What is the maximum premium for Medicare Part B?

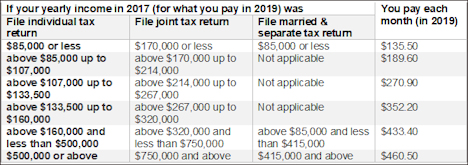

Nov 08, 2019 · The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

What is current Medicare Part B premium?

Jan 26, 2020 · The minimum premium for Part B coverage in 2020 is $144.60 each month, which is a $9 increase from 2019’s minimum premium of $135.50 each month. In 2020, certain income brackets that determine if high-income recipients pay more for their Part B premium each month were changed for the first time.

How much are Medicare Part B premiums?

Nov 13, 2019 · The standard Medicare Part B premium will rise about $9 a month beginning Jan. 1, 2020, but beneficiaries in higher income brackets will see a larger increase.

Does Medicaid cover part B premium?

Dec 13, 2021 · 2020 Medicare Part B Premiums Medicare Part B premiums for 2020 increased by $9.10 from the premium for 2019. The 2020 premium rate started at $144.60 per month and increased based on your income to up to $491.60 for the 2020 tax year.

Is the Part B premium going up in 2021?

What is the Part B monthly premium for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What are the Medicare Part B premiums for 2021?

What will the Medicare Part B premium be in 2022?

What month is Medicare deducted from Social Security?

What changes are coming to Medicare in 2021?

Will Social Security get a raise in 2022?

What is the average cost of supplemental insurance for Medicare?

Will Medicaid pay for my Medicare Part B premium?

Why is my Medicare Part B premium so high?

Is Medicare Part B going up 2022?

At what income level does Medicare premium increase?

How much is the Part B premium for 2021?

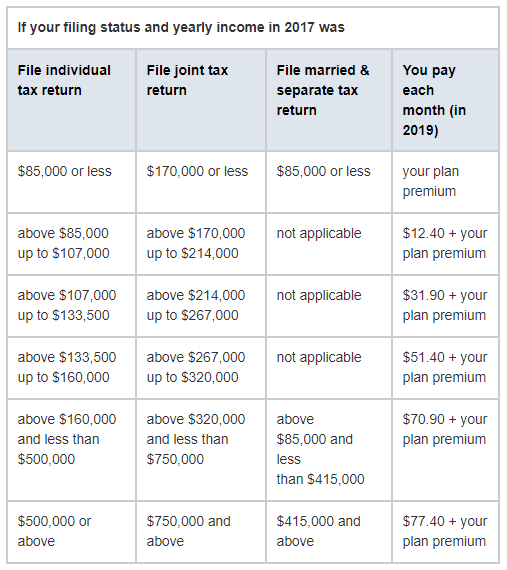

2021. The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How much will Medicare pay in 2021?

In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B premium for 2020?

more than $413,000, you pay $491.60 a month in 2020. The Part B premium can be scaled to the Social Security cost-of-living adjustment (COLA) if the rise in a premium is more than the change in a retiree’s Social Security benefit.

What is the deductible for Medicare Part B 2020?

Changes to the 2020 Annual Deductible. Medicare recipients must meet an annual deductible with Medicare Part B, which is $198 for 2020. If a Medicare enrollee was eligible for a Medigap plan that pays for the Part B deductible prior to 2020, they can still receive that benefit. Medigap plans that pay the Part B deductible are no longer offered as ...

How much is the deductible for Medicare Part B?

Medicare recipients must meet an annual deductible with Medicare Part B, which is $198 for 2020. If a Medicare enrollee was eligible for a Medigap plan that pays for the Part B deductible prior to 2020, they can still receive that benefit. Medigap plans that pay the Part B deductible are no longer offered as of January 1st, 2020.

How much is Part B insurance?

Changes to the 2020 Monthly Premium. The minimum premium for Part B coverage in 2020 is $144.60 each month, which is a $9 increase from 2019’s minimum premium of $135.50 each month.

What is the minimum premium for Part B insurance?

The minimum premium for Part B coverage in 2020 is $144.60 each month, which is a $9 increase from 2019’s minimum premium of $135.50 each month. In 2020, certain income brackets that determine if high-income recipients pay more for their Part B premium each month were changed for the first time.

How much do you make a month in 2020?

between $109,000 and $136,000, you pay $289.20 a month in 2020. between $136,000 and $163,000, you pay $376.20 a month in 2020. between $163,000 and $500,000, you pay $462.70 a month in 2020. more than $500,000, you pay $491.60 a month in 2020.

How much do you pay in 2020?

between $136,000 and $163,000, you pay $376.20 a month in 2020. between $163,000 and $500,000, you pay $462.70 a month in 2020. more than $500,000, you pay $491.60 a month in 2020. If you filed a joint tax return in 2018 and your income was: less than $174,000, you pay $144.60 a month in 2020.

Income Adjustment

The income figures used to determine your Part B premium payment may not reflect your current financial situation, especially in the event of a retirement, a divorce, or other life-changing events.

About the Author

Lilley serves as MOAA's digital content manager. His duties include producing, editing, and managing content for a variety of platforms, with a concentration on The MOAA Newsletter and MOAA.org. Follow him on Twitter: @KRLilley

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

How much is the 2021 Medicare premium?

The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

Who is Dana Anspach?

Linkedin. Follow Twitter. Dana Anspach is a Certified Financial Planner and an expert on investing and retirement planning. She is the founder and CEO of Sensible Money, a fee-only financial planning and investment firm.

Who is Thomas Brock?

Thomas Brock is a well-rounded financial professional, with over 20 years of experience in investments, corporate finance, and accounting. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar.

How much will Medicare premiums increase in 2020?

On November 8, 2019, the Centers for Medicare and Medicaid Services (CMS) released the new Medicare costs for 2020. Medicare Part B premiums will increase by about 7% for nearly 70% of all beneficiaries.

How long do you have to work to get Medicare Part A?

Medicare Part A is premium-free for 99 percent of Medicare beneficiaries who have worked for about 10 years and accumulated at least 40 quarters of work credit . However, beneficiaries who do not have 40 or more quarters of work credit will need to pay a premium according to how many credits they or their spouse have.

Who is Kayla Pearce?

Kayla Pearce is a Content Developer at Medicare World in Memphis, TN. She has backgrounds in professional and creative writing and over a decade of experience in research and editing. She is deeply interested in literature, poetry, cats, and dessert.

What is Medicare Part B premium?

Your Medicare Part B premium amount (and the Part D premium) is based on the Modified Adjusted Gross Income (MAGI) on your tax return from two years ago — the most recent federal tax return the IRS provides to Social Security. The Income Related Monthly Adjustment Amount (IRMAA) is an extra amount added to the base Medicare Part B premium ...

When did Ostrom retire?

Ostrom retired from the Air Force in 2000 and joined the MOAA team in 2006. His responsibilities include researching and answering member inquiries regarding military benefits, health care, survivor issues, and financial concerns.