How many employees do you need to have to qualify for Medicare?

For example, in Part A, the cost share of a five-day hospital stay would be your hospital deductible of $1,484 (2021). In a Medicare Advantage plan, you can pay $225-$375 a day for each day in the hospital. This is just one example and each plan may vary. Read More: Health Plan Changes for …

Can I have more than one Medicare Prescription Drug Plan?

Depending on your employer’s size, Medicare will work with your employer’s health insurance coverage in different ways. If your company has 20 employees or less and you’re over 65, Medicare will pay primary. Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage a small group health plan.

How many employees does Medicare pay for small group health insurance?

Jul 03, 2021 · Founded in 1853, Aetna proves to be one of the most established insurance companies, nationwide. Over 39 million customers rely on Aetna for health care coverage, including Medicare beneficiaries. When rated, the company earned an A from AM Best and an A+ from S&P. Thus, proving to be a top carrier all around.

What are the different types of Medicare plans?

May 28, 2021 · If you have both Medicare and private insurance, there are guidelines about which provider pays first for your healthcare services. ... If you have a …

:max_bytes(150000):strip_icc()/couple-working-at-laptop-in-home-office-652375041-5785659e3df78c1e1fa3e4a9.jpg)

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health insurance.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

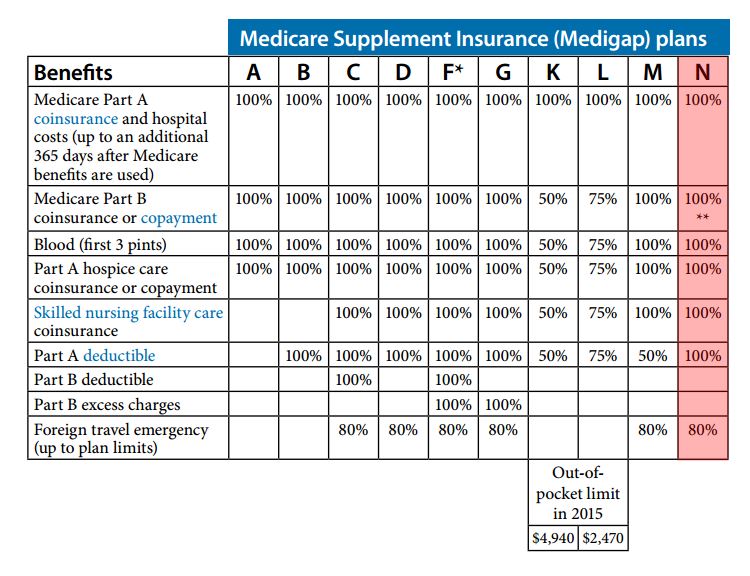

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When can I buy Medigap?

Get the facts about the specific times when you can sign up for a Medigap policy.

How to compare Medigap policies

Read about different types of Medigap policies, what they cover, and which insurance companies sell Medigap policies in your area.

Medigap & travel

Read about which Medigap policies offer coverage when you travel outside the United States (U.S.).

How many employees does Medicare pay?

If your company has 20 employees or less and you’re over 65, Medicare will pay primary. Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage a small group health plan.

Does Medicare cover health insurance?

Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance coverage in different ways. If your company has 20 employees or less and you’re over 65, Medicare will pay primary. Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage ...

How long does Medicare coverage last?

This special period lasts for eight months after the first month you go without your employer’s health insurance. Many people avoid having a coverage gap by signing up for Medicare the month before your employer’s health insurance coverage ends.

Does Medicare pay for secondary insurance?

If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first. Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance coverage in different ways. If your company has 20 employees or less and you’re over 65, Medicare will pay primary.

What factors affect Medicare premiums?

In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age , location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board. Each of the top 10 Medicare Supplement carriers on the list above is ...

What is United American insurance?

United American: A Medigap Carrier with High Ratings. United American Insurance Company was founded in 1947. The company maintains an A+ rating from AM Best and has done so for over 40 years. S&P’s rating for United American is AA-.

When was Aetna founded?

One of the most established insurance companies, Aetna was founded in 1853. Over 39 million customers rely on Aetna for health care, including Medicare. Aetna has excellent ratings all around; an A from AM Best and an A+ from S&P underscore the reasons for this company’s longevity.

What is INA insurance?

The Insurance Company of North America (INA) began in 1792 as the first Marine insurer of the United States. INA would eventually become the company we know today as Cigna, one of the most renowned health insurance carriers offering Medicare Supplement policies. Both AM Best and S&P rate Cigna at an A.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Is Medicare a public health insurance?

Public. Public health insurance plans are government funded. One example of a public health insurance program is Medicare. Others include Medicaid and Veteran’s Affairs benefits. According to a 2020 report from the U.S. Census Bureau, 68 percent of Americans have some form of private health insurance.

What age do you have to be to get Medicare?

are age 65 or older. have a qualifying disability. receive a diagnosis of ESRD or ALS. How Medicare works with your group plan’s coverage depends on your particular situation, such as: If you’re age 65 or older. In companies with 20 or more employees, your group health plan pays first.

Is Medicare the primary or secondary payer?

In some cases, Medicare may be the primary payer — in others, it may be the secondary payer.

Is Medicare covered by HMO?

If this is the case with your group health plan and it pays first, you may not be covered by Medicare if you choose to use an out-of- network provider.

Does tricare pay for Medicare?

TRICARE pays first for any services that are covered by Medicare. TRICARE will also cover Medicare deductibles and coinsurance costs, as well as any services covered by TRICARE but not Medicare. If you’re not on active duty. Medicare pays first. TRICARE can pay second if you have TRICARE for Life coverage.

What is health insurance?

Health insurance covers much of the cost of the various medical expenses you’ll have during your life. Generally speaking, there are two basic types of health insurance: Private. These health insurance plans are offered by private companies.

What are the different types of health insurance?

Generally speaking, there are two basic types of health insurance: Private. These health insurance plans are offered by private companies. Many people get private health insurance through a group plan provided by their employers. Public. Public health insurance plans are government funded.

Is hospice covered by Medicare?

Hospice benefits are still covered under Part A. Many Medicare Advantage plans include prescription drug coverage. Every Medicare Prescription Drug Plan typically uses a drug formulary to determine which medications are covered and how much you will pay for each.

Does Medicare Part D cover prescription drugs?

Medicare Part D coverage for prescription drugs is offered through private insurance companies approved by Medicare. You must enroll through the plan and pay any required premiums in order to get coverage. There are two types of Medicare Prescription Drug Plans:

What is Medicare prescription drug plan?

Medicare Prescription Drug Plans help Medicare beneficiaries pay for medications prescribed by a doctor. This coverage is available to anyone who is eligible for Medicare, whether he or she is enrolled in Original Medicare (Part A and Part B) or in a Medicare Advantage plan.

What is Medicare Advantage?

Medicare Advantage gives you a way to receive your Part A and Part B benefits through a private, Medicare-approved insurance company.

Can employers contribute to Medicare premiums?

Medicare Premiums and Employer Contributions. Per CMS, it’s illegal for employers to contribute to Medica re premiums. The exception is employers who set up a 105 Reimbursement Plan for all employees. The reimbursement plan deducts money from the employees’ salaries to buy individual insurance policies.

Is Medicare billed first or second?

If your employer has fewer than 20 employees, then Medicare becomes primary. This means Medicare is billed first, and your employer plan will be billed second. If you have small group insurance, it’s HIGHLY recommended that you enroll in both Parts A and B as soon as you’re eligible. If you don’t, your employer’s group plan can refuse ...

What happens if you don't have Part B insurance?

If you don’t, your employer’s group plan can refuse to pay your claims. Your insurance might cover claims even if you don’t have Part B, but we always recommend enrolling in Part B. Your carrier can change that at any time, with no warning, leaving you responsible for outpatient costs.

Is Part B premium free?

Since Part B is not premium-free like Part A is for most, you may wish to delay enrollment if you have group insurance. As stated above, the size of your employer determines whether your coverage will be considered creditable once you retire and are ready to enroll. Group coverage for employers with 20 or more employees is deemed creditable ...

What is CMS L564?

You will need your employer to fill out the CMS-L564 form. This form is a request for employment information form. Once the employer completes section B of the form, you can send in the document with your application to enroll in Medicare.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.

Does Medicare cover dental?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare ...

What are the problems with Medicare Advantage?

In 2012, Dr. Brent Schillinger, former president of the Palm Beach County Medical Society, pointed out a host of potential problems he encountered with Medicare Advantage Plans as a physician. Here's how he describes them: 1 Care can actually end up costing more, to the patient and the federal budget, than it would under original Medicare, particularly if one suffers from a very serious medical problem. 2 Some private plans are not financially stable and may suddenly cease coverage. This happened in Florida in 2014 when a popular MA plan called Physicians United Plan was declared insolvent, and doctors canceled appointments. 3 3 One may have difficulty getting emergency or urgent care due to rationing. 4 The plans only cover certain doctors, and often drop providers without cause, breaking the continuity of care. 5 Members have to follow plan rules to get covered care. 6 There are always restrictions when choosing doctors, hospitals, and other providers, which is another form of rationing that keeps profits up for the insurance company but limits patient choice. 7 It can be difficult to get care away from home. 8 The extra benefits offered can turn out to be less than promised. 9 Plans that include coverage for Part D prescription drug costs may ration certain high-cost medications. 4

What is Medicare Supplement?

Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, such as copayments, deductibles, and healthcare when you travel abroad.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

What happens if you have more than one health insurance?

It’s important here to understand the difference between primary versus secondary insurance. If you have more than one health plan, coordination of benefits is the process that decides which insurance pays first for a claim .

What happens if you have multiple health insurance policies?

So, even if you have multiple health insurance policies, you may still have leftover out-of-pocket medical costs.

How does insurance pay for a claim?

If you have more than one health plan, coordination of benefits is the process that decides which insurance pays first for a claim. Here’s where primary versus secondary insurance comes in: 1 Primary insurance: the insurance that pays first is your “primary” insurance, and this plan will pay up to coverage limits. You may owe cost sharing. 2 Secondary insurance: once your primary insurance has paid its share, the remaining bill goes to your “secondary” insurance, if you have more than one health plan. Your secondary insurance may cover part or all of the remaining cost.

What is primary insurance?

Primary insurance: the insurance that pays first is your “primary” insurance, and this plan will pay up to coverage limits. You may owe cost sharing. Secondary insurance: once your primary insurance has paid its share, the remaining bill goes to your “secondary” insurance, if you have more than one health plan.

How old do you have to be to be a dependent?

You are an adult or child under 26 who has coverage through your parents and your own employer. You are a married couple, and both of you have health insurance through your own employers. You are under 26 years old with married parents who have separate health plans, and both parents list you as a dependent under their plans.

How old do you have to be to be covered by your employer?

You’re under 26 and covered by your school/employer’s plan and your parents’ health plan. You’re married and both of you have coverage through your employers. You’re under 26 with married parents, and both parents cover you under their separate policies.

Who has custody of a child?

The parent with custody of the child. If both parents have joint custody, the birthday rule applies. The parent who doesn’t have custody (if applicable) You’re under 26, married and covered by both your spouse’s plan and your parents’ plan. Spouse’s coverage. Parents’ coverage.