What year did seniors have to start paying for Medicare?

The United States national health insurance program known as Medicare has been providing people with health care insurance coverage since 1966. Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older. The U.S. government has set the age of eligibility for Original Medicare Parts A and B at 65. And, while most people enroll at this age, others continue working and choose to stay on their employer’s insurance plan until the time they retire.

How much does Medicare cost at age 65?

In 2021, the premium is either $259 or $471 each month ($274 or $499 each month in 2022), depending on how long you or your spouse worked and paid Medicare taxes. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

How does a senior apply for extra help with Medicare?

These programs can help you pay your Medicare costs:

- Medicaid. Medicaid is federal program overseen by each state that helps people with limited incomes pay their healthcare costs.

- Medicare savings programs (MSPs). MSPs help people with limited incomes pay some of the out-of-pocket costs of Medicare.

- Program of All-inclusive Care for the Elderly (PACE). ...

- Extra Help. ...

Is Medicare free for seniors?

MEDICARE STILL IS NOT COVERING THESE TESTS ... four free tests for home delivery through covidtests.gov or picking free tests up from community locations such as libraries or senior centers that distribute them.At-home tests were in vexingly short supply ...

How much is taken out of Social Security check for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

How much do most seniors pay for Medicare?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

At what income level do you pay more for Medicare?

You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

How much does Medicare cost for the average 65 year old?

Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year. Deductibles for Medicare Part B benefits are $198.00 as of 2020 and you pay this once a year.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Why is my Medicare bill so high?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Do retirees have to pay for Medicare?

Because you pay for Medicare Part A through taxes during your working years, most people don't pay a monthly premium. You're usually automatically enrolled in Part A when you turn 65 years old. If you're not, it costs nothing to sign up.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What percentage of Medicare expenses are covered by seniors?

If seniors' benefits are increasing, it also means their potential liability might be as well. Keep in mind that about 80% of medical expenses are covered by Medicare, possibly putting seniors on the hook for 20% of a growing number by 2030.

How much does Social Security outweigh Medicare?

So, for those who turned 65 in 2010, average Social Security benefits outweigh average Medicare benefits by $97,000 for men and by $95,000 for women. However, by 2030, per the Urban Institute's calculations, this gap is expected to shrink to $28,000 for men and just $9,000 for women. In other words, Medicare's importance is growing by leaps ...

How much more will male retirees get in 2030?

The Urban Institute estimates that by 2030, male retirees will receive $221,000 more in lifetime benefits than they paid into Medicare, while female retirees will take home $263,000 on top of what they contributed. This fundamental flaw behind Medicare makes fixing the program for the long term a daunting task.

How much does a single woman make in a lifetime?

Single female earning an average wage: $207,000 in lifetime benefits. Two-earner couple earning an average wage: $387,000 in lifetime benefits. You may have noticed the difference in lifetime benefits between men and women. That difference arises because women live an average of five years longer than men, and thus have higher medical costs.

When will Medicare shrink?

First, the current gap (as of 2010) between the estimated lifetime benefits received from Social Security and Medicare is expected to shrink dramatically by 2030.

What is the most important social program for seniors?

Social Security, which provides income to retired workers in order to help them meet their monthly expenses, is typically seen as the most important social program for seniors. It's easy to see why, given that Social Security pays out a cash benefit each and every month for the rest of your life. But let's not forget about Medicare.

Is original Medicare only for seniors?

First, understand that original Medicare isn't your only option. For around 70% of today's seniors, original Medicare has been working wonderfully.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much is Medicare Part B premium for 2017?

For about 30%, the monthly Part B premium for 2017 is $134. For all Medicare Part B beneficiaries, there is a $183 deductible. For Part C, a.k.a. Medicare Advantage or "Medigap" coverage, there's a wide range of coverage options and premiums, so quoting an average premium wouldn't be too helpful. You can choose a low-cost plan ...

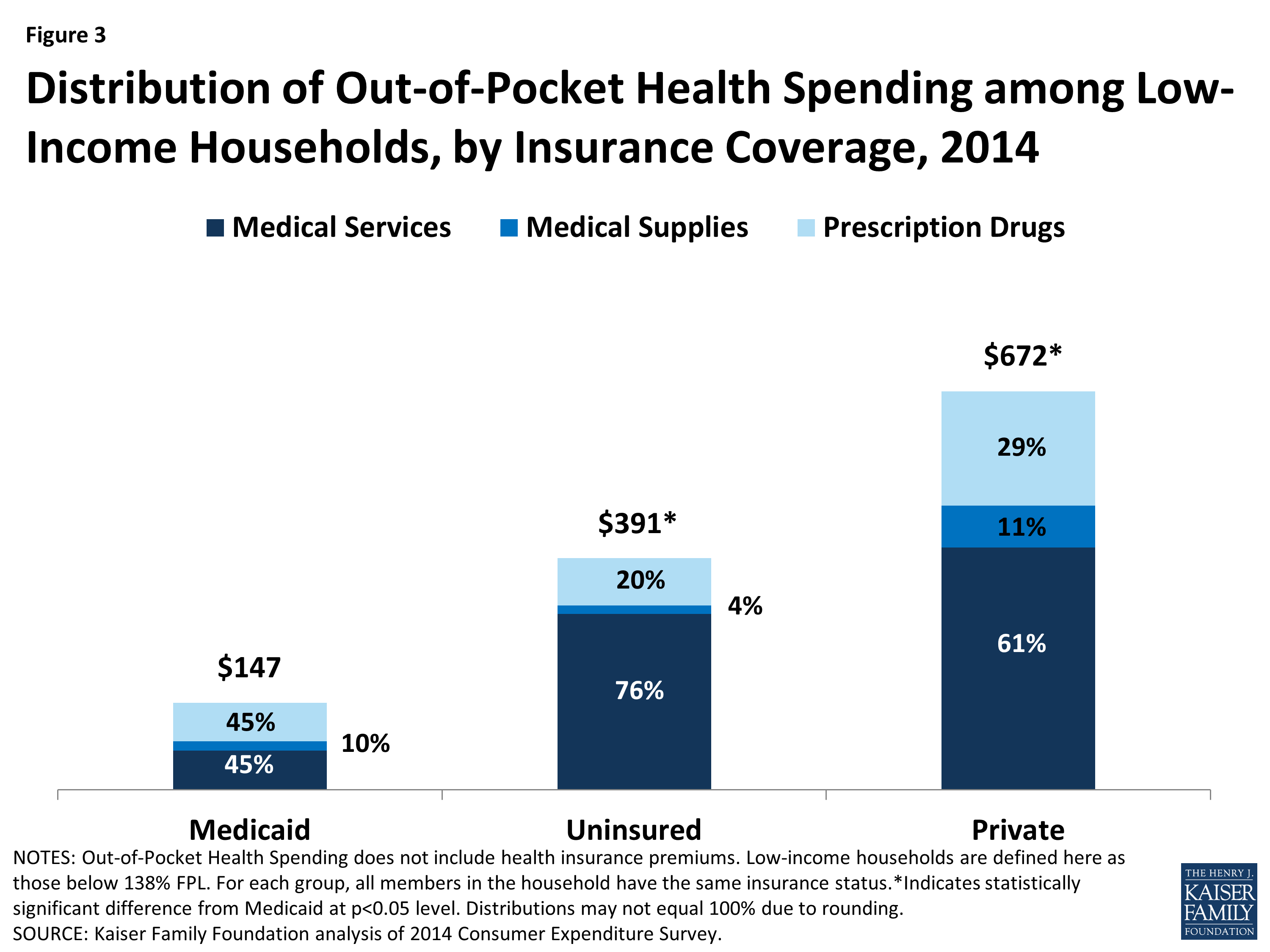

What age group has the most out of pocket expenses?

The same KFF study found that the average person in the 85-and-up age group has more than three times the out-of-pocket expenses of someone in the 65-74 age group, not counting premiums.

Does Medicare Part A have a premium?

Also notice that the "other premiums" category is listed as zero, because Medicare Part A generally doesn't have a premium. However, many retirees elect to carry Part C coverage, also known as Medicare Advantage, as well as Part D coverage, which is for prescription drugs.

Can you choose a low cost Medicare plan?

You can choose a low-cost plan that will still leave you with a lot of out-of-pocket costs, or you can choose an expensive plan that will cover virtually every copay and deductible that you may have. Medicare offers a search tool that can help you compare the options available to you.

Does Medicare cover dental insurance?

In addition to premiums and deductibles, there are several healthcare expenses not covered by Medicare. You'll notice in the chart above that dental services are not covered by Medicare, so unless you have a separate dental plan, you'll need to pay these costs out of pocket.

Can you save money on Medicare before retiring?

Above all, remember that these are just averages, and other than Medicare premiums, out-of-pocket healthcare expenses can vary tremendously in retirement from person to person. Therefore it may be a good idea to prepare by considering a Medicare Advantage plan and saving extra money before you retire for the specific purpose of paying for healthcare expenses.

How much does Medicare cover?

Since Medicare only covers about 80% of your medical bills, many people add on a Medicare Supplement to pick up the remaining costs. The monthly premium for a Medicare Supplement will depend on which plan you choose, your age, your gender, your zip code, and your tobacco usage.

What will Medicare pay for in 2021?

2021 Medicare Part A Costs. Medicare Part A helps cover bills from the hospital. So, if you are admitted and receive inpatient care, Medicare Part A is going to help with those costs. If you’ve worked at least 10 years or can draw off a spouse who has, Medicare Part A is free to have.

What is Medicare MSA?

A Medicare MSA, a type of Medicare Advantage plan, is another option for seniors. The most widely available plan is from Lasso Healthcare, and it is $0 premium. An MSA combines high-deductible health coverage with an annually funded medical savings account.

How much is Medicare Part A deductible for 2021?

The Medicare Part A deductible, as well as the coinsurance for care, fluctuates slightly every year, but here are the current costs for 2021: $1,484 deductible. Days 1-60: $0 coinsurance. Days 61-90: $371 coinsurance. Days 91+: $742 coinsurance per “lifetime reserve day,” which caps at 60 days. Beyond lifetime reserve days: You pay all costs.

How much does Medicare Part B cost in MA?

Often times, MA plans also include a drug benefit, so you also replace Part D. However, you still must pay the $148.50 monthly premium for Medicare Part B. MA premiums vary, depending on which type of plan you choose, which area you’re in, and other similar factors.

Does Medicare Part A have coinsurance?

That means you don’t have any monthly costs to have Medicare Part A . This doesn’t mean that Medicare Part A doesn’t have other costs like a deductible and coinsurance – because it does – but you won’t have to pay those costs unless you actually need care. For most people, having Medicare Part A is free.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

How much does Medicare pay for seniors?

In 2019, seniors paid an average of $29 a month for their Medicare Advantage plans. Available plans vary by state, and monthly premiums vary too: Some plans pay for a person’s Medicare Part B premiums, while other plans include extra benefits, like dental and vision coverage.

What is the cheapest Medicare plan for seniors?

With an average $23 monthly premium, HMO plans were the cheapest option for seniors in 2019.

Why do seniors not have to pay Medicare Part D?

Many plans eliminate the need for Medicare Part D because they include prescription drug coverage. Seniors pay a premium for their Medicare Advantage Plans every month. They also pay a deductible on covered services, and coinsurance after they’ve met the deductible.

Why do people choose Medicare Advantage?

Many individuals beyond retirement age opt for Medicare Advantage Plans because they reduce annual out-of-pocket health care costs. They feel familiar, too, because they’re essentially the same as other health insurance plans.

Can I get Medicare Part A for free?

Most retirees qualify for premium-free Medicare Part A. Seniors who paid Medicare taxes for less than 40 quarters aren’t automatically eligible to receive free Medicare Part A, but they can buy into the plan by paying a monthly fee.

Do seniors need to sign up for Medicare Part B?

Seniors don’t need to buy Medicare Part B if they decide to opt for Original Medicare; however if they want a Medicare Advantage Plan, they usually do need to sign up for Medicare Part B. Again, some Medicare Advantage Plans pay Medicare Part B costs to the government on a policyholder’s behalf.

Medicare Covers Medically Necessary Home Health Services

Medicare does not usually cover the cost of non-medical home care aides if that is the only type of assistance that a senior needs.

Medicare Advantage May Offer More Comprehensive Coverage

Private insurance companies run Medicare Advantage. Those companies are regulated by Medicare and must provide the same basic level of coverage as Original Medicare. However, they also offer additional coverage known as “supplemental health care benefits.”