A comparable individual plan, standard rate, will run approximately $550 per month. Once that person turns 65 and enters Medicare their monthly Part B premium is $99.90 per month, with income less than $85,000 per year.

Full Answer

What is the cheapest Medicare plan?

- New York City: Plan G is $268 to $545 High-deductible Plan G: $69 to $91

- Tampa, Florida: Plan G is $176 to $263 High-deductible Plan G: $52 to $92

- Houston, Texas: Plan G is $128 to $434 High-deductible Plan G: $36 to $86

- Albuquerque, New Mexico: Plan G is $105 to $355 High-deductible Plan G: $30 to $59

How much do tax payers pay for Medicare?

MEDICARE premiums are set to jump by far more than what experts had estimated next year. The new rates were announced by the Centers for Medicare & Medicaid Services (CMS) on November 12, 2021 - we explain what you need to know. Medicare's Part B standard ...

What drugs are covered by Medicare?

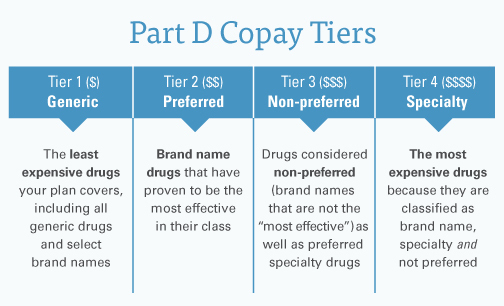

- Tier 1: Preferred generic drugs

- Tier 2: Generic drugs

- Tier 3: Preferred brand drugs and select insulin drugs

- Tier 4: Non-preferred drugs

- Tier 5: Specialty drugs

Does basic Medicare cover prescriptions?

Some higher-income beneficiaries will pay more. Part A, which covers hospital costs, is free. Basic Medicare does not cover prescription-drug costs, but you can buy a Medicare Part D policy that does. Despite new enhancements, Medicare continues to have some major gaps in coverage, so it's important to plan how you'll pay for these potential costs.

What is Medicare drug coverage?

You'll make these payments throughout the year in a Medicare drug plan: A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. ).

When will Medicare start paying for insulin?

Look for specific Medicare drug plan costs, and then call the plans you're interested in to get more details. Starting January 1, 2021, if you take insulin, you may be able to get Medicare drug coverage that offers savings on your insulin.

Why are my out-of-pocket drug costs less at a preferred pharmacy?

Your out-of-pocket drug costs may be less at a preferred pharmacy because it has agreed with your plan to charge less. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. paying your drug coverage costs.

What is formulary in insurance?

Your prescriptions and whether they’re on your plan’s list of covered drugs (. formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list.

When is open enrollment for insulin?

Find a plan that offers this savings on insulin in your state. You can join during Open Enrollment (October 15 – December 7, 2020). Note. If your drug costs are higher than what you paid last year, talk to your doctor.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

How long do you have to pay late enrollment penalty?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What is Medicare drug plan?

These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee‑for‑Service plans, and Medical Savings Account plans. You must have

How to compare Medicare Advantage plans?

Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in to get more details. For help comparing plan costs, contact your State Health Insurance Assistance Program (SHIP).

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

What do you give when you join a Medicare plan?

When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started. This information is on your Medicare card.

What happens if you don't get prescription drug coverage?

If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later.

What is a PACE plan?

Programs of All-inclusive Care for the Elderly (PACE) organizations are special types of Medicare health plans. PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits. with drug coverage.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or other. Medicare Health Plan. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

How does Medicare calculate penalty?

Medicare calculates the penalty by multiplying 1 percent of the “national base beneficiary premium” ($35.02 in 2018) times the number of full , uncovered months you didn’t have Part D or creditable coverage. The monthly premium is rounded to the nearest $.10 and added to your monthly Part D premium. The national base beneficiary premium may increase each year, so your penalty amount may also increase each year.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C): Medicare Advantage plans not only provide all of the same coverage as Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance), they also generally offer additional benefits, such as vision, dental, and hearing, and prescription drug coverage. Medicare Advantage Plans ...

What is Medicare Part D?

Medicare Prescription Drug Plan (Part D): Medicare Part D, also called the Medicare prescription drug benefit, and sometimes called “PDPs” can be added to your Original Medicare (Part A and/or Part B) coverage. Medicare Prescription Drug Plans typically charge a monthly fee that varies by plan and is paid in addition to your Part B premium.

How long is the Medicare Part D penalty?

Medicare Part D Penalty for Late Enrollment. All eligible Medicare beneficiaries have a seven-month Initial Enrollment Period (IEP) when they can enroll in Medicare Part A and/or Part B, as well as sign up for a Medicare Advantage Plan (Part C) and/or a Medicare Prescription Drug Plan (Part D). The IEP starts 3 months before you turn 65, includes ...

How to contact Medicare.org?

Contact a Medicare.org licensed sales agent at (888) 815-3313 – TTY 711 to help you find the right Medicare coverage for your needs.

When can you change your Medicare coverage?

Each year, from October 15th – December 7th, you can make changes to parts of your Medicare coverage – which includes changes to your prescription drug coverage – during Medicare’s Annual Enrollment Period (AEP). Here’s what you can do during AEP:

Does Medicare cover prescription drugs?

Original Medicare (Part A and Part B) does not cover prescription drugs. If you want prescription drug coverage, you must join a plan run by an insurance company or other private company approved by Medicare.

How much will the copay be for prescriptions in 2021?

The copays for prescriptions in the catastrophic coverage level are set by CMS each year; in 2021, they’re $3.70 and $9.20, which is a slight increase from 2020.

Why do Medicare Part D plans go up?

Since Part D plans often charge coinsurance (a percentage of the cost) rather than copays (a flat amount), some seniors may find that their costs go up from one year to the next, simply due to the rising prices for prescription drugs. If you’re paying 25 percent of the cost and the cost goes up, your portion goes up as well. According to a Wall Street Journal analysis, the median out-of-pocket cost for a medication purchased via Medicare Part D was $117 in 2015, up from $79 in 2011.

What happens after you pay your deductible?

After you pay your deductible, you pay copays (a fixed amount) or coinsurance (a percentage of the cost) for your medications until the total you and the plan have spent hits the lower threshold of the donut hole, otherwise known as the initial coverage limit. Before we get into the specific donut hole changes for 2021, ...

What happened to Medicare's donut hole?

What happened to Medicare's 'donut hole'? Medicare’s Part D prescription drug coverage gap or “donut hole” was gradually closed over the course of several years. The donut hole for brand-name drugs closed in 2019, and it was eliminated for generic drugs as of 2020. Prior to 2010, Medicare Part D enrollees were responsible for 100 percent ...

How much is Part D deductible?

A: The Part D prescription drug deductible was a maximum of $435 in 2020, and that increased to $445 for 2021. Some plans have deductibles well under these amounts (or no deductible at all), but no plans can have deductibles that exceed $445 in 2021.

Will the Part D deductible increase in 2021?

The maximum Part D deductible increased slightly for 2021.

How many days can you use Medicare?

Beginning on day 91 of your stay, you will begin using your “Medicare lifetime reserve days.” Medicare limits you to only 60 of these days to use over the course of your lifetime, and they require a coinsurance payment of $742 per day in 2021.

What is the Medicare Advantage spending limit?

Medicare Advantage (Medicare Part C) plans, however, do feature an annual out-of-pocket spending limit for covered Medicare expenses. While each Medicare Advantage plan carrier is free to set their own out-of-pocket spending limit, by law it must be no greater than $7,550 in 2021. Some plans may set lower maximum out-of-pocket (MOOP) limits.

What is the Medicare donut hole?

Medicare Part D prescription drug plans feature a temporary coverage gap, or “ donut hole .”. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs. Once you and your plan combine to spend $4,130 on covered drugs in 2021, you will enter the donut hole. Once you enter the donut hole in 2021, you ...

How much is Medicare Part A deductible in 2021?

You are responsible for paying your Part A deductible, however. In 2021, the Medicare Part A deductible is $1,484 per benefit period. During days 61-90, you must pay a $371 per day coinsurance cost (in 2021) after you meet your Part A deductible.

What happens if you spend $6,550 out of pocket in 2021?

After you spend $6,550 out-of-pocket on covered drugs in 2021, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

What is Medicare Part B and Part D?

Medicare Part B (medical insurance) and Part D have income limits that can affect how much you pay for your monthly Part B and/or Part D premium. Higher income earners pay an additional amount, called an IRMAA, or the Income-Related Monthly Adjusted Amount.

What Medicare plans limit the number of providers you can visit?

Some private Medicare plans such as Medicare Advantage plans and Part D plans may feature provider or pharmacy networks that limit the providers you can visit for covered services.

How does Medicare pay per capita?

Medicare makes per capita monthly payments to plans for each Part D enrollee. The payment is equal to the plan’s approved standardized bid amount, adjusted by the plan beneficiaries’ health status and risk, and reduced by the base beneficiary premium for the plan.

How much does Medicare cost at 65?

A comparable individual plan, standard rate, will run approximately $550 per month.

How much is Medicare subsidized in Sacramento?

In the Sacramento region, Medicare beneficiaries are having their MA-PD subsidized by $738 – $750 on average. (Average capitation rate – Part B cost of $99.90). The stand alone PDP are subsidized on average of $53 across the nation.

How much money was spent on Medicare in 2011?

We all know that the Federal expenditures for Medicare are growing fast and it’s putting a real strain on our budget. $835 billion dollars was spent on Medicare and Medicaid in 2011. That big number doesn’t translate well into an expense per Medicare beneficiary for me.

Does Medicare go away?

While the new Medicare beneficiary realizes a savings, the cost of the insurance doesn’t go away. Medicare funds a large portion of the insurance cost when they select a Medicare Advantage Plan or a stand alone PDP.

Does Part D require a bid for reimbursement?

However, all companies that wish to participate must submit a bid for monthly reimbursement to CMS.

Is capitation only for Medicare Advantage?

The capitation amount is only for the medical portion of the Medicare Advantage health plan. There is a separate amount if the plan includes prescription drug coverage.