Average reimbursement for physical therapy visit s under Medicare part B will pay between $97 and $105 for a 60-minute, 4-unit physical therapy treatment. The initial evaluation visit typically reimburses at a higher rate of $130 to $160 on average due to the higher relative value of the initial evaluation code.

How much does Medicare Part B pay for physical therapy?

On average, Medicare part B will pay between $97 and $105 for a 60-minute, 4-unit physical therapy treatment. The initial evaluation visit typically reimburses at a higher rate of $130 to $160 on average due to the higher relative value of the initial evaluation code.

What is a Medicare payment amount?

In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference.

How much does Medicare pay for outpatient therapy?

Medicare law no longer limits how much it pays for your medically necessary outpatient therapy services in one calendar year. To find out how much your test, item, or service will cost, talk to your doctor or health care provider.

Can Medicare reimbursements be enhanced or penalized for physician performance?

As a result, depending on physician performance within this program, Medicare reimbursements can be enhanced or penalized by up to 9%, although there is a two-year delay in this application (e.g. provider performance in 2021 will lead to the enhancement or penalty in 2023). CMS is committed to move towards value and away from fee-for-service.

What percentage of the allowed charges will Medicare pay a participating physician?

Under current law, when a patient sees a physician who is a “participating provider” and accepts assignment, as most do, Medicare pays 80 percent of the fee schedule amount and the patient is responsible for the remaining 20 percent.

What is Medicare par fee?

A. Amounts listed under “par fee” represent the potential Medicare allowance for a physician or nonphysician practitioner who has signed a Medicare participation agreement (form CMS-460).

What is the incentive to Medicare participating providers?

A Buck Ch16QuestionAnswerThe incentive to Medicare participating providers isDirect payment is made on all clains, faster processing and a 5% higher fee schedulePart B services are billed usingICD-9-CM, CPT, HCPCSWho is the largest third-party payer in the nationthe government53 more rows

What is Medicare par status?

PAR stands for participating, and as such, your practice has a contract with Medicare. As part of your PAR provider contract, your practice agrees to take assignment on all Medicare claims. This means you must accept the amount that Medicare assigns for payment for the services you provide.

What is the difference between par and Nonpar provider?

A “Par” provider is also referred to as a provider who “accepts assignment”. A “Non-Par” provider is also referred to as a provider who “does not accept assignment”. The primary differences are, 1) the fee that is charged, 2) the amount paid by Medicare and the patient, and 3) where Medicare sends the payment.

What is the maximum fee a Medicare participating provider can collect for services?

The limiting charge is 15% over Medicare's approved amount. The limiting charge only applies to certain services and doesn't apply to supplies or equipment. ". The provider can only charge you up to 15% over the amount that non-participating providers are paid.

Can a doctor charge more than Medicare allows?

A doctor is allowed to charge up to 15% more than the allowed Medicare rate and STILL remain "in-network" with Medicare. Some doctors accept the Medicare rate while others choose to charge up to the 15% additional amount.

How does Medicare reimburse physician services?

Traditional Medicare reimbursements Instead, the law states that providers must send the claim directly to Medicare. Medicare then reimburses the medical costs directly to the service provider. Usually, the insured person will not have to pay the bill for medical services upfront and then file for reimbursement.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What are the advantages of being a participating provider?

The advantages of being a participating provider: Higher allowances (5% higher than non-participating providers). Direct payment (Medicare sends payment directly to the provider, not the patient). Medigap transfer (Medicare forwards claims on to Medigap insurers for providers).

What does a participating provider agree to do?

Participating Provider — a healthcare provider that has agreed to contract with an insurance company or managed care plan to provide eligible services to individuals covered by its plan. This provider must agree to accept the insurance company or plan agreed payment schedule as payment in full less any co-payment.

How is the Medicare physician fee schedule calculated?

Calculating 95 percent of 115 percent of an amount is equivalent to multiplying the amount by a factor of 1.0925 (or 109.25 percent). Therefore, to calculate the Medicare limiting charge for a physician service for a locality, multiply the fee schedule amount by a factor of 1.0925.

How much is Medicare reimbursement enhanced?

As a result, depending on physician performance within this program, Medicare reimbursements can be enhanced or penalized by up to 9%, although there is a two-year delay in this application (e.g. provider performance in 2021 will lead to the enhancement or penalty in 2023).

When will CMS change the physician fee schedule?

CMS has announced changes to the physician fee schedule for 2021. On December 2, 2020, the Centers for Medicare and Medicaid Services (CMS) published its final rules for the Part B fee schedule, referred to as the Physician Fee Schedule (PFS). Substantial changes were made, with some providers benefiting more than others, ...

When will the CPT code 99201 be revised?

On Nov. 1, 2019, CMS finalized revisions to the evaluation and management (E/M) office visit CPT codes 99201-99215. These revisions will go into effect on Jan. 1, 2021. They build on the goals of CMS and providers to reduce administrative burden and put “patients over paperwork” thereby improving the health system.

When will CMS update the E/M code?

These revisions build on the goals of CMS and the provider community to reduce administrative burden and put “patients over paperwork.” These revisions will be effective Jan. 1, 2021 .

Is telehealth included in CMS 2021?

In the 2021 Final Rule, CMS has included several Category 1 Telehealth Service additions as well as the addition of telehealth services, on an interim basis, to those services put in place during COVID-19.

How long does it take to get a CMS 460?

Most providers that intent to be PAR submit the CMS 460 form at the time of enrollment, although you have up to 90 day to do so (but your assignment will not being until your submitted form is accepted.

What happens if you violate Medicare assignment?

You violate the assignment agreement if you collect or attempt to collect from the beneficiary or other person any amount other than coinsurance, non-covered charges or unmet deductible. If you violate your assignment agreement, you could face one of the following penalties:

What is a non-participating provider?

Non-Participating Provider (NON-PAR): A non-participating provider can elect participation on a claim-by-claim basis, but receive a lower reimbursement amount of 95% of the allowed amount, regardless of whether the claim is assigned or not assigned . NON-PAR providers can bill beneficiaries for more than the Medicare allowable for unassigned claims, ...

When is Medicare open enrollment?

Participation in Medicare is on an annual calendar year basis, with open enrollment dates generally beginning on November 15 th of each year. (Dates are published annually in the fee schedule final rule). Most providers that intent to be PAR submit the CMS 460 form at the time of enrollment, although you have up to 90 day to do so ...

Can non-PAR providers bill Medicare?

NON-PAR providers can bill beneficiaries for more than the Medicare allowable for unassigned claims, up to the limiting charge – which is 115% of the fee schedule amount. Reimbursement is sent to the beneficiary on unassigned claims, which means the provider must seek payment from the beneficiary. On assigned claims the payment is sent directly ...

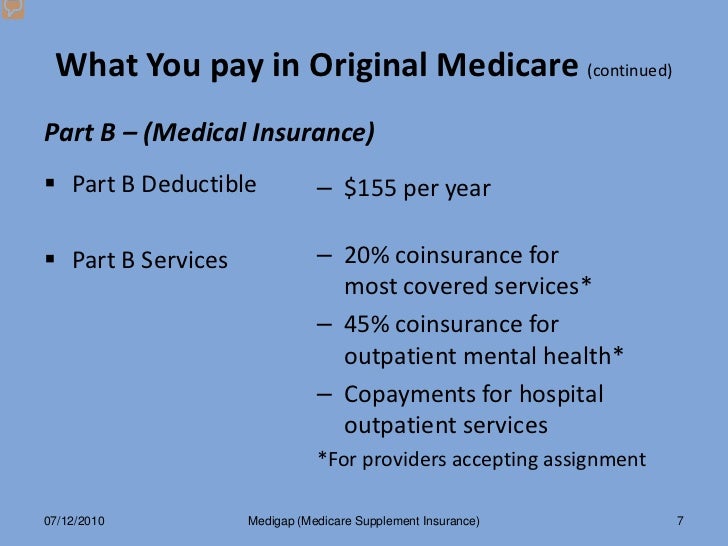

How much is the Medicare Part B deductible for 2020?

In 2020, the Part B deductible is $198 per year under Original Medicare benefits.

What is Medicare Part B?

With your healthcare provider’s verification of medical necessity, Medicare Part B covers the evaluation and treatment of injuries and diseases that prohibit normal function. Physical therapy may be needed to remedy the issue, maintain the present functionality or slow the decline.

What is Part B?

Other provisions of Part B. In addition to outpatient care, Part B applies to visits to doctor and outpatient care and services, along with durable medical equipment and mental health services as well as other medical services.

What are the different types of physical therapy?

Medical News Today describes several different types of physical therapy across a wide spectrum of conditions: 1 Orthopedic: Treats injuries that involve muscles, bones, ligaments, fascias and tendons. 2 Geriatric: Aids the elderly with conditions that impact mobility and physical function, such as arthritis, osteoporosis, Alzheimer’s, hip and joint replacements, balance disorders and incontinence. 3 Neurological: Addresses neurological disorders, Alzheimer’s, brain injury, cerebral palsy, multiple sclerosis, Parkinson’s disease, spinal cord injury and stroke. 4 Cardiovascular: Improves physical endurance and stamina. 5 Wound care: Includes manual therapies, electric stimulation and compression therapy. 6 Vestibular: Restores normal balance and coordination that can result from inner ear issues. 7 Decongestive: Promotes draining of fluid buildup.

What determines Medicare Part B Reimbursement rates for Physical Therapy?

Different states have different reimbursement rates. Watch the video at the bottom of this article to learn how you can check reimbursement rates specific to your state.

Does Outpatient Physical Therapy In-The-Home Pay Different?

No, there is no different between Medicare Part B reimbursement for physical therapy service delivered in the home or in the clinic.

How do I Become a Contracted Medicare provider?

If you would like to learn more about contracting with Medicare as a physical therapist in private practice read this post: Click here

What does Medicare Part B pay for a physical therapy initial evaluation CPT code 97161?

Medicare Part B allows $98.01 reimbursement in the state of Ohio for calendar year 2021.

What is the Medicare allowed amount for CPT Code 97110, 97530, 97140?

Below is an image is taken from the CMS Physician Fee Schedule Lookup tool on 10/27/2021 for Ohio.

What is the difference between Facility and Non-Facility Price?

Physical therapists, occupational therapists, and speech-language pathologists in private practice use the Non-facility price to estimate the allowed amount.

Is it better for a physical therapist to be NonPAR?

In my opinion, it is NOT better for a physical therapist, occupational therapist, or speech-language pathologist to be Non-PAR.

Does Medicare Part B have a CAP on Physical Therapy Services?

No, Medicare Part B no longer has a cap. Now it is referred to as a financial threshold. Click here for information directly from CMS.

What happens if physical therapy services exceed the financial threshold?

If therapy services continue to be medically necessary based on established CMS guidelines, local MAC published guidelines, and the clinical judgement of the provider, then the KX modifier may be added to the CPT code claim line item and payment will be issued from Medicare.

What if a Medicare beneficiary does not have a secondary insurance plan?

If the Medicare beneficiary does not have a secondary insurance policy that Medicare part B will cover 80% of the allowed amount and the patient will be responsible to pay the remaining 20%.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. , and the Part B deductible applies.

What is part B in physical therapy?

Physical therapy. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine. outpatient physical therapy.

Why is Physical Therapy Valuable?

According to the American Physical Therapy Association (APTA), physical therapy can help you regain or maintain your ability to move and function after injury or illness. Physical therapy can also help you manage your pain or overcome a disability.

Does Medicare Cover Physical Therapy?

Medicare covers physical therapy as a skilled service. Whether you receive physical therapy (PT) at home, in a facility or hospital, or a therapist’s office, the following conditions must be met:

What Parts of Medicare Cover Physical Therapy?

Part A (hospital insurance) covers physical therapy as an inpatient service in a hospital or skilled nursing facility (SNF) if it’s a Medicare-covered stay, or as part of your home health care benefit.

Does Medicare Cover In-home Physical Therapy?

Medicare Part A covers in-home physical therapy as a home health benefit under the following conditions:

What Are the Medicare Caps for Physical Therapy Coverage?

Medicare no longer caps medically necessary physical therapy coverage. For outpatient therapy in 2021, if you exceed $2,150 with physical therapy and speech-language pathology services combined, your therapy provider must add a modifier to their billing to show Medicare that you continue to need and benefit from therapy.

How long does it take for a provider to bill Medicare?

Providers who take assignment should submit a bill to a Medicare Administrative Contractor (MAC) within one calendar year of the date you received care. If your provider misses the filing deadline, they cannot bill Medicare for the care they provided to you.

What does it mean to take assignment with Medicare?

Taking assignment means that the provider accepts Medicare’s approved amount for health care services as full payment. These providers are required to submit a bill (file a claim) to Medicare for care you receive.

Does Medicare charge 20% coinsurance?

However, they can still charge you a 20% coinsurance and any applicable deductible amount. Be sure to ask your provider if they are participating, non-participating, or opt-out. You can also check by using Medicare’s Physician Compare tool .

Can non-participating providers accept Medicare?

Non-participating providers accept Medicare but do not agree to take assignment in all cases (they may on a case-by-case basis). This means that while non-participating providers have signed up to accept Medicare insurance, they do not accept Medicare’s approved amount for health care services as full payment.

Do opt out providers accept Medicare?

Opt-out providers do not accept Medicare at all and have signed an agreement to be excluded from the Medicare program. This means they can charge whatever they want for services but must follow certain rules to do so. Medicare will not pay for care you receive from an opt-out provider (except in emergencies).

Can you have Part B if you have original Medicare?

Register. If you have Original Medicare, your Part B costs once you have met your deductible can vary depending on the type of provider you see. For cost purposes, there are three types of provider, meaning three different relationships a provider can have with Medicare.

Do psychiatrists have to bill Medicare?

The provider must give you a private contract describing their charges and confirming that you understand you are responsible for the full cost of your care and that Medicare will not reimburse you. Opt-out providers do not bill Medicare for services you receive. Many psychiatrists opt out of Medicare.

Medicare Enrollment – Par Or Non-Par?

Running The Numbers

Enrolling in Medicare

Electing to Participate Or Not to Participate

Violating The Assignment Agreements – Beware of Penalties

- Any person who accepts assignment and who “”knowingly, willfully, and repeatedly” violates the assignment agreement shall be guilty of a misdemeanor and subject to a fine of not more than $2,000 or...

- CMS may exclude the provider from program participation and from any State health care programs.

- Any person who accepts assignment and who “”knowingly, willfully, and repeatedly” violates the assignment agreement shall be guilty of a misdemeanor and subject to a fine of not more than $2,000 or...

- CMS may exclude the provider from program participation and from any State health care programs.

- The statute provides for civil monetary penalties (CMPs) of up to $2,000 per item or service claimed against any person who violates the assignment agreement.

The Beneficiary, The Therapist and The Ca$H