What are the different types of Medicare supplement plans?

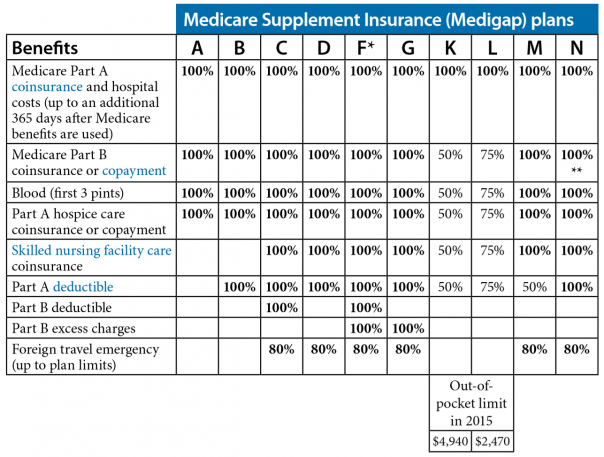

There are 10 standardized Medicare Supplement Insurance (Medigap) plans that are available in most states. These plans are labeled Plan A, B, C, D, F, G, K, L, M and N. When shopping for the best Medigap plan for your needs, it can help to compare Medigap quotes. How to Compare Medicare Supplement Plans

How many people have Medicare supplement insurance?

Out of the 64 million people in the United States who have traditional Medicare benefits, 81 percent of them have one sort of Medicare supplement insurance. These supplemental plans may include those that are provided by an employer, Medigap plans, or supplemental health care coverage through Medicaid.

Which Medicare supplement plan is best for seniors?

Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

How do I compare Medicare supplement insurance plans in my area?

A licensed insurance agent can help you compare Medicare Supplement Insurance plans that are available in your area. After you use the comparison chart above, you can ask a licensed agent about the types of Medigap plans that may be offered where you live. Find Medicare Supplement Insurance plans in your area.

How many different supplement plans are there?

10There are 10 standardized Medicare Supplement Insurance (Medigap) plans that are available in most states. These plans are labeled Plan A, B, C, D, F, G, K, L, M and N.

What are the 10 standardized Medigap plans?

Insurance companies may offer up to 10 different Medigap policies labeled A, B, C, D, F, G, K, L, M and N. Each lettered policy is standardized. This means that all policies labeled with the same letter have the same benefits, no matter which company provides them or their price.

Is plan F better than plan G?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What is the difference between plan G and plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

What are the 12 standardized Medigap plans?

There are 12 different standardized plans in most states. The Federal Government standardized these plans and created 12 options for consumers: A, B, C, D, F, G, K, L, M, N, HD-G, HD-F. Each plan covers a different range of costs. Plan F and Plan G offer high deductible plans too.

Why is plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What is the deductible for plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Which Medigap plans are no longer available?

The federal government standardizes all Medigap plans. Medicare Supplement Plan H, Plan I, and Plan J are no longer available. These plans were discontinued when the Medicare Modernization Act of 2003 became a law, introducing Medicare Part D.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the most popular Medigap policy?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the difference between plan F and plan G in Medicare?

The main difference between the two plans is how Plan G interacts with the Part B deductible. With Plan F, the Medicare Supplement plan pays for the Part B deductible. Under Plan G, you are responsible for the Part B deductible only. Otherwise, all Part A deductibles, copays, and coinsurance are covered.

What plan G does not cover?

Medigap Plan G does not cover dental care, or other services excluded from Original Medicare coverage like cosmetic procedures or acupuncture. Some Medicare Advantage policies may cover these services. Like Medigap, Medicare Advantage is private insurance.

What is the deductible for plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health insurance.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When can I buy Medigap?

Get the facts about the specific times when you can sign up for a Medigap policy.

How to compare Medigap policies

Read about different types of Medigap policies, what they cover, and which insurance companies sell Medigap policies in your area.

Medigap & travel

Read about which Medigap policies offer coverage when you travel outside the United States (U.S.).

Medicare Advantage (Part C)

You pay for services as you get them. When you get a covered service, Medicare pays part of the cost and you pay your share.

You can add

You join a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage.

Most plans include

Some extra benefits (that Original Medicare doesn’t cover – like vision, hearing, and dental services)

Medicare drug coverage (Part D)

If you chose Original Medicare and want to add drug coverage, you can join a separate Medicare drug plan. Medicare drug coverage is optional. It’s available to everyone with Medicare.

Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare.

What are the rules for Medicare?

Here’s what that means, under Medicare rules: 1 You have at least one condition that’s either life-threatening or that significantly impairs your function; 2 You have a high risk of hospitalization or negative health consequences; and 3 You require intensive coordination for your healthcare.

Why do seniors opt for Medicare Advantage?

Many seniors opt for Medicare Advantage over original Medicare because of the additional benefits associated with it . Dental care, vision screenings, and hearing aids, for example, are all non-covered services under Original Medicare, whereas Medicare Advantage plans commonly pick up their tab. And supplemental benefits are making Medicare ...

What are the benefits of Medicare Advantage 2021?

These perks include masks, thermometers, and hand sanitizer. Meanwhile, in 2021: 98% of Advantage plans will offer vision plans. 94% will cover hearing services.

What is the benefit for homebound seniors in 2021?

Meanwhile, in 2021: Benefits for homebound seniors and those with mobility issues will also be more widely available in 2021, with 57% of Advantage plans offering meal delivery (up from 23% in 2018) and 47% offering transportation to medical appointments.

When does Medicare open enrollment start?

If you are interested in pursuing these new benefits, it pays to assess your choices during the Medicare Advantage open enrollment period, which runs from January 1 through March 31. During this window, people who are already enrolled in Medicare Advantage can switch to a different Advantage plan, including one that offers the new supplemental benefits (note that only one plan change is allowed during this window, as opposed to the fall enrollment window, when multiple plan changes are allowed).

Can you qualify for supplemental benefits if you have a chronic health condition?

If you have a chronic health condition, you may qualify for supplemental benefits if it’s determined that they’ll improve your health or function. For example, as a diabetes patient, you may qualify for cooking classes that improve your diet, thereby resulting in fewer hospital visits.

Does Medicare cover carpet cleaning?

Take an asthma patient who frequently sees a doctor or gets hospitalized for recurring attacks. If a Medicare Advantage plan were to cover the cost of a carpet cleaning or air purifier, that patient would potentially suffer fewer attacks, thereby reducing the extent to which actual medical care is needed.

What Do Medicare Supplement Plans Cover?

Medigap plans cover all or some of the following costs, with a few exceptions:

What Do Medicare Supplement Plans Cost?

The costs of Medicare Supplement plans vary by state and by insurance company. The main factors that determine cost are your location and age. Keep in mind that a policy that looks less expensive at age 65 could become the most costly at age 85, so ask the insurance company how they set their premium pricing.

How to Apply for a Medicare Supplement Plan

The best time to apply for a Medicare Supplement plan is during your six-month open enrollment period. Open enrollment begins during the first month you’re 65 and enrolled in Medicare Part B. After this one-time open enrollment, you may not be able to purchase a Medigap plan or you might pay a lot more.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

What is the best alternative to Plan G?

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Does Cigna offer a discount on Medicare?

Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

How many people does Medicare Supplement cover?

Keep in mind that, just like Medicare, Medicare Supplement plans are individual insurance policies. They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan.

What percentage of Medicare supplement is paid?

After this is paid, your supplement policy pays your portion of the remaining cost. This is generally 20 percent. Some policies pay your deductibles The deductible is a set amount which you must pay before Medicare begins covering your health care costs.

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

How long does it take to get a Medigap plan?

When you turn 65 and enroll in Part B, you will have a 6-month Initial Enrollment Period to purchase any Medigap plan sold in your state. During this time, you have a “guaranteed issue right” to buy any plan available. They are required to accept you and cannot charge you more due to any pre-existing conditions.

How long does Medicare cover travel?

Each plan varies in what it covers, but all plans pay for Medicare Part A (hospital insurance) coinsurances for up to 365 days beyond the coverage that Medicare offers. Some of the plans cover a percentage of the cost for emergency health care while traveling abroad.

How old do you have to be to qualify for medicare?

To be eligible for Medicare, you must be at least 65 years old, a citizen of the United States or permanent legal resident for at least five consecutive years. Also, you, or your spouse, must have worked and paid federal taxes for at least ten years (or 40 quarters).

Does Medicare cover long term care?

Most plans do not cover long-term care, vision, dental, hearing care, or private nursing care. All Medicare Supplement insurance coverage comes with a monthly premium which you pay directly to your provider. How much you pay depends on which plan you have.

How many people will be on Medicare in 2021?

Close to 63 million Americans are enrolled in Medicare in 2021, and this number will only continue to rise as members of the baby boomer generation continue to join the 65-and-over demographic. 1

What is Medicare Advantage?

A Medicare Advantage plan offers the same coverage as Medicare Part A and Part B , and some Medicare Advantage plans may also offer benefits such as vision, hearing and dental coverage. Some plans may also cover prescription drugs. Medicare Advantage plans are offered by private insurance companies. Plan availability varies from state to state.

What is a PPO plan?

Preferred Provider Organization (PPO) plans provide a little more freedom by offering some coverage for out-of-network care and not requiring members to obtain a referral before visiting a specialist. PPO plans can come in the form of either regional PPOs or local PPOs .

Does Alaska offer Medicare Advantage?

Alaska. Compare Alaska Medicare plans online, or get assistance from the state resources below. Alaska does not offer Medicare Advantage plans (Part C), but there are still other options for you to explore your Medicare coverage options and have your questions answered. AARP Public Benefits Guide.

Does Medicare cover HMO?

There is no coverage for care received outside of the plan’s network.

Does Maine have Medicare?

Medicare beneficiaries in Maine have a number of resources at their fingertips. The Pine Tree State offers options for those with low incomes to help pay for their Medicare benefits, as well as resources to help pay for prescription drug costs and to help those with disabilities. State of Maine Bureau of Insurance.