What is the monthly premium in Medicare Part D?

a Medicare, and Social Security policy analyst for The Senior Citizens League. The increase in Part B premiums in 2022, which covers the cost of doctors and outpatient services, is the highest increase dollar-wise in program history. The base monthly ...

What is the average cost of Medicare Part D?

So how much does Medicare Part D cost? According to the Centers for Medicare & Medicaid Services (CMS), the average cost of a Medicare Part D plan in 2022 will be approximately $33 per month. That represents a 4.9% increase from the 2021 average of $31.47 per month.

How to reduce Medicare Part D cost?

You can request a review of your income if any of the following circumstances occurred:

- You married, divorced, or became widowed

- You or your spouse stopped working or reduced your work hours

- You or your spouse lost income-producing property because of a disaster or other event beyond your control

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer's pension plan

How to compare Medicare Part D drug plan costs?

- Select your State and enter at least the first three letters of your drug name or

- select your State and enter your drug’s 11-digit National Drug Code (NDC) or

- select the starting letter for the drug you wish to find. You will be taken to a page showing all Medicare Part D drugs beginning with this letter. ...

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is the cost of Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

Is Part D Medicare expensive?

Are Part D plans expensive? In general, no — at least, not compared with standard premiums for Part B, which are $170.10 per month in 2022 for most Medicare recipients.

What is the monthly payment for Medicare Part D?

If your filing status and yearly income in 2020 wasFile individual tax returnFile joint tax returnYou pay each month (in 2022)above $170,000 and less than $500,000above $340,000 and less than $750,000$71.30 + your plan premium$500,000 or above$750,000 or above$77.90 + your plan premium5 more rows

Who has the cheapest Part D drug plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

Why is Medicare Part D so expensive?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive. Read more about .

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the Medicare Part D deductible for 2021?

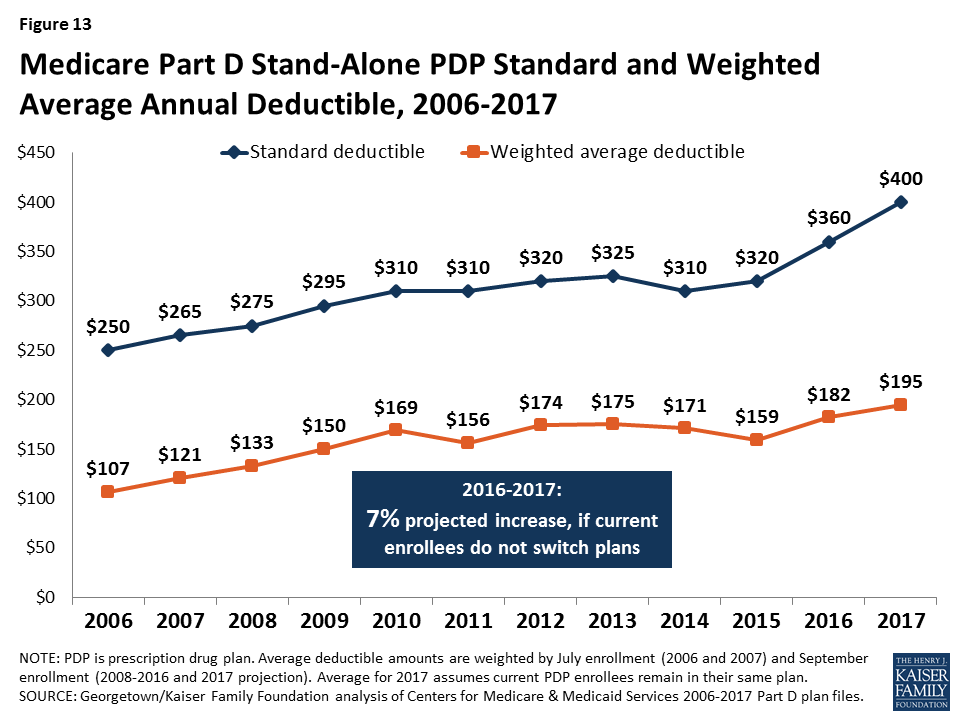

$445Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

Are Medicare Part D premiums tax deductible?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

When will Medicare start paying for insulin?

Look for specific Medicare drug plan costs, and then call the plans you're interested in to get more details. Starting January 1, 2021, if you take insulin, you may be able to get Medicare drug coverage that offers savings on your insulin.

What is Medicare drug coverage?

You'll make these payments throughout the year in a Medicare drug plan: A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. ).

Why are my out-of-pocket drug costs less at a preferred pharmacy?

Your out-of-pocket drug costs may be less at a preferred pharmacy because it has agreed with your plan to charge less. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. paying your drug coverage costs.

What is formulary in insurance?

Your prescriptions and whether they’re on your plan’s list of covered drugs (. formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

How much is the deductible for Part D in 2021?

The initial deductible for Part D is $445 in 2021. In 2022, the initial deductible will be $480.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

How much discount do you get for a brand name drug?

The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if you reach the donut hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your total out-of-pocket spending limit.

What are not covered prescriptions?

Not Covered Prescriptions: Drugs for cosmetic purposes. Medicines for anorexia, weight gain, or weight loss. Drugs meant to relieve colds and coughs. Medications for erectile dysfunction. Individual outpatient drugs. Over-the-counter medications. Minerals or vitamin drugs except those noted in the formulary.

Do you have to pay a coinsurance for Medicare Part D?

If you receive extra help paying your Part D Medicare costs. One major cost that you should consider is the monthly premium. Stand-alone Part D policies and Medicare Advantage policies have a monthly premium. Other than the monthly premiums, you may have to pay an annual deductible and a co-payment/coinsurance.

How much is Medicare Part D 2021?

This varies depending on your income and the plan you choose, but the nationwide base premium is $33.06 per month for 2021. 4

How much is a copayment for a generic drug?

The copayment on generic drugs might be $5, while brand name drugs on certain tiers might require a $25 copayment. Higher tiers might require a larger copayment. You might pay a coinsurance amount for drugs in the highest tiers. If the prescription costs $400, you might pay a coinsurance of 25%, making your portion of the bill $100. 6 .

What is the maximum deductible for Medicare 2021?

The highest annual deductible allowed by Medicare in 2021 is $445 (up from $435 in 2020). 5 Many plans come with a much smaller deductible and some don’t have one. Each plan will also have a copayment and coinsurance amount. A copayment is a fixed amount that you pay for your prescriptions.

What is the coverage gap for 2021?

The coverage gap is a temporary limit on what the plan will cover for drugs. If you receive extra help from Medicare, you won’t enter a coverage gap, ...

Is Medicare Part D cheaper?

Sometimes cheaper is better, but in the case of Medicare Part D coverage, that's typically not the case. The most important thing to check is the plan’s coverage for the drugs you currently take. If a low-cost plan doesn’t cover your drugs, your out-of-pocket expenses will more than negate the money you saved on the premiums.

Does Medicare cover the gap?

If you receive extra help from Medicare, you won’t enter a coverage gap, but most insurance plans do not cover the gap. 7 . In 2021, 75% of the price of both branded and generic drugs will be covered while you’re in the coverage gap.

Do you have to pay coinsurance for Part D?

Some drugs could require a copayment and coinsurance. Because Part D is administered through private insurance companies, each may place certain drugs in different tiers. You might pay higher out-of-pocket expenses for the same drug in a different plan.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Medicare Advantage Plan (Part C)

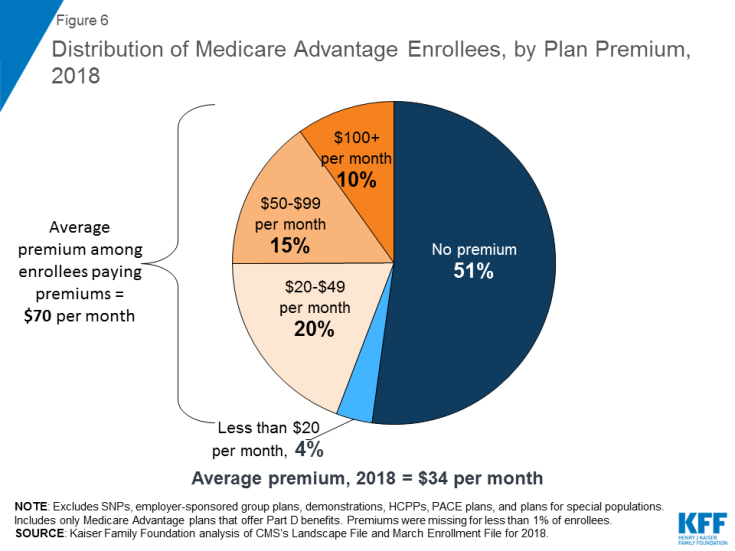

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

How much is deductible for Part D?

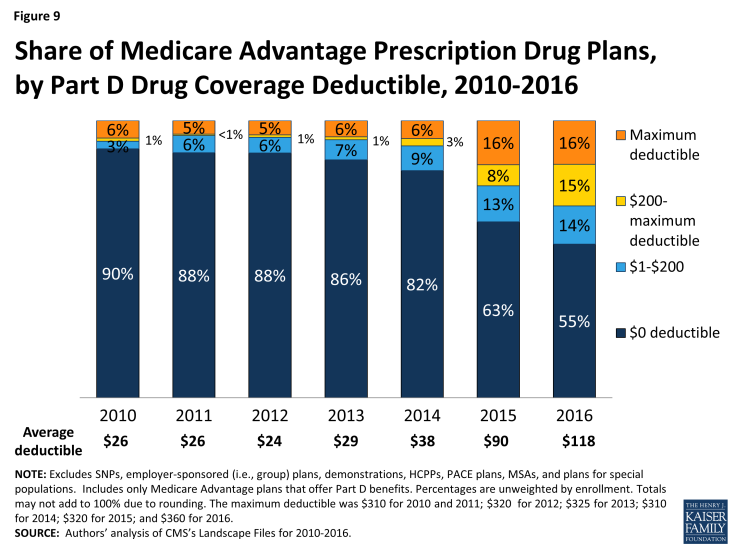

First, plans are allowed by law to charge deductibles of as much as $435 in 2020, up $20 from 2019's levels. However, Part D plans don't have to charge the full amount, or any deductible at all. Also, Part D plans can set fixed copays or certain coinsurance percentage amounts to require participants to bear some of the costs ...

How much is the catastrophic coverage level for Part D?

Once the total of your cost and the value of any manufacturer discounts you received on your prescription drugs hits $6,350, you'll reach the catastrophic coverage level.

What is Medicare Part A?

Medicare is an essential part of how retirees manage their finances. Historically, Medicare recipients only had access to hospital coverage under Part A and outpatient medical services like doctor visits under Part B.

Why is Medicare Part D important?

In its short history, Medicare Part D has become quite popular, and it's important for those retirees struggling to make ends meet. Looking into Part D coverage can be the best move an older American can make to protect their health.

How much does Medicare pay for married filing separately?

Data source: Medicare. Note: Married persons filing separately who live together at any time during the year pay $70 if their income is $87,000 to $413,000, or $76.40 if their income is more than $413,000. There are a few other costs you might have to pay.

Does Medicare Part D cost?

As with coverage options, what you'll pay for various Medicare Part D plans can differ substantially. Some Part D plans are actually available at no cost at all , although their coverage of prescription drugs tends to be limited, at best. More comprehensive plans typically charge at least modest monthly premiums.

Can Part D plans have higher copayments?

Some plans put drugs into categories, some of which have higher copayments than others. Plans can require using certain pharmacy benefit management companies to fill prescriptions. However, there are limits on how much flexibility Part D plans have.