Is Medicare supplement insurance worth the cost?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a …

What is the average cost of a Medicare supplement plan?

Jun 16, 2021 · Determining a true average cost is not easy, but Medicare Supplement Insurance plans can cost anywhere between $50 and $500 per month depending on a number of factors. The chart below shows the range of monthly premiums for some of the most popular Medigap plans for a 65-year-old non-smoking male in several different parts of the country.

What is the average cost of Medicare supplemental insurance?

Feb 03, 2022 · Medicare Supplement Insurance Plan F premiums in 2022 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). Medigap Plan G premiums in 2022 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

Do I really need a Medicare supplement?

Nov 07, 2019 · How much does a Medicare Supplement plan cost? Last Updated : 11/07/2019 7 min read. Perhaps you are considering supplementing your Medicare Part A and Part B coverage with other insurance that can help you pay out-of-pocket Medicare costs. It may be a good idea to learn about Medicare Supplement plans and how much they cost.

How much a month is Medicare supplement?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

What are the pros and cons of Medicare supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

Does Medicare supplement cost increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

Is Medicare Supplement cost based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the difference between Medicare Supplement and Advantage plans?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Do Medicare supplements go up every year?

Medicare supplement rate increases usually average somewhere between 3% and 10% per year. And sometimes Medicare supplement rate increases even happen twice in the same year!Mar 28, 2022

How much does Medicare take out of Social Security?

You will pay no monthly premium for Medicare Part A if you are older than age 65 and any of these apply: You receive retirement benefits from Social Security....Is Medicare Part A free?Amount of time worked (and paid into Medicare)Monthly premium in 2021< 30 quarters (360 weeks)$47130–39 quarters (360–468 weeks)$259Dec 1, 2021

Does Medicare check your bank account?

Medicare will usually check your bank accounts, as well as your other assets when you apply for financial assistance with Medicare costs. However, eligibility requirements and verification methods vary depending on what state you live in. Some states don't have asset limits for Medicare savings programs.Feb 10, 2022

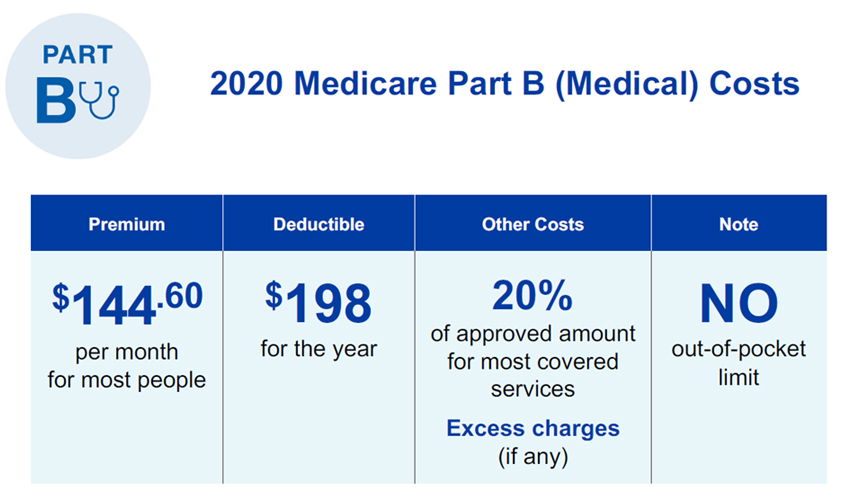

What is the Medicare Part B deductible for 2021?

$203 in 2021Medicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

How to collect Medicare Supplement Insurance?

The easiest way to collect Medicare Supplement Insurance plan costs is to contact a licensed insurance agent who can gather up price quotes for multiple carriers selling Medigap plans in your location . You can also compare plans for free online.

What happens if you apply for Medicare Supplement?

If you apply for a Medicare Supplement Insurance plan during your Medigap Open Enrollment Period, you will have guaranteed issue rights. That means an insurance company is not allowed to use medical underwriting to charge you a higher rate for your coverage.

Is it uncommon for a product to cost more in a large city than it does in a more rural

The cost of living can be significantly different in one market compared to another. It’s not uncommon for a product to cost more in a large city than it does in a more rural setting, and the same can be said for Medicare Supplement Insurance plans.

Does Medicare Supplement Insurance offer discounts?

It’s not uncommon for insurance companies to offer discounts on Medicare Supplement Insurance plans. Discounts are often available for non-smokers, married couples and other criteria. Be sure to ask your insurance agent or insurance carrier about any potential discounts that may be available.

What are the factors that affect the cost of Medicare Supplement?

There may be plans available in your area that cost less than the average listed above for your age. Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates. A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan ...

What is the factor that determines the premiums for Medicare Supplement Insurance?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age .

Why does my Medigap premium increase?

As you age, your Medigap plan premiums will gradually increase each year. Medigap premiums can increase over time due to inflation and other factors , regardless of the pricing model your insurance company uses.

What is the lowest Medicare premium for 2020?

Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

How does age affect Medicare premiums?

How Does Age Affect Medicare Supplement Insurance Premiums? 1 Community-rated Medigap plans#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market. 2 Issue-age-rated Medigap plans#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age. 3 Attained-age-rate Medigap plans#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

How much is the 203 deductible?

The $203 annual deductible equates to around $17.00 per month. This means that a Plan G with a premium of no more than $17.00 per month more than a Plan F option could actually serve as a better value, provided you meet the entire Part B deductible.

When will Medicare plan F be available?

Important: Plan F is not available to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020. If you already have Medicare, you can still enroll in Plan F if the plan is available in your area.

What are the benefits of Medicare Supplement?

All the standardized Medicare Supplement plans share some basic benefits. Aside from the first benefit listed below, not all plans cover these benefits at 100%. Basic benefits include: 1 Medicare Part A coinsurance and coverage for hospital services 2 Medicare Part B coinsurance or copayment 3 Blood transfusions (first three pints) 4 Hospice care coinsurance or copayment

What is Medicare Supplement Plan?

Medicare Supplement plans (also known as Medigap plans) are designed to work alongside Part A and Part B and to help pay out-of-pocket costs, which may include deductibles, copayments, and coinsurance, for example. Medicare Supplement insurance coverage for these expenses varies by plan type. If you enroll in a Medicare Supplement plan, you will ...

How many states have Medicare Supplement Plans?

In 47 states, there are up to 10 standardized Medicare Supplement plans available. With the exception of Massachusetts, Minnesota and Wisconsin, which have their own standardized Medicare Supplement plan types, Medicare Supplement benefit plans are labeled with alphabetic letters for easy reference.

When is the best time to apply for Medicare Supplement?

Probably the best time to apply for a Medicare Supplement plan is the six-month period that begins the first month you are enrolled in Medicare Part B and you are age 65 or older.

Can you be turned down for Medicare Supplement Plan?

This time period is often referred to as Medicare Supplement Plan Open Enrollment, and you cannot be turned down for insurance coverage or charged a higher premium because of a health condition you have, although you might face a waiting period for coverage of your health condition.

Is Medicare Supplement Plan renewable?

Medicare Supplement plans are guaranteed renewable in most cases; generally as long as you continue to pay your premiums, you may continue your coverage from the Medicare Supplement plan year after year. You may also want to consider the long-range cost of your Medicare Supplement plan as well as the short-range, ...

Is Plan G the same as Plan M?

Plan G covers the same benefits as Plan M; however, Plan G also covers 100% of the Part A deductible and 100% of the Part B excess charge (the legally allowed amount above the Medicare approved fee). Because Plan G provides more coverage than Plan M, it is likely to cost more than Plan M. You can compare the coverage provided by ...

How many different Medicare Supplement plans are there?

However, this is not such a straightforward question to answer as one might think. For starters, there are 10 different standardized Medicare Supplement plans with different costs and coverage. The best way to find out how much ...

How much is Medigap high deductible?

Medigap High Deductible F and High deductible G are much cheaper than all of the other plans for the simple fact that they have a deductible of $2,370. Their premium starts from as little as $40 in some states.

Why are Medigap premiums higher in New York?

Connecticut and New York, for example, have higher Medigap premiums than those of Texas because CT and NY have protections in place that allow members to enroll or switch plans without health reviews.

What is the difference between Medigap Plan N and Plan G?

It can start as low as $75 depending on state, age, etc. Medigap Plan N has a lower premium than G or F and should be considered if you cannot afford the above.

How much does Medigap Plan F increase?

And remember, according to the Health and Human Services, the average Medigap plan increases about 4% each year. Medigap Plan F used to be the most popular Medicare Supplement plan. You must have turned 65 before 2020 to purchase Plan F.

Does Medigap Plan N cover Part B?

Medigap Plan N has a lower premium than G or F and should be considered if you cannot afford the above. It does not cover the Part B deductible or the dreaded Medicare Excess Charges. Also Medigap Plan N has a $20 copay for doctor visits and a $50 copay for emergency room.

Is there a fee for Senior65?

We at Senior65 dedicate ourselves to help people enroll in Medigap, Medicare Advantage and Part plans at no additional cost. There is never a fee or hidden charge to work with Senior65.com. Since Medicare insurance pricing is regulated, no one can sell you the same plan for less than we can.

Which is the most expensive Medicare supplement plan?

It makes sense that Plan F and Plan G are the most expensive plans because they have the most coverage, and people want to know the cost of Medicare supplement plans. But, the pricing is different for everyone. Insurance carriers have more than one way to rate their plans for an initial premium and rate increases.

What is Medicare Supplement Plan?

A Medicare Supplement plan (aka, Medigap) is additional insurance that helps pay some of the deductibles. A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share.... , copayments.

How much does Medicare pay for skilled nursing?

But, Medicare only pays for the first 20 days. After that, you’ll pay $176 per day. Medicare Part B deductible: The Part B deductible is $198 per year.

What is Medicare premium?

A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ... . Several other factors influence Medicare supplement insurance cost, too, so read on.

What is a copayment?

A copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service.... , and coinsurance. Coinsurance is a percentage of the total you are required to pay for a medical service. ... that’s baked into Original Medicare.

How much does a hip replacement cost?

The average cost of a hip replacement in the United States is almost as costly at $32,000. Most of us simply can’t afford to pay 20% of those kinds of costs out-of-pocket. That’s what makes it necessary to buy supplemental Medicare insurance. As with car insurance, we really don’t have a choice.

What factors influence insurance premiums?

Zip code and age significantly influence the monthly premium. Costs vary by insurance carrier and rating method (attained-age, issue-age, community). Gender and the use of tobacco also influence premiums. A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis.

What is a Medicare Supplement monthly premium?

Monthly Premium. A monthly premium is the fee you pay to the plan in exchange for coverage. Each Medicare Supplement plan has a different monthly premium.

What to think about when choosing a Medicare Supplement Plan?

When choosing a Medicare Supplement plan, it's a good idea to think about things like premiums, your out-of-pocket medical expenses and what Original Medicare will and will not cover.

What is the difference between Medicare Supplement Plan A and B?

Plans A & B. Medicare Supplement Plan A offers just the Basic Benefits, while Plan B covers Basic Benefits plus a benefit for the Medicare Part A deductible , which could be one of the largest out-of-pocket expenses if you need to spend time in a hospital.

How much is Medicare Part B deductible?

In most cases, you’re responsible for your Medicare Part B deductible, which is an annual cost of $198 in 2020.

What is a K and L plan?

Plans K & L are cost sharing plans with lower monthly premiums. They pay a percentage of the coinsurance instead of the full amount, and you are responsible for the rest. Once the out-of-pocket limit is reached, these plans pay 100% of covered services for the rest of the calendar year.

What is a copay?

A copay is a set, flat amount paid each time, such as a $20 copay for each in-office doctor visit. Coinsurance requires you to pay a percentage of the Medicare-approved amount each time.

Does AARP pay royalty fees?

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance Company. UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, ...

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.