Do Congress members pay Medicare taxes?

All federal employees, including Congress members, pay the same payroll taxes as other workers for Medicare Part A coverage, and they’re eligible when they turn 65 to enroll in Medicare Part B, Part C and Part D. But there’s a sweetener for Congress members.

How much do members of Congress pay for Obamacare?

Instead, they choose a gold-level Obamacare policy and receive federal subsidies that cover 72 percent of the cost of the premiums. In short, Snopes reports that members of Congress and staff "pay approximately 28 percent of their annual healthcare premiums through pre-tax payroll deductions.".

Are members of Congress paid more for their retirement benefits?

However, all Members of Congress and congressional staff also paid a higher percentage of salary for their retirement benefits than most other federal employees before P.L. 112-96 was enacted. P.L. 112-96 made two significant changes to the retirement benefits of Members of Congress who

Do members of Congress over 65 get Medicare?

William wants to know: “Do members of Congress over 65 get Medicare?” Short answer: Yup. But that’s not all. Under the Affordable Care Act, Congress members obtain health insurance through an online exchange, just like others who aren’t covered by a plan from their employer or spouse.

How is Medicare funded in Australia?

The Australian government pays for Medicare through the Medicare levy. Working Australians pay the Medicare levy as part of their income tax. High income earners who don't have an appropriate level of private hospital insurance also pay a Medicare levy surcharge.

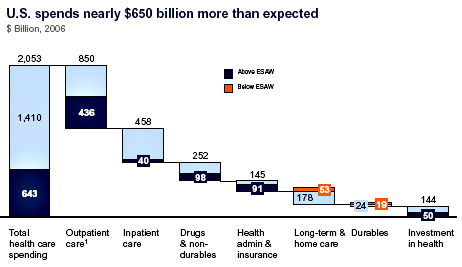

How much does the US spend on Medicare and Medicaid?

Historical NHE, 2020: Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE.

Who controls Medicare?

the Centers for Medicare & Medicaid ServicesMedicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

Does Medicare lose money?

Medicare is not going bankrupt. It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses.

How does the government pay for Medicare?

Medicare is funded primarily from general revenues (43 percent), payroll taxes (36 percent), and beneficiary premiums (15 percent) (Figure 7). Part A is financed primarily through a 2.9 percent tax on earnings paid by employers and employees (1.45 percent each) (accounting for 88 percent of Part A revenue).

How much of the federal budget goes to Medicare?

12 percentMedicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

Who paid for Medicare?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare.

Where does Medicare funding come from?

The Medicare program is primarily funded through a combination of payroll taxes, general revenues and premiums paid by beneficiaries. Other sources of revenues include taxes on Social Security benefits, payments from states and interest on payments and investments.

Does Medicare take money from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare about to collapse?

At its current pace, Medicare will go bankrupt in 2026 (the same as last year's projection) and the Social Security Trust Funds for old-aged benefits and disability benefits will become exhausted by 2034.

Is Social Security running out of money?

The Social Security trust funds going broke: It is true that the Social Security trust funds, where the money raised by Social Security taxes is invested in non-marketable securities, is projected to run out of funds by around 2034.

Does Medicare pay for itself?

It turns out that Medicare payroll taxes fully fund Part A hospital expenses (together with your share of uncovered Part A expenses), but that is literally where the buck stops. Expenses for Parts B, C (Medicare Advantage) and D (prescription drugs) are paid mostly by Uncle Sam, to the tune of nearly $250 billion.

Does the Affordable Care Act apply to Congress?

The Affordable Care Act stipulates that ordinary people aren’t eligible for coverage through the exchanges if they’re also covered by Medicare. That rule doesn’t apply to Congress members.

Do all federal employees pay the same payroll taxes as other workers for Medicare?

Advertisement. All federal employees, including Congress members, pay the same payroll taxes as other workers for Medicare Part A coverage, and they’re eligible when they turn 65 to enroll in Medicare Part B, Part C and Part D. But there’s a sweetener for Congress members.

How is Congress' retirement funded?

As it is for all other federal employees, congressional retirement is funded through taxes and the participants' contributions. Members of Congress under FERS contribute 1.3% of their salary into the FERS retirement plan and pay 6.2% of their salary in Social Security taxes. Members of Congress become eligible to receive a pension at the age ...

How much did the House and Senate get paid?

By the time the first U.S. Congress under the Constitution convened in 1789, members of both the House and Senate were paid $6 for each day there were actually in session, which was then rarely more than five months a year.

How many retired members of Congress are receiving pensions?

According to the Congressional Research Service, there were 617 retired members of Congress receiving federal pensions based fully or in part on their congressional service as of October 1, 2018. Of this number, 318 had retired under CSRS and were receiving an average annual pension of $75,528. A total of 299 Members had retired with service under FERS and were receiving an average annual pension of $41,208 in 2018. 1

How much can a member of Congress retain?

Many members of Congress retain their private careers and other business interests while they serve. Members are allowed an amount of permissible "outside earned income" limited to no more than 15% of the annual rate of basic pay for level II of the Executive Schedule for federal employees, or $28,845.00 a year in 2018. 5 However, there is currently no limit on the amount of non-salary income members can retain from their investments, corporate dividends or profits.

What was the federal health insurance system before the Affordable Care Act?

Prior to the passage of the Affordable Care Act, insurance for members of Congress was provided through the Federal Employees Health Benefits Program (FEHB); the government’s employer-subsidized private insurance system. However, not even under the FEHB plan was the insurance “free.”. On average, the government pays about 72% ...

How much can a member deduct from their federal income tax?

Members are allowed to deduct up to $3,000 a year from their federal income tax for living expenses while they are away from their home states or congressional districts. 1

What is Congress' annual allowance?

Allowances. Members of Congress are also provided with an annual allowance intended to defray expenses related carrying out their congressional duties, including "official office expenses, including staff, mail, travel between a Member's district or state and Washington, DC, and other goods and services.".

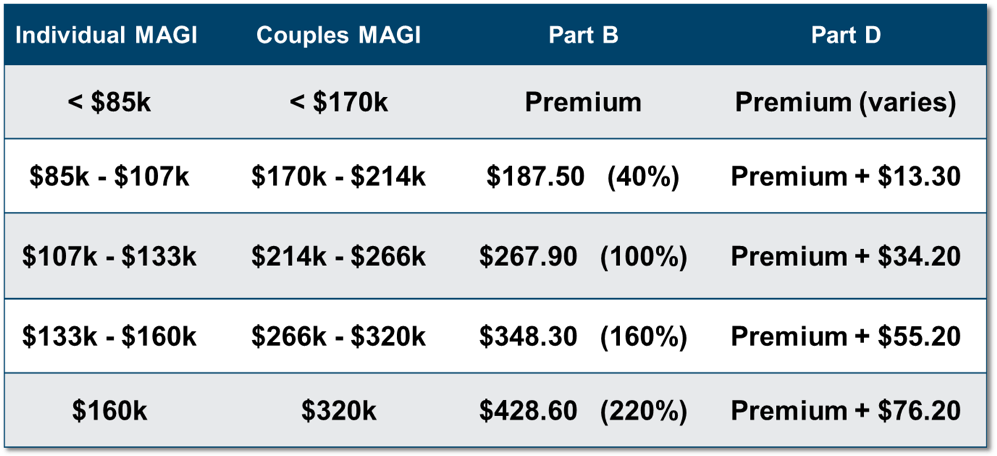

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How long was Social Security on budget?

This means at no point over this 22-year period where Social Security was on-budget did a dime of Social Security income, benefits, or asset reserves get commingled with the federal government's General Fund.

How much interest did Social Security get in 2018?

In 2018, $83 billion in interest income was collected by Social Security. If the folks who believe that Congress stole from Social Security got their way, and the federal government repaid every cent it borrowed, Social Security would have lost out on this $83 billion in interest income in 2018.

Why is Social Security facing a huge cash shortfall?

One of the more common theories as to why Social Security is facing a huge long-term cash shortfall is that lawmakers in Congress have pilfered cash from the program and never returned it. This idea goes all the way back to 1968, when then-President Lyndon B. Johnson made a change to how the federal budget would be presented.

How much is Social Security shortfall?

According to the latest report from the Social Security Board of Trustees, Social Security is staring down a $13.9 trillion cash shortfall between 2035 and 2093, with the expectation that its $2.9 trillion in asset reserves will be completely exhausted in ...

What has Congress not done?

What Congress hasn't done is steal from Social Security. However, lawmakers have known of the program's shortcomings since 1985, and have yet to find a middle-ground solution to fix it. If you want to point the finger at lawmakers, do so because bountiful solutions exist, but political hubris appears to be getting in the way.

What was the President's Commission on Budget Concepts?

Prior to 1974, before Congress had an independent budgeting process, the President's Commission on Budget Concepts had three separate budgets, all of which had differing deficits. To simplify things, Johnson called for Social Security and its trust funds to be included in the annual federal budget. In 1983, the Reagan administration voted ...

When did Social Security get pilfered?

First of all, there's the period between 1968 and 1990, which is believed to be when Congress pilfered America's top social program. What needs to be understood here is that, while Social Security's two trusts (the Old Age and Survivors Insurance Trust and Disability Insurance Trust) and its asset reserves were technically "on-budget," funding ...