Most people pay $0 per month; others pay $259 or $471 per month, depending on how many quarters of Medicare taxes they paid. Most people pay the standard $148.50 per month. Those with higher income pay as much as $504.90 per month. It varies by plan.

How much do tax payers pay for Medicare?

Feb 15, 2022 · The average premium paid for a Medicare Supplement Insurance (Medigap) plan in 2019 was $125.93 per month. 3 It’s important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with …

How much does Medicare cost at age 65?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a …

What if I need help paying for Medicare?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274.

Does a retire pay for Medicare?

Dec 01, 2021 · Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount (IRMAA), meaning if you make more, you’ll pay more.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.

What percentage of Medicare deductible is paid?

After your deductible is paid, you pay a coinsurance of 20 percent of the Medicare-approved amount for most services either as an outpatient, inpatient, for outpatient therapy, and durable medical equipment.

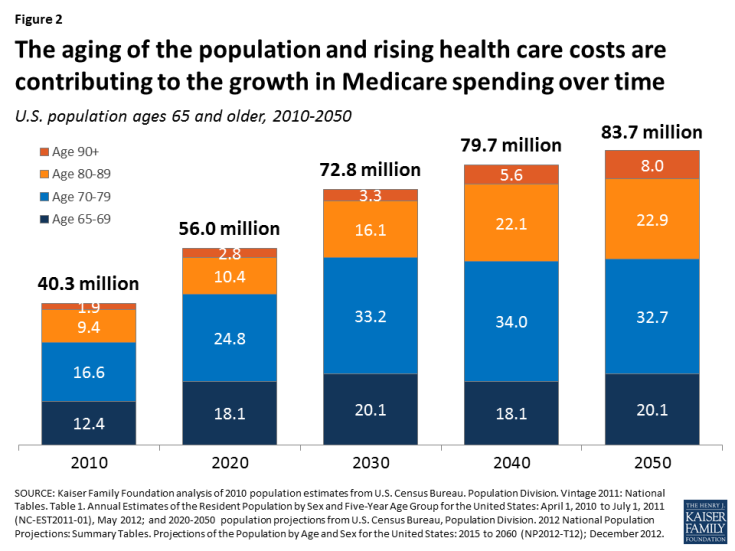

How many people are covered by Medicare?

Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

How many parts of Medicare are there?

The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

How much does Medicare Part B cost?

Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

How much is Part A deductible for 2020?

If you purchase Part A, you may have to also purchase Part B and pay the premiums for both parts. As of 2020, your Part A deductible for hospital stays is $1408.00 for each benefit period. After you meet your Part A deductible, your coinsurance costs are as follows: • Days 1 – 60: $0 coinsurance per benefit period.

How much does Medicare cost a month?

If you or your spouse paid Medicare taxes for less than 10 years total, you will have to pay a monthly fee for Part A coverage. The premium could be as much as $407 a month. Deductible costs. If you stay overnight in the hospital or use other Part A services, you'll pay a deductible.

How much does Medicare cost if you have a higher income?

If you have a higher income, you may pay more each month. If your income is over $85,000 you will pay your plan premium plus an additional fee, ranging from $12.40 to $77.40, depending on your income. Deductible costs: Each year you pay a deductible before Medicare starts sharing the cost for your medicines.

How much is the deductible for Medicare for hospital stays?

The deductible is the amount you must pay before Medicare pays anything for your care. For 2019, the deductible for each hospital stay is $1,364. Copay costs.

What happens after you pay your Medicare deductible?

After you've paid the deductible, your Medicare prescription drug plan kicks in and you pay a copay or coinsurance. Out-of-pocket costs: The part you pay for your medicines is either called a copay or coinsurance. The amount depends on the plan you've chosen.

What is Medicare Advantage?

Medicare Part D. Medicare Advantage (Part C) Medigap. Medicare is a health insurance program for people 65 and older. People younger than 65 who are disabled or who have end-stage kidney disease or ALS can also get health care through Medicare. Find a Medicare Plan that Fits Your Needs Get a Free Medicare Plan Review. Get Started.

Do you pay more for brand name drugs?

The amount depends on the plan you've chosen. You may pay more for some drugs than others, such as brand-name drugs. Costs in the donut hole: If you and your drug plan spend a certain amount on medicines, you'll have a gap in your drug coverage, which is often called the donut hole.

How much was Medicare paid in 2015?

Also in 2015, the most recent year for which complete taxation data is available, $241.1 billion was paid in Medicare payroll taxes. Of this amount, $211.9 billion came from wage income. The remaining $30 billion or so came from other sources that don't impact the average American, such as the 0.9% additional Medicare tax I mentioned earlier.

What is the Medicare tax rate?

Image source: Getty Images. On the other hand, the Medicare tax rate of 1.45% is assessed on all wage income. Employers pay an equal amount, for a total rate of 2.9%. And although it doesn't affect the average American worker, in the interest of being complete, there's an additional Medicare tax that high earners are required to pay.

How much is Medicare deficit?

According to the Medicare Trustees Report, the 75-year deficit is projected to be equivalent to 0.73% of taxable payroll. This means that by raising the current 2.9% Medicare tax rate to 3.63% (1.815% for employees), the program would maintain its solvency for at least another 75 years.

How many people paid Medicare taxes in 2015?

So, let's see how much the average American pays in Medicare taxes. According to the Bureau of Labor Statistics, there were about 137.9 million American workers in mid-2015, if you include part-time employees.

Is Medicare taxing in 2028?

However, there's a strong possibility that the Medicare tax rate will be increased in the not-too-distant future. It's no secret that Medicare isn' t in the best financial shape, and at the current rate, the program will be out of money in 2028.

Is Medicare based on income?

Of the three wage-based types of tax American workers pay, Medicare is perhaps the most straightforward and easy to calculate. Federal and state income taxes are based on a set of marginal tax brackets, and Social Security tax is only assessed on income below a certain threshold that changes annually.

How much does Medicare cover?

Since Medicare only covers about 80% of your medical bills, many people add on a Medicare Supplement to pick up the remaining costs. The monthly premium for a Medicare Supplement will depend on which plan you choose, your age, your gender, your zip code, and your tobacco usage.

How much does Medicare Part B cost in MA?

Often times, MA plans also include a drug benefit, so you also replace Part D. However, you still must pay the $148.50 monthly premium for Medicare Part B. MA premiums vary, depending on which type of plan you choose, which area you’re in, and other similar factors.

What is Medicare MSA?

A Medicare MSA, a type of Medicare Advantage plan, is another option for seniors. The most widely available plan is from Lasso Healthcare, and it is $0 premium. An MSA combines high-deductible health coverage with an annually funded medical savings account.

How much is Medicare Part A deductible for 2021?

The Medicare Part A deductible, as well as the coinsurance for care, fluctuates slightly every year, but here are the current costs for 2021: $1,484 deductible. Days 1-60: $0 coinsurance. Days 61-90: $371 coinsurance. Days 91+: $742 coinsurance per “lifetime reserve day,” which caps at 60 days. Beyond lifetime reserve days: You pay all costs.

What will Medicare pay for in 2021?

2021 Medicare Part A Costs. Medicare Part A helps cover bills from the hospital. So, if you are admitted and receive inpatient care, Medicare Part A is going to help with those costs. If you’ve worked at least 10 years or can draw off a spouse who has, Medicare Part A is free to have.

How much is coinsurance for days 21 through 100?

For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $185.50 in 2021.

Does Medicare Part A have coinsurance?

That means you don’t have any monthly costs to have Medicare Part A . This doesn’t mean that Medicare Part A doesn’t have other costs like a deductible and coinsurance – because it does – but you won’t have to pay those costs unless you actually need care. For most people, having Medicare Part A is free.

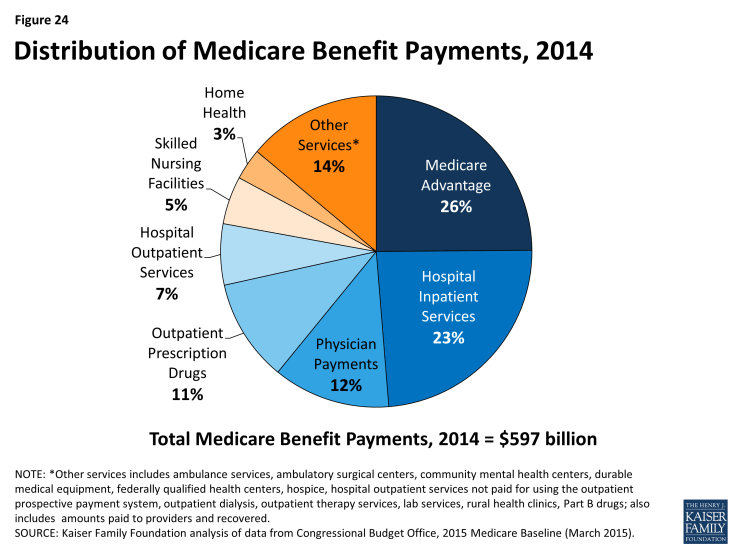

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

How is Medicare funded?

How Medicare Is Funded. Medicare is funded by two trust funds that can only be used for Medicare. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits. 11 .

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

How is Medicare supplemental insurance fund funded?

Medicare's supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Part D benefits, and program administration expenses.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is the Medicare tax rate for 2013?

On Jan. 1, 2013, the ACA also imposed an additional Medicare tax of 0.9% on all income above a certain level for high-income taxpayers. Single filers have to pay this additional amount on all earned income they receive above $200,000 and married taxpayers filing jointly owe it on earned income in excess of $250,000.

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

How much does a female Medicare beneficiary spend on health insurance?

Female Medicare beneficiaries spent a slightly higher average portion of self-reported income on health coverage and out-of-pocket costs than their male counterparts (spending $5,748 versus $5,104 spent by men), although this was not the case for those under age 65 who are enrolled in Medicare because of disability.

How much did Medicare cost in 2016?

In 2016, Medicare enrollees who reported being in poor health spent $6,384 in premiums and out-of-pocket health costs, while those who reported being in excellent or good health had average costs of $4,715.

How much did Medicare pay out of pocket in 2016?

A: According to a Kaiser Family Foundation (KFF) analysis of Medicare Current Beneficiary Survey (MCBS), the average Medicare beneficiary paid $5,460 out-of-pocket for their care in 2016, including premiums as well as out-of-pocket costs when health care was needed.

Does Medicare cover long term care?

In addition to cost sharing (deductibles, co-pays and coinsurance), beneficiaries have to pay out-of-pocket for expenses Medicare doesn’t cover, such as long-term care and dental services. According to the KFF analysis, the amount Medicare beneficiaries paid for covered and non-covered care decreased slightly from 2013 and 2016, ...

Is there a deductible for Medicare Part A 2020?

The Part A deductible and coinsurance also increased slightly in 2020, as did the premium for Part A that applies to people who don’t have enough work history (or a spouse with enough work history) to qualify for premium-free Medicare Part A.