How much has Congress borrowed from Social Security? The total amount borrowed was $17.5 billion. The Old-Age and Survivors Trust Fund borrowed the money-$5.1 billion from the Disability Trust Fund and $12.4 billion from the Medicare Trust Fund.

How much does the government spend on Medicare?

In fact, payroll taxes and premiums together only cover about half of the program’s cost. Medicare is the second largest program in the federal budget: 2020 Medicare expenditures, net of offsetting receipts, totaled $776 billion — representing 12 percent of total federal spending.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers.

How much has Obama taken from Medicare to fund Obamacare?

A report issued by the Congressional Budget Office (CBO) finds that the amount of money President Obama has taken from Medicare to fund Obamacare totals $716 Billion: Senger, Alyene, Heritage.org, "Obamacare Robs Medicare of $716 Billion to Fund Itself".

How much has the federal government borrowed from the Social Security Fund?

That $2.85 Trillion was “borrowed” by the Federal Government. All that is left is a file cabinet at the Bureau of Public Debt filled with non-negotiable bonds. Congress has borrowed from the Social Security Trust Fund since it began.

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

Who was the first president to dip into Social Security?

President Jimmy Carter1.SOCIAL SECURITY SYSTEM--May 9, 19773.SOCIAL SECURITY FINANCING BILL -- October 27, 19774.SOCIAL SECURITY FINANCING LEGISLATION -- December 1, 19775.SOCIAL SECURITY AMENDMENTS OF 1977 --December 20, 19776.SOCIAL SECURITY FINANCING LEGISLATION --April 10, 19788 more rows

When did Congress start borrowing from Social Security?

Where the idea comes into play that Congress stole from Social Security is, during this 1968 to 1990 period (1990 is when Social Security was completely off-budget again), it's believed that lawmakers commingled Social Security's asset reserves (i.e., its aggregate annual net-cash surpluses built up since inception) ...

Who does the US government borrow money from?

The public holds over $22 trillion of the national debt. 3 Foreign governments hold a large portion of the public debt, while the rest is owned by U.S. banks and investors, the Federal Reserve, state and local governments, mutual funds, pensions funds, insurance companies, and holders of savings bonds.

Did the government borrow from Social Security?

The Social Security Trust Fund has never been "put into the general fund of the government." Most likely this question comes from a confusion between the financing of the Social Security program and the way the Social Security Trust Fund is treated in federal budget accounting.

Why is Social Security running out of money?

Over the next ten plus years, the Social Security administration will draw down its reserves as a decreasing number of workers will be paying for an increasing number of beneficiaries. This is due to a decline in the birth rate after the baby boom period that took place right after World War II, from 1946 to 1964.

How much has the US government borrowed from Social Security?

The total amount borrowed was $17.5 billion.

Did Congress steal from Social Security?

Myth #5: The government raids Social Security to pay for other programs. The facts: The two trust funds that pay out Social Security benefits — one for retirees and their survivors, the other for people with disabilities — have never been part of the federal government's general fund.

What did Ronald Reagan do to Social Security?

In 1981, Reagan ordered the Social Security Administration (SSA) to tighten up enforcement of the Disability Amendments Act of 1980, which resulted in more than a million disability beneficiaries having their benefits stopped.

Who holds the most U.S. debt?

Of the total 7.55 trillion held by foreign countries, Japan and Mainland China held the greatest portions. China held 1.05 trillion U.S. dollars in U.S. securities. Japan held 1.3 trillion U.S. dollars worth. Other foreign holders included oil exporting countries and Caribbean banking centers.

Which country has no debt?

In 2020, Russia's estimated level of national debt reached about 19.28 percent of the GDP, ranking 14th of the countries with the lowest national debt....The 20 countries with the lowest national debt in 2020 in relation to gross domestic product (GDP)CharacteristicNational debt in relation to GDPTuvalu7.29%12 more rows

How much would each person have to pay to pay off the national debt?

$91,490 for every person living in the U.S.[7] $234,286 for every household in the U.S.[8] 70% more than the combined consumer debt of every household in the U.S.[9] 6.8 times annual federal revenues.

How much money did Obama take from Medicare?

A report issued by the Congressional Budget Office (CBO) finds that the amount of money President Obama has taken from Medicare to fund Obamacare totals $716 Billion: Obama's Cuts to Medicare: Total Amount Cut by Service: Hospital Services.

Why is Wyden's call to insert negotiation into Medicare Part D misleading?

Wyden’s call to insert negotiation into Medicare Part D is misleading because there already is competition and negotiation in the healthcare program. Part D facilitates negotiation between pharmacy benefit managers (PBMs), pharmaceutical manufacturers, and plans.

How many IRS agents are there in 2019?

This is an increase from 2019, when the number was 60 percent. And now President Biden and the Democrats want to sic 87,000 new IRS agents on the American people, with a 50 percent increase in small business audits.

How many IRS agents will be added to Nationals Park?

It would add a whopping 87,000 new IRS agents – enough to fill Nationals Park twice. That is a greater quantity of agents than all the personnel on all 11 U.S. aircraft carriers.

What is Biden's plan for taxes?

Included in this plan is a proposal to slug small businesses with higher taxes by eliminating step-up in basis and creating a second death tax.

How many employees did pass throughs have in 2011?

The majority, or 64 percent, of pass-throughs in 2011 had fewer than five employees while nearly 99 percent had fewer than 500 employees, according to the Congressional Research Service . Of the 26 million businesses in 2014, 95 percent were pass-throughs.

Who is the president of Americans for Tax Reform?

Americans for Tax Reform President Grover Norquist appeared today on Fox Business Network’s Mornings with Maria to discuss the Democrats' socialist tax-and-spend plan, legislation they’ve named, “Build Back Better.” Norquist warned the bill will lead to higher taxes, reduced American global competitiveness, and tax carveouts for Democrats’ special interests.

What percentage of Medicare is from the federal government?

The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970. Looking forward, such revenues are projected to continue funding a major share of the Medicare program.

How much of Medicare is financed?

As a whole, only 53 percent of Medicare’s costs were financed through payroll taxes, premiums, and other receipts in 2020. Payments from the federal government’s general fund made up the difference.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

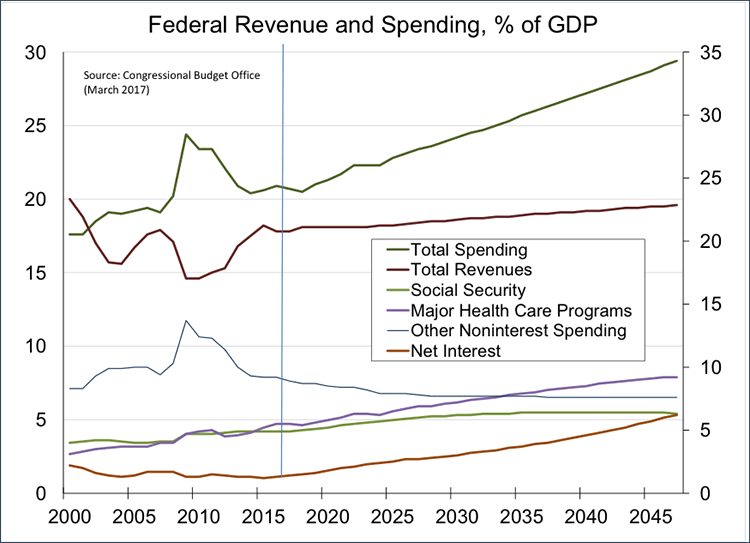

What percentage of GDP will Medicare be in 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

How much did Medicare cost in 2019?

In 2019, it cost $644 billion — representing 14 percent of total federal spending. 1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending. In 2019, Medicare provided benefits to 19 percent of the population. 2.

How much will Medicaid cost in 2030?

By 2030, the cost will almost double to $665 billion, exceeding that of Medicaid. 1 It's not a mandatory program, but it must be paid in order to avoid a U.S. debt default. These estimates will increase if interest rates rise.

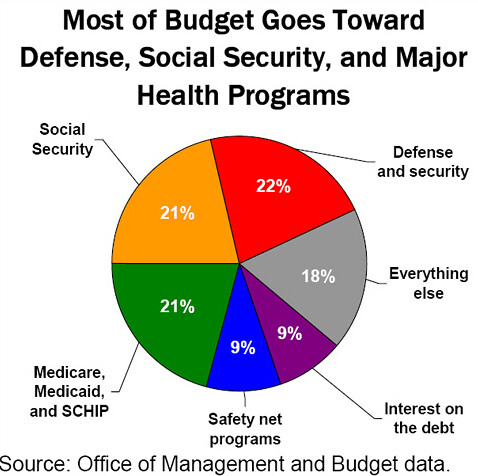

What is the next largest expense for Social Security?

10 It also means that Congress can no longer "borrow" from the Social Security Trust Fund to pay for other federal programs. Medicare ( $722 billion) and Medicaid ($448 billion) are the next largest expenses.

How much is the national debt in 2021?

These are part of mandatory spending, which are programs established by prior Acts of Congress. The interest payments on the national debt total $378 billion for FY 2021. They are necessary to maintain faith in the U.S. government. About $1.485 trillion in FY 2021 goes toward discretionary spending, which pays for all federal government agencies.

How much did the government spend during the Great Recession?

In the decade leading up to the Great Recession, the government kept federal spending below 20% of GDP. It grew no faster than the economy, around 2% to 3% per year. During the recession, spending grew to a record 24.4% of GDP in FY 2009. This increase was due to economic stimulus and two overseas wars. 3

What is the budget for FY 2021?

Key Takeaways. Government spending for FY 2021 budget is $4.829 trillion. Despite sequestration to curb government spending, deficit spending has increased with the government’s effort to continually boost economic growth. Two-thirds of federal expenses must go to mandatory programs such as Social Security, Medicare, and Medicaid.

How much will the mandatory budget cost in 2021?

The mandatory budget will cost $2.966 trillion in FY 2021. 1 Mandatory spending is skyrocketing, because more baby boomers are reaching retirement age. By 2030, one in five Americans will be older than 65. 8

How much is discretionary spending?

Discretionary spending is $1.485 trillion. 1 It pays for everything else. Congress decides how much to appropriate for these programs each year. It's the only government spending that Congress can cut. 12

How is Medicare funded?

Rather, they are funded through a combination of enrollee premiums (which support only about one-quarter of their costs) and general revenues —another way of saying the government borrows most of the money it needs to pay for Medicare.

Why did Medicare build up a trust fund?

Because it anticipated the aging Boomers, Medicare built up a trust fund while its costs were relatively low. But that reserve is rapidly being drained, and, in 2026, will be out the money. That is the source of all those “going broke” headlines.

When did Medicare change to Medicare Access and CHIP?

But that forecast is built on several key assumptions that are unlikely to occur. In the 2010 Affordable Care Act, Congress adopted a package of cost-cutting measures. In 2015, in a law called the Medicare Access and CHIP Reauthorization Act (MACRA), it began to change the way Medicare pays physicians, shifting from a system that pays by volume to one that is intended to pay for quality. As part of the transition, MACRA increased payments to doctors until 2025.

What is Medicare report?

The report is an annual exercise designed to review the health of the nation’s biggest health insurance program. It looks in detail at each of Medicare’s pieces, including Part A inpatient hospital insurance; Part B coverage for outpatient hospital care, physician services, and the like; Part C Medicare Advantage plans; and Part D drug insurance.

Will Medicare costs increase in the next 75 years?

So we face what the economists like to call an asymmetric risk: It is possible that future Medicare costs will grow more slowly than predicted, but it is more likely that they’ll be significantly higher than the trustees forecast .

Will Medicare go out of business in 2026?

No, Medicare Won't Go Broke In 2026. Yes, It Will Cost A Lot More Money. Opinions expressed by Forbes Contributors are their own. It was hard to miss the headlines coming from yesterday’s Medicare Trustees report: Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026.

Will Medicare stop paying hospital insurance?

It doesn’t mean Medicare will stop paying hospital insurance benefits in eight years. We don’t know what Congress will do—though the answer is probably nothing until the last minute. Lawmakers could raise the payroll tax.

How much interest did Social Security collect in 2017?

Ultimately, Congress' borrowing allowed Social Security to collect $85.1 billion in interest income for 2017, and it's expected to provide $804 billion in aggregate interest income between 2018 and 2027.

How many people are receiving Social Security?

Of the nearly 63 million people currently receiving a benefit check, more than a third are being kept out of poverty as a result of the added income they're receiving from the program.

How much is the Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook. If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

What are the effects of Social Security?

Ongoing demographic changes that include the retirement of baby boomers, increased longevity, lower fertility rates, and growing income inequality, are adversely impacting Social Security. According to the June 2018 report, the program is soon expected to begin paying out more money than it collects each year.

When was Social Security signed into law?

Yet for as important as Social Security is, it's also about to encounter its biggest speed bump since being signed into law back in 1935.

Will Social Security be cut in 2034?

Based on the estimates of the Trustees, Social Security's $2.9 trillion in asset reserves will be completely gone by 2034. Should lawmakers not find a way to raise additional revenue and/or cut expenditures by then, an across-the-board cut in benefits of up to 21% may await. That's particularly worrisome, given that 62% of retired workers rely on their benefit check to account for at least half of their income.

Is Social Security generating interest income?

What's more, Social Security is already generating interest income from the federal government on its borrowing. As of Dec. 31, 2018, the $2.9 trillion in special-issue bonds and certificates of indebtedness were yielding an average of 2.85%. Since these bonds range in maturity from 1 to 15 years, there's plenty of opportunity to take advantage of rising yields and adjust the program's bond investments as needed.

How long was Social Security on budget?

This means at no point over this 22-year period where Social Security was on-budget did a dime of Social Security income, benefits, or asset reserves get commingled with the federal government's General Fund.

How much interest did Social Security get in 2018?

In 2018, $83 billion in interest income was collected by Social Security. If the folks who believe that Congress stole from Social Security got their way, and the federal government repaid every cent it borrowed, Social Security would have lost out on this $83 billion in interest income in 2018.

Why is Social Security facing a huge cash shortfall?

One of the more common theories as to why Social Security is facing a huge long-term cash shortfall is that lawmakers in Congress have pilfered cash from the program and never returned it. This idea goes all the way back to 1968, when then-President Lyndon B. Johnson made a change to how the federal budget would be presented.

How much is Social Security shortfall?

According to the latest report from the Social Security Board of Trustees, Social Security is staring down a $13.9 trillion cash shortfall between 2035 and 2093, with the expectation that its $2.9 trillion in asset reserves will be completely exhausted in ...

What has Congress not done?

What Congress hasn't done is steal from Social Security. However, lawmakers have known of the program's shortcomings since 1985, and have yet to find a middle-ground solution to fix it. If you want to point the finger at lawmakers, do so because bountiful solutions exist, but political hubris appears to be getting in the way.

What was the President's Commission on Budget Concepts?

Prior to 1974, before Congress had an independent budgeting process, the President's Commission on Budget Concepts had three separate budgets, all of which had differing deficits. To simplify things, Johnson called for Social Security and its trust funds to be included in the annual federal budget. In 1983, the Reagan administration voted ...

When did Social Security get pilfered?

First of all, there's the period between 1968 and 1990, which is believed to be when Congress pilfered America's top social program. What needs to be understood here is that, while Social Security's two trusts (the Old Age and Survivors Insurance Trust and Disability Insurance Trust) and its asset reserves were technically "on-budget," funding ...

How much money does the government owe to the Social Security Fund?

Technically the government owes the Social Security fund an estimated $2.9 trillion, money that has been used and not repaid to the fund. The money is legally held in a special type of bond that by law cannot be used for any other purpose other than to put the money back into the fund.

When will Social Security outflow exceed inflow?

There is an ongoing debate about whether the Federal government and its spending policies are responsible for the current projections that by the year 2034 the outflow of payments will exceed the inflow of tax revenues to fund the social security program.

Why is Social Security like a lottery?

Actually, the Social Security program has become much like a state lottery or casino because it depends on people playing, not to fund the intended program (education, assistance for the elderly) but to fill holes in the larger budget where overspending has occurred.

Do millennials pay taxes?

Millennials and younger generations complain they are paying their taxes in just to finance the 63 million retirees, about half who depend on their Social Security check to pay part or all of their monthly bills. But when looking at that $2.9 trillion owed to the fund, and the fact that the fund actually has more money going in than coming out, the problem clearly lies with the government’s addiction to spending. Money is the drug of choice in Washington D.C., and whoever gets elected will get their fix sooner or later.

Is there cash in the bank to pay out Social Security benefits?

There is no cash in the bank to pay out monthly benefit checks. The Congress, those keepers of the financial retirement flame, have been using Social Security taxes to fund other parts of the government because, well the money is there.

Is the $2.9 trillion problem the government's fault?

An odd thing is taking place in some financial and economic circles, where people are arguing that the problem of the $2.9 trillion is somehow not the government’s fault and is really not that big of a deal. The clock is running and no one seems to have a solution, yet all admit the government does owe the Social Security fund the money and that the government continues to borrow from the fund every year. Maybe many of these so-called experts won’t be around in 2034 and can act as if the problem is not really a problem. The real problem is that neither the average person or the accountants and financial planners in the government actually understand what $1 trillion is in real money. Maybe someone could make $1 trillion in dollar bill sized pieces of paper and have them delivered to the Congress. But that would cost too much.