Monthly Medicare Premiums for 2022

| Modified Adjusted Gross Income (MAGI) | Part B monthly premium amount | Prescription drug coverage monthly premi ... |

| Individuals with a MAGI of less than or ... | 2022 standard premium = $170.10 | Your plan premium |

| Individuals with a MAGI above $91,000 up ... | Standard premium + $68.00 | Your plan premium + $12.40 |

| Individuals with a MAGI above $114,000 u ... | Standard premium + $170.10 | Your plan premium + $32.10 |

| Individuals with a MAGI above $142,000 u ... | Standard premium + $272.20 | Your plan premium + $51.70 |

Full Answer

What is modified adjusted gross income (MAGI) for Medicare?

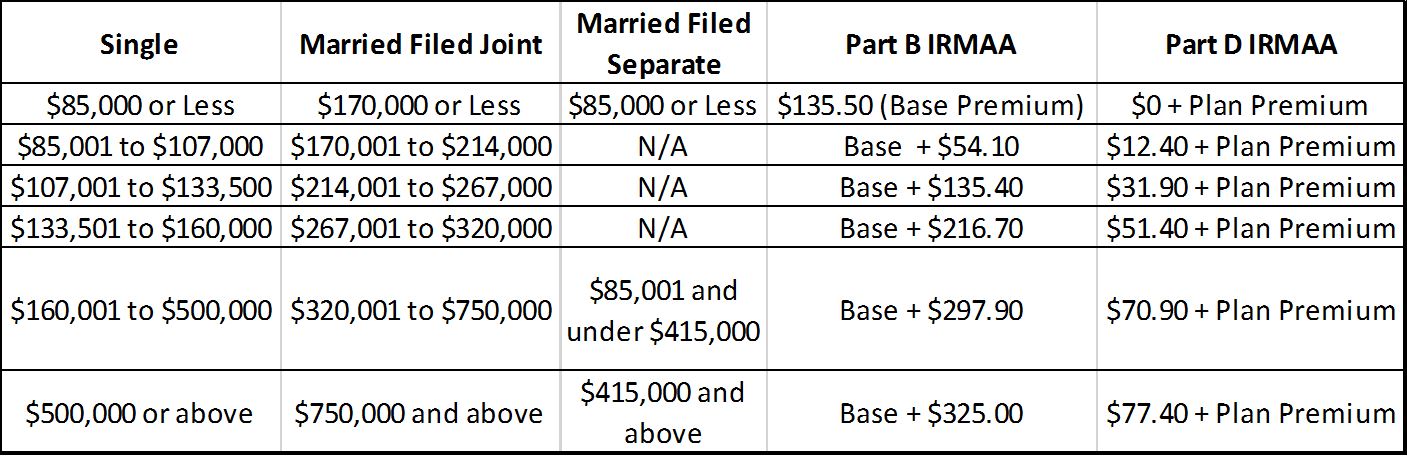

Nov 27, 2021 · The cost of Medicare B and D premiums are based on your modified adjusted gross income. If your MAGI is above $87,000 , then your premiums will be subject to the income-related monthly adjustment amount . Below are two charts from the Centers for Medicare and Medicaid Services showing how IRMAA can affect premiums at different MAGI levels.

How does my Magi affect my Medicare Part B premiums?

Once you exceed $87,000 yearly income if you file an individual tax return, or $174,000 if you file a joint tax return, the cost goes up to $202.40. As your income rises, so too does the premium amount until a certain level of income is exceeded based on tax return filing status. At that level, the monthly premium is set at $491.60.

How much do you have to make to qualify for Magi?

6 rows · Modified Adjusted Gross Income (MAGI) Part B monthly premium amount Prescription drug coverage ...

What is Magi and how do I calculate it?

Sep 20, 2021 · What is modified adjusted gross income? In short, your MAGI is simply your adjusted gross income with any tax-exempt interest income and certain deductions added back in. The IRS uses your MAGI in a lot of ways to determine if you’re eligible for certain deductions and credits. Your MAGI determines whether or not you can: Contribute to a Roth IRA

What Is Adjusted Gross Income?

Generally, your adjusted gross income is your household's income minus various adjustments. Adjusted gross income is calculated before the itemized...

What Is Modified Adjusted Gross Income?

Generally, your modified adjusted gross income (MAGI) is the total of your household's adjusted gross income plus any tax-exempt interest income yo...

How to Calculate Your Gross Income

Your gross income (GI) is the money you earned through wages, interests, dividends, rental and royalty income, capital gains, business income, farm...

How to Calculate Your Adjusted Gross Income

Once you have gross income, you "adjust" it to calculate your AGI. You make adjustments by subtracting qualified deductions from your gross income....

How to Calculate Your Modified Adjusted Gross Income

Once you have adjusted gross income, you "modify" it to calculate your MAGI. For most people, MAGI is the same as AGI.Specifically, Internal Revenu...

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

What happens if you don't get Social Security?

If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency , such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

What is the MAGI for health insurance?

The tax credits will cover the rest. The “household income” figure here is your modified adjusted gross income (MAGI). Your MAGI is a measure used by the IRS to determine if you are eligible to use certain deductions, credits (including premium tax credits), or retirement plans. The percentage of income you must pay for individual health insurance ...

How to calculate MAGI?

According to Internal Revenue Code ( (d) (2) (B)), you should add the following to your AGI to determine your MAGI: 1 Any amount excluded from gross income in section 911 (Foreign earned income and housing costs for qualified individuals) 2 Any amount of interest received or accrued by the taxpayer during the taxable year which is exempt from tax 3 Any amount equal to the portion of the taxpayer’s social security benefits (as defined in Section 86 (d)) which is not included in gross income under section 86 for the taxable year. (Any amount received by the taxpayer by reason of entitlement to a monthly benefit under title II of the Social Security Act, or a tier 1 railroad retirement benefit.)

How to calculate adjusted gross income?

Calculating your adjusted gross income. Once you have gross income, you "adjust" it to calculate your AGI by subtracting qualified deductions from your gross income. Adjustments can include items like some contributions to IRAs, moving expenses, alimony paid, self-employment taxes, and student loan interest.

What is gross income?

Your gross income (GI) is the money you earned through wages/salary, interests, dividends, rental and royalty income, capital gains, business income, farm income, unemployment, and alimony received. This is the basis for your AGI calculation.

Is MAGI the same as AGI?

Most people don’t have any of the income just described so their MAGI is the same as their AGI. Once you know your MAGI, you can shop the ACA marketplace or your state exchange for plans. These sites will ask for your MAGI and household size, then calculate tax credits for you.

How much does Medicare cover?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%. Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with ...

How many income brackets are there for IRMAA?

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay.

How much is Medicare Part B 2021?

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes.

How long does it take to pay Medicare premiums if income is higher than 2 years ago?

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes.

When will IRMAA income brackets be adjusted for inflation?

The IRMAA income brackets (except the very last one) started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and the projected brackets for 2022 coverage. Before the government publishes the official numbers, I’m able to make projections based on the inflation numbers to date.

Can seniors sign up for Medicare?

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors’ services and Medicare Part D that covers prescription drugs.

How to keep MAGI low?

Strategies to keep MAGI Low 1 1 – Don’t make any income! This is important. 2 2a – Remember tax exempt income is pulled back in, so interest paid by municipal bonds will count against you! Don’t own Municipal bonds. 3 2b – All the income you get from cash and bonds will be included. 4 3b – Ordinary dividends will be pulled in. If you buy and sell stocks, mutual funds or ETFs frequently (or have actively managed funds) this can hurt! 5 4b – Pension income will fully count against you, as will ALL or part of social security. If you want ACA Premium Tax Credits, delay taking pensions and social security until at least age 65. In addition, pre-tax accounts (IRAs, 401k) should not be accessed for income. This includes Roth Conversions! 6 Schedule 1 – Again, check out the sources of income you want to avoid on schedule 1. Note that you include capital gain harvesting here!

What is above the line deduction on 1040?

This is because they were on the front page of the old 1040 and above the bottom line on that form: the adjusted gross income. Also called “adjustments to your income,” you can look at schedule 1 again to see what they are.

What line do you add on to 1040?

In line 6 of Form 1040, you add on any income on line 22 from schedule 1. It is best to take a look at lines 1-22 of schedule 1, as it pulls in a lot of different income sources that will be included in you MAGI! This is your so-called total income.

Is Social Security taxable?

For social security, this could be between 0-85%. Pensions are usually fully taxable! Taxation of annuities are complicated, but there is frequently an exclusion rate. On your tax-deferred accounts, include the entire amount of your IRA distribution.

Can I retire before Medicare?

If you plan on retiring prior to Medicare, health care insurance is a huge concern. Many folks will try to get Premium ACA Tax Credits to lower their health insurance bill. In order to get these credits, you need to understand MAGI. Or if you are on Medicare and want to avoid IRMAA, you need to understand MAGI!

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.

What is IRMAA Medicare?

What is IRMAA? For Medicare beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

Who is Jae Oh?

Jae W. Oh is a nationally recognized Medicare expert, frequently quoted in the national press, including on USA Today, Dow Jones, CNBC, and Nasdaq.com, as well as on radio talk shows nationwide. His book, Maximize Your Medicare, is available in print and ebook formats.

What age can you contribute to an IRA?

The SECURE Act has a number of different features – such as allowing IRA contributions after age 70½ if you’re still earning an income – and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70½ to 72. Note that those who are already at least 70½ must continue to receive RMDs.

Do mutual funds distribute dividends?

At the end of every year, many mutual funds distribute capital gains or dividends to those with mutual fund holdings. As a result, people can unknowingly earn more income as a result of investments, and the results can be higher Medicare premiums.