Medicare works in tandem with your other health insurance coverage. The two tag team. One insurance plan becomes the primary payer or the one that pays costs first. The other insurance becomes the secondary payer and pays the remaining costs.

Full Answer

What companies offer Medicare Advantage plans?

What Companies Offer Medicare Advantage Plans Currently

- Aetna Medicare Advantage Plans. ...

- Benefits of Aetna Medicare Advantage Plans. ...

- Blue Cross and Blue Shield Medicare Advantage Plans. ...

- Benefits of Blue Medicare Advantage Plans. ...

- Cigna Medicare Advantage Plans. ...

- Benefits of Cigna Medicare Advantage Plans. ...

- Humana Medicare Advantage Plans. ...

- Benefits of Humana Medicare Advantage Plans. ...

What are the best Medicare Advantage plans?

What to Know About the Best Medicare Advantage Plans

- Most Medicare Advantage plans are PPO and HMO. Most Medicare Advantage plans are either PPO or HMO, representing 46% and 39% of available plans. ...

- Most Medicare Advantage plans include prescription drug coverage. ...

- Vision, dental and hearing benefits are widespread. ...

- Just over half of Medicare Advantage plans have $0 premiums. ...

How do I choose the best Medicare Advantage plan?

- Do your important physicians participate in any Medicare Advantage plans or do they only accept Original Medicare?

- What insurance is accepted by your preferred hospitals?

- Do you travel out of the area frequently? ...

- What is your risk tolerance? ...

- How about peace of mind? ...

What do you pay in a Medicare Advantage plan?

- Complete a new Medicare enrollment (unless you are in your initial or special enrollment period)

- Switch from Original Medicare to Medicare Advantage

- Enroll in a stand-alone Part D prescription drug plan (unless you are moving to Original Medicare from Medicare Advantage)

Can Medicare Advantage plans have a secondary?

If you're in a Medicare Advantage Plan (with or without drug coverage), you can switch to another Medicare Advantage Plan (with or without drug coverage). You can drop your Medicare Advantage Plan and return to Original Medicare. You'll also be able to join a Medicare drug plan.

Can you have Medicare and Medicare Advantage both?

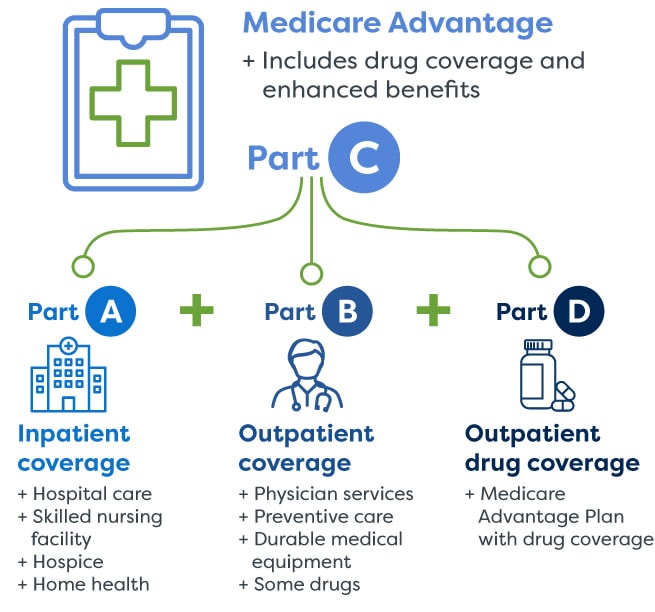

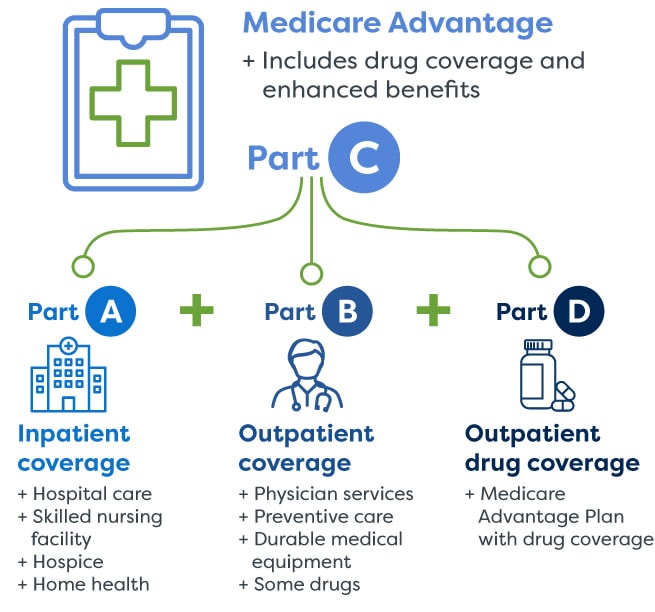

People with Medicare can get their health coverage through either Original Medicare or a Medicare Advantage Plan (also known as a Medicare private health plan or Part C).

Can I have an advantage plan and a supplemental plan?

You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

What type of coverage may be excluded from a Medicare Advantage plan?

Non-medical services, including a private hospital room, hospital television and telephone, canceled or missed appointments, and copies of x-rays. Most non-emergency transportation, including ambulette services. Certain preventive services, including routine foot care.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Can I switch from a Medicare Advantage plan back to Original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

When can you add a Medicare Supplement to a client with a Medicare Advantage plan?

Can I combine Medicare Supplement with Medicare Advantage? If you already have Medicare Advantage plan, you can generally enroll in a Medicare Supplement insurance plan under one condition – your Medicare Advantage plan must end before your Medicare Supplement insurance plan goes into effect.

Does getting a Medicare Advantage plan make you lose original Medicare?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Can you switch from Medicare Advantage to Medigap with pre existing conditions?

The Medigap insurance company may be able to make you wait up to 6 months for coverage of pre-existing conditions. The number of months you've had your current Medigap policy must be subtracted from the time you must wait before your new Medigap policy covers your pre-existing condition.

Do Medicare Advantage plans deny coverage?

Generally, if you're eligible for Original Medicare (Part A and Part B), you can't be denied enrollment into a Medicare Advantage plan. If a Medicare Advantage plan gave you prior approval for a medical service, it can't deny you coverage later due to lack of medical necessity.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Do Medicare Advantage plans cover surgeries?

Medicare Part B and Medicare Advantage plans generally cover physician services, including surgeons and anesthesiologists who participate in the inpatient surgery but who are not employees of the hospital.

Can I contribute to my HSA at work?

A: Under IRS rules, you cannot contribute to a health savings account (HSA) at work in any month that you are enrolled in any part of Medicare. But there are steps you can take to keep your HSA without being penalized. — Read Full Answer.

Do I need to sign up for Medicare if I have Indian health care?

Q. If I receive health care from the Indian Health Service, do I need to enroll in Medicare? A: Yes, you are required to sign up for Medicare Parts A and B, though not necessarily for Part D.— Read Full Answer.

Can I delay Medicare enrollment?

A: No, you can’t delay Medicare enrollment until COBRA expires — not without facing a gap in coverage and late penalties. — Read Full Answer. Q. I will continue to work after turning 65. My employer’s health insurance is a high-deductible health plan paired with a health savings account.

Does Medicare cover tricare for life?

A: Medicare becomes your primary health insurance and TRICARE For Life becomes supplemental coverage that wraps around Medicare benefits. So you must sign up with Medicare in order to maintain eligibility for TFL. — Read Full Answer.

Is Medicare Part B compulsory?

A: Part B enrollment is not compulsory. You don’t need to sign up if you don’t want to. But if you change your mind at a later date, Medicare will always cost you far more than if you sign up at 65. — Read Full Answer. Q.

Can I get medicaid and Medicare at the same time?

A: Eligibility for Medicaid depends entirely on your income, according to the rules of your state. If you still qualify for Medicaid when you become eligible for Medicare, you’ll have both at the same time. —. Read Full Answer.

Can I sign up for Medicare at age 65?

A: No, not yet. Like other people who work for large employers after age 65, you can delay signing up for Medicare until you retire. If you’re married and your FEHB plan covers your spouse, he or she can also delay Medicare enrollment until your employment ends. — Read Full Answer.

How does Medicare work?

Here's how Medicare payments work if your employer covers you: 1 If you work for a company with fewer than 20 employees, Medicare is usually considered primary and your employer is secondary. 2 If you work for a larger company, your employer is primary and Medicare is secondary. 3 If Medicare is the secondary payer, it will reimburse based on what the employer paid, what is allowed in Medicare and what the doctor or provider charged. You will then have to pay what's left over.

How does Medicare work if you work for a company?

Here's how Medicare payments work if your employer covers you: If you work for a company with fewer than 20 employees, Medicare is usually considered primary and your employer is secondary. If you work for a larger company, your employer is primary and Medicare is secondary.

What happens if you don't sign up for Part B?

If you don't sign up for Part B, you will lose TRICARE coverage. TRICARE FOR LIFE (TFL) is what TRICARE-eligible individuals have if they carry Medicare Part A and B. TFL benefits include covering Medicare's deductible and coinsurance. The exception is if you need medical attention while overseas, then TFL is primary.

What is Cobra insurance?

COBRA. COBRA lets you keep your employer group health insurance plan for a limited time after your employment ends. This continuation coverage is meant to protect you from losing your health insurance immediately after you lose a job. If you're on Medicare, Medicare pays first and COBRA is secondary.

How to decide if you have dual health insurance?

When deciding whether to have dual health insurance plans, you should run the numbers to see whether paying for two plans would be more than offset by having two insurance plans paying for medical care. If you have further questions about Medicare and COB, call Medicare at 855-798-2627.

Does Medicare cover VA?

Medicare doesn't cover services within the VA. Unlike the other scenarios on this page, there is no primary or secondary payer when it comes to VA vs. Medicare. Having both coverage gives veterans the option to get care from either VA or civilian doctors depending on the situation.

Does Medicare pay a doctor if they are owed money?

The rest is on you if the doctor is still owed money. If Medicare is the secondary payer and the primary insurer doesn't pay swiftly enough, Medicare will make conditional payments to a provider when "there is evidence that the primary plan does not pay promptly.".

You have a Medicare MSA Plan and have or want to buy other insurance

In general, you can't have other insurance that would cover the cost of services during your Medicare MSA Plan's yearly deductible.

You have a Medicare MSA Plan & a Medicare Supplement Insurance (Medigap) policy

Medicare Supplement Insurance sold by private insurance companies to fill "gaps" in Original Medicare coverage.

You have a Medicare MSA Plan & a Medigap policy with prescription drug coverage

If you join a Medicare MSA Plan and already have a Medigap policy with drug coverage, you can continue to use this coverage to pay for some of your drugs. You can also join a Medicare Prescription Drug Plan to help with your drug costs.

You have a Medicare MSA Plan & want to enroll in a Medigap policy

It's illegal for anyone to sell you a Medigap policy if you have a Medicare MSA Plan.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Medicare Pays First When It Serves As Your Primary Payer

If you have Medicare as well as another type of insurance, your coverage is provided through a coordination of benefits. In some situations, Medicare will serve as your primary payer, which means Medicare pays first. Your other insurance coverage will then serve as your secondary payer.

Medicare Secondary Claim Development Questionnaire

The Medicare Secondary Claim Development Questionnaire is sent to obtain information about other insurers that may pay before Medicare. When you return the questionnaire in a timely manner, you help ensure correct payment of your Medicare claims.

Does Medicare Work Together With Medicaid

Yes, but Medicaid will always pay as the payer of last resort. This means if you have Medicare and Medicaid, Medicare will pay as primary and Medicaid as secondary. If you have Medicare, another insurance, and Medicaid, Medicaid will only pay after Medicare and the other insurance company have processed the claim.

Employer Or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan as retiree health coverage from an employer or the military , you may not need additional insurance. Review the EGHPs costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

How Does Medicare Work With My Other Health Insurance Coverage

Medicare works in tandem with your other health insurance coverage. The two tag team. One insurance plan becomes the primary payer or the one that pays costs first. The other insurance becomes the secondary payer and pays the remaining costs.

Is Medicare A Primary Or Secondary Payer

Medicare can be either a primary or secondary payer, depending on what other insurance you have and the situation involved in the claim. For those who have Medicare, here are some of the situations when Medicare might be the secondary payer:

Which Is Better For Those With Dependents

Typically, private insurance is a better option for people with dependents. While Medicare plans offer coverage only to individuals, private insurers usually allow people to extend health coverage to dependents, including children and spouses.

Who is eligible for Medicare?

Typically, anyone age 65 or older is eligible for Medicare. Younger people may also be eligible for Medicare if they have disabilities, end-stage renal disease, or amyotrophic lateral sclerosis (ALS, or Lou Gehrig’s disease).

Can you use Medicare while you are working?

You can, but you don’t have to. Your initial Medicare enrollment period begins 3 months before your 65th birthday and lasts for 7 months, but you can enroll after that period ends if you have an employer-sponsored plan. Just be sure to inform Medicare of your other coverage in order to avoid owing a Part B late-enrollment penalty.

How do you know if Medicare is primary or secondary?

Medicare and your other insurance plans coordinate their benefits to avoid duplicate payments. If Medicare is your primary payer, it will pay first and your private plan will kick in to cover some or all of the costs not covered by Medicare. If Medicare is secondary, the opposite will occur.

How to get the most out of your combination of health insurance plans

To make the most of the health insurance plans for which you’re eligible, you’ll need to understand the rules and the costs of the plans. Typically, it makes sense to enroll in Medicare Part A (hospital insurance) when you’re eligible, since many enrollees pay zero in premiums.

Take our quiz

Navigating Medicare can be challenging, especially since different types of coverage won’t necessarily cover all of your expenses. Choosing to purchase additional coverage may help. Find out which supplemental coverage option is best for you, Medicare Advantage or Original Medicare with Medigap.

The bottom line

Sorting out how Medicare works with other types of insurance can feel overwhelming, but to make the most of what’s available to you, understanding how your policies work together is key.