The Centers for Medicare and Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Full Answer

What is the Part D deductible for Medicare Part D?

52 rows · Nov 18, 2021 · How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2022 is $47.59 per month. The average Part D plan deductible in 2022 is $367.80 per year. 1. The table below shows the average premiums and deductibles for Medicare Part D plans in 2022 for each state.

How much does Medicare cost for people on disability?

There are four phases of Part D coverage: Deductible Period: During this time, you will pay the full negotiated price of your drugs until you meet your Part D deductible. After you have met your …

How much does Part D drug insurance cost?

Mar 25, 2019 · The Centers for Medicare and Medicaid Services (CMS) has rules in place to protect Medicare beneficiaries. Every year, CMS sets the highest amount an insurance …

Can I get Medicare Part D If I am on disability?

Jul 16, 2020 · How much does Medicare cost on disability? If you qualify for SSDI, you'll typically qualify for premium-free Medicare Part A based on your work record. Part B requires a monthly …

How do I get my $144 back from Medicare?

How much is Medicare Part D every month?

What is the Part D premium for 2021?

What is the cost of Part D for 2022?

What is the most popular Medicare Part D plan?

| Rank | Medicare Part D provider | Medicare star rating for Part D plans |

|---|---|---|

| 1 | Kaiser Permanente | 4.9 |

| 2 | UnitedHealthcare (AARP) | 3.9 |

| 3 | BlueCross BlueShield (Anthem) | 3.9 |

| 4 | Humana | 3.8 |

Is Medicare Part D automatically deducted from Social Security?

How much is the Medicare Part D deductible for 2021?

Do I need Medicare Part D if I don't take any drugs?

Why is Medicare charging me for Part D?

What is the max out of pocket for Medicare Part D?

What is the Best Medicare plan D for 2022?

- Best in Ease of Use: Humana.

- Best in Broad Information: Blue Cross Blue Shield.

- Best for Simplicity: Aetna.

- Best in Number of Medications Covered: Cigna.

- Best in Education: AARP.

What is the Medicare Part D premium for 2022?

Do I Need A Medicare Part D Plan?

If you have Original Medicare (Part A and Part B) and want prescription drug coverage for prescription drugs you take at home, you will likely have...

What Is The Medicare Deductible For A Medicare Part D Plan?

A Medicare deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to...

How Else Do Stand-Alone Medicare Part D Plans differ?

Unlike Medicare Part D deductibles, Medicare doesn’t set a dollar limit for Medicare Part D premiums. Your plan sets the amount for your monthly pr...

Key Takeaways

Does Medicare pay for prescriptions? Yes—drug coverage is available through Medicare Part D.

How much does Medicare Part D cost?

Medicare will pay part of the costs of prescription drug coverage for everyone who enrolls in a Part D plan. How much you pay will depend on which prescription drug plan you choose and whether or not you qualify for Extra Help that assists in covering the costs of this coverage.

Medicare Part D Deductible

Remember, a plan with a deductible will not pay for your prescriptions until you pay the deductible amount out-of-pocket. The highest deductible a plan can charge in 2022 is $480. Some plans offer $0 deductible and will pay for your prescriptions right away. Other plans may offer a deductible lower than the maximum of $480 such as $150 or $250.

Copayments and Coinsurance

A copayment, or copay, is a fixed dollar amount for your prescriptions. For example, you might have to pay $5 for a generic drug, $25 for a "preferred" brand name drug and $40 for a non-preferred brand name drug.

What are copay tiers?

Each plan places the drugs it will pay for in different levels, called tiers. Each tier has its own copay or coinsurance amount. Your drugs may be included in all the plans in your area, but they could be listed on different tiers with different copay amounts.

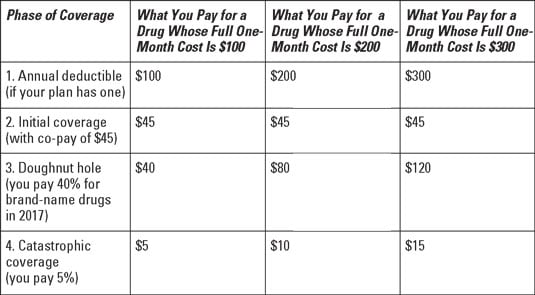

Phases of Part D Prescription Costs

Prescription drug costs may change throughout the year depending on which phase of Part D coverage you are in. There are four phases of Part D coverage:

When does the coverage gap end (catastrophic coverage)?

In Part D, you and the plan you join share the cost of drugs. The money that you spend is called your out-of-pocket costs. That determines if and when the catastrophic coverage begins. In 2022, the catastrophic coverage starts when you have paid $7,050 out-of-pocket.

How much did Medicare spend on prescriptions in 2006?

Before Part D began in 2006, Medicare beneficiaries spent an average of $2,318 out of pocket on their medications. After Part D, prescription drug coverage, while not free, did become more manageable for seniors. Out of pocket expenses are now associated with premiums, deductibles, copayments, and coinsurance .

How many medications are covered by Medicare Part D?

The Centers for Medicare and Medicaid Services (CMS) requires Part D plans to offer at least two medications per drug category. 1 In addition, they have six classes of medications—anticonvulsants, antidepressants, antipsychotics, cancer drugs, HIV/AIDS drugs, and immunosuppressant drugs—where most, if not all, medications have to be covered.

What happens if you don't pay your Part D insurance?

These premiums do not pay towards any of your medications but pay for the benefit of having prescription drug coverage. If you do not pay your premiums, you will be dropped from the plan and end up with no coverage at all.

How much is the Medicare Part D deductible for 2019?

The amount for 2019 was set at $415 but increased to $435 in 2020. 3 . Again, private insurance companies can set their own rates. Depending on what Part D plan you sign up for, you may have no deductible at all but you will pay no more than the rate set by the government.

How many tiers are there in Part D?

The lower the tier, the lower the cost to you. There are no official rules in place for insurance companies to arrange their tiers. Some plans may have only three tiers, others as many as five or more. Example of Simple Tier System.

How long do you have to apply for Medicare?

By employer: When you work for a company that hires 20 full-time employees or the equivalent and have an employer-sponsored health plan through that company, you have eight months from the time you leave that job or that health plan, whichever comes first, to apply for Medicare and Part D.

What is the donut hole in Medicare?

Medicare Part D has a coverage gap known as the donut hole. After you and your Part D plan pay a certain amount of money, your prescription drug coverage drops off, leaving you to pay more out of pocket. 7 This lapse in coverage is short-term but could get expensive depending on the medications you take.

Can I get Medicare based on disability?

Medicare enrollment for SSDI recipients. To become eligible for Medicare based on disability, you must first qualify for Social Security Disability Insurance. SSDI pays monthly benefits to people with disabilities who might be limited in their ability to work. If you are injured or have a medical condition that limits your ability to work, ...

What is ESRD in Medicare?

ESRD, also known as permanent kidney failure, is a disease in which the kidneys no longer work. Typically, people with ESRD need regular dialysis or a kidney transplant (or both) to survive. Because of this immediate need, Medicare waives the waiting period. 2

When will Medicare be available for seniors?

July 16, 2020. Medicare is the government health insurance program for older adults. However, Medicare isn’t limited to only those 65 and up—Americans of any age are eligible for Medicare if they have a qualifying disability. Most people are automatically enrolled in Medicare Part A and Part B once they’ve been collecting Social Security Disability ...

Is Medicare for older adults?

Medicare is the government health insurance program for older adults. However, Medicare isn’t limited to only those 65 and up—Americans of any age are eligible for Medicare if they have a qualifying disability.

What conditions are considered to be eligible for Medicare?

Even though most people on Social Security Disability Insurance must wait for Medicare coverage to begin, two conditions might ensure immediate eligibility: end-stage renal disease (ESRD) and Lou Gehrig’s disease (ALS).

Does Medicare waive the waiting period for ESRD?

ESRD, also known as permanent kidney failure, is a disease in which the kidneys no longer work. Typically, people with ESRD need regular dialysis or a kidney transplant (or both) to survive. Because of this immediate need, Medicare waives the waiting period. 2. However, even if you’re diagnosed with ESRD, you must have an employment ...

How long do you have to work to qualify for Medicare?

However, even if you’re diagnosed with ESRD, you must have an employment history—typically around 10 years —to be eligible for Medicare. If your work record doesn’t meet the standard, you may still qualify if you are the spouse or child of someone with an eligible work history.

What is Medicare Part D?

Medicare Part D plans are private insurance plans. Insurance companies are free to design plan benefits and cost-sharing structures to meet the needs of their members, as long as they follow Medicare’s rules for minimum coverage requirements. Your costs and benefits may be different with each plan available in your area.

What is Medicare Part D deductible?

A Medicare Part D deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to pay its share of your medications that are covered. This is for a calendar year and resets every January 1.

What is the maximum deductible for Medicare Part D?

Summary: The Centers for Medicare and Medicaid Services (CMS) sets the maximum Medicare Part D deductible each year. In 2020, the maximum Part D deductible is $435, but depending on where you live, you may find a plan with a lower deductible or even no deductible at all.

What is the maximum deductible for 2020?

The 2020 maximum deductible set by CMS is $435, however, insurers can set their deductible below the limit. According to research by the Kaiser Family Foundation, 86% of stand-alone Part D prescription drug plans have an annual deductible.

Is it better to have a lower deductible on prescriptions?

If you don’t use a lot of prescription medications, that may be the most cost-effective option for you. On the other hand, if you take daily medications, a lower deductible may be more important so you get help with your medications with less out-of-pocket expense.

Does Medicare cover prescription drugs?

Medicare Part D coverage for prescription drugs is technically optional , but if you enroll in Original Medicare (Part A and Part B), there is very little coverage for prescription medications you take at home. For that reason, most Medicare enrollees choose to buy a Medicare Part D plan to help pay for prescription drugs.

Why do people buy Medicare Part D?

For that reason, most Medicare enrollees choose to buy a Medicare Part D plan to help pay for prescription drugs. Medicare Part D plans are private insurance plans. Insurance companies are free to design plan benefits and cost-sharing structures to meet the needs of their members, as long as they follow Medicare’s rules for minimum coverage ...

Is Medicare Part D insurance?

Medicare Part D plans are Medicare-approved insurance plans, but private companies administer them . This makes their costs widely variable. Your Medicare Part D cost could depend on where you live, what kind of plan you have, which drugs you use and whether they’re covered in your plan’s formulary, whether you take generic or brand-name drugs, and many other factors. Your premiums and copays are variable, too. In addition, you may pay extra fees if you enroll after your initial enrollment period.

What is the coverage gap in Medicare Part D?

Another factor to consider in your Medicare Part D cost is the coverage gap, commonly known as the “donut hole.” Most Part D plans have a temporary limit to their benefits. The coverage gap doesn’t affect everyone, though—it comes into play once you’ve spent a certain amount. In 2018, once you’ve spent $3,700 on covered prescriptions, you’re in the donut hole. When you meet your out-of-pocket spending limit, you’re out of the coverage gap.

Is Medicare expensive for disabled people?

Medicare can be quite expensive for those on disability who aren't fully insured, but if you are eligible to be a Qualified Medicare Beneficiary (QMB) because of low-income, a Medicare Savings Program will pay your Part A premium, and possibly other costs as well.

How much is the Part D premium for 2021?

Part D Costs. Part D premiums vary depending on the plan you choose. The maximum Part D deductible for 2021 is $445 per year, but some plans waive the deductible. There are subsidies available to pay for Part D for those with low income (called Extra Help).

Do you have to pay Medicare Part A?

Part A Costs. You'll have to pay a premium for Medicare Part A (hospital insurance) if you aren't "fully insured" under Social Security. Generally, being fully insured means having worked 40 quarters (the equivalent of 10 years) in a job paying FICA taxes.

How much does Medicare cost if you have a low Social Security check?

But some people who have been on Medicare for several years will pay slightly less (about $145) if their Social Security checks are low (due to a hold harmless provision). And some people will pay more. If your adjusted gross income is over $88,000 (or $176,000 for a couple), the monthly premium can be over $400.

Does Medicare Advantage have copays?

Many Medicare Advantage plans don 't charge a monthly premium over the Part B premium, and some don't charge copays for doctor visits and other services. Medicare Advantage plans often include Part D prescription drug coverage, with small copays.

How much is the 2021 Part D deductible?

Part D premiums vary depending on the plan you choose. The maximum Part D deductible for 2021 is $445 per year , but some plans waive the deductible. There are subsidies available to pay for Part D for those with low income (called Extra Help). See Nolo's article on Extra Help for Part D for when you are eligible.

How much is the maximum deductible for 2021?

The maximum Part D deductible for 2021 is $445 per year, but some plans waive the deductible. There are subsidies available to pay for Part D for those with low income (called Extra Help). See Nolo's article on Extra Help for Part D for when you are eligible.

Does Social Security disability qualify you for Medicare?

Everyone eligible for Social Security Disability Insurance ( SSDI ) benefits is also eligible for Medicare after a 24-month qualifying period.

What kind of Medicare do you get with disability?

People who meet all the criteria for Social Security Disability are generally automatically enrolled in Parts A and B. People who meet the standards, but do not qualify for Social Security benefits, can purchase Medicare by paying a monthly Part A premium, in addition to the monthly Part B premium.

Do you have to pay for Medicare Part B if you are disabled?

Most of the people who receive Social Security Disability benefits do have to pay a premium for Medicare Part B , but you may choose to opt out of this program if you already have medical insurance. Like Medicare Part B , you will need to pay a premium for Medicare Part D.

Does Social Security pay Medicare premiums?

Medicare Costs Deducted From Social Security Individuals enrolled in Medicare need to pay for the coverage. For those receiving Social Security benefits and enrolled in Medicare , the premiums for Medicare are usually automatically deducted from Social Security payments .

How much does Medicare cost on disability?

Most people pay a Part B premium of $144.60 each month. But some people who have been on Medicare for several years will pay slightly less (about $135) if their Social Security checks are low (due to a hold harmless provision). And some people will pay more.

What is the highest paying state for disability?

At 8.9 percent, West Virginia came in at the top of the list among states where the most people receive disability benefits. Residents there received $122.4 million in monthly benefits. West Virginia’s labor force participation rate was 52.7 percent – the lowest in the country.

Does disability automatically qualify you for Medicaid?

Medicaid is a medical insurance program designed for needy, low income people. While many Social Security Disability recipients do receive Medicaid , the program is not limited to the disabled . In most states, those who are eligible to receive SSI automatically qualify to receive Medicaid .

Can a disabled child get medicare?

Medicare for Disabled Youth. Children under the age of 20 with ESRD can qualify for Medicare if they need regular dialysis treatment and at least one of their parents is eligible for or receives Social Security retirement benefits. If your child is over the age of 20, they qualify for Medicare after receiving SSDI benefits for at least 24 months.

Do you pay a premium on Social Security Disability?

You’ll pay a premium, and a copay or coinsurance. Many people on Social Security Disability qualify for Extra Help with Part D costs. Eligibility for Extra Help is based on income and assets. If you’re on Medicaid, you automatically qualify for Extra Help.

How long do you have to be on Medicare if you are 65?

When you’re under 65, you become eligible for Medicare if: You’ve received Social Security Disability Insurance (SSDI) checks for at least 24 months. At the end of the 24 months, you’ll automatically enroll in Parts A and B. You have End-Stage Renal Disease (ESRD) and need dialysis or a kidney transplant. You can get benefits with no waiting period ...

What is Medicare Advantage?

Medicare Advantage Plans for Disabled Under 65. Most Social Security Disability Advantage plans combine Medicare coverage with other benefits like prescription drugs, vision, and dental coverage. Medicare Advantage can be either HMOs or PPOs. You may have to pay a monthly premium, an annual deductible, and copays or coinsurance for each healthcare ...

Can you sign up for a special needs plan if you are on Medicare?

Many people on Social Security Disability also qualify for their state’s Medicaid program. If you’re on Medicare and Medicaid, you can still sign up for an Advantage plan.

Does Medicare cover Medigap?

Medicare pays a large portion of the cost, but not all of it. Medigap can help cover what Medicare doesn’t cover. But if you’re under 65, it can be hard to find an affordable Medigap plan. While some states require companies to offer at least one Medigap plan to people under age 65, others do not.

Can a child with ESRD qualify for Medicare?

Children under the age of 20 with ESRD can qualify for Medicare if they need regular dialysis treatment and at least one of their parents is eligible for or receives Social Security retirement benefits . If your child is over the age of 20 , they qualify for Medicare after receiving SSDI benefits for at least 24 months.