Combine your Medicare coverage with GEHA’s Standard Option or High Option plan and your GEHA coverage picks up where Medicare stops. GEHA can help pay for many of your health care expenses that are not covered by Medicare. For more than 83 years, GEHA has been working for federal employees and retirees.

Full Answer

Does Geha cover Medicare deductible?

Prescription drugs are covered starting at a 25 percent coinsurance after the annual deductible is met. GEHA offers a Medicare supplement plan that covers out-of-pocket costs including deductibles and co-pays for eligible members who are enrolled in Medicare.

What does Geha stand for insurance?

Why GEHA

- Exclusively for federal employees. GEHA exclusively serves federal employees, federal retirees, military retirees and their families. ...

- Large network. GEHA gives you access to millions of providers across the country. ...

- Earn rewards. Our Elevate and Elevate Plus medical plans reward you for your healthy behavior. ...

- Made for Medicare. ...

Is Geha a HMO or PPO?

GEHA Connection Dental Federal www.gehadental.com 877-434-2336 2020 A National Dental PPO Plan IMPORTANT • Rates: Back Cover • Changes for 2020: Page 4 • Summary of Benefits: Page 47 Who may enroll in this Plan: All Federal employees, annuitants, and certain TRICARE beneficiaries in the United States and overseas who

What is Geha insurance provider phone number?

To find PPO providers, use this site's Provider Search or call GEHA at 800.296.0776. When you phone for an appointment, please remember to verify that the physician is still a PPO provider.

Do I need Medicare if I have GEHA?

As long as you keep your GEHA medical plan, you do not have to join a Medicare drug plan now or when you are first eligible, and will not have to pay a penalty for Medicare prescription drug coverage if you decide to join a plan later.

Does GEHA offer Medicare plans?

GEHA works with Medicare A & B With a GEHA medical plan to supplement your Medicare coverage, a sudden hospital stay, a prolonged illness or a major surgical procedure won't overwhelm your budget. GEHA offers five unique medical plan options, each with comprehensive coverage that coordinates with Medicare.

Is GEHA the same as Medicare?

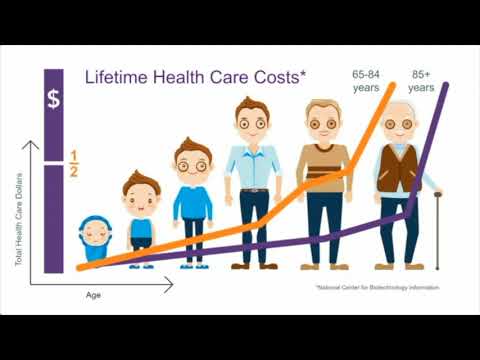

GEHA can help pay for many of your health care expenses that are not covered by Medicare. Medicare is a health insurance program provided by the federal government. If you are age 65 or older and entitled to monthly Social Security benefits, you may be eligible for Medicare.

Is GEHA secondary to Medicare?

If your Medicare Advantage plan is your primary insurance, GEHA Standard, High or Elevate Plus plan pays secondary.

What type of insurance is GEHA?

GEHA (Government Employees Health Association) is a self-insured, not-for-profit association providing medical and dental plans to federal employees and retirees and their families through the Federal Employees Health Benefits (FEHB) program and the Federal Employees Dental and Vision Insurance Program (FEDVIP).

Is GEHA primary or secondary?

GEHA is your primary insurance carrier.

Is GEHA under UnitedHealthcare?

UnitedHealthcare Options PPO is GEHA's preferred network in Alabama, Arkansas, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Mexico, North Dakota, South Carolina, South Dakota, Tennessee and Wyoming through Dec.

Who is Medicare through?

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that runs Medicare. The program is funded in part by Social Security and Medicare taxes you pay on your income, in part through premiums that people with Medicare pay, and in part by the federal budget.

Is Aetna and GEHA the same?

Aetna Signature Administrators® and Government Employees Health Association (GEHA) are expanding their relationship. Starting January 1, 2021, GEHA members living in the following states will be able to access the Aetna Signature Administrators PPO program and medical network nationally.

How does Medicare Part B reimbursement work?

The Medicare Part B Reimbursement program reimburses the cost of eligible retirees' Medicare Part B premiums using funds from the retiree's Sick Leave Bank. The Medicare Part B reimbursement payments are not taxable to the retiree.

How do I get my Medicare premium refund?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

Your Final Decision On Medicare Part B And The Fehb Program

Throughout our advice we have highlighted specific advantages and disadvantages of enrolling in Medicare Part B in addition to your FEHB enrollment. On the minus side there is one large factorpaying two costly sets of premiums instead of one.

How Do Fehbs And Medicare Work Together In Retirement

You can keep your FEHB plan after you retire as long as you meet a couple of requirements. The first is that youll need to go through the retirement process, not just quit your federal job. You wont be able to keep your FEHB plan if you leave your job under any circumstances other than retirement.

How Much Does Medicare Part B Coverage Cost

Medicare Part B generally pays 80% of approved costs of covered services, and you pay the other 20%. Some services, like flu shots, may cost you nothing.

Two Parts Of Medicare

Part A . Most people do not have to pay for Part A. If you or your spouse worked for at least 10 years in Medicare-covered employment, you should be able to qualify for premium-free Part A insurance. Otherwise, if you are age 65 or older, you may be able to buy it.

Get Help Comparing Medicare Plans Where You Live

You may contact your local State Health Insurance Assistance Program for free assistance with your Original Medicare benefits.

How Do Fehbs Work If You Have Medicare

Youll be eligible for Medicare once you turn age 65. If you have health insurance from an FEHB plan, you can use it alongside Medicare. You can make a few combinations of Medicare and your FEHB plan depending on your circumstances.

Do I Need Medicare If I Have An Fehb

In most cases, you can elect to not use your Medicare coverage and just keep using your FEHB plan. Medicare is an optional plan, meaning you dont have to have either Part A or Part B coverage.

What is a MRA in GEHA?

GEHA's Medicare Part B Reimbursement Account (MRA) program, powered by HealthEquity, reimburses High Option members enrolled in both Medicare Parts A &B with tax-free money. Eligible members can be reimbursed up to $600 for their Medicare Part B premiums.

How long does it take for a health equity claim to be processed?

Paper claim forms will be processed by HealthEquity within 2 days of receipt and paper checks should reach you within two weeks.