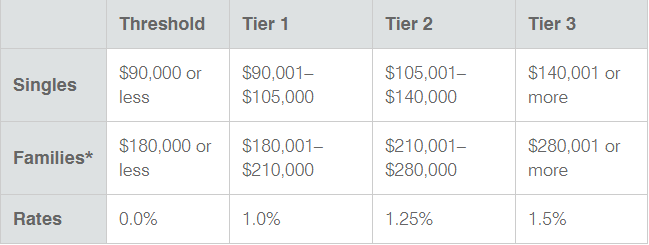

The Medicare Levy Surcharge is a tax you pay if you don’t have private health cover and your annual taxable income is over $90,000 as a single or $180,000 as a couple or family. Depending on your income, the surcharge will be between 1% to 1.5%.

Do I have to pay the Medicare levy surcharge?

Who Pays the Medicare Levy? If you earn more than $29,033 in the most recent tax year, you will pay the Medicare Levy at a simple 2% of your taxable income. Using some very simple numbers: A part-time or casual employee who earned $20,000 pays zero Medicare Levy. An employee earning $50,000 in the last tax year pays $1,000.

What is the Medicare levy on my taxes?

The family income threshold is increased by $1,500 for each MLS dependent child after the first child. Example: Medicare levy surcharge for a single adult. In the 2020–21 income year, Tom doesn't have the appropriate level of private patient hospital cover and is: 35 years old. single without any dependants.

How do I qualify for a reduced Medicare levy rate?

The Medicare levy is 2% of your taxable income, in addition to the tax you pay on your taxable income. You may get a reduction or exemption from paying the Medicare levy, depending on your and your spouse's circumstances. You need to consider your eligibility for a reduction or an exemption separately. You can use the Medicare levy calculator to work out your Medicare …

What is the Medicare levy for part-time employees?

Jun 29, 2020 · Not everyone is required to pay the Medicare levy surcharge, but if you’re single and earning more than $90,000 or part of a family earning $180,000, you may be charged. We’ve put together a handy online table that lets you calculate exactly how much your surcharge will be, but to give you an idea, if your taxable income is $100,000, you might expect to pay an extra $1,000.

What is the threshold for the Medicare levy?

How do you get around the Medicare levy?

Does everyone pay Medicare levy in Australia?

What is the Medicare surcharge tax for 2021?

Who are exempt from Medicare levy?

Is Medicare levy surcharge based on gross income?

Do you pay Medicare levy if you have private health?

What is half Medicare levy exemption?

How does Medicare work in Australia?

How do I avoid paying the Medicare levy surcharge?

Do I have Medicare if I pay Medicare tax?

How does the 3.8 Medicare tax work?

What is Medicare levy?

Medicare levy. The Medicare levy helps fund some of the costs of Australia's public health system known as Medicare. The Medicare levy is 2% of your taxable income, in addition to the tax you pay on your taxable income. You may get a reduction or exemption from paying the Medicare levy, depending on your and your spouse's circumstances.

How much is Medicare levy?

The Medicare levy is 2% of your taxable income, in addition to the tax you pay on your taxable income. You may get a reduction or exemption from paying the Medicare levy, depending on your and your spouse's circumstances. You need to consider your eligibility for a reduction or an exemption separately. You can use the Medicare levy calculator ...

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

What percentage of Medicare Part B is paid?

After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

Does Medicare Advantage have a monthly premium?

Some of these additional benefits – such as prescription drug coverage or dental benefits – can help you save some costs on your health care, no matter what your income level may be. Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is Medicare surcharge?

The Medicare Levy Surcharge is a tax you pay if you don’t have private health cover and your annual taxable income is over $90,000 as a single or $180,000 as a couple or family. Depending on your income, the surcharge will be between 1% to 1.5%. It’s designed to incentivise higher income earners to take up private health insurance, ...

What is the surcharge for health insurance?

The surcharge is payable for each day you don’t have private health insurance within a financial year. That means if you don’t purchase a policy before 1st July, but buy one later in the year, you’ll pay a charge for each day you weren’t covered. 1:41.

What is Medicare tax?

The Medicare Levy and Medicare Levy Surcharge are both used by the government to fund public healthcare. The Medicare Levy is a 2% tax paid by most Australians, while the Medicare Levy Surcharge only applies to people above a certain annual income. Holding private hospital cover will not impact any Medicare Levy payable.

How much is Medicare levy?

How much is the Medicare Levy Surcharge? The levy is calculated based on your taxable income - the more you earn, the higher percentage you’ll pay. As a single, you’ll pay 1% if your taxable income is above $90,000, 1.25% if you earn over $105,000, and the maximum rate of 1.5% if you earn over $140,000.

Who is Dr Adrian Raftery?

Mr Taxman, Dr Adrian Raftery is the best-selling author of 101 Ways to Save Money on Your Tax - Legally! (now in its 11th edition) and is widely sought by the media for his views on tax, superannuation and financial issues. He runs a COVID-19 proof award-winning tax & accounting practice remotely in the Mornington Peninsula down in Melbourne.

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is a hold harmless?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

How much is Medicare levy?

How much is the Medicare Levy? For the 2019–20 financial year, if you earned over $28,501 you would have paid a Medicare levy of 2% of your taxable income. For a single person earning $28,501 with no dependents, this would have equated to $570.

What is the Medicare levy for 2019-20?

The Medicare levy lower threshold for the 2019-20 financial year is set at $22,801 ($36,056 for seniors and pensioners) advice from the ATO states. This means if you earn equal to or less than this amount you won’t pay any Medicare Levy. Anyone earning above $22,801 but less than $28,501 ($45,069 for seniors and pensioners) will pay ...

Why is MLS important?

The MLS was introduced to help ease the burden on the Medicare system by encouraging Australians on higher incomes to take out private health insurance. As the government’s PrivateHealth website explains, the MLS is different to the Medicare Levy, which applies to almost all Australian taxpayers, and is in addition to this.

Is unemployment taxable income?

Pensions, interest and dividends, capital gains, unemployment income are all considered unearned income sources. These may be taxable depending on your age, total income, and your filing status. A simple way to start is to add half your Social Security benefits to other unearned income such as those listed above.

Do you owe taxes on Social Security?

Your tax liability for Social Security depends on whether you have other sources of income in retirement and how much you receive from those resources. If your only source of income in retirement is Social Security you will probably not owe federal taxes on it. If you take one half your Social Security and add it to all other sources ...