The rise in Medicaid

Medicaid

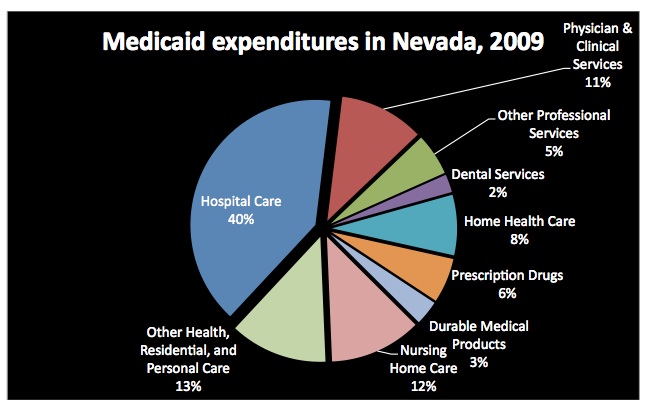

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

How much does the government spend on Medicare each year?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare: Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure.

How much does Medicare cost per person?

That's $11,172 per person. This figure accounted for 17.7% of gross domestic product (GDP) that year. If we look at each program individually, Medicare spending grew 6.4% to $750.2 billion in 2018,...

How is Medicare and Medicaid funded?

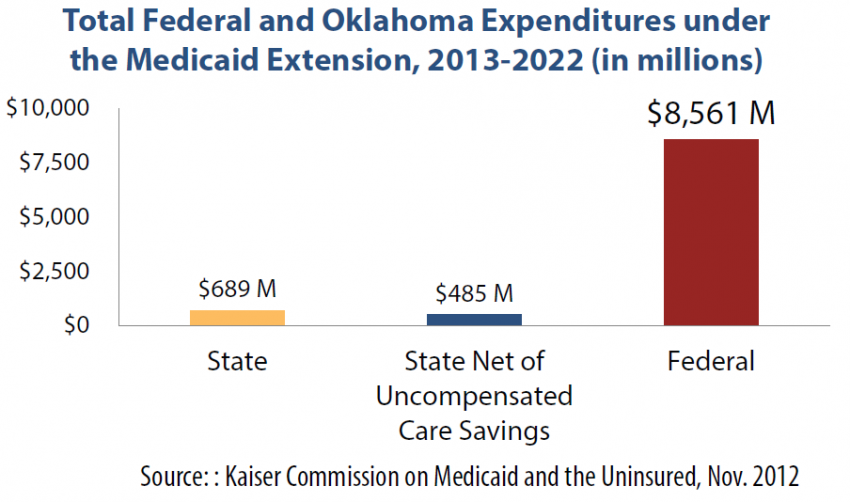

Medicaid is funded by the federal government and each state. Both programs received additional funding as part of the fiscal relief package in response to the 2020 economic crisis. Medicare is administered by the Centers for Medicare & Medicaid Services (CMS), a component of the Department of Health and Human Services.

How much does Medicare subsidy cost in Sacramento?

In the Sacramento region, Medicare beneficiaries are having their MA-PD subsidized by $738 – $750 on average. (Average capitation rate – Part B cost of $99.90). The stand alone PDP are subsidized on average of $53 across the nation.

How much a subsidy is Medicare?

The analysis estimates a lifetime subsidy of about $20,000 to $60,000 per person, depending on life expectancy, interest rates, and expected drug spending.

How much does the US government subsidize healthcare?

How much does the federal government spend on health care? The federal government spent nearly $1.2 trillion in fiscal year 2019. In addition, income tax expenditures for health care totaled $234 billion. The federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1).

Does the government subsidize Medicare?

The government paying a portion or all of your Medicare Advantage premiums, coinsurance, copayments, and deductibles is generally considered by most people to be a Medicare subsidy, even if the payment is for a Medicare Advantage plan instead of for Original Medicare.

Does the US subsidize healthcare?

Health coverage available at reduced or no cost for people with incomes below certain levels. Examples of subsidized coverage include Medicaid and the Children's Health Insurance Program (CHIP). Marketplace insurance plans with premium tax credits are sometimes known as subsidized coverage too.

What percentage of healthcare is paid by the government?

The deceleration was largely associated with slower federal Medicaid spending. Despite the slower growth, the federal government's share of health care spending remained at 28 percent.

How much will Obamacare subsidies cost taxpayers?

According to the Joint Committee on Taxation, about 73 million taxpayers earning less than $200,000 will see their taxes rise as a result of various Obamacare provisions. The CBO originally estimated that Obamacare would cost $940 billion over ten years. That cost has now been increased to $1.683 trillion.

Is Medicare funded by income tax?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare.

Is Medicare fully funded?

Medicare is funded through multiple sources: 46% comes from general federal revenue such as income taxes, 34% comes from Medicare payroll taxes and 15% comes from the monthly premiums paid by Medicare enrollees. Other sources of funding included taxation of Social Security benefits and earned interest.

What happens when Medicare runs out of money?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

What percentage of taxes go to healthcare?

In other words, the federal government dedicates resources of nearly 8 percent of the economy toward health care. By 2028, we estimate these costs will rise to $2.9 trillion, or 9.7 percent of the economy. Over time, these costs will continue to grow and consume an increasing share of federal resources.

Why is healthcare so expensive in the US?

The price of medical care is the single biggest factor behind U.S. healthcare costs, accounting for 90% of spending. These expenditures reflect the cost of caring for those with chronic or long-term medical conditions, an aging population and the increased cost of new medicines, procedures and technologies.

Does Canada have free healthcare?

Canada has a universal health care system funded through taxes. This means that any Canadian citizen or permanent resident can apply for public health insurance. Each province and territory has a different health plan that covers different services and products.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What percentage of Medicare is paid to MA?

Based on a federal annual report, KFF performed an analysis to reveal the proportion of expenditure for Original Medicare, Medicare Advantage (MA) and Part D (drug coverage) from 2008 to 2018. A graphic depiction on the KFF website illustrates the change in spending of Medicare options. Part D benefit payments, which include stand-alone and MA drug plans, grew from 11% to 13% of total expenditure. Payments to MA plans for parts A and B went from 21% to 32%. During the same time period, the percentage of traditional Medicare payments decreased from 68% to 55%.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Is Medicare a concern?

With the aging population, there is concern about Medicare costs. Then again, the cost of healthcare for the uninsured is a prime topic for discussion as well.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How many people did Medicare cover in 2017?

programs offered by each state. In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds.

What is the CMS?

The Centers for Medicare & Medicaid Services ( CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the. Department Of Health And Human Services (Hhs) The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, ...

What is Medicare Part B?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. and. Medicare Drug Coverage (Part D) Optional benefits for prescription drugs available to all people with Medicare for an additional charge.

What is covered by Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

Who pays payroll taxes?

Payroll taxes paid by most employees, employers, and people who are self-employed. Other sources, like these: Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

Does Medicare cover home health?

Medicare only covers home health care on a limited basis as ordered by your doctor. , and. hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient.

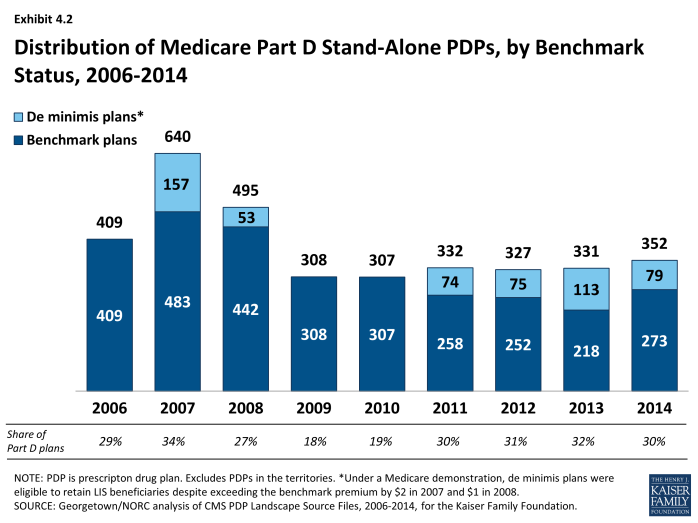

How does Medicare pay per capita?

Medicare makes per capita monthly payments to plans for each Part D enrollee. The payment is equal to the plan’s approved standardized bid amount, adjusted by the plan beneficiaries’ health status and risk, and reduced by the base beneficiary premium for the plan.

How much is Medicare subsidized in Sacramento?

In the Sacramento region, Medicare beneficiaries are having their MA-PD subsidized by $738 – $750 on average. (Average capitation rate – Part B cost of $99.90). The stand alone PDP are subsidized on average of $53 across the nation.

How much money was spent on Medicare in 2011?

We all know that the Federal expenditures for Medicare are growing fast and it’s putting a real strain on our budget. $835 billion dollars was spent on Medicare and Medicaid in 2011. That big number doesn’t translate well into an expense per Medicare beneficiary for me.

How much does Medicare cost at 65?

A comparable individual plan, standard rate, will run approximately $550 per month.

Does Medicare go away?

While the new Medicare beneficiary realizes a savings, the cost of the insurance doesn’t go away. Medicare funds a large portion of the insurance cost when they select a Medicare Advantage Plan or a stand alone PDP.

Does Part D require a bid for reimbursement?

However, all companies that wish to participate must submit a bid for monthly reimbursement to CMS.

Is capitation only for Medicare Advantage?

The capitation amount is only for the medical portion of the Medicare Advantage health plan. There is a separate amount if the plan includes prescription drug coverage.

Can you get extra help if your income is over the limit?

Even if your income or assets are above the eligibility limits, you could still qualify for Extra Help because certain types of income and assets may not be counted, in addition to the $20 mentioned above.

Is Extra Help a replacement for Medicare?

Remember that Extra Help is not a replacement for Part D or a plan on its own: You must still have a Part D plan to receive Medicare prescription drug coverage and Extra Help assistance. If you do not choose a plan, you will in most cases be automatically enrolled in one.

Can you get extra help if you have SSI?

If you are enrolled in Medicaid, Supplemental Security Income (SSI), or a Medicare Savings Program (MSP), you automatically qualify for Extra Help regardless of whether you meet Extra Help’s eligibility requirements.

How much does Medicare pay per month?

Many people are shocked to learn that the federal government, through Medicare, can pay the Medicare Advantage plans over $1,000 per month for each enrollment per individual.

What is the foundation of Medicare monthly rate?

The foundation of the monthly rate is the health care claims Medicare pays for beneficiaries in Original Medicare Fee for Service coverage. In an effort to reduce the growth in spending on Medicare Advantage plans, the Congressional Budget Office (CBO) undertook a review of how the plans are paid and specifically the quality bonuses.

What insurance company pays for Medicare Advantage?

When a Medicare beneficiary enrolls in a Medicare Advantage plan, usually sponsored by private insurance companies like Blue Cross, Blue Shield, Health Net, Kaiser, UnitedHealthcare, et al, Medicare pays the private insurer a monthly capitation amount to accept the responsibility of all the claims that might be generated by the beneficiary.

How does quality score affect Medicare?

The second way that quality scores impact plan payments is through the size of the rebate that a plan receives when it bids below the benchmark. Plans with 4.5 stars or more retain 70 percent of the difference between the bid and the quality-adjusted benchmark, plans with 3.5 to 4.0 stars retain 65 percent of that difference, and plans with 3 stars or less retain 50 percent of that difference. Recent evidence suggests that quality bonuses have increased Medicare’s payments to plans by 3 percent (Medicare Payment Advisory Commission 2018).

When did Medicare reduce quality bonus payments?

Reduce Quality Bonus Payments to Medicare Advantage Plans, December 13, 2018. Roughly one-third of all Medicare beneficiaries are enrolled in the Medicare Advantage program under which private health insurers assume the responsibility for, and the financial risk of, providing Medicare benefits.

Which CMS pays higher rated plans?

The Centers for Medicare & Medicaid Services (CMS) pays higher-rated plans more in two ways. First, plans that have composite quality scores with at least 4 out of 5 stars are paid on the basis of a benchmark that is 5 percent higher than the standard benchmark.

Why are health care payments adjusted?

Payments are further adjusted to reflect differences in expected health care spending that are associated with beneficiaries’ health conditions and other characteristics. Plans also receive additional payments—referred to as quality bonuses—that are tied to their average quality score.

How is Medicare Advantage financed?

Medicare Advantage plans are also financed by monthly premiums paid by subscribers. The premium amounts vary by company and plan. Subscribers may also be asked to pay a certain amount of their expenses in the form of a deductible or copayment.

What is Medicare Advantage?

Medicare is a federal health insurance plan for adults aged 65 and over. Original Medicare is provided by the federal government and covers inpatient and home health care (Part A), as well as medically necessary services (Part B).Seniors can also choose Medicare Advantage plans through approved private insurance companies. These plans may bundle Part A and Part B coverage with additional benefits for dental, vision, hearing and wellness (Part C), as well as prescription drugs (Part D).

Where does federal health insurance come from?

Funding for federal health insurance comes from two trust funds which are dedicated to Medicare use and held by the U.S. Treasury.

What is Supplementary Medical Insurance Fund?

The Supplementary Medical Insurance Fund is composed of funds approved by Congress and Part B and Part D premiums paid by subscribers.