Full Answer

Do Medicare beneficiaries need Medigap insurance?

Most Medicare beneficiaries are not eligible for Medicaid or QMB, however, and may want to obtain Medigap insurance. Approximately two-thirds purchase Medigap policies. As of July 31, 1992, Medigap policies were standardized throughout the United States.

What is a Medicare Medigap policy?

A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.

How many people with Medicare have other insurance?

Nine in 10 people with Medicare either had traditional Medicare along with some type of supplemental coverage (51%), including Medigap, employer-sponsored insurance, and Medicaid, or were enrolled in Medicare Advantage (39%) in 2018 (Figure 1).

What do Medicare and Medigap have in common?

As you can see, the big thing that these steps have in common is Bob’s lack of involvement in them. Medicare and Medigap plans require no claims involvement from the beneficiary. They are designed to, and do, work together. Neither Medicare nor Medigap plans have any specific networks that you must use.

What percentage of people have Medicare supplement?

Approximately 81 percent of traditional Medicare enrollees have some form of supplemental coverage.

What percentage of beneficiaries who are in the original Medicare plan?

Currently, 44 million beneficiaries—some 15 percent of the U.S. population—are enrolled in the Medicare program. Enrollment is expected to rise to 79 million by 2030. Only one in 10 beneficiaries relies solely on the Medicare program for health care coverage.

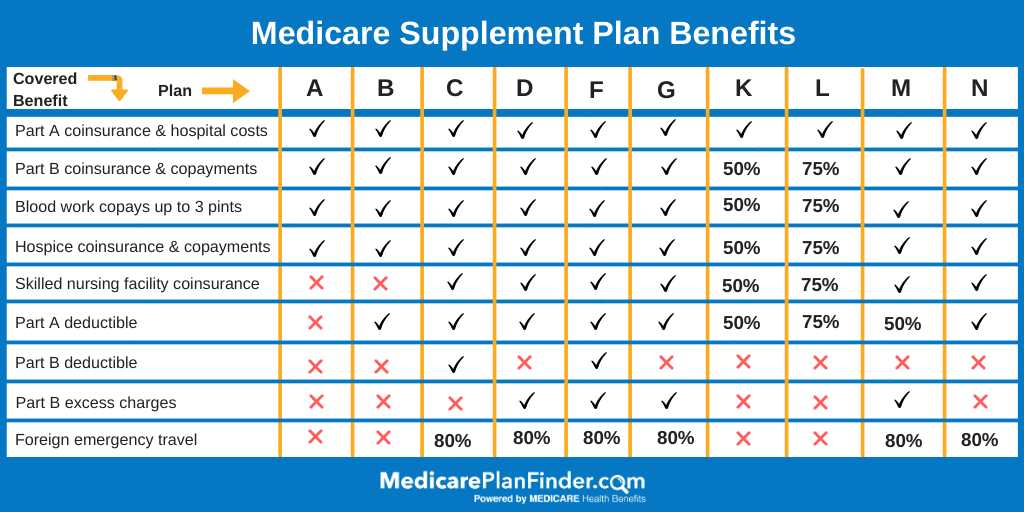

How many Medicare supplement Medigap plans are there?

12 Medigap plansThere are 12 Medigap plans, lettered A through N. Each lettered plan covers the core policy benefits and different levels of additional benefits.

What percentage or portion of Medicare beneficiaries receive services through Medicare Advantage plans?

Discussion. Medicare Advantage enrollment has steadily increased both nationally and within most states since 2005, with more than 40 percent of Medicare beneficiaries enrolled in Medicare Advantage plans in 2021.

What percent of seniors choose Medicare Advantage?

A team of economists who analyzed Medicare Advantage plan selections found that only about 10 percent of seniors chose the optimal Medicare Advantage plan. People were overspending by more than $1,000 per year on average, and more than 10 percent of people were overspending by more than $2,000 per year!

Who uses the most Medicare?

The majority (83%) of Medicare beneficiaries are ages 65 and older, while 17 percent are under age 65 and qualify for Medicare because of a permanent disability. However, a much larger share of black (31%) and Hispanic beneficiaries (23%) than white beneficiaries (14%) are under age 65 and living with disabilities.

How many standardized Medigap policies are there?

10 different standardized policiesOnce you decide you need a Medigap and know you are eligible to enroll, compare the different types of policies that exist. As mentioned above, there are 10 different standardized policies in most states, each covering a different range of Medicare cost-sharing.

What is the difference between Medigap and Medicare Advantage?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

Is Medigap and supplemental insurance the same?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

How popular are Medicare Advantage plans?

All that marketing seems to be working. Recently, 42 percent of Medicare beneficiaries were enrolled in Advantage plans, up from 31 percent in 2016, according to data from the Kaiser Family Foundation. Those numbers include 50 percent of Black and 54 percent of Hispanic enrollees vs. 36 percent of whites in 2018.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

How many Medicare beneficiaries are there in 2021?

As of October 2021, the total Medicare enrollment is 63,964,675. Original Medicare enrollment is 36,045,321, and Medicare Advantage and Other Health Plan enrollment is 27,919,354. This includes enrollment in Medicare Advantage plans with and without prescription drug coverage.

How many different types of Medigap are there?

There are 10 different types of Medigap Plans (labeled A through N), each having a different, standardized set of benefits. Most cover some or all of the Part A deductible. Some are high deductible plans with an out-of-pocket maximum, and a few cover some overseas travel (Table 1).

How many states have Medigap?

In 20 states, at least one-quarter of all Medicare beneficiaries have a Medigap policy. States with higher Medigap enrollment tend to be in the Midwest and plains states, where relatively fewer beneficiaries are enrolled in Medicare Advantage plans. 4.

What states require continuous or annual guaranteed issue protections for Medigap?

Only four states (CT , MA, ME, NY) require either continuous or annual guaranteed issue protections for Medigap for all beneficiaries in traditional Medicare ages 65 and older, regardless of medical history (Figure 1). Guaranteed issue protections prohibit insurers from denying a Medigap policy to eligible applicants, including people with pre-existing conditions, such as diabetes and heart disease.

What are the policy discussions affecting Medicare?

Ongoing policy discussions affecting Medicare and its benefit design could provide an opportunity to consider various ways to enhance federal consumer protections for supplemental coverage or manage beneficiary exposure to high out-of-pocket costs. As older adults age on to Medicare, they would be well-advised to understand the Medigap rules where they live, and the trade-offs involved when making coverage decisions.

How long is the open enrollment period for Medicare Part B?

Federal law provides limited consumer protections for adults ages 65 and older who want to purchase a supplemental Medigap policy—including, a one-time, 6-month open enrollment period that begins when they first enroll in Medicare Part B.

What are the different rating systems for Medigap?

There are three different rating systems that can affect how Medigap insurers determine premiums: community rating, issue-age rating, or attained-age rating (defined in the Text box below). States can impose regulations on which of these rating systems are permitted or required for Medigap policies sold in their state. Of the three, community rating provides the strongest consumer protection for Medigap policies because it does not allow premiums to be based on the applicant or policyholder’s age or health status. However, insurers in states that require community rating may charge different premiums based on other factors, such as smoking status and residential area. In states that allow attained age rating, older applicants and policyholders have considerably less protection from higher premiums because premiums may increase at unpredictable rates as policyholders age.

When does Medicare require supplemental coverage?

Federal law requires Medigap guaranteed issue protections for people age 65 and older during the first six months of their Medicare Part B enrollment and during a “trial” Medicare Advantage enrollment period. Medicare beneficiaries who miss these windows of opportunity may unwittingly forgo the chance to purchase a Medigap policy later in life if their needs or priorities change. 13 This constraint potentially affects the nearly 9 million beneficiaries in traditional Medicare with no supplemental coverage; it may also affect millions of Medicare Advantage plan enrollees who may incorrectly assume they will be able to purchase supplemental coverage if they choose to switch to traditional Medicare at some point during their many years on Medicare.

How long can a Medicare beneficiary stay in another plan?

If such a beneficiary enrolled in a Medicare managed care plan which withdrew from the geographic area within the first 12 months of the individual’s enrollment and the individual enrolled in another Medicare managed care plan, the time in which the beneficiary may disenroll and purchase any Medigap plan is extended for a second 12 month period, for a total of 24 months.

How long does Medicare extend Medigap?

If such an individual enrolled for the first time in a Medicare managed care plan which withdrew from the geographic area within the first 12 months of the individual’s enrollment, the time in which these special Medigap rights apply is extended for a second 12 month period, for a total of 24 months.

How long is a Medigap plan creditable?

For Medigap purposes, creditable coverage is conferred for the number of months an individual was covered by another Medigap policy or was enrolled in a Medicare HMO. Thus, if an individual was previously in another Medigap plan or Medicare managed care plan for at least six months, no pre-existing condition limit can be imposed by a new Medigap plan.

How old do you have to be to get a Medigap policy?

This right only applies to Medicare beneficiaries who are 65 years of age or older. Insurance companies are not required by federal law to offer the same range of Medigap policies to Medicare beneficiaries with disabilities that they offer for sale to Medicare beneficiaries over age 65.

What is QMB in Medicare?

People who do not qualify for Medicaid but are within 100% of the federal poverty level are eligible for coverage under a program known as the Qualified Medicare Beneficiary Program (QMB) . QMB program benefits include: Payment of Medicare premiums. Payment of Medicare annual deductibles.

How long does a hospital stay deductible?

Hospital deductible per spell of illness; Hospital coinsurance payments (Medicare covers the first 60 days in full after the deductible has been met; days 61 to 90 require a copayment, and days 91 to 150 – the “lifetime reserve days” – a higher copayment still); Hospital services beyond 150 days per spell of illness;

Why do people in traditional Medicare need Medicare Supplement?

Individuals in traditional Medicare may want to obtain Medicare Supplement (“Medigap”) insurance because Medicare often covers less than the total cost of the beneficiary’s health care. Medicare is divided into two coverage components, Part A and Part B.

How many people are covered by Medicare?

More than 62 million people, including 54 million older adults and 8 million younger adults with disabilities, rely on Medicare for their health insurance coverage. Medicare beneficiaries can choose to get their Medicare benefits (Part A and Part B) through the traditional Medicare program, or they can enroll in a Medicare Advantage plan, such as a Medicare HMO or PPO. Medicare Advantage plans provide all benefits covered by Medicare Parts A and B, often provide supplemental benefits, such as dental and vision, and typically provide the Part D prescription drug benefit. Many traditional Medicare beneficiaries also rely on other sources of coverage to supplement their Medicare benefits. Supplemental insurance coverage typically covers some or all of Medicare Part A and Part B cost-sharing requirements and, in some instances, provides benefits not otherwise covered by Medicare. Beneficiaries can also enroll in a Part D plan for prescription drug coverage, either a stand-alone plan to supplement traditional Medicare or a Medicare Advantage plan that covers drugs.

How many Medicare beneficiaries have employer sponsored retirement?

Employer-sponsored Retiree Health Coverage. In total, 14.3 million of Medicare beneficiaries – a quarter (26%) Medicare beneficiaries overall — also had some form of employer-sponsored retiree health coverage in 2018. Of the total number of beneficiaries with retiree health coverage, nearly 10 million beneficiaries have retiree coverage ...

What are the characteristics of Medicare beneficiaries with different sources of coverage?

Among Medicare beneficiaries in traditional Medicare, most (83%) have supplemental coverage, either through Medigap (34%), employer-sponsored retiree health coverage (29%), or Medicaid (20%). But nearly 1 in 5 (17%) Medicare beneficiaries in traditional Medicare have no supplemental coverage ( Figure 2 ).

What is the age limit for Medigap?

Compared to all traditional Medicare beneficiaries in 2018, a larger share of Medigap policyholders had annual incomes greater than $40,000, had higher education levels, were disproportionately White, and were in excellent, very good, or good health ( Table 1 ). Only a small share of Medigap policyholders (2%) were under age 65 and qualified for Medicare due to having a long-term disability; most states do not require insurers to issue Medigap policies to beneficiaries under age 65. Federal law provides time-limited guarantee issue protections for adults ages 65 and older when they enroll in Medicare if they want to purchase a supplemental Medigap policy, but these protections do not extend to adults under the age of 65. Legislation has been introduced in the 117 th Congress to require insurers to offer Medigap coverage to younger adults with disabilities when they first go on Medicare, and to others.

What is Medicare Advantage?

Medicare Advantage plans provide all benefits covered by Medicare Parts A and B, often provide supplemental benefits, such as dental and vision, and typically provide the Part D prescription drug benefit. Many traditional Medicare beneficiaries also rely on other sources of coverage to supplement their Medicare benefits.

How is supplemental coverage determined?

Sources of supplemental coverage are determined based on the source of coverage held for the most months of Medicare enrollment in 2018. The analysis excludes beneficiaries who were enrolled in Part A only or Part B only for most of their Medicare enrollment in 2018 (n=4.7 million) and beneficiaries who had Medicare as a secondary payer ...

Does Medicare have supplemental coverage?

No Supplemental Coverage. In 2018, 5.6 million Medicare beneficiaries in traditional Medicare– 1 in 10 beneficiaries overall (10%) or nearly 1 in 5 of those with traditional Medicare (17%) had no source of supplemental coverage. Beneficiaries in traditional Medicare with no supplemental coverage are fully exposed to Medicare’s cost-sharing ...

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

What is a select Medicare policy?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. . If you buy a Medicare SELECT policy, you have rights to change your mind within 12 months and switch to a standard Medigap policy.

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

What is coinsurance percentage?

An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).

Can you charge more for a Medigap policy?

Charge you more for a Medigap policy. In some cases, an insurance company must sell you a Medigap policy, even if you have health problems. You're guaranteed the right to buy a Medigap policy: When you're in your Medigap open enrollment period. If you have a guaranteed issue right.

Can Medigap refuse to cover out-of-pocket costs?

A health problem you had before the date that new health coverage starts. . In some cases, the Medigap insurance company can refuse to cover your. out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance.

Can you get Medicare if you are 65?

Some states provide these rights to all people with Medicare under 65. Other states provide these rights only to people eligible for Medicare because of disability or only to people with ESRD. Check with your State Insurance Department about what rights you might have under state law.

What is Medicare and Medigap?

Medicare and Medigap insurance comprise a sound financial plan for someone over age 65. Medicare works as the primary coverage, with the Medigap plan (sometimes called a Medicare Supplement) filling in the gaps in Medicare. But, how exactly do Medicare and Medigap work together?

How does Medicare work?

The way it works is that a doctor’s office files a claim to Medicare first, which pays that claim electronically. After Medicare pays, the Medigap plan pays as a secondary payer, after receiving the claim through the Medicare “crossover” system (see Fact #4 below)

How does the Medicare crossover work?

The way that the “crossover” system works is that Medicare sends claims information to the secondary payer (the Medigap company) and, essentially, coordinates the payment on behalf of the provider.

What happens if you go to a doctor who doesn't accept Medicare?

In other words, if you go to a doctor who does not accept Medicare, or file to Medicare, your Medigap plan (regardless of what company it is with) will be useless. The key, as a Medicare beneficiary, is seeing if your doctor/hospital, or any doctor/hospital you wish to use, accepts Medicare.

What is the Medicare Part B deductible for 2020?

Plan G which is the next step down, and usually is the best deal, pays all but the Medicare Part B deductible, which is $198/year (for 2020). NOTE: For people who were first eligible for Medicare after 1/1/2020, Plan F is no longer available.

Do Medicare and Medigap work together?

Medicare and Medigap plans work together seamlessly. One the major concerns that we address in people turning 65 is how the Federal government health program could possibly work well together with a private insurance company’s individual health insurance policy. Although we certainly recognize the root of this concern, ...

Does Medicare pay for claims?

Medicare does not pay any claims or provide any coverage if you have a Medicare Advantage plan. I’ve heard enough…. Email me the list of Medigap options with rates and ratings for my area. Get a List of Medigap Plans for Your Zip Code. Complete the form to receive the information via email. Name: