What are the advantages and disadvantages of Medicare Advantage plans?

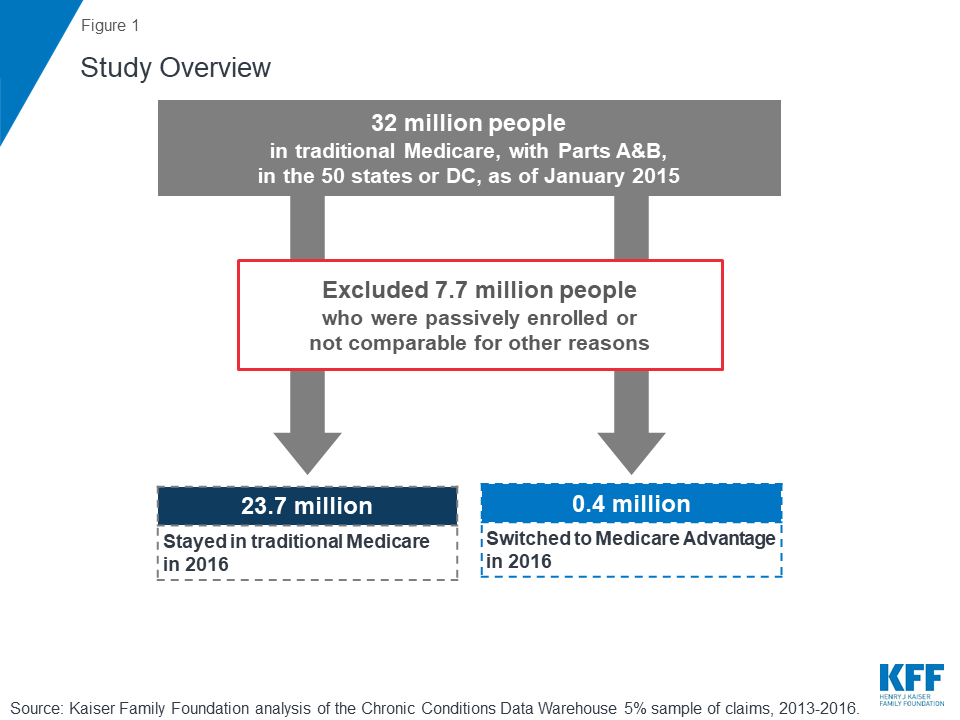

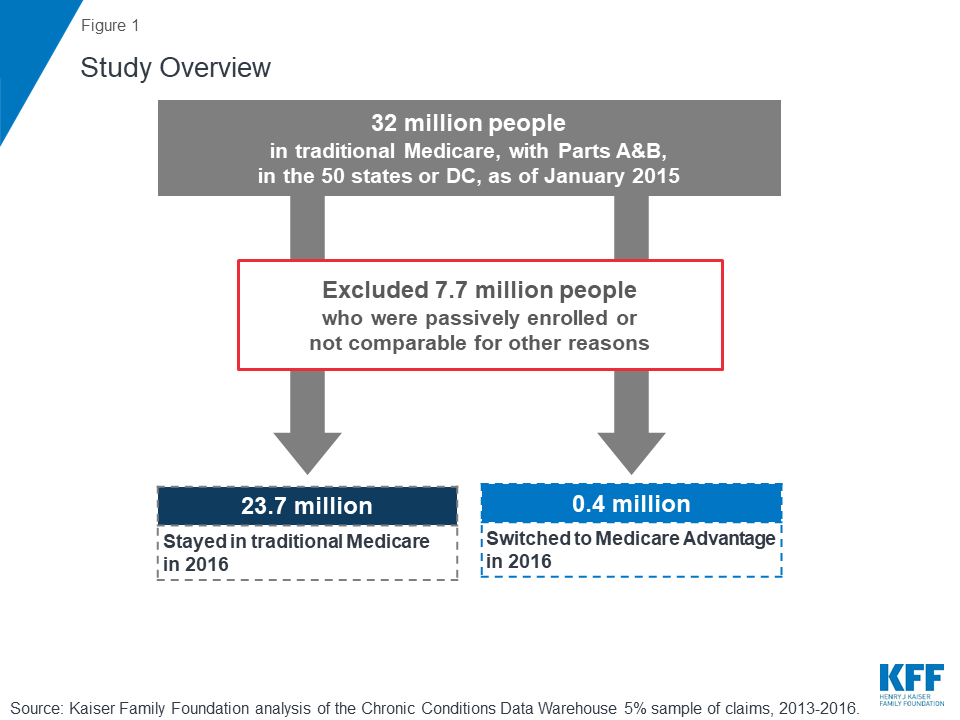

Jun 12, 2019 · Kaiser found that 71 percent of people enrolling in Medicare for the first time chose traditional Medicare, as compared with 29 percent who chose Medicare Advantage. People choosing traditional Medicare appear willing to spend more on their coverage upfront and want to avoid getting a referral or a prior authorization before receiving specialty care.

Is Medicare Advantage good or bad?

More than 21 million people with Medicare chose to receive their benefits from a Medicare Advantage plan. Most people can choose from, on average, 28 available Medicare Advantage plans in 2020, according to a report by the Kaiser Family Foundation. The Medicare Advantage (Medicare Part C) program enjoys a lively market.

Is Medicare Advantage good insurance?

Jun 06, 2019 · Figure 1: Total Medicare Advantage Enrollment, 1999-2019 (in millions) In 2019, one-third (34%) of all Medicare beneficiaries – 22 million people – are enrolled in Medicare Advantage plans ...

What is a five star Medicare plan?

Jan 06, 2022 · This coverage is purchased through a private health insurance company approved by Medicare, and there is a monthly premium to pay, no matter how many prescriptions you use—just like Part B. The average cost for this premium is $34 as of early 2018. This cost may be a little higher if your income is above $85,000 (this extra cost will be paid ...

Can you change your Medicare Advantage plan?

You can change from one Medicare Advantage plan to a different one during certain enrollment periods. Plan benefits may change from year to year, and new plans may become available

Is Medicare Advantage changing?

Summary: Today, Medicare Advantage plans can offer more choices in benefits than before – often with lower premiums. But many people don’t realize that Medicare Advantage plans are changing or emerging all the time. Some people review their coverage every year and decide whether to switch plans. Others review their coverage ...

What is Medicare Advantage landscape?

Medicare Advantage landscape: more choice in plans, more diversity in benefits. Medicare Advantage is an increasingly attractive way to get Medicare Part A and Part B benefits. Your choice is that way or through the federal Medicare insurance program. According to the Centers of Medicare & Medicaid Services (CMS), ...

When is Medicare open enrollment?

The Medicare Advantage Open Enrollment Period is January 1 – March 31.

What are the benefits of eHealth?

There could be a number of reasons for eHealth customers to compare Medicare coverage options. For example, eHealth has an easy-to-use, no-obligation plan comparison tool. More than 50% of respondents said new Medicare Advantage benefits would have an influence on their decision-making. Here are just a few examples of possible benefits: 1 Routine dental and vision benefits 2 Alternative medicine coverage 3 Nutritional support 4 Medical transportation 5 Telehealth services 6 Personal home helper assistance.

How many people will be enrolled in Medicare Advantage in 2020?

Enrollment in Medicare Advantage has doubled over the past decade. In 2020, nearly four in ten (39%) of all Medicare beneficiaries – 24.1 million people out of 62.0 million Medicare beneficiaries overall – are enrolled in Medicare Advantage plans; this rate has steadily increased over time since the early 2000s.

How many people will be on Medicare in 2020?

In 2020, nearly four in ten (39%) of all Medicare beneficiaries – 24.1 million people out of 62.0 million Medicare beneficiaries overall – are enrolled in Medicare Advantage plans; this rate has steadily increased over time since the early 2000s.

What percentage of Medicare beneficiaries are in Miami-Dade County?

Within states, Medicare Advantage penetration varies widely across counties. For example, in Florida, 71 percent of all beneficiaries living in Miami-Dade County are enrolled in Medicare Advantage plans compared to only 14 percent of beneficiaries living in Monroe County (Key West).

How much is the deductible for Medicare Advantage 2020?

In contrast, under traditional Medicare, when beneficiaries require an inpatient hospital stay, there is a deductible of $1,408 in 2020 (for one spell of illness) with no copayments until day 60 of an inpatient stay.

How much does Medicare Advantage pay in 2020?

However, 18 percent of beneficiaries in MA-PDs (2.8 million enrollees) pay at least $50 per month, including 6 percent who pay $100 or more per month, in addition to the monthly Part B premium. The MA-PD premium includes both the cost of Medicare-covered Part A and Part B benefits and Part D prescription drug coverage. Among MA-PD enrollees who pay a premium for their plan, the average premium is $63 per month. Altogether, including those who do not pay a premium, the average MA-PD enrollee pays $25 per month in 2020.

Does Medicare Advantage offer supplemental benefits?

Medicare Advantage plans may provide extra (“supplemental”) benefits that are not offered in traditional Medicare, and can use rebate dollars to help cover the cost of extra benefits. Plans can also charge additional premiums for such benefits. Beginning in 2019, Medicare Advantage plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental benefits must still be considered “primarily health related” but CMS expanded this definition, so more items and services are available as supplemental benefits.

Does Medicare Advantage require prior authorization?

Medicare Advantage plans can require enrollees to receive prior authorization before a service will be covered, and nearly all Medicare Advantage enrollees (99%) are in plans that require prior authorization for some services in 2020. Prior authorization is most often required for relatively expensive services, such as inpatient hospital stays, skilled nursing facility stays, and Part B drugs, and is infrequently required for preventive services. The number of enrollees in plans that require prior authorization for one or more services increased from 2019 to 2020, from 79% in 2019 to 99% in 2020. In contrast to Medicare Advantage plans, traditional Medicare does not generally require prior authorization for services, and does not require step therapy for Part B drugs.

What percentage of Medicare beneficiaries are in Advantage plans?

In 28 states and Puerto Rico, at least 31 percent of Medicare beneficiaries are enrolled in Medicare Advantage plans, with more than 40 percent of enrollees in six states (HI, FL, MN, OR, WI, PA) and Puerto Rico.

How many Medicare Advantage enrollees are there in 2019?

One in five Medicare Advantage enrollees (4.4 million) are in group plans offered by employers and unions for their retirees in 2019. Under these arrangements, employers or unions contract with an insurer and Medicare pays the insurer a fixed amount per enrollee to provide benefits covered by Medicare.

How many states have Medicare Advantage?

In 28 states and Puerto Rico, at least 31 percent of Medicare beneficiaries are enrolled in Medicare Advantage plans, with more than 40 percent of enrollees in six states (HI, FL, MN, OR, WI, PA) and Puerto Rico.

Is Medicare available in Minnesota?

The majority of the Medicare private health plan enrollment in Minnesota has historically been in cost plans, rather than Medicare Advantage plans, but as of 2019, most cost plans in Minnesota are no longer offered and have been replaced with risk-based HMOs and PPOs.

Does Medicare require prior authorization?

Medicare Advantage plans can require enrollees to receive prior authorization before a service will be covered, and nearly four out of five Medicare Advantage enrollees (79%) are in plans that require prior authorization for some services in 2019.

What is a SNP plan?

Special Needs Plans (SNPs) restrict enrollment to specific types of beneficiaries with significant or relatively specialized care needs. The majority of SNP enrollees (85%) are in plans for beneficiaries dually eligible for Medicare and Medicaid (D-SNPs), with the remainder in plans for beneficiaries requiring a nursing home or institutional level of care (I-SNPs), or with severe chronic or disabling conditions (C-SNPs.)

When did CVS buy Aetna?

CVS purchased Aetna in 2018 and the combined company had the second largest growth in Medicare Advantage enrollment in 2019, increasing by also about 520,000 beneficiaries between March 2018 and March 2019. 5.

How to find Medicare Advantage plan?

While you search for your Medicare Advantage plan, here are a few questions to keep in mind: 1 Do you have a favorite doctor you’ve been seeing for years? If you choose a plan with a network of preferred providers, make sure your doctor is on the list. The same is true of hospitals — if you have several in your region, it’s good to know that the one you prefer will accept your Advantage insurance. 2 Do you take medications on a maintenance schedule? If so, make sure that your plan includes drug coverage. Most Medicare Advantage plans do — but not all of them. 3 What is your chosen plan’s deductible? The higher the deductible, the more you’ll pay out-of-pocket before your plan kicks in. 4 Likewise, what are the copays? If you frequently need to see a healthcare professional for a chronic condition, a plan with lower copays makes sense, and may even make up for higher monthly premiums. 5 Do you have frequent vision, dental, or hearing issues? A plan that covers these health care needs may save you money.

What are the benefits of Medicare Advantage?

Medicare Advantage plans differ depending on the company that is overseeing them, but in general they offer benefits beyond what Medicare Part A and B offer, such as vision, hearing, and dental coverage, gym memberships, and drug coverage. Plus, the all-in-one nature of the plans makes them easy to manage. Choosing a plan that’s right ...

Can you go out of network with Medicare Advantage?

But you can go out-of-network when needed, though there may be a higher copay or coinsurance cost.

What is an HMO plan?

These plans feature a network of approved health care providers in your region, and in order for your insurance to pay for a doctor’s visit or other health care need, you must use the providers that are in your network. The exceptions are for emergency care, out-of-area urgent care, ...

Who is Caren Lampitoc?

Caren Lampitoc is an educator and Medicare consultant for Medicare Risk Adjustments and has over 25 years of experience working in the field of Medicine as a surgical coder, educator and consultant.

How to Choose a Medicare Plan Type

There are a few considerations to keep in mind as you begin searching for Medicare Supplemental insurance. First and foremost, there are two types of Medicare plans. You need to understand the difference between a Medicare Supplement and a Medicare Advantage plan.

How to Choose a Medicare Supplement

Medicare Supplement plans were standardized by the government in 1990. This was done to make it easier to compare plans. You can find our Medicare plans comparison chart on this website for an overview of Plans A – N.

How to Choose a Medicare Advantage Plan

On the other hand, if you prefer Medicare Advantage, we like to use the www.medicare.gov website to find options. The Medicare Plan Finder Tool will let us search for Medicare Advantage plans in your county based on your preferences. Some people prefer Medicare HMO plans for the lowest premiums.

Get Someone on Your Side with Medicare

If you have been asking yourself: Who can help me choose a Medicare plan – look no further!

What are the different types of Medicare Advantage plans?

There are several different types of Medicare Advantage plans. The two most popular are: 1 Health Maintenance Organizations (HMOs). HMOs have closed provider networks and you generally must get all but emergency care within your plan’s network. You choose a primary care doctor who oversees all your medical care. Your plan may require you to get a referral for specialist care and prior authorization for certain tests and procedures. HMO plans almost always include Part D prescription drug coverage. 2 Preferred Provider Organizations (PPOs). These plans also have provider networks, but you can still use any provider that accepts Medicare. You’ll pay a lot less out-of-pocket if you stay in your network, however. You don’t have to choose a primary care doctor or need a specialist referral. Most PPO plans also include Part D coverage.

Why is it so hard to give a snapshot of your Medicare Advantage plan?

It’s difficult to give a snapshot of your costs with a Medicare Advantage plan because each one is different . Each company that offers a plan can choose what to charge for premiums, deductibles, and copayment amounts.

What is a zero premium Medicare Advantage plan?

A zero-premium plan simply means that it doesn’t add any additional premiums above what you are already paying for Part B.

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans have a deductible and others don’t. Deductibles may apply to inpatient services, outpatient services or Part D. About half of all Medicare Advantage plans with Part D benefits don’t have a Part D deductible.

What are the two parts of Medicare?

Original Medicare benefits include two parts, Part A and Part B , that provide your hospital and medical insurance. If you have a qualifying work history, your Part A benefits are premium-free. Medicare Part B premiums are set each year by the federal government and most people pay the same standard rate.

Can you use any provider under Medicare Advantage?

Many Medicare Advantage plans have networks, such as HMOs (health maintenance organizations) or PPOs* (preferred provider organization). Many Medicare Advantage plans may have provider networks that limit the doctors and other providers you can use. Under Original Medicare, you can use any provider that accepts Medicare assignment.

Does Medicare Advantage have a monthly premium?

For starters, Medicare Advantage plans are offered by private insurance companies but are regulated by Medicare. Regardless if the Medicare Advantage plan you choose has a monthly premium or not, you must continue to pay your Medicare Part B premium. Some Medicare Advantage plans have premiums as low as $0.

What are the benefits of a syringe?

Other extra benefits may include: 1 Meal delivery for beneficiaries with chronic illnesses 2 Transportation for non-medical needs like grocery shopping 3 Carpet shampooing to reduce asthma attacks 4 Transport to a doctor appointment or to see a nutritionist 5 Alternative medicine such as acupuncture

What are the disadvantages of Medicare Advantage?

A possible disadvantage of a Medicare Advantage plan is you can’t have a Medicare Supplement plan with it. You may be limited to provider networks. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

Is Medicare Advantage a private insurance?

For starters, Medicare Advantage plans are offered by private insurance companies but are regulated by Medicare. Regardless if the Medicare Advantage plan you choose has a monthly premium or not, you must continue to pay your Medicare Part B premium.

Does Medicare have an out-of-pocket maximum?

You may not know that Original Medicare (Part A and Part B) has no out-of- pocket maximum. That means that if you face a catastrophic health concern, you may be responsible to pay tens of thousands of dollars out of pocket.

What is the out of pocket limit for Medicare Advantage?

Once you meet this limit, your plan covers the costs for all Medicare-covered services for the rest of the year. In 2021 the out of pocket limit is $7,550, according to the Kaiser Family Foundation.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

What are the problems with Medicare Advantage?

In 2012, Dr. Brent Schillinger, former president of the Palm Beach County Medical Society, pointed out a host of potential problems he encountered with Medicare Advantage Plans as a physician. Here's how he describes them: 1 Care can actually end up costing more, to the patient and the federal budget, than it would under original Medicare, particularly if one suffers from a very serious medical problem. 2 Some private plans are not financially stable and may suddenly cease coverage. This happened in Florida in 2014 when a popular MA plan called Physicians United Plan was declared insolvent, and doctors canceled appointments. 3 3 One may have difficulty getting emergency or urgent care due to rationing. 4 The plans only cover certain doctors, and often drop providers without cause, breaking the continuity of care. 5 Members have to follow plan rules to get covered care. 6 There are always restrictions when choosing doctors, hospitals, and other providers, which is another form of rationing that keeps profits up for the insurance company but limits patient choice. 7 It can be difficult to get care away from home. 8 The extra benefits offered can turn out to be less than promised. 9 Plans that include coverage for Part D prescription drug costs may ration certain high-cost medications. 4

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.

What is Medicare Supplement?

Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, such as copayments, deductibles, and healthcare when you travel abroad.

Does Medicare cover dental?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare ...