What is the monthly premium in Medicare Part D?

52 rows · Nov 18, 2021 · Medicare Part D provides coverage for prescription medications. The average Part D plan premium in 2022 is $47.59 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans …

What is the average cost of Medicare Part D?

There are four phases of Part D coverage: Deductible Period: During this time, you will pay the full negotiated price of your drugs until you meet your Part D deductible. After you have met your deductible, your plan will begin to cover the cost of your …

How to reduce Medicare Part D cost?

If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you’re married and file jointly), you’ll pay an extra ...

How to compare Medicare Part D drug plan costs?

You’ll pay $233, before Original Medicare starts to pay. You pay this deductible once each year. Costs for services (coinsurance) You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

See more

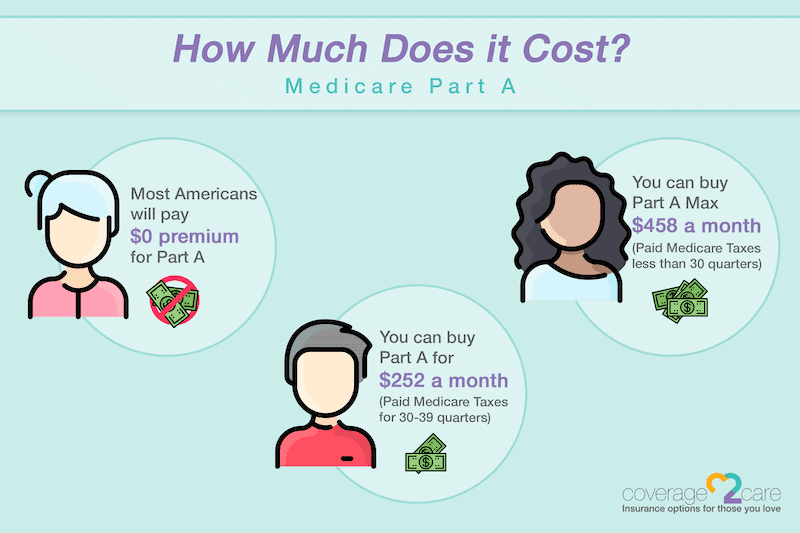

2022 costs at a glance. Part A premium. Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard ...

What is the average cost for Medicare Part D?

What is the Part D premium for 2021?

What is the cost of Part D for 2022?

The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.Nov 2, 2021

Can you buy Medicare Part D by itself?

What is the most popular Medicare Part D plan?

| Rank | Medicare Part D provider | Medicare star rating for Part D plans |

|---|---|---|

| 1 | Kaiser Permanente | 4.9 |

| 2 | UnitedHealthcare (AARP) | 3.9 |

| 3 | BlueCross BlueShield (Anthem) | 3.9 |

| 4 | Humana | 3.8 |

Is Medicare Part D automatically deducted from Social Security?

What is the Best Medicare Plan D for 2022?

- Best in Ease of Use: Humana.

- Best in Broad Information: Blue Cross Blue Shield.

- Best for Simplicity: Aetna.

- Best in Number of Medications Covered: Cigna.

- Best in Education: AARP.

What is the max out of pocket for Medicare Part D?

Do I need Medicare Part D if I don't take any drugs?

Why is Medicare charging me for Part D?

What happens if I don't want Medicare Part D?

Is GoodRx better than Medicare Part D?

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does Medicare cover emergency services?

In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for under Original Medicare (your Cost Plan pays for emergency services or urgently needed services ). with drug coverage, the monthly premium may include an amount for drug coverage.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Part D?

1 The law created what we now know of as Medicare Part D, an optional part of Medicare that provides prescription drug coverage. Part D plans are run by private insurance companies, not the government.

What is a Part D premium?

Part D Premiums. A premium is the amount of money you spend every month to have access to a health plan. The government sets no formal restrictions on premium rates and prices may change every year. 3 Plans with extended coverage will cost more than basic-coverage plans.

Does Medicare cover prescriptions?

Updated on November 09, 2020. Before 2006, Medicare did not cover prescription medications, at least not most of them. A limited number of medications were offered under Medicare Part B, but otherwise, you had to pay for your medications out-of-pocket.

What is the donut hole in Medicare?

In fact, it has a big hole in it. The so-called donut hole is a coverage gap that occurs after you and Medicare have spent a certain amount of money on your prescription medications.

What is the maximum deductible for 2021?

A deductible is the amount of money you spend out-of-pocket before your prescription drug benefits begin. Your plan may or may not have a deductible. The maximum deductible a plan can charge for 2021 is set at $445, 2 an increase of $10 from 2020.

When will the donut hole close?

The donut hole closed in 2020 thanks to the Affordable Care Act (aka Obamacare). Starting in 2013, regulations in the Affordable Care Act gradually decreased how much you would be forced to spend out-of-pocket on your medications. 5 Starting in 2020, you will not be allowed to pay more than 25% of the retail costs for your drugs.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

Does Medicare Part A require coinsurance?

Part A also requires coinsurance for hospice care and skilled nursing facility care. Part A hospice care coinsurance or copayment. Medicare Part A requires a copayment for prescription drugs used during hospice care. You might also be charged a 5 percent coinsurance for inpatient respite care costs.

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is a Medicare donut hole?

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a “donut hole” or “coverage gap,” which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

When will Medicare start paying for insulin?

Look for specific Medicare drug plan costs, and then call the plans you're interested in to get more details. Starting January 1, 2021, if you take insulin, you may be able to get Medicare drug coverage that offers savings on your insulin.

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums , deductibles, and coinsurance. paying your drug coverage costs. Look for specific Medicare drug plan costs, and then call the plans you're interested in to get more details. Note.

What is formulary in insurance?

Your prescriptions and whether they’re on your plan’s list of covered drugs (. formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list.

What is a drug list?

A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. ). What “tier” the drug is in. Which drug benefit phase you’re in (like whether you’ve met your deductible, or if you’re in the catastrophic coverage phase).