If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $458. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $252. The standard Part B premium amount is $144.60 (or higher depending on your income). $198.

Full Answer

Who qualifies for premium-free Medicare Part A?

Medicare Part A (Hospital Insurance) Costs Part A monthly premium Most people don’t pay a Part A premium because they paid Medicare taxes while . working. If you don’t get premium-free Part A, you pay up to $499 each month. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

Who pays for part a Medicare coverage?

Part A costs: What you pay in 2022: Premium. $0 for most people (because they paid Medicare taxes long enough while working - generally at least 10 years). This is sometimes called “premium-free Part A.” Who qualifies for Part A without paying a monthly premium? If you don’t qualify for a premium-free Part A, you might be able to buy it.

Is there a deductible for Medicare Part A?

Learn more about Part A costs. Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A" ). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Do I pay for part a Medicare?

Feb 15, 2022 · But beginning on day 61 of your stay in 2022, you’re required to make a Medicare Part A coinsurance payment of $389 per day through day 90. After your 90 th day in the hospital, you must pay $778 per day for up to 60 more days in 2022. Those 60 “ lifetime reserve days ” do not reset annually. They can only be used once.

Is Medicare Part A ever free?

coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A. The health care items or services covered under a health insurance plan.

Does everyone pay the same for Medicare Part A?

Most people don't pay a Part A premium because they paid Medicare taxes while working. If you don't get premium-free Part A, you pay up to $499 each month. If you don't buy Part A when you're first eligible for Medicare (usually when you turn 65), you might pay a penalty.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How do I know if I will have to pay for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

Is Medicare Part A free at age 65?

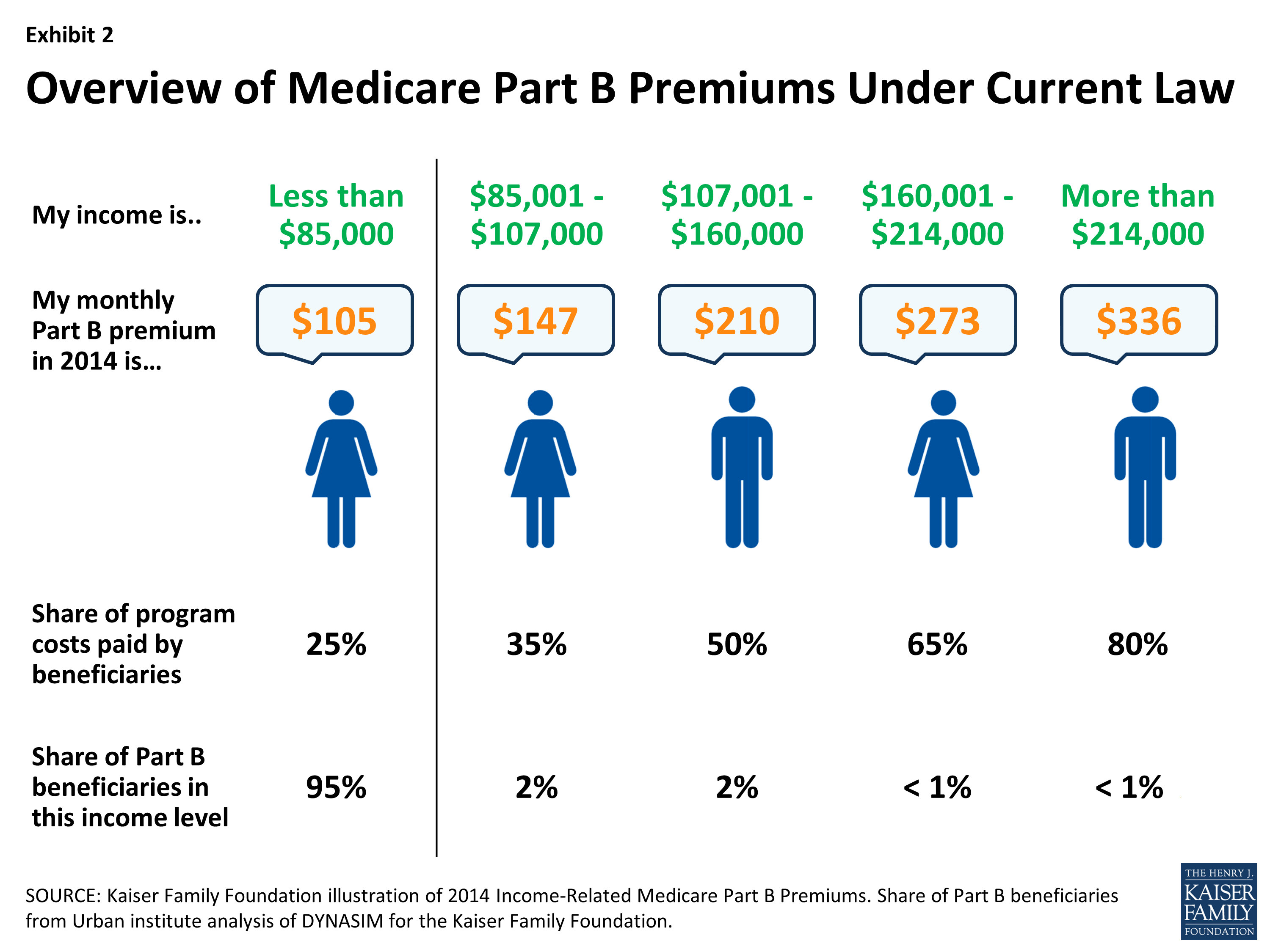

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Is Medicare Part B going up 2022?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

What is the difference between Medicare Part A and Part B?

Medicare Part A covers hospital expenses, skilled nursing facilities, hospice and home health care services. Medicare Part B covers outpatient medical care such as doctor visits, x-rays, bloodwork, and routine preventative care. Together, the two parts form Original Medicare.May 7, 2020

What is Medicare Part A deductible for 2022?

Medicare Deductibles. The 2022 deductible for Medicare Part A is $1,556 for each benefit period: $0 for days 1-60, $389 coinsurance per day for days 61-90 and $778 per each "lifetime reserve day" after 91 days.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.Feb 15, 2022

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

Does Medicare Part A require coinsurance?

Part A also requires coinsurance for hospice care and skilled nursing facility care. Part A hospice care coinsurance or copayment. Medicare Part A requires a copayment for prescription drugs used during hospice care. You might also be charged a 5 percent coinsurance for inpatient respite care costs.

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much is coinsurance for skilled nursing in 2021?

Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay. Skilled nursing care is based on benefit periods like inpatient hospital stays.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

What is Medicare Part A coinsurance?

You’re responsible for a daily coinsurance. Coinsurance is the percentage of your medical costs that you pay after you meet your deductible.

What is Medicare Part B?

cost for enrollees who have worked for at least ten years. Medicare Part B. Medicare Part B is the portion of Medicare that covers your medical expenses. Sometimes called "medical insurance," Part B helps pay for the Medicare-approved services you receive.

How much is Medicare Part B 2021?

Medicare Part B premium 2021: $148.50. Your income plays a part in your Part B premium. For 2021, individuals making $88,000 per year or less, and couples making $176,000 or less, pay the standard monthly amount of $148.50 each.

What is disability insurance?

A disability is an illness or injury that limits daily activities. Disability insurance may be part of your health plan, or you may buy it to supplement your health plan. Disability coverage usually pays for some or all of your salary if you can't work. .

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

Who sells Medicare Advantage plans?

Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live. This guide shows the average cost of Medicare Part C plans in each state.

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

What does Part C cover?

In addition to prescription drug coverage that is offered by many plans, some Part C plans may also cover some or all of the following: Routine dental care. Vision exams and coverage for eyeglasses. Routine hearing care and coverage for hearing aids. Fitness memberships.

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.