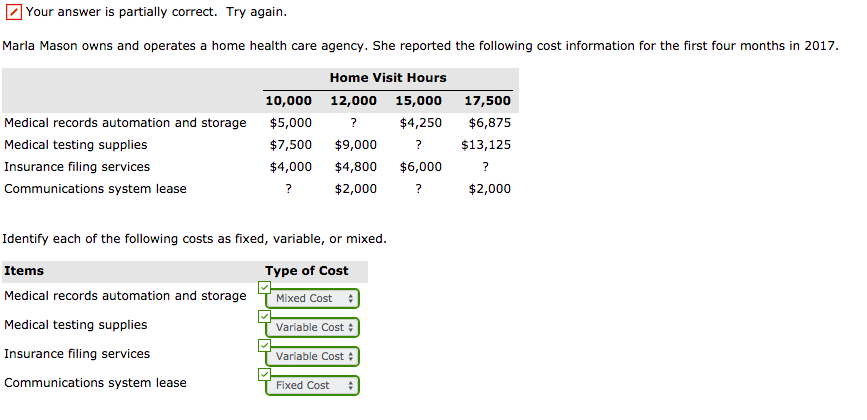

How much does AARP Medicare supplement cost?

Mar 07, 2022 · It’s a pre-set, fixed cost. Most Medicare Supplement plans provide coverage for your Part A hospital deductible. In most cases, you’re responsible for your Medicare Part B deductible, which is an annual cost of $233 in 2022.

How much does AARP supplemental insurance cost?

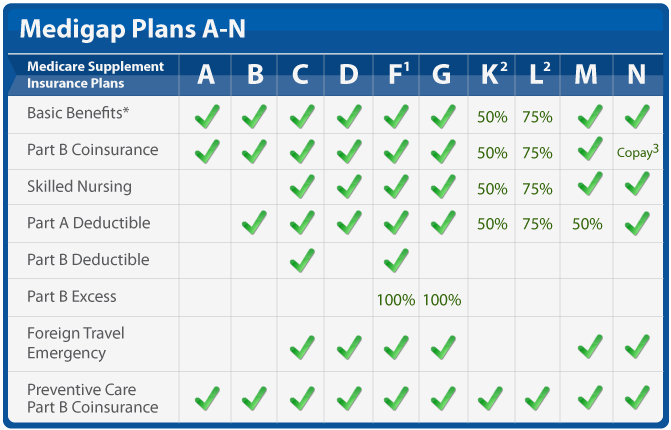

Mar 07, 2022 · Medicare supplement plans are designed to help limit out-of-pocket costs by helping to pay for some of the costs Original Medicare doesn't pay. There are Medigap plan options available with low to no copays. For example, the only out-of-pocket costs associated with Plan G would be your monthly premium and the annual Part B deductible ($233 in 2022).

Does AARP offer supplemental health insurance?

Oct 21, 2020 · Before you qualify for an AARP Medicare Supplement plan, you must become an AARP member. Luckily, that’s simple and inexpensive to do — a membership costs about $16 per year. Next, pay careful...

What is Medicare complete with AARP?

A: The Part B costs for Original Medicare are as follows: Premium - $104.90 per month (in 2015); Deductible - $147 per year (in 2015); and Coinsurance - …

What is the monthly premium for AARP Medicare Supplement?

In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85.Jan 24, 2022

How much is AARP Medicare Advantage plan?

About 7 out of 10 of AARP's Medicare Advantage plans offer $0 premiums. Of AARP plans that have a premium, the monthly consolidated premium (including Part C and Part D) ranges from $9 to $112.

How much is a Medicare supplement premium?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles. Plans with lower monthly premiums typically have higher deductibles.

How much does AARP Plan F Cost?

Nationwide, the average premium for the most popular Medigap F plan costs roughly $326 a month. There is also a high-deductible F plan ($2,340 for 2020), and that premium averages about $68 a month. Premiums are based on three pricing systems and vary widely based on where you live.Jul 6, 2020

What does AARP supplemental cover?

It pays 50 percent of mental health services and 100% of some preventive services. Medigap plans cover all or part of your share of these services – 20 percent of the Medicare-approved amount for doctor services and 50 percent for mental health services.

What's the difference between a Medicare Advantage plan and a supplement plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Does AARP pay Medicare deductible?

AARP Medicare Supplement Plan G Plan G does not cover your Medicare Part B deductible. However, it does cover all of the standard benefits included with Plan A. It also includes: Medicare Part B excess charges.Jan 4, 2022

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Is AARP worth joining?

Is AARP worth it? For most people age 50 and older, it's a great deal, as long as you're comfortable with the group's lobbying efforts and can stand the junk mail. Just one night in a hotel or a couple of dinners out per year can cover the cost of membership and then some.Aug 11, 2021

What is a premium?

A premium is a set amount (often monthly) you must pay for coverage.

Which costs do I share with Medicare or my plan?

Deductible:This is a set amount that you pay out of pocket for covered services before Medicare,your Medicare Advantage plan, and/or your Prescript...

Are there plans that limit out-of-pocket spending each year?

An out-of-pocket limit is also known as an out-of-pocket maximum. Whether or not there is a limit depends on which type of plan you have.Original M...

What costs can I expect for 2020?

Depending on which type of coverage you have, your costs may be different.Original Medicare:To get an idea of 2020 costs, you can visit Medicare 20...

What if I need help paying Medicare costs?

There are several programs that help pay Medicare costs. Unfortunately, many people who qualify never sign up. Don’t hesitate to apply. Income and...

What is AARP Medicare Supplement?

AARP is simply a different branding of UnitedHealthcare policies. AARP does get to choose what UnitedHealthcare plans feature the AARP name. Agents who offer AARP Medicare Supplement plans undergo additional training to understand beneficiaries’ needs and how to match them with the best Medicare product ...

What is Medicare Supplement Plan?

A Medicare Supplement plan helps you cover costs such as deductibles, coinsurance, copays, and extended hospital care. iStock. AARP has joined forces with UnitedHealthcare, one of the largest insurance providers in the country.

When does Medicare enrollment end?

Your Initial Enrollment Period begins three months before your 65th birthday month, includes your birthday month, and ends three full months after your birthday month.

What is the most comprehensive Medicare Supplement plan?

All carriers who offer Medicare Supplement plans are required to offer at least Plan A, so that will be an option for you no matter where you live. Plans C and F are the most comprehensive plans, but they are only available to beneficiaries who were eligible for Medicare prior to January 1, 2020.

Is AARP the least expensive insurance?

Must be an AARP member to purchase. Plans aren’t the least expensive, but they are competitive in some areas. Often a better deal for beneficiaries who manage health conditions. Note: Some low ratings are due to customer service issues, but many of them are coverage complaints.

Does AARP pay royalty fees?

AARP endorses Medicare Supplement insurance plans through UnitedHealthcare. AARP is not an insurer — UnitedHealthcare pays AARP royalty fees for the use of its name . In terms of name recognition with seniors, AARP Medicare Supplement plans are noteworthy.

How much is the penalty for Medicare Part D?

A: Generally, a penalty of 1 percent per month will be added to the Part D monthly premium for each month you could have enrolled but did not enroll or have coverage at least as good as Medicare’s, also known as “creditable coverage.” — Read Full Answer

What is coinsurance in Medicare?

A: Coinsurance is the amount you may be required to pay for services after you pay any deductibles. This could be a percentage (such as 20 percent) of the Medicare-approved amount or a fixed dollar amount. — Read Full Answer.

What is the income level for Part D?

A: If your income level is higher than $85,000 for a single person or $170,000 for a married couple filing a joint tax return, you will pay higher Part D premiums. — Read Full Answer

How long do you have to notify Medicare of a drug change?

A: If you are taking the drug, Medicare requires your plan to notify you 60 days prior to the change or, at the time of refill, provide you a 60-day supply, if prescribed. — Read Full Answer

Does Medicare cover all of your medical bills?

A: Medicare does not cover all of your health care costs. Depending on which plan you choose, you might have to share in the cost of your care by paying premiums, deductibles, copayments and coinsurance. — Read Full Answer

How much will Medicare Advantage cost in 2021?

If you sign up for a Medicare Advantage plan that includes prescription drugs with a mid-priced premium, CMS predicts you’ll pay $4,339 in 2021. These are just estimates, of course, but they can help you choose the policy that’s best for your health care needs and financial situation.

How many days can you use Medicare?

Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once. Part B: Typically, 20 percent of the Medicare-approved cost of the service for most services.

Does Medicare have out of pocket costs?

Medicare’s out-of-pocket costs — premiums, deductibles, copays and coinsurance — can easily result in a large tab each year. If you’re struggling to meet those expenses, you might be eligible for federal and state assistance. If you qualify for Medicaid, the federal-state health insurance program for people with low incomes ...

Does Medicaid pay out of pocket?

If you qualify for Medicaid, the federal-state health insurance program for people with low incomes and individuals with disabilities, it will pay some or all of your out-of-pocket expenses. Individuals on both Medicare and Medicaid are known as “dual eligibles.”.

What happens if you can't leave your home?

If you cannot leave your home, Medicare will allow your doctor to order a test to be brought to you and administered there. The Specified Low-Income Medicare Beneficiary (SLMB) program helps pay only for Part B premiums, not the Part A premium or other cost sharing.

Our thoughts: Why we recommend AARP Medicare Supplement

Medicare Supplement Insurance (also called Medigap) plans from AARP/UnitedHealthcare are a good choice for most people. The customer service rating is not as strong as that of some other companies. However, the wide range of policy selections makes it easy to choose the best plan for you, and the AARP endorsement can give you peace of mind.

How do AARP Medicare Supplement plans work?

When you buy an AARP Medicare Supplement Insurance plan, you’re actually getting a policy from UnitedHealthcare. As part of the business agreement, AARP endorses and does marketing for select UnitedHealthcare plans, and in turn, AARP gets an estimated 4.95% fee for each plan sold.

Medigap costs vary by state

Costs for supplemental plans vary widely. To a large degree, this is due to state differences in pricing regulations.

How AARP Medigap costs compare to other insurance companies

Because of the variable plan structures, it can be difficult to compare costs, and the most accurate comparison will be based on insurance quotes for your location and situation . In states where prices change as you age, the different formulas for price increases can affect your total lifetime costs.

Customer reviews and satisfaction

AARP/UnitedHealthcare has mediocre customer reviews with several metrics indicating user complaints and frustrations.

Frequently asked questions

A supplemental insurance plan from AARP/UnitedHealthcare is a good value. It can help you reduce your out-of-pocket costs for medical care, and it includes discounts on vision, dental, hearing, gym membership and more.

Sources and methodology

The above comparisons are based on plan coverage levels, policy details, third-party rankings and sample cost data for 2021. Price quotes for a female nonsmoker were analyzed based on age, location and provider.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage plan costs can be as varied as the plans themselves. In addition to covering medical services, most include prescription drugs, too. Many also offer extra benefits and services not provided by Original Medicare, like wellness programs or a fitness benefit.

Is Medicare free?

Estimate Medicare Plan Costs. Medicare isn't free. When you're shopping for coverage, it's important to think about what your budget needs are. It's about more than just premiums.