Is Medicare Part B free?

| Individual annual income | Couple’s joint annual income | Monthly premium |

| ≤ $88,000 | ≤ $176,000 | $148.50 |

| > $88,000–$111,000 | > $176,000–$222,000 | $207.90 |

| > $111,000–$138,000 | > $222,000–$276,000 | $297 |

| > $138,000–$165,000 | > $276,000–$330,000 | $386.10 |

What do you pay for Medicare?

What you pay for Medicare depends on how long you worked, how much you make now, and what programs you choose. Comparing Medicare plans can help you choose the best options for your individual situation. There are several different Medicare programs or parts, with each serving different health needs.

Is Medicare really free?

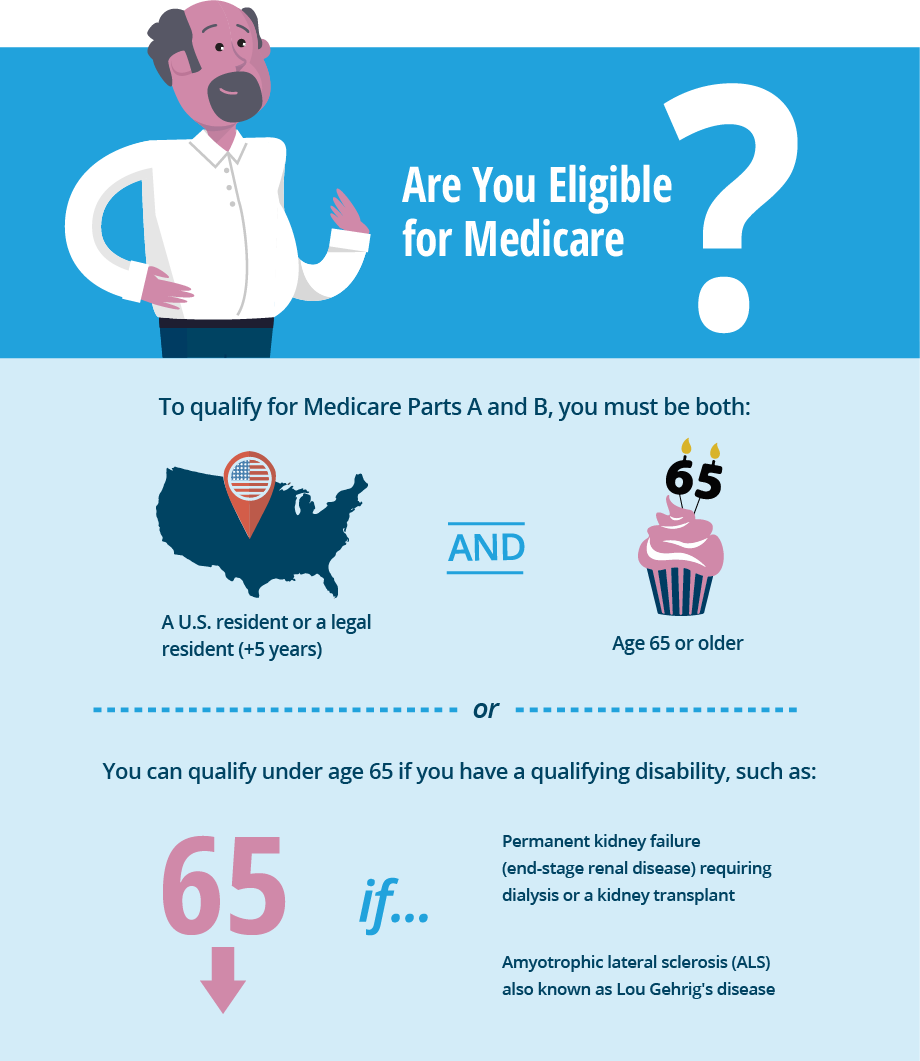

While Medicare isn’t exactly free, many people won’t pay a monthly premium for basic care. Medicare is a federal health insurance program that you qualify for at age 65 or with certain health problems or disabilities.

How much will my Medicare deductible be?

You’ll pay $233, before Original Medicare starts to pay. You pay this deductible once each year. You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

What is the income limit to receive Medicare?

There are no income limits to receive Medicare benefits. You may pay more for your premiums based on your level of income. If you have limited income, you might qualify for assistance in paying Medicare premiums.

How much money can you make and not have to pay for Medicare?

To qualify, your monthly income cannot be higher than $1,010 for an individual or $1,355 for a married couple. Your resource limits are $7,280 for one person and $10,930 for a married couple.

Do you pay more for Medicare if you make more money?

If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

At what income level do my Medicare premiums increase?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $170,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $85,000, you'll pay higher premiums.

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

At what age can you earn unlimited income on Social Security?

You can earn any amount and not be affected by the Social Security earnings test once you reach full retirement age, or FRA. That's 66 and 2 months if you were born in 1955, 66 and 4 months for people born in 1956, and gradually increasing to 67 for people born in 1960 and later.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

Can I qualify for QI if I have medicaid?

You can’t qualify for the QI program if you have Medicaid. If you have a monthly income of less than $1,456 or a joint monthly income of less than $1,960, you are eligible to apply for the QI program. You’ll need to have less than $7,860 in resources. Married couples need to have less than $11,800 in resources.

How much does Medicare Part B cost?

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple.

What are the three cost reduction programs for Medicare Part B?

The three cost reduction programs are the Qualified Medicare Beneficiary (QMB), the Specified Low-Income Medicare Beneficiary (SLMB), and Qualifying Individual (QI)

What is a qualified Medicare beneficiary?

Qualified Medicare Beneficiary. The first program that can help reduce your costs is the Qualified Medicare Beneficiary (QMB). There are two requirements to be eligible for this program, which include the income limit and asset limit. If you meet both of these requirements and are eligible for the program, your state should pay your premiums, ...

How much was Medicare Part B premium in 2015?

The standard Part B premium for 2015 was $121.80, although it can be higher based on your income or other factors. Although most people have to pay a premium to be eligible to receive Medicare Part B benefits, there are programs that can help reduce or cover the cost depending on your circumstances. Enter your zip code above to receive private ...

What is the minimum income for a married couple in 2020?

Your income must be no more than the federal poverty level to be eligible for this program, which was an annual income of $12,760 for a single person and an annual income of $17,240 for a married couple in 2020.

Is Silver Sneakers A Government Program

SilverSneakers is considered a basic fitness service and Original Medicare, Part A and Part B, does not cover this benefit. However, Medicare Advantage plans, also known as Medicare Part C, may provide this benefit. To find a Medicare Advantage plan with SilverSneakers in your area, enter your zip code on this page.

How Do I Know If Im Enrolled In Extra Help

Youll receive notice of your Extra Help status from the SSA. Notices are different colors depending on your status:

Commission For Selling Medicare Advantage Plans

DD: A lot of agents are looking at this like weve talked about it from a final expense standpoint.

What To Expect On Your First Presentation

DD: Lets imagine we have an agent selling Medicare insurance. Theyve done AHIP and certification for the carriers as well as a lead program set up. Theyre running their very first presentation.

Agents Need Someone In Their Corner

The only time Im not going to answer is when Im with a customer. Other than that, Im usually going to pick up the phone or Im going to reply to a text and Im like you, Im a workaholic. I work all the time.

How Much Does Medicare Part A Cost

Medicare Part A, or hospital insurance, covers a variety of services, such as:

Is There Help For Me If I Cant Afford Medicares Premiums

Medicare Savings Programs can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets.

How long do you have to be on Medicare if you are 65?

You may also qualify for premium-free Medicare Part A if you are under age 65 and any of these apply: You have received Social Security disability benefits for 24 months. You have received Railroad Retirement Board disability benefits for 24 months.

What happens if you don't qualify for Medicare Part A?

If you do not quality for premium-free Medicare Part A, you will pay a premium based on the number of quarters you worked in your lifetime. Amount of time worked.

What is Medicare Part C?

Medicare Part C (Medicare Advantage) plans are private insurance plans that combine the aspects of both Medicare Part A and Medicare Part B, plus other services. Private companies receive funding from Medicare, so some plans may still offer reduced or even $0 monthly premiums.

Does Medicare Part B cover home health?

While Part A covers your inpatient care and some home health needs, you will also need to have Part B coverage for other medical visits and preventive care. Medicare Part B does not offer a premium-free option like Part A. Monthly premiums are charged based on your income level, but not everyone receives a bill for their premium.

Does Medicare Part D cover prescriptions?

Medicare Part D covers prescription medications and is paid through premiums and other fees. Medicare Advantage plans may include prescription coverage, but you will still be responsible for a portion of your medication costs.

Does Medicare pay monthly premiums?

Many people will pay no monthly premium for Medicare Part A, which covers inpatient hospital and hospice care, as well as limited skilled nursing and home healthcare services. Exact costs for Part A depend on your situation and how long you worked.

Is Medigap insurance free?

Medigap (Medicare Supplement) policies are available through private insurance companies. They are not free but may help you save money on other Medicare program costs. Some Medigap plans cover the costs of the Medicare Part B deductible.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

Does Medicare Part D cover copayments?

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage. Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

Does Medicare Part B and D have to be higher?

Learn more about what you may pay for Medicare, depending on your income. Medicare Part B and Part D require higher income earners to pay higher premiums for their plan.

Does Medicare Advantage have a monthly premium?

Some of these additional benefits – such as prescription drug coverage or dental benefits – can help you save some costs on your health care, no matter what your income level may be. Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations.

Medicaid Income Limits by State

See the Medicaid income limit for every state and learn more about qualifying for Medicaid health insurance where you live. While Medicaid is a federal program, eligibility requirements can be different in each state.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.