resident requires skilled nursing care on a daily basis.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row.

What is the definition of health care?

Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine.

How long does it take to get into an inpatient rehab facility?

You’re admitted to an inpatient rehabilitation facility within 60 days of being discharged from a hospital.

How much coinsurance is required for a day 91?

Days 91 and beyond: $742 coinsurance per each “lifetime reserve day” after day 90 for each benefit period (up to 60 days over your lifetime).

Does Medicare cover private duty nursing?

Medicare doesn’t cover: Private duty nursing. A phone or television in your room. Personal items, like toothpaste, socks, or razors (except when a hospital provides them as part of your hospital admission pack). A private room, unless medically necessary.

Does Medicare cover outpatient care?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

How often do you need to renew your plan of care?

Your plan of care must be reviewed and renewed (if appropriate) at least every 60 days.

How long do you have to stay in hospital for SNF?

You have a qualifying hospital stay, that is, if you’ve stayed in the hospital for at least three days, and you go into the SNF within 30 days.

Does Medicare Supplement Insurance cover Part B coinsurance?

Medicare Supplement Insurance (Medigap) generally covers the 20% Part B coinsurance. Most Medigap plans cover the Part A deductible and homebound coinsurance costs. You can purchase a Medigap plan if you have Original Medicare, but not if you have a Medicare Advantage Plan.

Is PT required by Medicare?

PT must always be medically necessary for Medicare to provide coverage. That means it is a treatment for your condition that meets accepted standards of medicine.

Do you have to have an ongoing medical need for PT to continue?

You must have an ongoing medical need for PT to continue.

Does Medicare Cover Physical Therapy?

Medicare covers physical therapy as a skilled service. Whether you receive physical therapy (PT) at home, in a facility or hospital, or a therapist’s office, the following conditions must be met: