How many people are enrolled in the Medicare program?

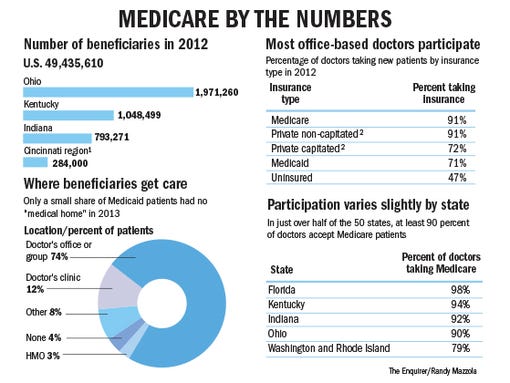

Mar 23, 2021 · More than 62 million people, including 54 million older adults and 8 million younger adults with disabilities, rely on Medicare for their health insurance coverage. Medicare beneficiaries can ...

What percentage of Medicare beneficiaries have a Medigap policy?

Feb 16, 2022 · Medicare Part D is otherwise known as prescription drug coverage and also covers many recommended vaccines. While there is no standard premium for Part A, in 2021, Part B costs 149 U.S. dollars ...

What percentage of Medicare beneficiaries received Medicaid in 2017?

Assets at end of 2018: $200.4: $96.3 $8.0: $304.7: Total income in 2019. Payroll taxes Interest ... workers pay an additional 0.9 percent of their earnings above $200,000 (for those who file an individual return) or $250,000 (for those who file a joint income tax return) ... Benefit for dual eligibles (those who qualify for Medicare and ...

What is the Medicare Part a hospital deductible for 2018?

The Henry J. Kaiser Family Foundation Headquarters: 185 Berry St., Suite 2000, San Francisco, CA 94107 | Phone 650-854-9400 Washington Offices and Barbara Jordan Conference Center: 1330 G …

How many Medicare beneficiaries are there in 2018?

62.9 milliono The total Medicare population, including dually eligible beneficiaries, increased from 45.7 million in 2006 to 62.9 million in 2018, an AAGR of 2.7 percent.

How many people go on Medicare every day?

10,000 peopleBut here's a sobering statistic that President Obama glossed over: About 10,000 people are now enrolling in Medicare every day. That's a record surge in Medicare enrollment, and it's expected to continue for the next 15 years, as the Baby Boomers age into their golden years.Jul 13, 2015

How many Medicare beneficiaries are there in 2019?

64.4 million Medicare beneficiariesMedicare Enrollment, 2019 The number of people enrolled in Medicare varied by state. There were a total of 64.4 million Medicare beneficiaries in 2019.

How many Medicare enrollees are there?

6.2 millionWith over 6.2 million, California was the state with the highest number of Medicare beneficiaries.Feb 16, 2022

What percentage of the population is covered by Medicare?

18 percentMedicare is an important public health insurance scheme for U.S. adults aged 65 years and over. As of 2020, approximately 18 percent of the U.S. population was covered by Medicare, a slight increase from the previous year.Sep 24, 2021

How many Medicare beneficiaries are there in 2021?

As of October 2021, the total Medicare enrollment is 63,964,675. Original Medicare enrollment is 36,045,321, and Medicare Advantage and Other Health Plan enrollment is 27,919,354. This includes enrollment in Medicare Advantage plans with and without prescription drug coverage.Dec 21, 2021

How many Medicare beneficiaries are there in 2022?

The Centers for Medicare & Medicaid Services (CMS) reports that 13.8 million Americans have signed up for or were automatically re-enrolled in 2022 individual market health insurance coverage through the Marketplaces since the start of the 2022 Marketplace Open Enrollment Period (OEP) on November 1.Jan 10, 2022

How many Medicare Part B beneficiaries are there?

The national base beneficiary premium for 2019 was $32.74....Number of People Receiving Medicare (2019): *Total Medicare beneficiaries • Aged • Disabled61.2 million • 52.6 million • 8.7 millionPart A (Hospital Insurance, HI) beneficiaries • Aged • Disabled60.9 million • 52.2 million • 8.7 million3 more rows•Aug 24, 2020

What are Medicare beneficiaries?

A Medicare beneficiary is someone aged 65 years or older who is entitled to health services under a federal health insurance plan.

How many people age into Medicare per day?

Members of the baby-boom generation (born between mid-1946 and 1964) began aging into Medicare in 2011 at a rate of about 10,000 people per day, a rate that will continue until 2030.

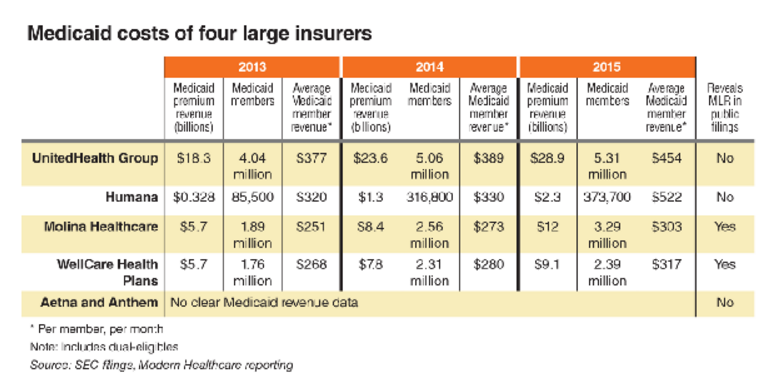

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

How many people are on Medicare in 2019?

In 2019, over 61 million people were enrolled in the Medicare program. Nearly 53 million of them were beneficiaries for reasons of age, while the rest were beneficiaries due to various disabilities.

What is Medicare in the US?

Matej Mikulic. Medicare is a federal social insurance program and was introduced in 1965. Its aim is to provide health insurance to older and disabled people. In 2018, 17.8 percent of all people in the United States were covered by Medicare.

Which state has the most Medicare beneficiaries?

With over 6.1 million, California was the state with the highest number of Medicare beneficiaries . The United States spent nearly 800 billion U.S. dollars on the Medicare program in 2019. Since Medicare is divided into several parts, Medicare Part A and Part B combined were responsible for the largest share of spending.

How much is Medicare Part A deductible?

– Initial deductible: $1,408.

What is Medicare Advantage?

Medicare Advantage (MA): Eligibility to choose a MA plan: People who are enrolled in both Medicare A and B, pay the Part B monthly premium, do not have end-stage renal disease, and live in the service area of the plan. Formerly known as Medicare+Choice or Medicare Health Plans.

How much will Social Security increase in 2018?

After several years of no or very small increases, Social Security benefits will increase by 2.0 percent in 2018 due to the Cost of Living adjustment.

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the deductible for Medicare Part B?

The annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A annual inpatient hospital deductible ...

What is the Medicare Part B premium?

Medicare Part B Premiums/Deductibles. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017.

What is the difference between medicaid and medicare?

Medicare is a federal program with uniform eligibility rules, payments (geographically adjusted), and a standard benefit package, whereas Medicaid is a joint federal-state program with eligibility rules , payments , and benefits varying across the states ( MedPAC & MACPAC, 2018 ). For dual eligibles, Medicare is the primary payer for most medical services, such as inpatient and outpatient care, physician services, diagnostic and preventive care, post-acute skilled-level care, and prescription drugs ( Jacobson et al., 2012 ). Medicaid is the secondary payer, providing financial assistance to dual-eligible beneficiaries for Medicare premiums and cost sharing, as well as services not covered by Medicare, such as non-skilled LTSS and, as a state-level option, hearing, vision, and dental services ( Young et al., 2013 ).

What is dual eligibility?

Dual-eligible beneficiaries consist of two subgroups, differentiated by the amounts of Medicaid assistance they are entitled to receive: full-benefit duals and partial-benefit duals ( Medicare-Medicaid Coordination Office, 2017b ). The Medicaid eligibility requirements for the two types of duals are illustrated in Figure 1 and described below.

Is dual eligibility for medicaid a high need?

Individuals who are dually eligible for Medicare and Medicaid represent a high-need, high-cost, and vulnerable segment of the population. If current enrollment trends continue, the population of dual-eligible beneficiaries will keep growing and remain the focus of policy attention in years to come. The current administration is aggressively seeking to reduce Medicaid financial outlays and, in moving toward this goal, may revamp the Medicaid program. Whether and how the evolving Medicaid policy landscape will affect current and future dual-eligible beneficiaries remains uncertain. For policymakers, health care providers, and insurers, one thing is certain: concerted and continued efforts are needed to remove barriers to care coordination for dual-eligible beneficiaries in a more cost-effective, person-centered, and integrated delivery system than the bifurcated and fragmented system we currently have. Many ongoing policy initiatives, including the Financial Alignment Initiative demonstrations, have the potential to develop innovative approaches to achieving this end, although challenges abound.

What percentage of Medicare spending is disproportionate?

Dually eligible beneficiaries accounted for a disproportionate share of spending: In Medicare, they account for 34 percent of spending and 20 percent of enrollees. In Medicaid, they account 32 percent of spending and 15 percent of enrollees.

What is Chapter 6 of the Medicare Act?

Chapter 6 continues the Commission’s work on integrating care for the 12.3 million individuals who are dually eligible for Medicaid and Medicare. People who are eligible for both programs often experience fragmented care and poor health outcomes because their benefits are not coordinated.

What is a dually eligible beneficiary?

Dually eligible beneficiaries are people enrolled in both Medicare and Medicaid who are eligible by virtue of their age or disability and low incomes.

How much does Medicare Part A cost?

However, if you don't qualify, then you can still get Part A coverage as long as you pay a monthly premium. In 2018, the premium for those with 30 to 39 quarters of coverage will be $232 per month, up $5 from 2017's figure. If you have fewer than 30 quarters, then the monthly premium is $422, up $9 from last year.

How much is Medicare Part B deductible?

For instance, the annual deductible for 2018 remains at $183 per year, which represents the amount you have to pay for doctor visits or other outpatient services before Part B coverage kicks in.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

Is Medicare Part B flat?

It can be difficult for retirees to handle even small increases in living expenses, so the flat premiums for many Medicare Part B recipients are good news. Yet with the hold-harmless provision finally undoing its positive impacts over previous years, many retirees will nevertheless have to figure out how to deal with seeing more of their hard-earned money go toward Medicare in 2018.

How long does it take to enroll in Medicare Part B?

If you are eligible for Medicare because you are 65 or older and are covered by your job-based insurance or your spouse’s, you have a Special Enrollment Period (SEP) to enroll in Medicare Part B while you are covered by job-based insurance and up to eight months after you no longer have that coverage.

Is Medicare Part B primary or secondary?

Job-based insurance is primary if it is from an employer with 20 or more employees. Medicare is secondary in this case, and some people in this situation choose not to enroll in Medicare Part B so that they do not have to pay the monthly premium. Job-based insurance is secondary if it is from an employer with fewer than 20 employees;

Does job based insurance pay for Medicare?

Having job-based insurance does allow you to delay Medicare enrollment without penalty and delay paying the Medicare Part B premium (the standard Medicare Part B premium is expected to be $134 a month in 2019). However, it’s important to know whether your job-based insurance will pay primary or secondary to Medicare.