How many Medicare beneficiaries also have employer-sponsored retirement health coverage?

In total, 14.3 million of Medicare beneficiaries – a quarter (26%) Medicare beneficiaries overall — also had some form of employer-sponsored retiree health coverage in 2018.

How many people are enrolled in the Medicare program?

In 2017, over 58 million people were enrolled in the Medicare program. Nearly 50 million of them were beneficiaries for reasons of age, while the rest were beneficiaries due to various disabilities.

Which states have the most Medicare beneficiaries?

With over 6.1 million, California was the state with the highest number of Medicare beneficiaries . The United States spent nearly 800 billion U.S. dollars on the Medicare program in 2019. Since Medicare is divided into several parts, Medicare Part A and Part B combined were responsible for the largest share of spending.

How many Medicare beneficiaries have Medigap insurance?

Medicare supplement insurance, also known as Medigap, provided supplemental coverage to 2 in 10 (21%) Medicare beneficiaries overall, or 34% of those in traditional Medicare (roughly 11 million beneficiaries) in 2018. As with other forms of supplemental insurance, the share of beneficiaries with Medigap varies by state.

How many Medicare beneficiaries are there in 2020?

62.6 million peopleMedicare beneficiaries In 2020, 62.6 million people were enrolled in the Medicare program, which equates to 18.4 percent of all people in the United States.

What is the Medicare population?

Currently, 44 million beneficiaries—some 15 percent of the U.S. population—are enrolled in the Medicare program. Enrollment is expected to rise to 79 million by 2030.

How many Medicare beneficiaries are there in 2022?

2022 was another banner year for Medicare Advantage. The program now boasts 28 million participants, which represent 45% of all Medicare beneficiaries. This marks a +3% point improvement in penetration over 2021 and a total program enrollment growth of +9%.

How many Medicare beneficiaries are there in 2030?

80 million beneficiariesThe Medicare population is projected to increase from 54 million beneficiaries today to over 80 million beneficiaries by 2030 as the baby-boom generation ages into Medicare.

What percentage of US citizens have Medicare?

Medicare is a federal health insurance program that pays for covered health care services for most people aged 65 and older and for certain permanently disabled individuals under the age of 65. An estimated 60 million individuals (18.4% of the U.S. population) were enrolled in Medicare in 2020.

What state has the most Medicare recipients?

CaliforniaIn 2020, California reported some 6.41 million Medicare beneficiaries and therefore was the U.S. state with the highest number of beneficiaries....Top 10 U.S. states based on number of Medicare beneficiaries in 2020.CharacteristicNumber of Medicare beneficiariesCalifornia6,411,106Florida4,680,1378 more rows•Jun 20, 2022

Is Medicare running out of money?

A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026.

Will Medicare ever go away?

Medicare is not going bankrupt. It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses.

How fast is the Medicare population growing?

California's Medicare population grew 11.3% from 5.8 million in 2016 to 6.5 million beneficiaries in 2021. (Page 10.) Enrollment in MA grew faster than enrollment in FFS, a trend continuing through 2021. (Page 10.)

What happens when Medicare runs out in 2026?

The trust fund for Medicare Part A will be able to pay full benefits until 2026 before reserves will be depleted. That's the same year as predicted in 2020, according to a summary of the trustees 2021 report, which was released on Tuesday.

Is Medicare Advantage the future?

After a 9 percent increase from 2021 to 2022, enrollment in the Medicare Advantage (MA) program is expected to surpass 50 percent of the eligible Medicare population within the next year. At its current rate of growth, MA is on track to reach 69 percent of the Medicare population by the end of 2030.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

How many people are on Medicare in 2019?

In 2019, over 61 million people were enrolled in the Medicare program. Nearly 53 million of them were beneficiaries for reasons of age, while the rest were beneficiaries due to various disabilities.

Which state has the most Medicare beneficiaries?

With over 6.1 million, California was the state with the highest number of Medicare beneficiaries . The United States spent nearly 800 billion U.S. dollars on the Medicare program in 2019. Since Medicare is divided into several parts, Medicare Part A and Part B combined were responsible for the largest share of spending.

What is Medicare 2020?

Research expert covering health, pharma & medtech. Get in touch with us now. , May 15, 2020. Medicare is a federal social insurance program and was introduced in 1965. Its aim is to provide health insurance to older and disabled people. In 2018, 17.8 percent of all people in the United States were covered by Medicare.

What is Medicare inpatient?

Hospital inpatient services – as included in Part A - are the service type which makes up the largest single part of total Medicare spending. Medicare, however, has also significant income, which amounted also to some 800 billion U.S. dollars in 2019.

What is Medicare Advantage?

Medicare Advantage (MA): Eligibility to choose a MA plan: People who are enrolled in both Medicare A and B, pay the Part B monthly premium, do not have end-stage renal disease, and live in the service area of the plan. Formerly known as Medicare+Choice or Medicare Health Plans.

How much is Medicare Part A deductible?

– Initial deductible: $1,408.

Is my test, item, or service covered?

Find out if your test, item or service is covered. Medicare coverage for many tests, items, and services depends on where you live. This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

Your Medicare coverage choices

Learn about the 2 main ways to get your Medicare coverage — Original Medicare or a Medicare Advantage Plan (Part C).

What Part A covers

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

What Part B covers

Learn about what Medicare Part B (Medical Insurance) covers, including doctor and other health care providers' services and outpatient care. Part B also covers durable medical equipment, home health care, and some preventive services.

What Medicare health plans cover

Medicare health plans include Medicare Advantage, Medical Savings Account (MSA), Medicare Cost plans, PACE, MTM

What's not covered by Part A & Part B

Learn about what items and services aren't covered by Medicare Part A or Part B. You'll have to pay for the items and services yourself unless you have other insurance. If you have a Medicare health plan, your plan may cover them.

How many people are covered by Medicare?

More than 62 million people, including 54 million older adults and 8 million younger adults with disabilities, rely on Medicare for their health insurance coverage. Medicare beneficiaries can choose to get their Medicare benefits (Part A and Part B) through the traditional Medicare program, or they can enroll in a Medicare Advantage plan, such as a Medicare HMO or PPO. Medicare Advantage plans provide all benefits covered by Medicare Parts A and B, often provide supplemental benefits, such as dental and vision, and typically provide the Part D prescription drug benefit. Many traditional Medicare beneficiaries also rely on other sources of coverage to supplement their Medicare benefits. Supplemental insurance coverage typically covers some or all of Medicare Part A and Part B cost-sharing requirements and, in some instances, provides benefits not otherwise covered by Medicare. Beneficiaries can also enroll in a Part D plan for prescription drug coverage, either a stand-alone plan to supplement traditional Medicare or a Medicare Advantage plan that covers drugs.

How many Medicare beneficiaries have employer sponsored retirement?

Employer-sponsored Retiree Health Coverage. In total, 14.3 million of Medicare beneficiaries – a quarter (26%) Medicare beneficiaries overall — also had some form of employer-sponsored retiree health coverage in 2018. Of the total number of beneficiaries with retiree health coverage, nearly 10 million beneficiaries have retiree coverage ...

What are the characteristics of Medicare beneficiaries with different sources of coverage?

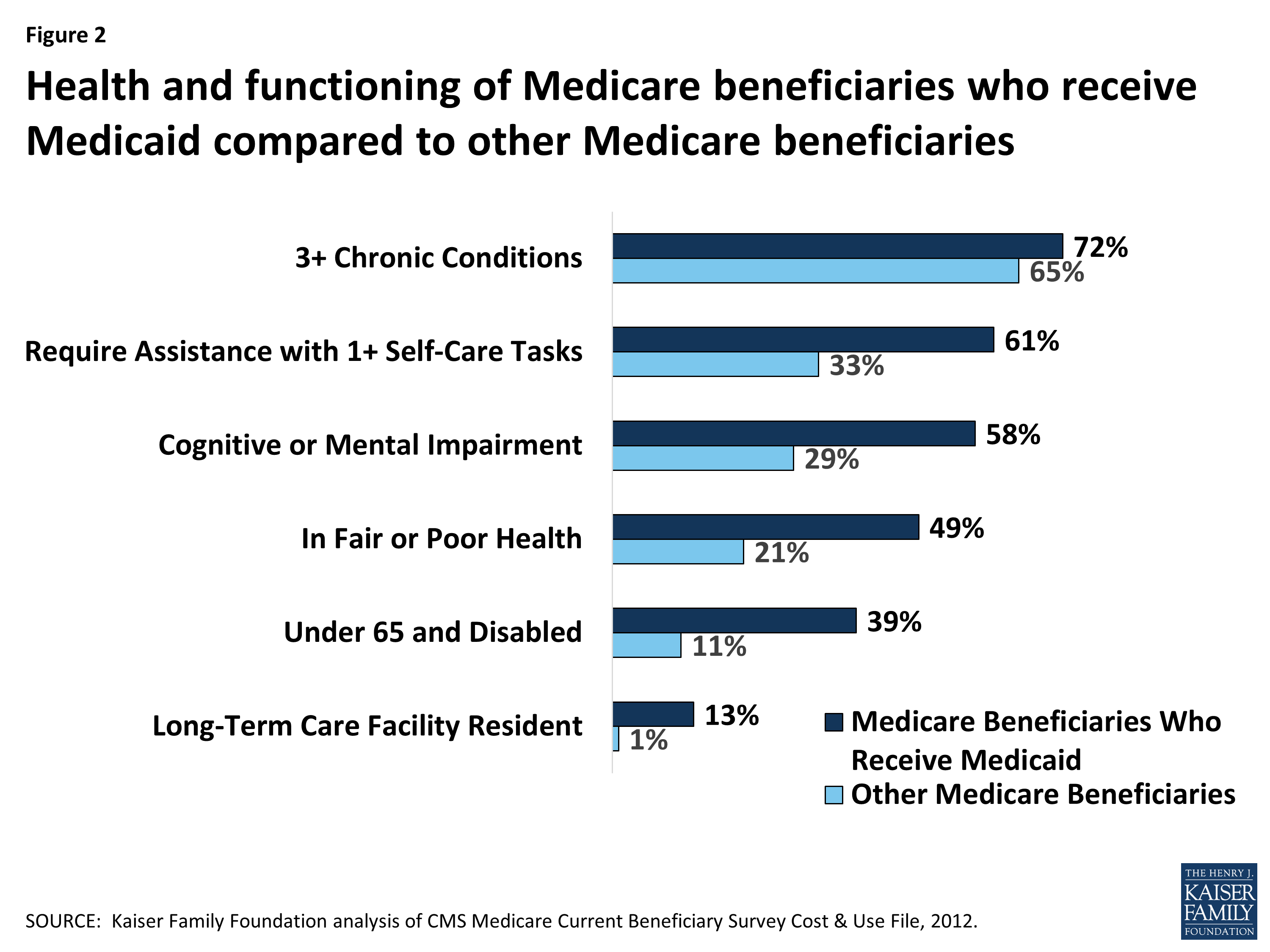

Among Medicare beneficiaries in traditional Medicare, most (83%) have supplemental coverage, either through Medigap (34%), employer-sponsored retiree health coverage (29%), or Medicaid (20%). But nearly 1 in 5 (17%) Medicare beneficiaries in traditional Medicare have no supplemental coverage ( Figure 2 ).

What is the age limit for Medigap?

Compared to all traditional Medicare beneficiaries in 2018, a larger share of Medigap policyholders had annual incomes greater than $40,000, had higher education levels, were disproportionately White, and were in excellent, very good, or good health ( Table 1 ). Only a small share of Medigap policyholders (2%) were under age 65 and qualified for Medicare due to having a long-term disability; most states do not require insurers to issue Medigap policies to beneficiaries under age 65. Federal law provides time-limited guarantee issue protections for adults ages 65 and older when they enroll in Medicare if they want to purchase a supplemental Medigap policy, but these protections do not extend to adults under the age of 65. Legislation has been introduced in the 117 th Congress to require insurers to offer Medigap coverage to younger adults with disabilities when they first go on Medicare, and to others.

What is Medicare Advantage?

Medicare Advantage plans provide all benefits covered by Medicare Parts A and B, often provide supplemental benefits, such as dental and vision, and typically provide the Part D prescription drug benefit. Many traditional Medicare beneficiaries also rely on other sources of coverage to supplement their Medicare benefits.

How is supplemental coverage determined?

Sources of supplemental coverage are determined based on the source of coverage held for the most months of Medicare enrollment in 2018. The analysis excludes beneficiaries who were enrolled in Part A only or Part B only for most of their Medicare enrollment in 2018 (n=4.7 million) and beneficiaries who had Medicare as a secondary payer ...

Does Medicare have supplemental coverage?

No Supplemental Coverage. In 2018, 5.6 million Medicare beneficiaries in traditional Medicare– 1 in 10 beneficiaries overall (10%) or nearly 1 in 5 of those with traditional Medicare (17%) had no source of supplemental coverage. Beneficiaries in traditional Medicare with no supplemental coverage are fully exposed to Medicare’s cost-sharing ...

How many people have Medicare?

In 2018, according to the 2019 Medicare Trustees Report, Medicare provided health insurance for over 59.9 million individuals —more than 52 million people aged 65 and older and about 8 million younger people.

How is Medicare funded?

Medicare is funded by a combination of a specific payroll tax, beneficiary premiums, and surtaxes from beneficiaries, co-pays and deductibles, and general U.S. Treasury revenue. Medicare is divided into four Parts: A, B, C and D.

What is the CMS?

The Centers for Medicare and Medicaid Services (CMS), a component of the U.S. Department of Health and Human Services (HHS), administers Medicare, Medicaid, the Children's Health Insurance Program (CHIP), the Clinical Laboratory Improvement Amendments (CLIA), and parts of the Affordable Care Act (ACA) ("Obamacare"). Along with the Departments of Labor and Treasury, the CMS also implements the insurance reform provisions of the Health Insurance Portability and Accountability Act of 1996 (HIPAA) and most aspects of the Patient Protection and Affordable Care Act of 2010 as amended. The Social Security Administration (SSA) is responsible for determining Medicare eligibility, eligibility for and payment of Extra Help/Low Income Subsidy payments related to Parts C and D of Medicare, and collecting most premium payments for the Medicare program.

How much does Medicare cost in 2020?

In 2020, US federal government spending on Medicare was $776.2 billion.

What is Medicare and Medicaid?

Medicare is a national health insurance program in the United States, begun in 1965 under the Social Security Administration (SSA) and now administered by the Centers for Medicare and Medicaid Services (CMS). It primarily provides health insurance for Americans aged 65 and older, ...

When did Medicare Part D start?

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan (PDP) or public Part C health plan with integrated prescription drug coverage (MA-PD). These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies; almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare (Part A and B), Part D coverage is not standardized (though it is highly regulated by the Centers for Medicare and Medicaid Services). Plans choose which drugs they wish to cover (but must cover at least two drugs in 148 different categories and cover all or "substantially all" drugs in the following protected classes of drugs: anti-cancer; anti-psychotic; anti-convulsant, anti-depressants, immuno-suppressant, and HIV and AIDS drugs). The plans can also specify with CMS approval at what level (or tier) they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

When did Medicare+Choice become Medicare Advantage?

These Part C plans were initially known in 1997 as "Medicare+Choice". As of the Medicare Modernization Act of 2003, most "Medicare+Choice" plans were re-branded as " Medicare Advantage " (MA) plans (though MA is a government term and might not even be "visible" to the Part C health plan beneficiary).

When did Medicare start putting new brackets?

These new brackets took effect in 2018, bumping some high-income enrollees into higher premium brackets.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

Is the Medicare Advantage out-of-pocket maximum changing for 2022?

Medicare Advantage plans are required to cap enrollees’ out-of-pocket costs for Part A and Part B services (unlike Original Medicare, which does not have a cap on out-of -pocket costs). The cap does not include the cost of prescription drugs, since those are covered under Medicare Part D (even when it’s integrated with a Medicare Advantage plan).

How much will the Part B deductible increase for 2022?

The Part B deductible for 2022 is $233. That’s an increase from $203 in 2021, and a much more significant increase than normal.

Can I still buy Medigap Plans C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are no longer available for purchase by people who become newly-eligible for Medicare on or after January 1, 2020. People who became Medicare-eligible prior to 2020 can keep Plan C or F if they already have it, or apply for those plans at a later date, including for 2022 coverage.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...