How many people in the United States have Medicare?

In 2020, 62.6 million people were enrolled in the Medicare program, which equates to 18.4 percent of all people in the United States. Around 54 million of them were beneficiaries for reasons of age, while the rest were beneficiaries due to various disabilities.

Do you pay more in taxes than you pay in Medicare?

Today's workers' taxes are funding the monthly checks being sent to today's retirees. When it comes to Medicare, however, virtually all Americans are getting far more than they pay in taxes, which is 2.9% on all of one's income, not including the new 0.9% surtax on high earners.

How much does the average American pay in Medicare taxes?

So, let's see how much the average American pays in Medicare taxes. According to the Bureau of Labor Statistics, there were about 137.9 million American workers in mid-2015, if you include part-time employees. Also in 2015, the most recent year for which complete taxation data is available, $241.1 billion was paid in Medicare payroll taxes.

Do you get more from Social Security and Medicare combined?

In most cases, people get more from Social Security and Medicare combined than they put in, though the specific amount can vary depending on income and family circumstances. Here are some examples for people who turned 65 in 2010.

How much does the average American put into Social Security?

Workers pay 6.2 percent of their earnings up to a cap, which is $127,200 a year in 2017. (The cap on taxable earnings usually rises each year with average wages.) Employers pay a matching amount for a combined contribution of 12.4 percent of earnings.

What is the percentage of your income that gets paid into Social Security and Medicare?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

How much money did the US collect in Social Security and Medicare taxes?

Since its inception, FICA has collected more than $20 trillion for Social Security and Medicare. Congress enacted FICA in 1935.

Who was the first president to dip into Social Security?

Which political party started taxing Social Security annuities? A3. The taxation of Social Security began in 1984 following passage of a set of Amendments in 1983, which were signed into law by President Reagan in April 1983.

How much Social Security will I get if I make $100000 a year?

Based on our calculation of a $2,790 Social Security benefit, this means that someone who averages a $100,000 salary throughout their career can expect Social Security to provide $33,480 in annual income if they claim at full retirement age.

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

Were Social Security and Medicare the largest contributors of revenue?

SOCIAL INSURANCE (PAYROLL) TAXES The payroll taxes on wages and earnings that fund Social Security and the hospital insurance portion of Medicare make up the largest portion of social insurance receipts.

Is Social Security running out of money?

The Social Security trust funds going broke: It is true that the Social Security trust funds, where the money raised by Social Security taxes is invested in non-marketable securities, is projected to run out of funds by around 2034.

At what age do you stop paying taxes on Social Security benefits?

However once you are at full retirement age (between 65 and 67 years old, depending on your year of birth) your Social Security payments can no longer be withheld if, when combined with your other forms of income, they exceed the maximum threshold.

Can someone who has never worked collect Social Security?

The only people who can legally collect benefits without paying into Social Security are family members of workers who have done so. Nonworking spouses, ex-spouses, offspring or parents may be eligible for spousal, survivor or children's benefits based on the qualifying worker's earnings record.

When did Congress start borrowing from Social Security?

As a stop-gap measure, Congress passed legislation in 1981 to permit inter-fund borrowing among the three Trust Funds (the Old-Age and Survivors Trust Fund; the Disability Trust Fund; and the Medicare Trust Fund).

Why is Social Security taxed twice?

The rationalization for taxing Social Security benefits was based on how the program was funded. Employees paid in half of the payroll tax from after-tax dollars and employers paid in the other half (but could deduct that as a business expense).

Who says it's possible to quantify exactly how much has been spent on beneficiaries beyond what they paid in?

Jagadeesh Gokhale of the libertarian Cato Institute says it’s possible to quantify exactly how much has been spent on beneficiaries beyond what they paid in, using an obscure line in the massive 2012 report of the Social Security trustees.

How much would a 65 year old get back in 2010?

A couple with only one spouse working (and receiving the same average wage) would have paid in $361,000 if they turned 65 in 2010, but can expect to get back $854,000 — more than double what they paid in. In 1980, this same 65-year-old couple would have received five times more than what they paid in, while in 1960, ...

Is Social Security a transfer system?

Thus, Social Security is — and always has been — a transfer system from younger generations to older generations. "We’re not really entitled to get our money back since we didn’t save it but rather spent it on our parents," said C. Eugene Steuerle, who helped assemble the Urban Institute’s calculations.

Does Social Security pay out to beneficiaries?

While there is technically a modest Social Security trust fund, the federal government has long paid out most Social Security revenues to beneficiaries, leaving the government and future workers with what amounts to an IOU to cover the next generation of beneficiaries.

Do people get more Social Security and Medicare?

In most cases, people get more from Social Security and Medicare combined than they put in, though the specific amount can vary depending on income and family circumstances. Here are some examples for people who turned 65 in 2010. See the footnotes for some important caveats.

Is Medicare a federal program?

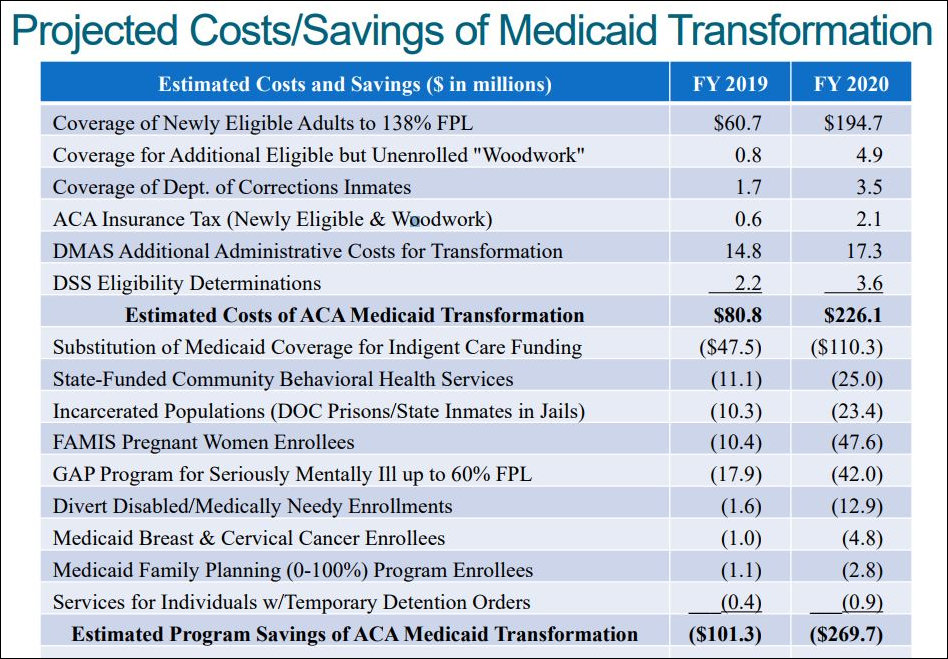

Given the similar names and some shared benefits, it’s understandable why so many people confuse Medicare and Medicaid. Both programs are federally regulated by the Centers for Medicare & Medicaid Services (CMS), though Medicaid programs can have some variations from one state to the next.

Is Medicaid cost lower than Medicare?

Costs are minimal and are generally lower than Medicare. Beneficiaries may pay limited premiums and small copayments. Certain beneficiaries are exempt from most or all Medicaid costs.

Can you get Medicare with dual eligible?

Dual eligible beneficiaries can receive coverage from both programs through a Medicare Savings Program, and some beneficiaries may be able to enroll in a private plan called a Dual Eligible Special Needs Plan (D -SNP) if any are available where they live.

How many Medicare Advantage enrollees are in a plan that requires higher cost sharing than the Part A hospital?

Nearly two-thirds (64%) of Medicare Advantage enrollees are in a plan that requires higher cost sharing than the Part A hospital deductible in traditional Medicare for a 7-day inpatient stay, and more than 7 in 10 (72%) are in a plan that requires higher cost sharing for a 10-day inpatient stay.

How many counties are covered by Medicare?

In 117 counties, accounting for 5 percent of the Medicare population, more than 60% of all Medicare beneficiaries are enrolled in Medicare Advantage plans or cost plans. Many of these counties are centered around large, urban areas, such as Monroe County, NY (69%), which includes Rochester, and Allegheny County, PA (63%), which includes Pittsburgh.

What are the companies that are part of Medicare Advantage?

Medicare Advantage enrollment is highly concentrated among a small number of firms. UnitedHealthcare and Humana together account for 44 percent of all Medicare Advantage enrollees nationwide, and the BCBS affiliates (including Anthem BCBS plans) account for another 15 percent of enrollment in 2020. Another four firms (CVS Health, Kaiser Permanente, Centene, and Cigna) account for another 23 percent of enrollment in 2020. For the fourth year in a row, enrollment in UnitedHealthcare’s plans grew more than any other firm, increasing by more than 500,000 beneficiaries between March 2019 and March 2020. This is also the first year that Humana’s increase in plan year enrollment was close to UnitedHealthcare’s, with an increase of about 494,000 beneficiaries between March 2019 and March 2020. CVS Health purchased Aetna in 2018 and had the third largest growth in Medicare Advantage enrollment in 2020, increasing by about 396,000 beneficiaries between March 2019 and March 2020.

How much is the deductible for Medicare Advantage 2020?

In contrast, under traditional Medicare, when beneficiaries require an inpatient hospital stay, there is a deductible of $1,408 in 2020 (for one spell of illness) with no copayments until day 60 of an inpatient stay.

What percentage of Medicare beneficiaries are in Miami-Dade County?

Within states, Medicare Advantage penetration varies widely across counties. For example, in Florida, 71 percent of all beneficiaries living in Miami-Dade County are enrolled in Medicare Advantage plans compared to only 14 percent of beneficiaries living in Monroe County (Key West).

What are the changes to Medicare 2020?

Changes for 2020 due to COVID-19: The COVID-19 stimulus package, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, includes $100 billion in new funds for hospitals and other health care entities. The Centers for Medicare and Medicaid Services (CMS) has recently made $30 billion of these funds available to health care providers based on their share of total Medicare fee-for-service (FFS) reimbursements in 2019, resulting in higher payments to hospitals in some states than in others. Hospitals in states with higher shares of Medicare Advantage enrollees may have lower FFS reimbursement overall. As a result, some hospitals and other health care entities may be reimbursed less that they would if the allocation of funds took into account payments received on behalf of Medicare Advantage enrollees.

How many people will be enrolled in Medicare Advantage in 2020?

Enrollment in Medicare Advantage has doubled over the past decade. In 2020, nearly four in ten (39%) of all Medicare beneficiaries – 24.1 million people out of 62.0 million Medicare beneficiaries overall – are enrolled in Medicare Advantage plans; this rate has steadily increased over time since the early 2000s.

When did Medicare start providing prescription drugs?

Since January 1, 2006, everyone with Medicare, regardless of income, health status, or prescription drug usage has had access to prescription drug coverage. For more information, you may wish to visit the Prescription Drug Coverage site.

How long do you have to be on disability to receive Social Security?

You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months. ( Note: If you have Lou Gehrig's disease, your Medicare benefits begin the first month you get disability benefits.)

Why do couples receive more benefits than they pay in taxes?

In this scenario, the couple would receive more benefits than they pay in taxes because the wife's checks often will be based on her husband's earnings.

How much did a retired person get in Social Security in 1990?

Here are the numbers: A couple who each earned the average wage during their careers and retired in 1990 would have paid $316,000 in Social Security taxes, but collected $436,000 in benefits, ...

How much was Medicare paid in 2015?

Also in 2015, the most recent year for which complete taxation data is available, $241.1 billion was paid in Medicare payroll taxes. Of this amount, $211.9 billion came from wage income. The remaining $30 billion or so came from other sources that don't impact the average American, such as the 0.9% additional Medicare tax I mentioned earlier.

How many people paid Medicare taxes in 2015?

So, let's see how much the average American pays in Medicare taxes. According to the Bureau of Labor Statistics, there were about 137.9 million American workers in mid-2015, if you include part-time employees.

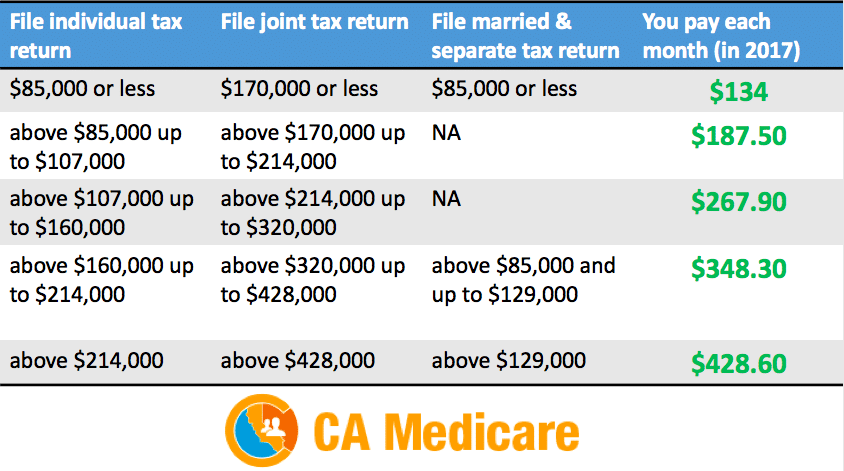

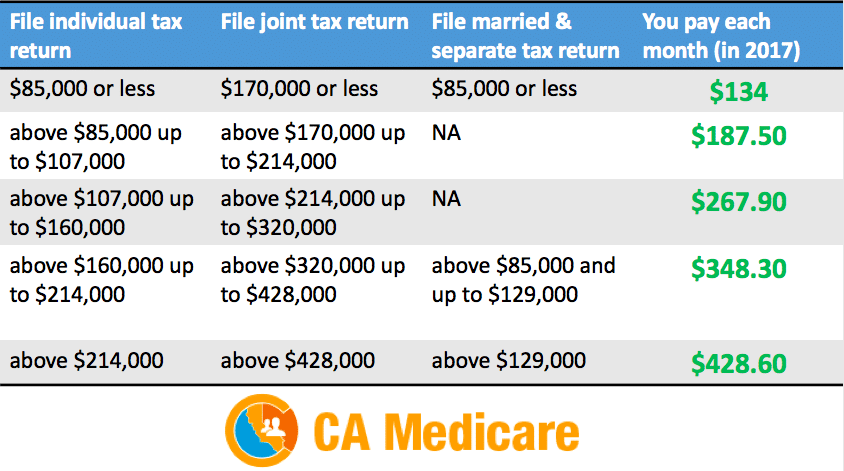

What is the Medicare tax rate?

Image source: Getty Images. On the other hand, the Medicare tax rate of 1.45% is assessed on all wage income. Employers pay an equal amount, for a total rate of 2.9%. And although it doesn't affect the average American worker, in the interest of being complete, there's an additional Medicare tax that high earners are required to pay.

How much is Medicare deficit?

According to the Medicare Trustees Report, the 75-year deficit is projected to be equivalent to 0.73% of taxable payroll. This means that by raising the current 2.9% Medicare tax rate to 3.63% (1.815% for employees), the program would maintain its solvency for at least another 75 years.

Is Medicare taxing in 2028?

However, there's a strong possibility that the Medicare tax rate will be increased in the not-too-distant future. It's no secret that Medicare isn' t in the best financial shape, and at the current rate, the program will be out of money in 2028.

Is Medicare based on income?

Of the three wage-based types of tax American workers pay, Medicare is perhaps the most straightforward and easy to calculate. Federal and state income taxes are based on a set of marginal tax brackets, and Social Security tax is only assessed on income below a certain threshold that changes annually.

How long do you have to live to qualify for Medicare?

You qualify for full Medicare benefits if: You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and. You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.

How old do you have to be to get Medicare?

citizen or have been a legal resident for at least five years, you can get full Medicare benefits at age 65 or older. You just have to buy into them by: Paying premiums for Part A, the hospital insurance.

How much will Medicare premiums be in 2021?

If you have 30 to 39 credits, you pay less — $259 a month in 2021. If you continue working until you gain 40 credits, you will no longer pay these premiums. Paying the same monthly premiums for Part B, which covers doctor visits and other outpatient services, as other enrollees pay.

How long do you have to be on disability to receive Social Security?

You have been entitled to Social Security disability benefits for at least 24 months (that need not be consecutive); or. You receive a disability pension from the Railroad Retirement Board and meet certain conditions; or.

Do you pay the same monthly premium for Part D?

Paying the same monthly premium for Part D prescription drug coverage as others enrolled in the drug plan you choose.

Is Medicare automatic for older people?

But qualifying for the program is not automatic. Here’s how to determine if you are eligible.