How do I report fraud, waste or abuse of Medicare?

You can report suspected fraud or corruption by:

- completing our reporting suspect fraud form

- completing our health provider fraud tip-off form

- calling our fraud hotline – 1800 829 403

- writing to us

How to report Medicare fraud, abuse, and waste?

- Department of Health and Human Services (HHS) Office of Inspector General (OIG) Medicare fraud hotline at 1-800-HHS-TIPS

- Contact the HHS by mail at HHS Tips Hotline, PO Box 23489, Washington, DC 20026-348

- Centers for Medicare and Medicaid Services at 1-800-MEDICARE

How do I identify Medicare fraud?

- Call Medicare’s help line at 800-633-4227.

- Call the Office of Inspector General directly at 800‑HHS‑TIPS (800‑447‑8477, or TTY 800‑377‑4950).

- File an online report with the Office of Inspector General.

How to help stop Medicare fraud?

Tips to prevent fraud

- Protect your Medicare Number and your Social Security Number.

- Use a calendar to record all of your doctor's appointments and any tests you get.

- Learn more about Medicare and recent scams.

- Know what a Medicare plan can and can't do before you join.

How much does Medicare cost?

What does FWA stand for in Medicare?

How much was Ryan's budget?

What is improper payment?

About this website

What is the Medicare fraud rate?

The FY 2020 Medicare FFS estimated improper payment rate is 6.27 percent, representing $25.74 billion in improper payments. This compares to the FY 2019 estimated improper payment rate of 7.25 percent, representing $28.91 billion in improper payments.

Is there a lot of Medicare fraud?

The total amount of Medicare fraud is difficult to track, because not all fraud is detected and not all suspicious claims turn out to be fraudulent. According to the Office of Management and Budget, Medicare "improper payments" were $47.9 billion in 2010, but some of these payments later turned out to be valid.

How common is fraud in healthcare?

The National Health Care Anti-Fraud Association estimates conservatively that health care fraud costs the nation about $68 billion annually. That's about 3 percent of the nation's $2.26 trillion in health care spending. Other estimates range as high as 10 percent of annual health care expenditure, or $230 billion.

What is a major part of Medicare fraud?

Billing for physician visits and services not rendered or not medically necessary. Billing for durable medical equipment such as wheelchairs, body jackets, incontinence supplies or diabetic supplies without a doctor's prescription.

What is fraud waste and abuse in healthcare?

What is it exactly? Well, fraud is when someone intentionally lies to a health insurance company, Medicaid or Medicare to get money. Waste is when someone overuses health services carelessly. And abuse happens when best medical practices aren't followed, leading to expenses and treatments that aren't needed.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Why is Medicare fraud an issue?

There are health care consequences due to Medicare fraud. A beneficiary may later receive improper medical treatment from legitimate providers because of inaccurate medical records that may contain false diagnoses or incorrect lab results.

How extensive is healthcare fraud?

The National Health Care Anti-Fraud Association (NHCAA) estimates that the financial losses due to health care fraud are in the tens of billions of dollars each year.

How to report Medicare fraud?

To help fight Medicare fraud, waste, and abuse report any suspicious activity to 1-800-HHS-TIPS (1-800-447-8477). You can also describe the incident in up to ten pages and email it to [email protected].

How much is Medicare fraud penalty?

Your coverage should be more important than profits. Penalties for committing Medicare fraud can reach nearly $100,000 and result in extraction from all government health care programs.

Why does the government lose millions of dollars in Medicare?

The government loses millions each year due to Medicare fraud, waste, and abuse, causing prices to rise. Medicare fraud, waste, and abuse come from a series of laws designed to protect all parties involved in Medicare and Medicaid.

What is the False Claims Act?

False Claims Act (FCA) – Protects the government from being overcharged on goods or services. No proof of intent is required.

Can a doctor make a referral to a health care company?

Physician Self-Referral Law (Stark Law) – Doctors cannot make referrals to health care companies in which they have an interest. Criminal Health Care Fraud Statute – Cannot defraud; bill for unnecessary medical goods and services (like drugs that are not needed or wheelchairs for those who are not impaired). [clickToTweet tweet=”The government ...

How much does Medicare cost?

It is massive: The program spends about $700 billion per year serving some 58 million Americans and making payments to 1 million entities.

What does FWA stand for in Medicare?

Waste is enough a problem that it is part of an acronym used by the federal Centers for Medicare & Medicaid Services: FWA, for fraud, waste and abuse. In a training manual for employees, CMS says with bold type and an exclamation point that "combating FWA is everyone’s responsibility!"

How much was Ryan's budget?

Of the $52 billion Ryan alluded to, $45 billion consisted of overpayments and $7 billion, underpayments, Badoyan told us.

What is improper payment?

Under federal law, an improper payment is one "that should not have been made or that was made in an incorrect amount, including overpayments and underpayments." These could range from coding errors in the billing process to fraud, such as companies billing Medicare for services that were never provided.

What is TPE in Medicare?

The Centers for Medicare and Medicaid Services (CMS) established the Targeted Probe and Educate (TPE) process in response to physicians concerns about how the Medicare Administrative Contractors (MAC) selected claims for review. TPE uses data analytics to target only those physicians who have high denial rates or unusual billing practices.

Does CMS allow RACs to request more medical records?

CMS will place a lower limit on the number of medical records a RAC may request of a physician with a low denial rate. CMS will also allow RACs to request more medical records from physicians with higher denial rates. The medical record limits will be adjusted as a physician’s denial rate decreases. Therefore, a physician who complies with Medicare rules will have fewer RAC document requirements.

Do RACs have to reimburse physicians for printing and mailing medical records?

RACs must reimburse physicians for the cost of printing and mailing medical records.

How does Medicare fraud, abuse and waste affect the original Medicare program?

Every year millions of dollars are taken from the original Medicare program through deceptive practices resulting in Medicare fraud, abuse and waste. Medicare fraud, abuse and waste not only hurt the original Medicare program as a whole, but everyone who receives original Medicare benefits. Medicare Pathways wants you to understand what constitutes Medicare fraud, abuse and waste and how you can do your part to protect the Medicare program by reporting suspicious behavior with regard to your treatment or items billed to Medicare on your behalf.

What is Medicare fraud?

First, Medicare, abuse and waste occurs when false claims are made on behalf of a Medicare beneficiary. For example, you visit a particular physician or medical clinic, they ask for your original Medicare card and give you a certain amount that is due, but then bill original Medicare for more than that amount. The physician or medical clinic then pockets the difference. Another type of Medicare fraud, abuse and waste is when someone bills original Medicare for services or equipment that a Medicare beneficiary never received or for items different from what the beneficiary received.

What are the red flags for Medicare?

Other “red flags” to watch for include pressure selling for higher priced services, receiving Medicare bills for services you have not received, so called “free” consultations for Medicare beneficiaries, marketing tactics being used by a provider such as charges for co-payments on services that are supposed to be covered 100 percent by original Medicare. (For more information regarding services that are covered 100 percent by original Medicare visit Medicare Pathways News Blog article regarding preventive services covered by original Medicare at no cost to the Medicare beneficiary.)

What is Medicare abuse?

Abuse includes any practice that does not provide patients with medically necessary services or meet professionally recognized standards of care.

Which Medicare programs prohibit fraudulent conduct?

In addition to Medicare Part A and Part B, Medicare Part C and Part D and Medicaid programs prohibit the fraudulent conduct addressed by

What is the role of third party payers in healthcare?

The U.S. health care system relies heavily on third-party payers to pay the majority of medical bills on behalf of patients . When the Federal Government covers items or services rendered to Medicare and Medicaid beneficiaries, the Federal fraud and abuse laws apply. Many similar State fraud and abuse laws apply to your provision of care under state-financed programs and to private-pay patients.

Why do doctors work for Medicare?

Most physicians try to work ethically, provide high-quality patient medical care, and submit proper claims. Trust is core to the physician-patient relationship. Medicare also places enormous trust in physicians. Medicare and other Federal health care programs rely on physicians’ medical judgment to treat patients with appropriate, medically necessary services, and to submit accurate claims for Medicare-covered health care items and services.

What is heat in Medicare?

The DOJ, OIG, and HHS established HEAT to build and strengthen existing programs combatting Medicare fraud while investing new resources and technology to prevent and detect fraud and abuse . HEAT expanded the DOJ-HHS Medicare Fraud Strike Force, which targets emerging or migrating fraud schemes, including fraud by criminals masquerading as health care providers or suppliers.

Is there a measure of fraud in health care?

Although no precise measure of health care fraud exists, those who exploit Federal health care programs can cost taxpayers billions of dollars while putting beneficiaries’ health and welfare at risk. The impact of these losses and risks magnifies as Medicare continues to serve a growing number of beneficiaries.

Is CPT copyrighted?

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSAR apply. CPT is a registered trademark of the American Medical Association. Applicable FARS/HHSAR Restrictions Apply to Government Use. Fee schedules, relative value units, conversion factors and/or related components are not assigned by the AMA, are not part of CPT, and the AMA is not recommending their use. The AMA does not directly or indirectly practice medicine or dispense medical services. The AMA assumes no liability of data contained or not contained herein.

What is the federal government's role in Medicaid fraud?

The federal government has a significant interest in combatting waste, fraud, and abuse in the Medicaid program because it provides more than half of the program’s financing (approximately 60 percent), but the states are largely responsible for carrying out Medicaid fraud prevention and detection activities because the states are the administrators of the program.

Why are there so many opportunities for Medicaid fraud?

Some of these opportunities are the result of efforts to guard against improper denial of benefits. Other opportunities exist because of the overwhelming effort required to verify every piece of information ...

What percentage of Medicaid payments were improper in 2014?

In 2014, 6.7 percent of all Medicaid payments were improper, causing Medicaid to be responsible for 14 percent ($17.5 billion) of all federal improper payments, second only to Medicare, which was responsible for 49 percent of federal improper payments.

What is Medicaid fraud recovery?

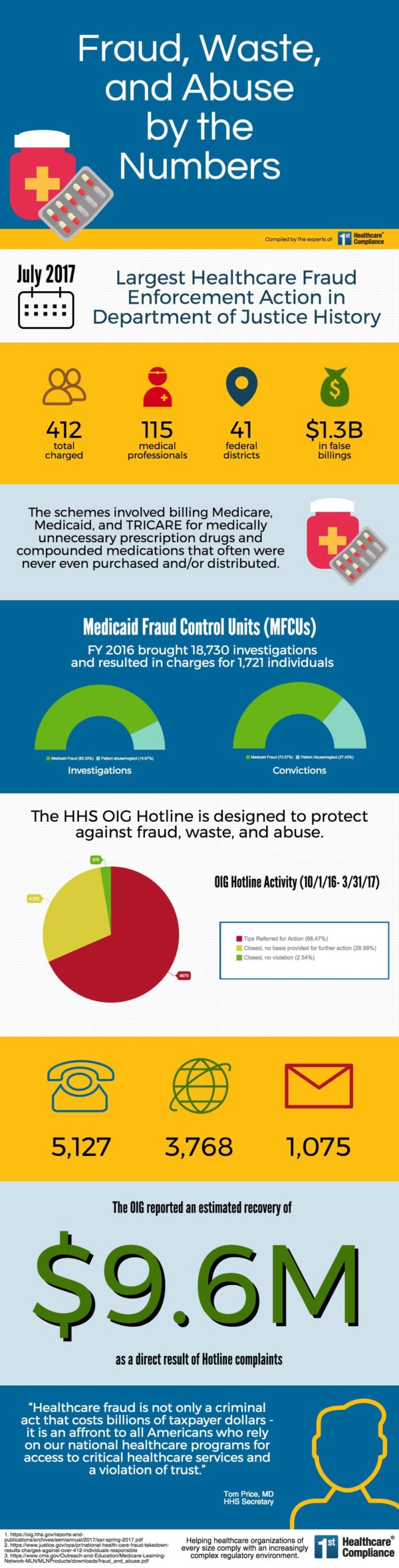

States’ fraud recovery efforts are largely carried out through Medicaid Fraud Control Units (MFCUs). These units typically operate through the state Attorney General’s office, and are certified and overseen by the HHS OIG. These units investigate and prosecute provider fraud, as well as investigate and report patient abuse and neglect in health care facilities. States are reimbursed with federal funds for operating expenses based on the amount of time a state’s MFCU has been operational: in the first three years, the federal government will pay 90 percent of a state’s costs, and 75 percent thereafter. [23]

What is improper payment?

Improper payments include payments of an incorrect amount (either overpayments or underpayments) or payments that should not have been made at all. Improper payments may be made to an ineligible recipient, made for an ineligible good or service, a duplicate payment, a payment for a good or service not provided or received, or a payment that does not account for credit of applicable discounts. Waste includes inaccurate payments for services, such as unintentional duplicate payments, or payments for unnecessary services or higher cost services when a lower-cost service would have served the patient just as well. Abuse occurs when an individual knowingly and intentionally misrepresents his or her actions or acts in a manner which is inconsistent with acceptable business or medical practices. [1]

When did CMS establish Medicaid Integrity Program?

In 2005, Congress ordered CMS to establish the Medicaid Integrity Program (MIP) and to develop every five years a strategy outlined in the Comprehensive Medicaid Integrity Plan (CMIP) which details how auditing contractors (RACs and Audit MICs) will be used and how CMS will effectively support state efforts to combat fraud and abuse. [28] CMS must report to Congress annually on their use and effectiveness of MIP funds. CMS contracts with independent Audit Medicaid Integrity Contractors (Audit MICs) and Recovery Audit Contractors (RACs) to audit providers and reconcile improper payments. [29]

How much has Medicaid increased since 2013?

Since 2013, enrollment in Medicaid has increased 25 percent. Total program expenditures increased 11 percent in 2014 and federal expenditures increased an estimated 16 percent in 2015.

How much does Medicare cost?

It is massive: The program spends about $700 billion per year serving some 58 million Americans and making payments to 1 million entities.

What does FWA stand for in Medicare?

Waste is enough a problem that it is part of an acronym used by the federal Centers for Medicare & Medicaid Services: FWA, for fraud, waste and abuse. In a training manual for employees, CMS says with bold type and an exclamation point that "combating FWA is everyone’s responsibility!"

How much was Ryan's budget?

Of the $52 billion Ryan alluded to, $45 billion consisted of overpayments and $7 billion, underpayments, Badoyan told us.

What is improper payment?

Under federal law, an improper payment is one "that should not have been made or that was made in an incorrect amount, including overpayments and underpayments." These could range from coding errors in the billing process to fraud, such as companies billing Medicare for services that were never provided.