Full Answer

How much do you pay for Medicare each month?

Most people don’t pay a Part A premium because they paid Medicare taxes while working. If you don’t get premium-free Part A, you pay up to $422 each month. The standard Part B premium amount in 2018 is $134 or higher depending on your income. However, most people who get Social Security benefits pay less than this amount ($130 on average).

What is the average monthly premium for Social Security Part B?

Part B Monthly Premium. The standard Part B premium amount in 2018 is $134 or higher depending on your income. However, most people who get Social Security benefits pay less than this amount ($130 on average).

How much does Medicare cost for people on disability?

Medicare can be quite expensive for those on disability who aren’t fully insured, but if you are eligible to be a Qualified Medicare Beneficiary (QMB) because of low-income, a Medicare Savings Program will pay your Part A premium, and possibly other costs as well. Most people pay a Part B premium of $134.00 each month.

Will Medicare cost more than Social Security benefits?

The Medicare Trustees have for years described in their annual report how rising Medicare costs will take an ever-growing portion of Social Security benefits. They estimate that Medicare Part B and Part D premiums, as well as cost sharing for both programs, currently equals just 24 percent of the level of the average Social Security benefit.

How much is taken out of my Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Does your Medicare premium come out of your Social Security check?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

At what income level do my Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

What is the standard Medicare Part B premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

How much Social Security will I get if I make $120000 a year?

If you make $120,000, here's your calculated monthly benefit According to the Social Security benefit formula in the previous section, this would produce an initial monthly benefit of $2,920 at full retirement age.

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the cost of Medicare Part B for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is the Medicare premium cost for 2021?

$148.50 forThe standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

How much will I pay for Medicare?

The amount you’ll pay for Medicare depends on several factors, including your sign-up date, income, work history, prescription drug coverage, and whether you sign up for extra coverage with an Advantage or Medigap plan. The Medicare Plan Finder can help you compare costs between different plans.

What does Medicare pay for?

Medicare pays for many different types of medical expenses . Part A covers inpatient hospital care, surgery, and home health care, among other items. Part B covers things such as preventive care, doctors’ visits, and durable medical equipment. Part D covers prescription drugs.

Who Is Eligible for Medicare?

Medicare is a social insurance program available to U.S. citizens and permanent residents 65 years of age or older. It’s also available to some younger Americans who are disabled or diagnosed with End-Stage Renal Disease (ESRD).

When Do You Have To Pay for Medicare?

If you don’t qualify for premium-free Part A coverage, you’ll need to pay a monthly premium. You’ll also have to pay a premium if you sign up for Part B, which is optional.

Can You Change How You Pay for Medicare?

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you don’t qualify for Social Security benefits , you’ll get a bill from Medicare that you’ll need to pay via:

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What happens if your MAGI is greater than $88,000?

If you file your taxes using a different status, and your MAGI is greater than $88,000, you’ll pay higher premiums (see the chart below, Modified Adjusted Gross Income (MAGI), for an idea of what you can expect to pay).

How to determine 2021 income adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

Why did my spouse receive a settlement?

You or your spouse received a settlement from an employer or former employer because of the employer’s closure, bankruptcy, or reorganization.

What happens if you don't get Social Security?

If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency , such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

How to appeal a monthly adjustment?

The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

How Much of Your Social Security Is Taken By Medicare Costs?

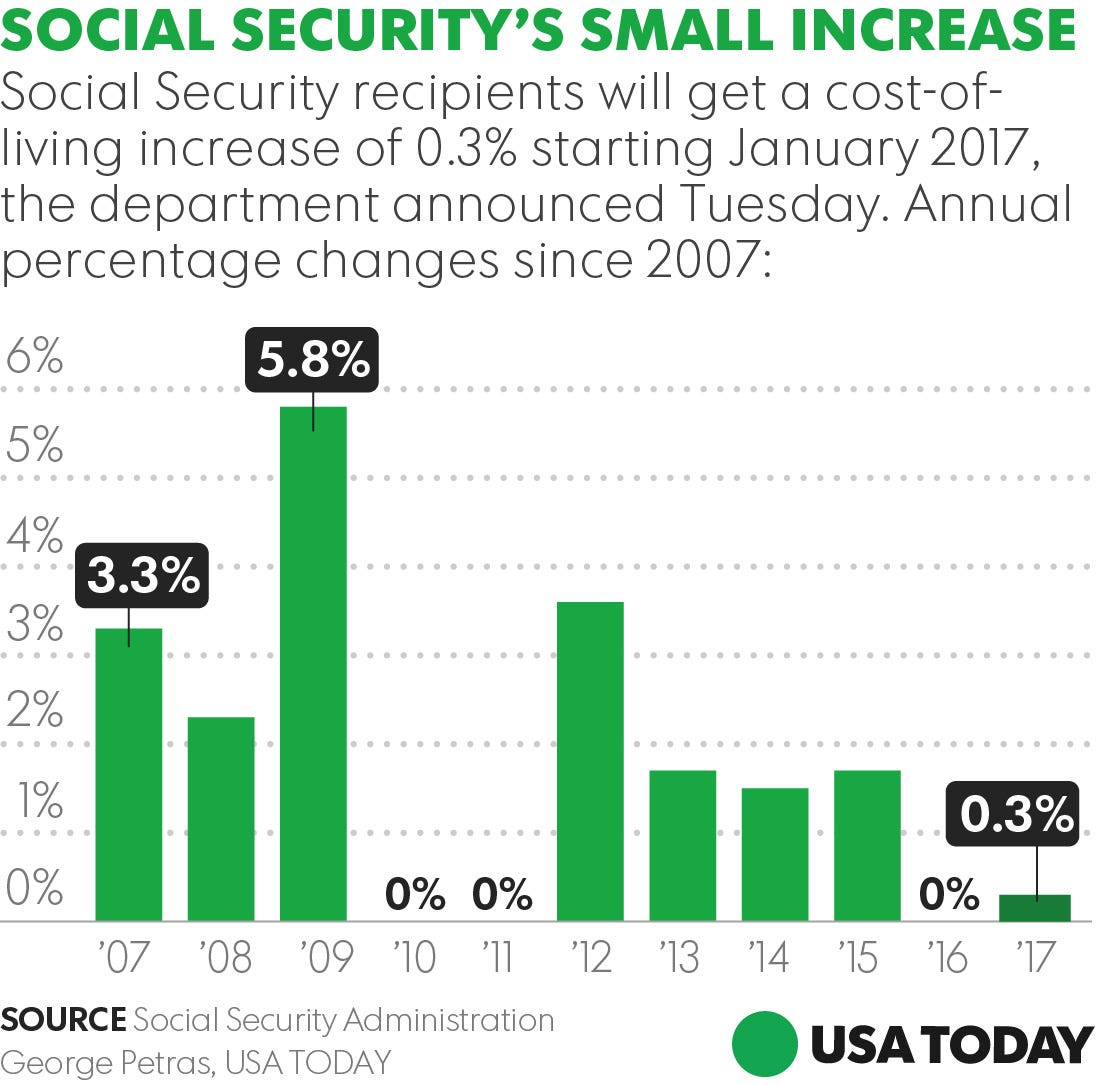

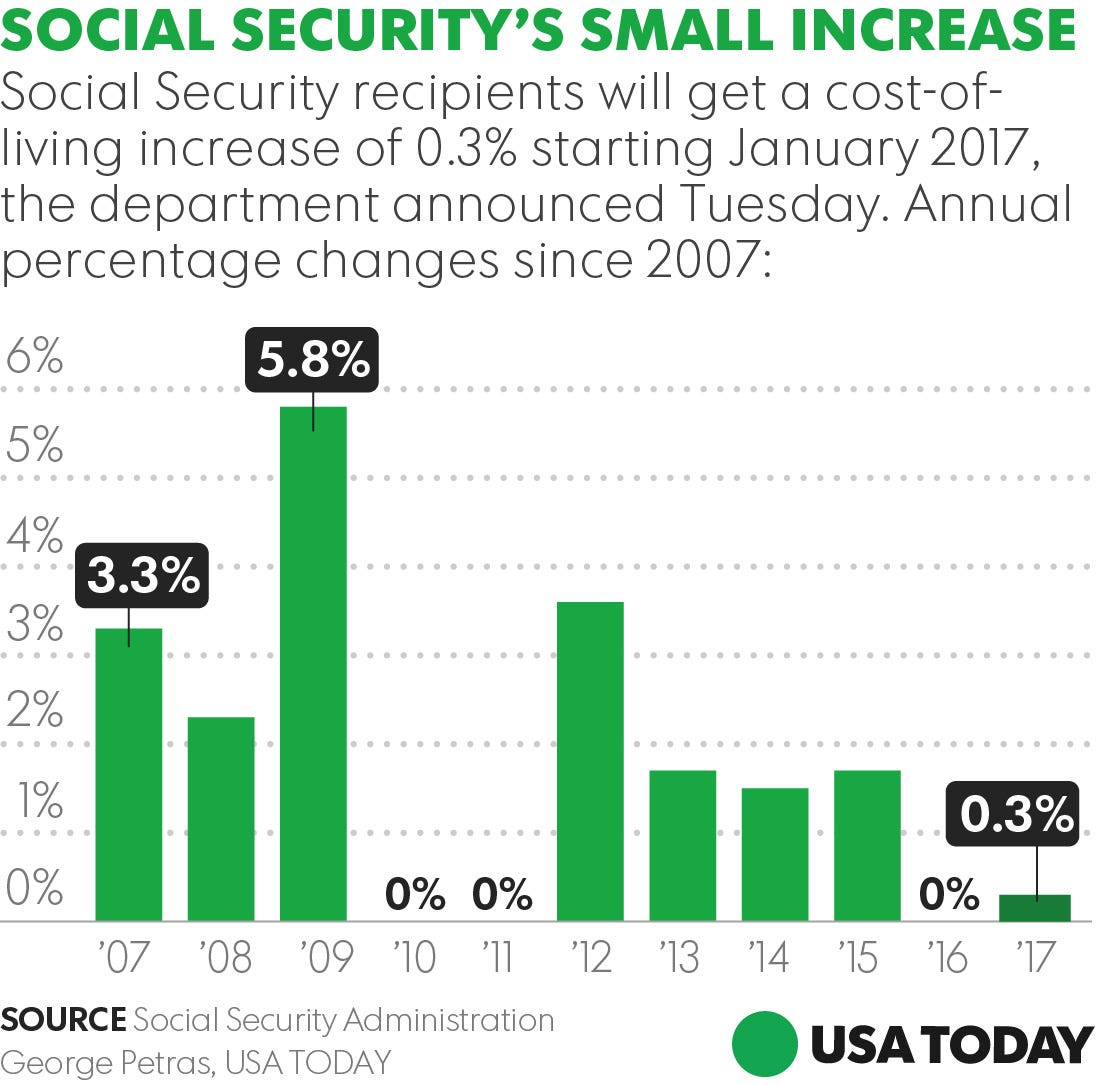

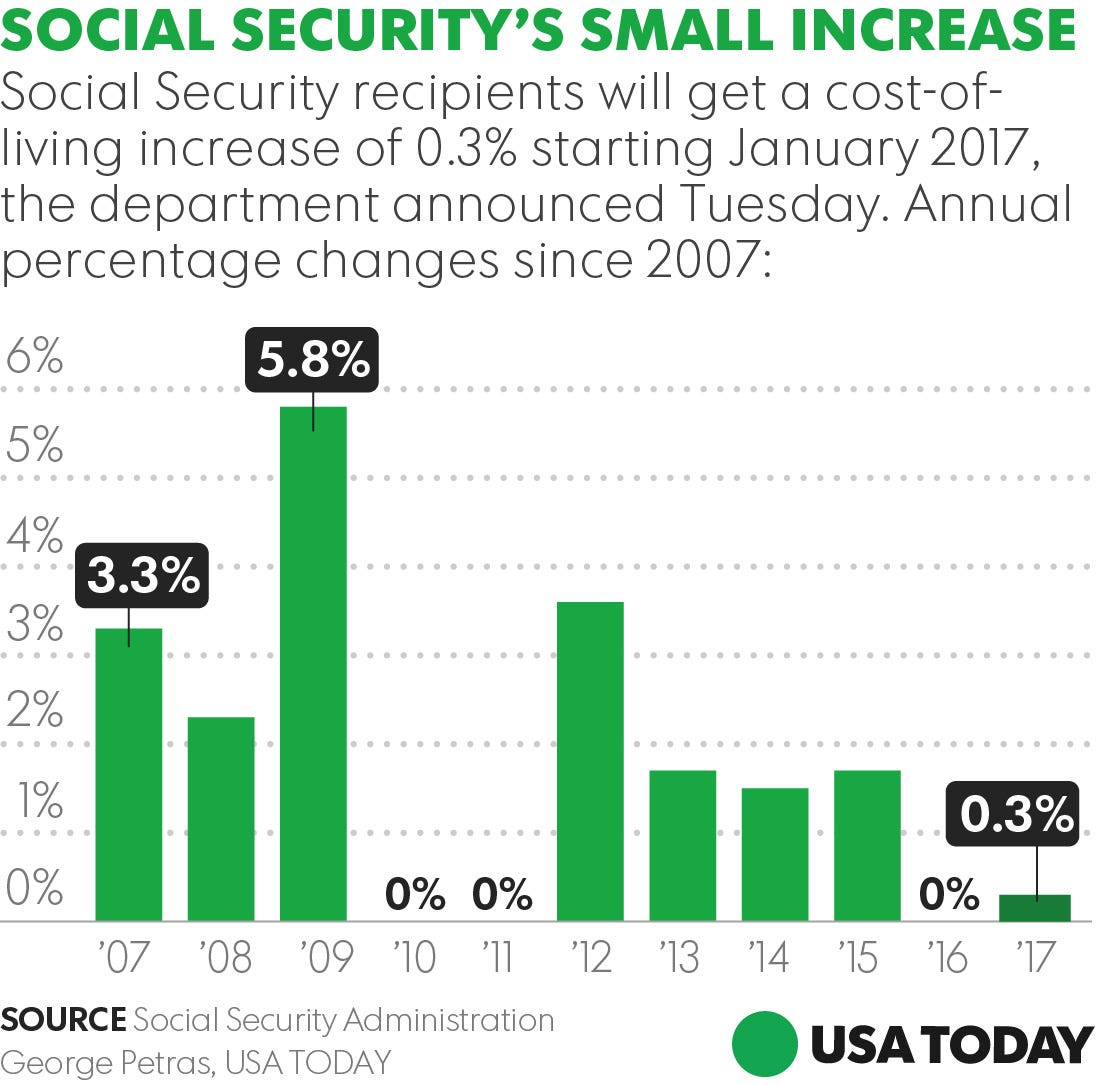

The Centers for Medicare and Medicaid Services recently announced that the standard Medicare Part B premium will be $148.50 in 2021, an increase of $3.90 per month from $144.60 in 2020. That increase, which I earlier feared would be considerably more, was restricted by legislation enacted last fall. But even with legislation to keep the Medicare Part B flat, the Part B premium still went up 2.6% over 2020, twice as much as the annual cost-of-living adjustment (COLA.). This trend of Medicare costs increasing several times faster than Social Security benefits creates chronic headaches for retirees, as the Medicare Part B premium consumes a growing share of Social Security benefits.

How much will Medicare premiums go up in 2020?

But even with legislation to keep the Medicare Part B flat, the Part B premium still went up 2.6% over 2020, twice as much as the annual cost-of-living adjustment (COLA.). This trend of Medicare costs increasing several times faster than Social Security benefits creates chronic headaches for retirees, as the Medicare Part B premium consumes ...

Why does Medicare Part B cost more than COLA?

Because Medicare Part B premiums and out-of-pocket costs grow several times faster than the annual COLA , healthcare costs take a rapidly growing share of Social Security benefits in retirement. The situation can leave older households without adequate income and dwindling savings just a few years after retiring.

What is the replacement for 1.3 percent COLA?

The Senior Citizens League is supporting the Emergency Social Security COLA for 2021 Act, which would replace the 1.3 percent COLA with a more adequate 3 percent COLA in 2021.

Is the 2021 retirement survey live?

Our 2021 Retirement Survey is live. SPEAK OUT NOW! And help shape TSCL’s legislative agenda.

Will Medicare Part B increase in 2021?

The 2021 Part B increase comes at the same time beneficiaries are receiving one of the lowest COLAs ever paid. The annual inflation adjustment will increase the average Social Security benefit by only $20.00 per month. Because Medicare Part B premiums and out-of-pocket costs grow several times faster than the annual COLA, ...

Does Medicare deduct premiums?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare Part A free?

Medicare Part A, which covers hospitalization, is free for anyone who is eligible for Social Security, even if they have not claimed benefits yet. If you are getting Medicare Part C (additional health coverage through a private insurer) or Part D (prescriptions), you have the option to have the premium deducted from your Social Security benefit ...

How much does Medicare cost if you have a low Social Security check?

But some people who have been on Medicare for several years will pay slightly less (about $145) if their Social Security checks are low (due to a hold harmless provision). And some people will pay more. If your adjusted gross income is over $88,000 (or $176,000 for a couple), the monthly premium can be over $400.

How to save money on Medicare?

You can often save money on Medicare costs by joining a Medicare Advantage plan that offers coverage through an HMO or PPO. Many Medicare Advantage plans don't charge a monthly premium over the Part B premium, and some don't charge copays for doctor visits and other services.

How long after Social Security disability is Medicare free?

You are eligible for Medicare two years after your entitlement date for Social Security disability insurance (SSDI). (This is the date that your backpay was paid from; see our article on when medicare kicks in for SSDI recipients ). Medicare isn't free for most disability recipients though.

How much is the Part D premium for 2021?

Part D Costs. Part D premiums vary depending on the plan you choose. The maximum Part D deductible for 2021 is $445 per year, but some plans waive the deductible. There are subsidies available to pay for Part D for those with low income (called Extra Help).

How many quarters do you have to work to be fully insured?

Generally, being fully insured means having worked 40 quarters (the equivalent of 10 years) in a job paying FICA taxes. Many disability recipients aren't fully insured because they became physically or mentally unable to work before getting enough work credits.

Is Medicare expensive for disabled people?

Medicare can be quite expensive for those on disability who aren't fully insured, but if you are eligible to be a Qualified Medicare Beneficiary (QMB) because of low-income, a Medicare Savings Program will pay your Part A premium, and possibly other costs as well.

Does Medicare go up every year?

There are premiums, deductibles, and copays for most parts of Medicare, and the costs go up every year. Here are the new figures for 2021, and how you can get help paying the costs.