How Much Does the Average Medicare Supplement Plan Cost in 2022?

| Average Monthly Cost of Plan F | Age in Years | Average Monthly Cost of Plan G |

| $184.93 | 65 | $143.46 |

| $186.76 | 66 | $144.94 |

| $188.48 | 67 | $146.35 |

| $192.55 | 68 | $149.62 |

Full Answer

What is the best and cheapest Medicare supplement insurance?

Jun 16, 2021 · You can compare Medicare Supplement plans and how much they cost online for free. Getting a free Medicare Supplement plan comparison is a great way to compare the plans available where you live to find out their costs and find the right plan for your budget. Compare Medicare Supplement Plan Costs. Determining a true average cost is not easy, but Medicare …

How much does a Medicare supplement insurance plan cost?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a …

What is the best Medicare plan?

Nov 01, 2021 · The average Medicare Supplement policy premium cost $154.50 per month in 2022. But, there’s no easy answer on how much you should expect to pay on the monthly premium on your Medicare Supplement plan. That’s because there are a few factors that can affect premiums, including: How much cover you want with your plan.

What are the top 5 Medicare supplement plans?

21 rows · Feb 03, 2022 · Medicare Supplement Insurance Plan F premiums in 2022 are lowest for beneficiaries at age 65 ( ...

How much a month is Medicare Supplement?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

What is the cost of supplemental insurance for Medicare?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles. Plans with lower monthly premiums typically have higher deductibles.

What are the pros and cons of Medicare Supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

What is the most comprehensive Medicare Supplement plan?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

Is there a Medicare Supplement that covers everything?

Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for your health care. Plan G is the most popular Medicare Supplement for new enrollees.Mar 16, 2022

Is Medigap and supplemental insurance the same?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What are the disadvantages of a Medigap plan?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans....Some disadvantages of Medicare Advantage include:Having to make sure your preferred provider is in your plan.No coverage while traveling.A likelihood of higher out-of-pocket and emergency costs.

What's the difference between Medigap and advantage?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Does Plan G cover Medicare deductible?

Get online quotes for affordable health insurance Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Why is Plan F being discontinued?

Why was Medigap Plan F discontinued? Per MACRA, first-dollar coverage plans will no longer be available to new beneficiaries. This is due to an effort by Congress to curb medical overspending and provide adequate wages for doctors. If you currently have Plan F or are not newly eligible, you can still enroll.

How Insurance Companies Set Medicare Supplement Insurance Plan Costs & Premiums

Insurance companies can decide the premium costs for the Medicare Supplement insurance plans they offer. They can use any of three ways to set prem...

When You Apply For A Medicare Supplement Insurance Plan

The time period when you apply for a Medicare Supplement insurance plan can affect your out-of-pocket costs. If you apply during the Medicare Suppl...

The Type of Medicare Supplement Insurance Plan Type You Select

The benefit coverage of the Medicare Supplement insurance plan you choose usually also affects the premium you will pay. For example, you might be...

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

Medicare supplement plan explained

First things first, before we dig deeper into the costs associated with the Medicare Supplement plan, let’s make sure we’re on the same page with what this plan is.

Why should you get Medicare supplement insurance?

Medicare supplement insurance plans bring plenty of benefits to people aged 65 or those with disabilities. And, it all comes down to efficiently tackling increasing healthcare costs. So, if you’re wondering whether or not Medicare Supplement Plans are worth it, find out that the answer is, “Absolutely!”

How much does Medigap policy cost on average?

Now, let’s get to the main question that probably everybody interested in getting Medigap has on their minds, “what is the average cost of supplemental insurance from MedicareWire ?”. The average Medicare Supplement policy premium cost $154.50 per month in 2022.

What is the factor that determines the premiums for Medicare Supplement Insurance?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age .

What are the factors that affect the cost of Medicare Supplement?

There may be plans available in your area that cost less than the average listed above for your age. Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates. A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan ...

Why does my Medigap premium increase?

As you age, your Medigap plan premiums will gradually increase each year. Medigap premiums can increase over time due to inflation and other factors , regardless of the pricing model your insurance company uses.

What is the lowest Medicare premium for 2020?

Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

How does age affect Medicare premiums?

How Does Age Affect Medicare Supplement Insurance Premiums? 1 Community-rated Medigap plans#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market. 2 Issue-age-rated Medigap plans#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age. 3 Attained-age-rate Medigap plans#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

How much is the 203 deductible?

The $203 annual deductible equates to around $17.00 per month. This means that a Plan G with a premium of no more than $17.00 per month more than a Plan F option could actually serve as a better value, provided you meet the entire Part B deductible.

When will Medicare plan F be available?

Important: Plan F is not available to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020. If you already have Medicare, you can still enroll in Plan F if the plan is available in your area.

Why are Medicare Supplement plans so expensive?

Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors. If you are interested in purchasing a Medicare Supplement insurance plan ...

Why is it important to consider how much Medicare supplement coverage you need?

It’s important to consider how much coverage you need from a Medicare Supplement insurance plan before you make a selection, because some Medicare Supplement insurance plans tend to have higher premiums than others. You can compare Medicare Supplement insurance plans that are available where you live – and their coverage ...

What is Medicare Supplement?

Medicare insurance Supplement insurance plans (also known as Medigap plans) are offered by private insurance companies and are designed to help pay out-of-pocket costs for services covered under Medicare Part A and Part B, such as deductibles, copayments, and coinsurance. Medicare supplement insurance coverage for these out-of-pocket expenses ...

Why does Medicare premium increase over time?

Over time, premiums may increase because of inflation and other factors, but they won’t change because of your age. Issue-age rating: The premium you pay is based on your age when you buy the Medicare Supplement insurance plan. Premiums are lower if you purchase the Medicare Supplement insurance plan when you are age 65 than if you wait ...

How long does Medicare Part B last?

This period begins the month you are both 65 years old and enrolled in Medicare Part B, and lasts for six months. If you apply during this period, you’re not required to go through medical underwriting, which can lead to a higher premium cost if you have health conditions at the time you apply.

When do Medicare premiums go down?

Premiums are lower if you purchase the Medicare Supplement insurance plan when you are age 65 than if you wait until you are older. Over time, premiums may increase because of inflation and other factors, but they won’t increase because of your age. Attained-age-rating: The premium you pay is based on your current age.

Which states have standardized Medicare Supplement plans?

With the exception of Massachusetts, Minnesota and Wisconsin, which have their own standardized plans, insurance companies offer standardized Medicare Supplement insurance plans identified by alphabetic letters (such as Medicare Supplement insurance Plan M). However, the premiums (the monthly amount you pay for a Medicare Supplement insurance plan) ...

How Much Does The Average Medicare Supplement Plan Cost In 2021

The table below displays the average cost of Medicare Supplement Insurance Plan G and Plan F by age.1

Is It Possible To Keep My Doctor On Medicare

If you have Medicare Part B coverage, you can go to any health care provider who takes Medicare and is taking new Medicare customers. You should inquire with your doctor about becoming a new Medicare patient.

Compare Medigap Plans Where You Live

1 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

Medicare Advantage Special Needs Plans May Have Lower Costs

A Medicare Special Needs Plan is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

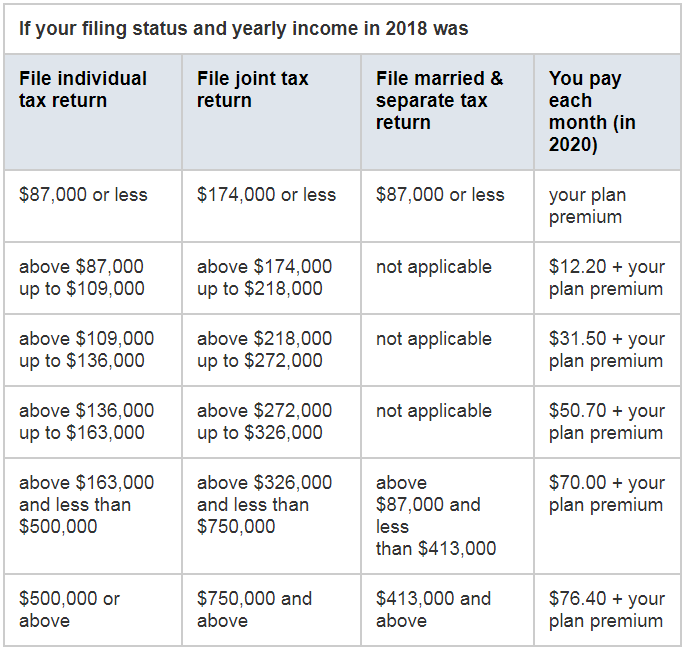

So How Much Does Medicare Cost Per Month

As you can see, Medicare costs are built up out of many building blocks. Theres no way to tell exactly how much you will pay each month, but this should give you the resources to do those calculations based on your own plans, income level, and healthcare needs.

Medicare Part C And Part D

If youre divorced or recently widowed, youll need to budget for your Medicare Advantage plan or Medicare Part D plan premiums, deductibles and copays. Shop around for the best plan for your needs and budget, as coverage and premium prices vary between providers.

Summary Of Medicare Benefits And Cost

The chart below is a comprehensive list of Medicare Part A and B costs, including premiums, deductibles and coinsurance. Medicare supplemental insurance, known as Medigap, can help cover some of the gaps in coverage and pay for part or all of Medicares coinsurance and deductibles, depending on the policy.

Which is the most expensive Medicare supplement plan?

It makes sense that Plan F and Plan G are the most expensive plans because they have the most coverage, and people want to know the cost of Medicare supplement plans. But, the pricing is different for everyone. Insurance carriers have more than one way to rate their plans for an initial premium and rate increases.

What is Medicare Supplement Plan?

A Medicare Supplement plan (aka, Medigap) is additional insurance that helps pay some of the deductibles. A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share.... , copayments.

How much does Medicare pay for skilled nursing?

But, Medicare only pays for the first 20 days. After that, you’ll pay $176 per day. Medicare Part B deductible: The Part B deductible is $198 per year.

What is Medicare premium?

A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ... . Several other factors influence Medicare supplement insurance cost, too, so read on.

How much does a hip replacement cost?

The average cost of a hip replacement in the United States is almost as costly at $32,000. Most of us simply can’t afford to pay 20% of those kinds of costs out-of-pocket. That’s what makes it necessary to buy supplemental Medicare insurance. As with car insurance, we really don’t have a choice.

What factors influence insurance premiums?

Zip code and age significantly influence the monthly premium. Costs vary by insurance carrier and rating method (attained-age, issue-age, community). Gender and the use of tobacco also influence premiums. A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis.

When will Medicare Supplements be available in 2021?

June 27, 2021. According to MedicareWire research, the average Medicare Supplement insurance. Medicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare (Medicare Part A and Medicare Part B) health insurance coverage....

What is Medicare supplement insurance?

Medicare supplement insurance (Medigap) policies are sold by private insurance companies. These plans help pay for some of the healthcare costs that aren’t covered by original Medicare. Some examples of the costs that may be covered by Medigap include: deductibles for parts A and B. coinsurance or copays for parts A and B.

What is a Medigap monthly premium?

The Medigap monthly premium is paid in addition to other monthly premiums associated with Medicare. These can include premiums for: Medicare Part A (hospital insurance), if applicable. Medicare Part B (medical insurance)

How do insurance companies set monthly premiums?

Insurance companies can set monthly premiums for their policies in three different ways: Community rated. Everyone that buys the policy pays the same monthly premium regardless of age. Issue-age rated. Monthly premiums are tied to the age at which you first purchase a policy, with younger buyers having lower premiums.

What is a Medigap plan?

Medigap is a type of supplemental insurance that you can purchase to help pay for health-related costs that aren’t covered by original Medicare. There are 10 different types of standardized Medigap plan. The cost of a Medigap plan depends on the plan you choose, where you live, and the company from which you purchase your policy.

What is the maximum amount you can pay out of pocket for 2021?

This is a maximum amount that you’ll have to pay out of pocket. In 2021, the Plan K and Plan L out-of-pocket limits are $6,220 and $3,110, respectively. After you meet the limit, the plan pays for 100 percent of covered services for the rest of the year.

Does Medigap cover coinsurance?

Like deductibles, Medigap itself isn’t associated with coinsurance or copays. You may still have to pay certain coinsurance or copays associated with original Medicare if your Medigap policy doesn’t cover them.

Does Medigap cover medical costs?

Cost factors. Plan prices. Takeaway. Medigap helps to pay for some of the healthcare costs that aren’t covered by original Medicare. The costs you’ll pay for Medigap depend on the plan you choose, your location, and a few other factors. Medigap usually has a monthly premium, and you may also have to pay copays, coinsurance, and deductibles.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.