What is the maximum premium for Medicare Part B?

7 rows · The amount you pay can change each year depending on your income. If you have to pay a higher amount ...

Does Medicare Part B have a premium?

2015 Medicare Part B is Medical Insurance and covers physician services, outpatient care, tests and supplies. (Monthly Premium $104.90) On Expenses Incurred for: Medicare Covers: You Pay: Doctor Office Visits; Lab Tests Outside Hospital; Surgeon’s Fee; Anaesthesiologist’s Fee; Doctor Visits –In Hospital; Doctor Visits –Nursing Facility; Ambulance; Speech Therapy

How much does Medicare Part B costs?

Medicare's Basic Part B Premium to Stay at $104.90 for 2015 January 27th, 2015 The Centers for Medicare and Medicaid has announced the Medicare …

How much does Part B insurance cost?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What were the Medicare Part B premiums in 2016?

What was the Medicare Part B premium in 2017?

What was the Medicare Part B premium in 2010?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $110.50 in 2010. However, most Medicare beneficiaries will not see an increase in their monthly Part B premiums in 2010 because of a “hold-harmless” provision in current law.

What is Medicare Part B 2015?

What was the cost of Medicare Part B in 2018?

What is the Medicare Part B deductible for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

How much does Medicare Part B increase each year?

What was Medicare premium in 2013?

What year did Medicare start charging premiums?

How much did Medicare go up in 2016?

| How Much You'll Pay for Medicare Part B in 2016 | ||

|---|---|---|

| Single Filer Income | Joint Filer Income | 2016 Monthly Premium |

| Up to $85,000 | Up to $170,000 | $121.80 or $104.90* |

| $85,001 - $107,000 | $170,001 - $214,000 | $170.50 |

| $107,001 - $160,000 | $214,001 - $320,000 | $243.60 |

Is Medicare Part B premium adjusted annually?

The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

What income is used to determine Medicare premiums 2021?

How much is the Part B premium for 2021?

2021. The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

Do you pay Medicare premiums if your income is above a certain amount?

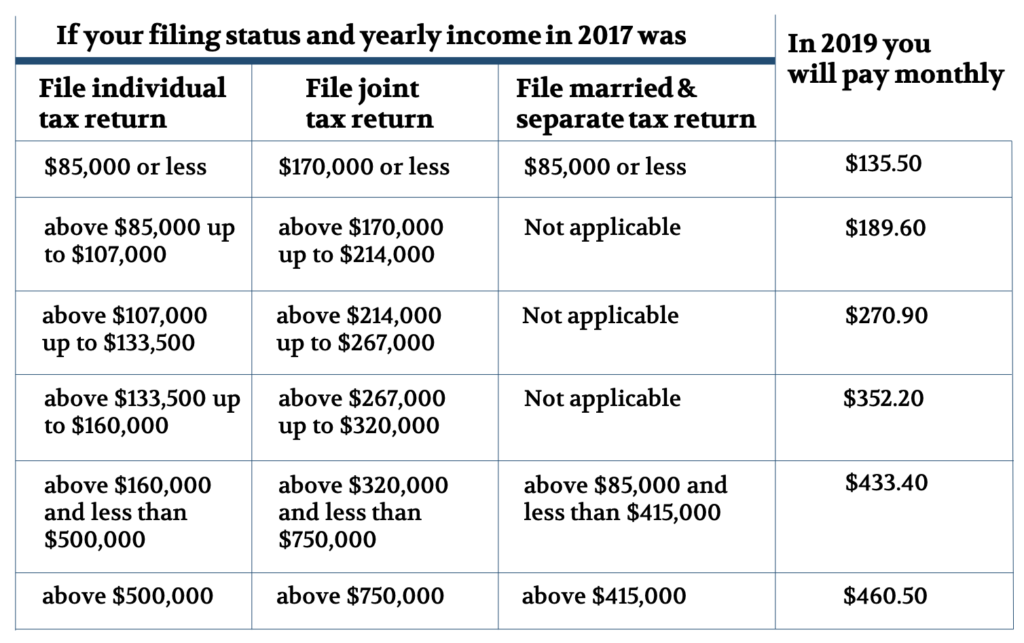

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much will Medicare pay in 2021?

In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is the difference between Part B and IRMAA?

If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much is Medicare Part B in 2015?

Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147. The Medicare Part A deductible, which covers the first 60 days of Medicare-covered inpatient hospital care, will rise to $1,260 in 2015, a $44 increase from 2014.

How much is Medicare Advantage going up?

The average premium for a Medicare Advantage plan is going up by about 9.5%, to $33.90 per month (you’re still on the hook for Part B premiums). However, premiums will remain the same for about 61% of people if they elect to stay with the same Medicare Advantage plan.

How long can you open enrollment for Medicare Supplement?

Medicare supplement policies don’t have an annual open-enrollment period; you can buy them anytime. But you usually can be rejected or charged more because of your health if you get the policy more than six months after signing up for Medicare Part B.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

How much is the 2021 Medicare premium?

The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

How much is Medicare Part A deductible in 2015?

The Medicare Part A deductible – for inpatient hospital, skilled nursing facility and home healthcare services – will increase by $44 in calendar year 2015 to $1,260, while the monthly Part A premium will decline by $19.

How much did Medicare increase in 2015?

The Medicare Part A deductible – for inpatient hospital, skilled nursing facility and home healthcare services – will increase by $44 in calendar year 2015 to $1,260, while the monthly Part A premium will decline by $19.

How much is Medicare coinsurance?

Daily Medicare coinsurance amounts will be $315 for days 61-90 of hospitalization in a benefit period; $630 for lifetime reserve days; and $157.50 for days 21-100 of extended care services in a skilled nursing facility in a benefit period.