Fact sheet 2019 Medicare Parts A & B Premiums and Deductibles

| Beneficiaries who are married and lived ... | Income-related monthly adjustment amount | Total monthly premium amount |

| Less than or equal to $85,000 | $0.00 | $135.50 |

| Greater than $85,000 and less than $415, ... | $297.90 | $433.40 |

| Greater than or equal to $415,000 | $325.00 | $460.50 |

How does income affect monthly Medicare premiums?

4 rows · Oct 12, 2018 · Medicare Part B covers physician services, outpatient hospital services, certain home health ...

How do you calculate Medicare premium?

6 rows · If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per ...

How does Medicare determine your income?

Jan 04, 2019 · The standard premium is set to rise to $135.50 per month in 2019, up $1.50 per month from 2018. A small number of participants will pay less than this if the increases in their Social Security...

How much is the Medicare Part a premium?

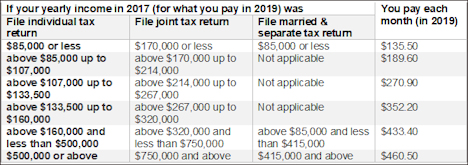

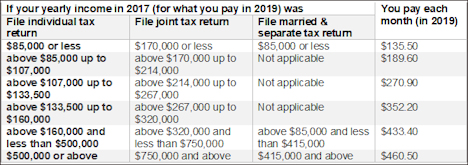

Jan 19, 2019 · How Much Are Medicare’s Income-Related Premiums in 2019? In 2019, Part B premiums for higher-income beneficiaries range from $189.60 per month for individuals with annual incomes above $85,000 up to $107,000 who are required to pay 35 percent of program costs, to $460.50 per month for individuals with incomes above $500,000 who are required to …

What were the Medicare premiums for 2019?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium. This higher Part B premium is called the Income-Related Monthly Adjusted Amount (IRMAA).

What is the Medicare premium for 2021?

$148.50The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

How much does Medicare cost per month in 2020?

$144.60 forThe standard monthly premium will be $144.60 for 2020, which is $9.10 more than the $135.50 in 2019. The annual deductible for Part B will rise to $198, up $13 from $185 this year.Nov 11, 2019

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

Is Medicare Part B going up 2022?

2022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

How much does Medicare take out of Social Security?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

How are Medicare premiums calculated?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Are Medicare premiums deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Why is my first Medicare premium bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.Dec 3, 2021

What is the minimum premium for Medicare Part B?

$170.10The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

Why is my Medicare premium so high?

CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system. Some of the higher health care spending is being attributed to COVID-19 care.Nov 15, 2021

How much is Medicare premium per month?

If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. How it changed from 2018. The 2019 Part A premiums increased a little over 3 percent from 2018.

How much is Medicare Part C?

Plan premiums will vary by provider, plan and location. The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

Is Medicare Part B optional?

Medicare Part B is optional. You will likely be automatically enrolled in Part B (with the option to drop it) if you are automatically enrolled in Medicare Part A.

What is the Medicare Part B premium?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

What is the COLA for 2019?

The COLA in 2019 is 2.8 percent. An additional income bracket was added in 2019. In 2020, the IRMAA will be indexed to inflation for the first time since 2010. It’s expected that the income thresholds that determine when someone pays a Medicare IRMAA will rise slightly in 2020.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

How much is Medicare premium in 2019?

The standard premium is set to rise to $135.50 per month in 2019, up $1.50 per month from 2018. A small number of participants will pay less than this if the increases in their Social Security benefits in recent years have been insufficient to keep up with the rising cost of Medicare premiums.

How much is Medicare Part A deductible?

You can see all the options in the table below: Medicare Charge. 2019 Cost (Change From 2018) Hospital deductible. $1,364 ( up $24) Coinsurance for days 61-90 of hospital stay.

Is Medicare free for older people?

However, Medicare isn't free , and the costs involved are often surprising to those who aren't familiar with the program.

Does Medicare have a monthly premium?

One of the most important parts of Medicare often comes with no monthly premium for participants. Hospital insurance coverage, also known as Medicare Part A, is free to those who had 40 quarters of qualifying employment for which they paid Medicare payroll taxes during their careers or are married to a spouse who did so.

Can Medicare retirees afford to pay more?

Many Medicare participants are retired and can't afford to pay any more than they have to for their healthcare coverage. Although 2019's increases to Medicare costs are relatively modest, they'll still put some strain on the finances of millions of older Americans in the coming year.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.