Medicare cost sharing may seem more complex than other forms of insurance because Medicare has four different parts, and each one covers something different. Two of those parts are public (Parts A and B), and two are private (Parts C and D). When you add Medicare Supplements to the mix, things may seem even more confusing.

Full Answer

What does Medicare Part A and Part B cover?

Medicare Part A and Part B cover most of your healthcare services (hospital and medical). You can add supplemental insurance to help cover the costs of Original Medicare (Parts A and B)

How much does Medicare Part a cost?

Medicare costs at a glance. Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $437 each month. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240.

What is part a of Medicare Part A?

Medicare Part A, also called "hospital insurance," covers the care you receive while admitted to the hospital, skilled nursing facility or other inpatient services. Medicare Part A is part of Original Medicare. A premium is a fee you pay to your insurance company for health plan coverage. This is usually a monthly cost.

How much does Medicare Part B cost for 2022?

Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

What does Medicare cost sharing mean?

Cost sharing means ... You pay some of your health care costs and your health insurance company pays some of your health care costs. If you get a service or procedure that's covered by a health or dental plan, you "share" the cost by paying a copayment, or a deductible and coinsurance.

What parts of Medicare have cost sharing?

Medicare Part B Annual Deductible and Share of Cost: This program will pay your Medicare Part B deductible which is $233 in 2022. It will also pay your share (20%) of the cost of services when you receive services from a Medicare provider.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Does Medicare Part A and B have copays?

Medicare parts A, C, and D have copayments and may also have deductibles and coinsurance. Medicare Part B does not usually have a copayment. A copayment is a fixed cost that a person pays toward eligible healthcare claims once they have paid their deductible in full.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

Who qualifies for free Medicare Part A?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

What does Medicare Part A pay for?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Do Medicare beneficiaries have cost-sharing?

The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries.

Does Original Medicare have no cost-sharing?

Medicare Advantage Plans may charge you for preventive services that Original Medicare does not cover with zero cost-sharing. You may be charged if you see an out-of-network provider.

What is an example of cost-sharing?

Examples of out-of-pocket payments involved in cost sharing include copays, deductibles, and coinsurance. In accounting, cost sharing or matching means that portion of project or program costs not borne by the funding agency. It includes all contributions, including cash and in-kind, that a recipient makes to an award.

What are shared costs?

Cost sharing or matching is that portion of the project or program costs that are not paid by the funding agency. Costing sharing includes all contributions, including cash and in-kind, that a recipient makes to an award.

What Do Medicare Part A and Part B Premiums Cover?

Medicare has different parts and plans, but the most common is Original Medicare (Parts A and B). Parts A and B are available to all Americans 65 y...

How Much Does Medicare Part A Cost?

The cost of Medicare Part A premiums depends on whether you or your spouse paid income taxes, and for how long. Most individuals won’t pay a Part A...

How Much Does Medicare Part B Cost?

Your monthly premiums and annual deductible help make up the cost of Medicare Part B. These payment amounts answer the question, “How much is Medic...

What Else Should I Consider?

Original Medicare (Parts A and B) is most common and has remained popular over the years. There are, however, other options that you may want to co...

Does my health play any role in my costs?

No. If you’re enrolled in Original Medicare (Parts A and Part B), your health won’t play a role in how much you pay for your Medicare coverage. Par...

What if I can't afford Part B?

If you’re at least 65 and can’t afford your Medicare Part B premium or deductible, there may be help. Medicare Savings Programs Medicare Savings Pr...

When can I enroll in Plan A and Plan B?

Your first chance to sign up for Original Medicare is during your Initial Enrollment Period (IEP) The Initial Enrollment Period (IEP) is the seven-...

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is premium free Part A?

Most people get premium-free Part A. You can get premium-free Part A at 65 if: The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

What is covered benefits and excluded services?

Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board. You're eligible to get Social Security or Railroad benefits but haven't filed for them yet. You or your spouse had Medicare-covered government employment.

What is Medicare Part A?

Medicare Part A is part of Original Medicare.

How much is Medicare Part B 2021?

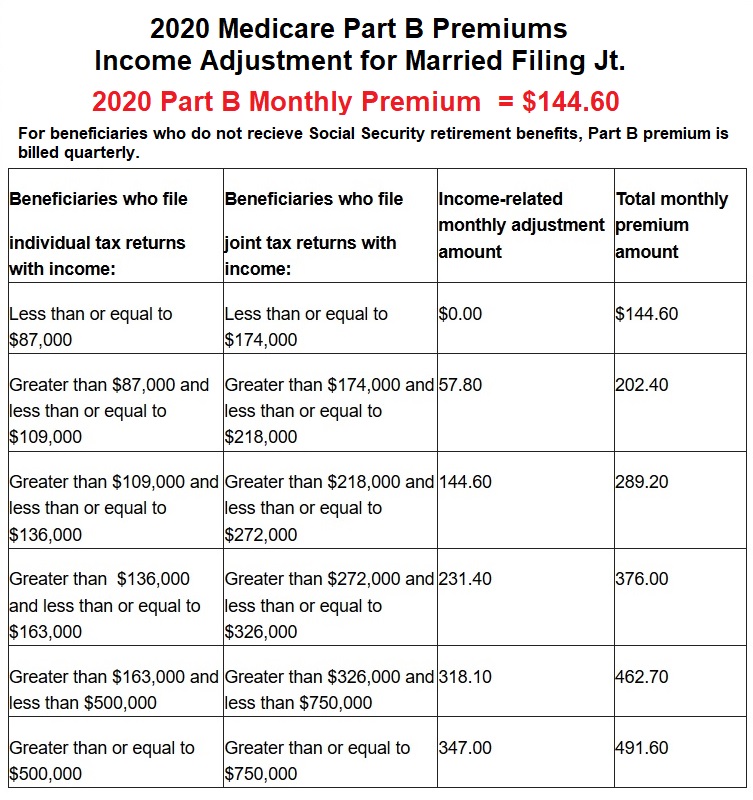

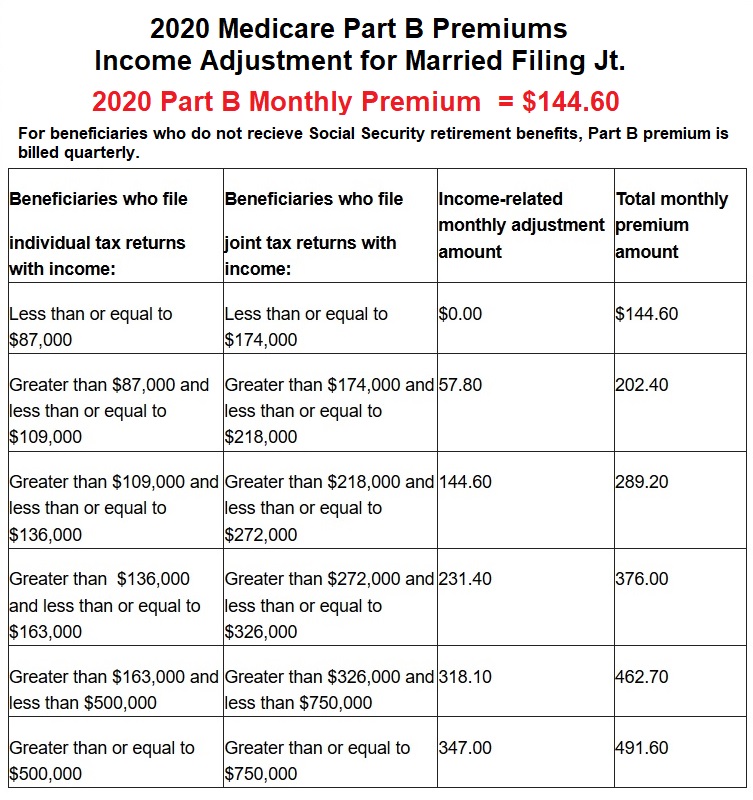

Medicare Part B premium 2021: $148.50. Your income plays a part in your Part B premium. For 2021, individuals making $88,000 per year or less, and couples making $176,000 or less, pay the standard monthly amount of $148.50 each.

What is Medicare Part A coinsurance?

You’re responsible for a daily coinsurance. Coinsurance is the percentage of your medical costs that you pay after you meet your deductible.

How much does Medicare Part A coinsurance increase?

Part A coinsurance increases when your length of stay in a facility increases: 0 to 60 days. 61 to 90 days. You have a lifetime limit of reserve days to use if your stay lasts longer than 90 days. Medicare Part A daily coinsurance rates: Days 0-60: $0. Days 61-90: $371 per day. Lifetime Reserve Days: $742 per day.

What is Medicare Part A deductible?

Medicare Part A Deductible. Most Part A costs come from the inpatient. Inpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facility.

Does Medicare Part A and Part B increase premiums?

Not enrolling on time can increase your premium amount. Medicare Part A and Part B cover most of your healthcare. Healthcare is the industry dedicated to maintaining or improving health and well-being. services (hospital and medical). You can add supplemental insurance to help cover the costs of Original Medicare (Parts A and B)

Does Medicare Advantage have an AEP?

It’s also important to know that Medicare Advantage also has its own Annual Enrollment Period (AEP). Medigap: Medicare Supplement Insurance (Medigap) Medicare Supplement Insurance (Medigap) is designed to provide coverage that Original Medicare (Parts A and B) does not.

How Do Medicare Deductibles Work

A deductible is an out-of-pocket amount beneficiaries must pay before the policy starts to pay. Part A has a deductible per benefit period, and Part B has a deductible that changes each year. Part D also has an annual deductible you must pay before benefits kick in.

Medicare Advantage Out-Of-Pocket Costs

When you enroll in an Advantage plan, the carrier determines what the cost-sharing will be. So, instead of the 20% coinsurance, you have to pay under Medicare, it could be more.

Medigap Cost-Sharing Plans

Three Medigap plans involve cost-sharing. These plans are Plan K, Plan L, and Plan M. The cost-sharing helps keep the premiums for these plans lower.

Get Quote

Compare rates side by side with plans & carriers available in your area.

What is Medicare Cost-Sharing?

When you use Medicare, you share the cost of your care by paying premiums, deductibles, copayments, co-insurance, and out-of-pocket maximums. If you receive a paycheck, part of your check will be set aside for Medicare. You pay for the program when you work and pay again when you use it.

We Explain Cost-Sharing Terms

Cost-Sharing includes your cost of premiums, deductibles, copayments, co-insurance, and out-of-pocket maximums. You share the cost of your medical services with your insurance company.

What happens if Medicare pays $80?

If the state's payment were $90, the state would pay the difference between Medicare's payment and the state’s payment, or $10.

Can advocates work with states to increase the state's cost sharing payment to the full Medicare rate?

Advocates can work with their states to increase the state’s cost-sharing payment to the full Medicare rate. Perhaps it is time for Congress to revisit the question of whether limited cost-sharing payments adversely impact beneficiaries.

Can a QMB be private?

with a straightforward, "No.". The guidance continues: Providers who bill QMBs for amounts above the Medicare and Medicaid payments (even when Medicaid pays nothing) are subject to sanctions. Providers may not accept QMB patients as "private pay" in order to bill the patient directly, and providers must accept Medicare assignment ...

Does Medicaid cover dual eligibles?

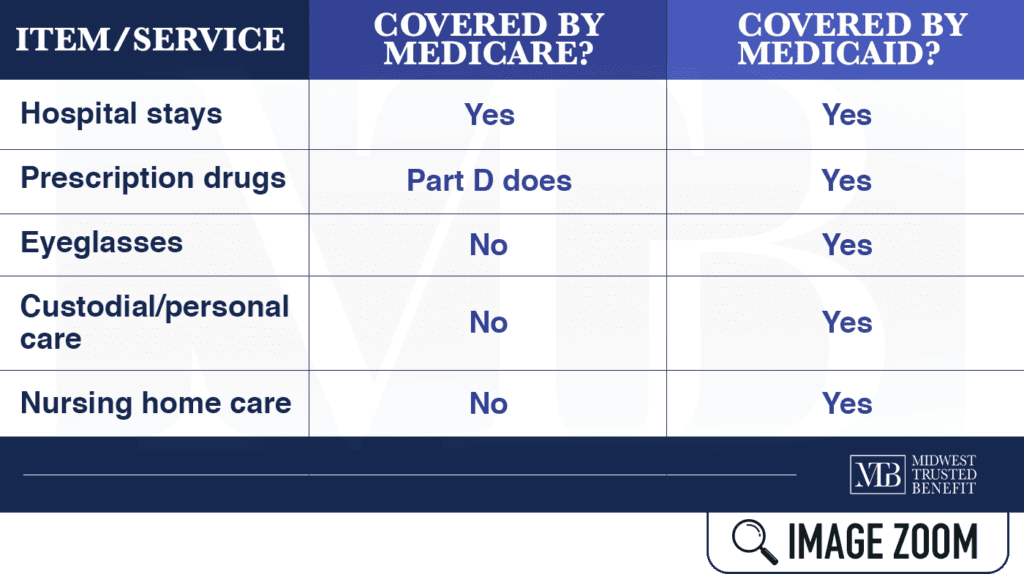

State Medicaid agencies have legal obligations to pay Medicare cost -sharing for most " dual eligibles" – Medicare beneficiaries who are also eligible for some level of Medicaid assistance . Further, most dual eligibles are excused, by law, from paying Medicare cost-sharing, and providers are prohibited from charging them. [1] .

Is dual eligible Medicare?

But the particulars are complex in traditional Medicare and become even more complex when a dual eligible is enrolled in a Medicare Advantage (MA) plan. [2] It may be helpful to think of dual eligibles in two categories: those who are Qualified Medicare Beneficiaries (QMBs) (with or without full Medicaid coverage) and those who receive full ...

Does Medicaid require cost sharing?

In addition to this obligation, the Medicaid statute authorizes – but does not require – states to pay providers Medicare cost-sharing for at least some non-QMB dual eligibles. [5] . It appears from the language of the statute that such payment could include cost-sharing for services not covered in the state Medicaid program.

Can you pay premiums for MA plans?

States can, but are not required to, pay premiums for MA plans' basic and supplemental benefits. The "Balance Billing" Q & A referenced above answers the question, "May a provider bill a QMB for either the balance of the Medicare rate or the provider's customary charges for Part A or B services?".

Medicare Cost Sharing Definitions

Medicare cost sharing may seem more complex than other forms of insurance because Medicare has four different parts, and each one covers something different. Two of those parts are public (Parts A and B), and two are private (Parts C and D).

Medicare Part A Cost Sharing

Medicare Part A is hospital insurance and it covers inpatient procedures, hospice care, and skilled nursing facilities. Many Medicare eligibles don’t pay a monthly premium for Part A. If you don’t meet the “premium-free Part A” requirements, you may pay up to $458 per month in 2020.

Medicare Part B Cost Sharing

Medicare Part B is medical insurance, and it helps pay for outpatient medical services such as doctor’s appointments, emergency medical transportation, outpatient therapy, and durable medical equipment (DME).

Medicare Part C Cost Sharing

Medicare Advantage (MA or Part C) are private plans that can cover additional benefits such as prescription drugs, dental, hearing, vision, and fitness classes. You must be enrolled in both Part A and Part B before you can enroll in a MA plan.

Medicare Part D Cost Sharing

Medicare Part D is prescription drug coverage. You may have to pay a monthly premium, for which the average cost was $33.19 nationwide in 2019.

Medicare Supplement Cost Sharing

Medicare Supplement (Medigap) plans have a different cost sharing structure than MA plans. Medigap plans have eight standardized coverage levels*. In 2020 there are eight different coverage levels:

We Can Help You Navigate Medicare Cost Sharing

Cost sharing with Medicare may seem complicated, and a licensed agent with Medicare Plan Finder can help you determine what you need. Our agents are highly trained, and they can find the Medicare Advantage, Medicare Supplement, and/or Medicare Part D plans in your area.