How much has the federal government borrowed from the Social Security Fund?

That $2.85 Trillion was “borrowed” by the Federal Government. All that is left is a file cabinet at the Bureau of Public Debt filled with non-negotiable bonds. Congress has borrowed from the Social Security Trust Fund since it began.

How much money does the US owe to Social Security?

In fact, the United States Treasury even created special bonds to to show how much money they owed to Social Security. Over the next thirty years, that surplus grew to almost $3 Trillion.

How much has Congress taken from social security 16 years later?

Over half a million people have read his answers and he is one of Quora’s top-ranked experts on Social Security, Government, and several other issues. Post navigation 16 Years Later: Congress Has Taken Nearly $2.9 Trillion From Social Security

Why is the government still using social security to fund other government?

The Congress, those keepers of the financial retirement flame, have been using Social Security taxes to fund other parts of the government because, well the money is there. Technically the government owes the Social Security fund an estimated $2.9 trillion, money that has been used and not repaid to the fund.

Which president started borrowing from Social Security?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

Has the government ever borrowed from the Social Security fund?

The Social Security Trust Fund has never been "put into the general fund of the government." Most likely this question comes from a confusion between the financing of the Social Security program and the way the Social Security Trust Fund is treated in federal budget accounting.

Does the government owe money to the Social Security fund?

Social Security benefits are paid from the reserves of the Old-Age, Survivors, and Disability Insurance ( OASDI ) trust fund. The reserves are funded from dedicated tax revenues and interest on accumulated reserve holdings, which are invested in Treasury securities.

Did Congress borrow from Social Security?

In 2018, $83 billion in interest income was collected by Social Security. If the folks who believe that Congress stole from Social Security got their way, and the federal government repaid every cent it borrowed, Social Security would have lost out on this $83 billion in interest income in 2018.

How much money does the federal government owe Social Security?

pdf) to get the answer. So, that's almost $2.6 trillion for the Old-Age and Survivors Insurance trust fund, plus an additional $140 billion or so for the Disability Insurance trust fund. Ouch.

Why is Social Security running out of money?

Over the next ten plus years, the Social Security administration will draw down its reserves as a decreasing number of workers will be paying for an increasing number of beneficiaries. This is due to a decline in the birth rate after the baby boom period that took place right after World War II, from 1946 to 1964.

Who holds the most U.S. debt?

Of the total 7.55 trillion held by foreign countries, Japan and Mainland China held the greatest portions. China held 1.05 trillion U.S. dollars in U.S. securities. Japan held 1.3 trillion U.S. dollars worth. Other foreign holders included oil exporting countries and Caribbean banking centers.

Is Social Security debt?

The current debt limit of $28.5 trillion includes both debt issued to the public and intragovernmental debt, meaning non-tradable bonds issued to various government trust funds. The largest holding of intragovernmental debt is the $2.8 trillion in Social Security's retirement and disability trust funds.

How much interest did Social Security collect in 2017?

Ultimately, Congress' borrowing allowed Social Security to collect $85.1 billion in interest income for 2017, and it's expected to provide $804 billion in aggregate interest income between 2018 and 2027.

How much is the Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook. If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

How long is Social Security?

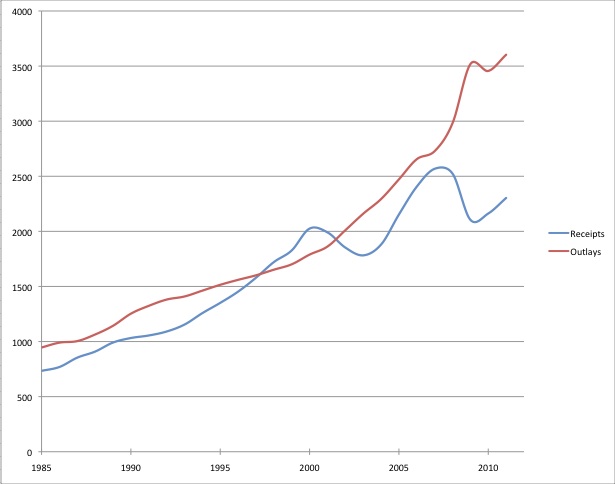

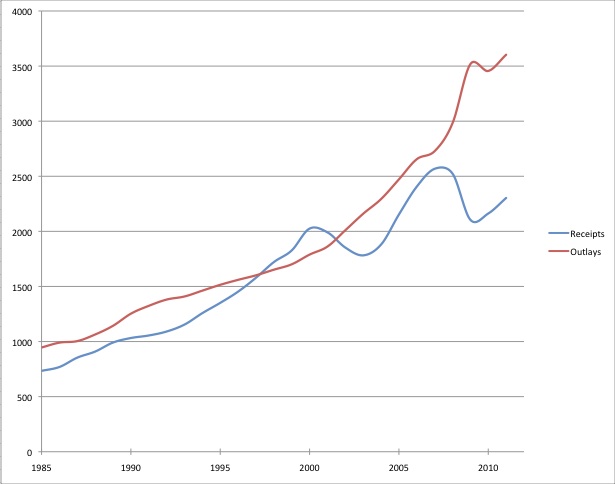

Every year, the Social Security Board of Trustees releases a report examining the short-term (10 year) and long-term (75 year) outlook for America's most important social program. Since 1985 , it's been warning that long-term revenue wouldn't be sufficient to sustain the existing payout schedule, ...

What are the effects of Social Security?

Ongoing demographic changes that include the retirement of baby boomers, increased longevity, lower fertility rates, and growing income inequality, are adversely impacting Social Security. According to the June 2018 report, the program is soon expected to begin paying out more money than it collects each year.

Has the government taken a dime from Social Security?

The federal government hasn't pilfered a dime from Social Security. The fact is that Congress, despite borrowing $2.9 trillion from Social Security, hasn't pilfered or misappropriated a red cent from the program.

The U.S. Treasury is required by law to issue bonds with Social Security surplus money

According to PolitiFact, a Social Security surplus has been building ever since former President Ronald Reagan, anticipating Baby Boomers reaching retirement, hiked payroll taxes in 1982. The U.S. Treasury is required by law to invest surplus Social Security funds in special Treasury bonds.

The surplus money can be used on any number of government projects

PolitiFact detailed this process in 2015 in response to social media posts that claimed former President George W. Bush borrowed $1.37 trillion of Social Security surplus to pay for the Iraq War and for tax cuts for the wealthy.

The borrowing averts inflation losses and gives Social Security billions in interest earnings

In 2020, The Motley Fool's Sean Williams argued that the funds the government is borrowing from Social Security are capital that “would otherwise be losing money to inflation.

How much money does the government owe to the Social Security Fund?

Technically the government owes the Social Security fund an estimated $2.9 trillion, money that has been used and not repaid to the fund. The money is legally held in a special type of bond that by law cannot be used for any other purpose other than to put the money back into the fund.

Why is Social Security like a lottery?

Actually, the Social Security program has become much like a state lottery or casino because it depends on people playing, not to fund the intended program (education, assistance for the elderly) but to fill holes in the larger budget where overspending has occurred.

When will Social Security outflow exceed inflow?

There is an ongoing debate about whether the Federal government and its spending policies are responsible for the current projections that by the year 2034 the outflow of payments will exceed the inflow of tax revenues to fund the social security program.

Is there cash in the bank for Social Security?

There is no cash in the bank to pay out monthly benefit checks. The Congress, those keepers of the financial retirement flame, have been using Social Security taxes to fund other parts of the government because, well the money is there. Technically the government owes the Social Security fund an estimated $2.9 trillion, ...

How long was Social Security on budget?

This means at no point over this 22-year period where Social Security was on-budget did a dime of Social Security income, benefits, or asset reserves get commingled with the federal government's General Fund.

How much interest did Social Security get in 2018?

In 2018, $83 billion in interest income was collected by Social Security. If the folks who believe that Congress stole from Social Security got their way, and the federal government repaid every cent it borrowed, Social Security would have lost out on this $83 billion in interest income in 2018.

Why is Social Security facing a huge cash shortfall?

One of the more common theories as to why Social Security is facing a huge long-term cash shortfall is that lawmakers in Congress have pilfered cash from the program and never returned it. This idea goes all the way back to 1968, when then-President Lyndon B. Johnson made a change to how the federal budget would be presented.

How much is Social Security shortfall?

According to the latest report from the Social Security Board of Trustees, Social Security is staring down a $13.9 trillion cash shortfall between 2035 and 2093, with the expectation that its $2.9 trillion in asset reserves will be completely exhausted in ...

What was the President's Commission on Budget Concepts?

Prior to 1974, before Congress had an independent budgeting process, the President's Commission on Budget Concepts had three separate budgets, all of which had differing deficits. To simplify things, Johnson called for Social Security and its trust funds to be included in the annual federal budget. In 1983, the Reagan administration voted ...

When did Social Security get pilfered?

First of all, there's the period between 1968 and 1990, which is believed to be when Congress pilfered America's top social program. What needs to be understood here is that, while Social Security's two trusts (the Old Age and Survivors Insurance Trust and Disability Insurance Trust) and its asset reserves were technically "on-budget," funding ...

Is Social Security going bankrupt?

On one hand, there is solace in knowing that Social Security isn't going bankrupt, which is a function of two of the program's revenue sources being recurring (the payroll tax on earned income and the taxation of benefits). On the other hand, there's no sugarcoating the worry that would follow if benefit cuts of up to 23% are passed along ...

How much money does the government borrow from Social Security?

The amount of money the federal government has borrowed from the Social Security trust fund, the Medicare trust fund and other government agencies just crossed the $5 trillion mark. Politicians downplay the number, saying it isn't really debt; it's money the government "owes itself.". But the bulk of that $5 trillion doesn't belong to ...

How much money does the government need to make to make good on its promises to retirees?

Long-term, the federal government will need to come up with over half a trillion dollars per year to make good on its promises to our retirees. But it won't come up with the money. Raising over half a trillion dollars in revenue would require either raising taxes by 30% or doubling the current deficit.

When will the $5 trillion end?

According to the Social Security Board of Trustees, Social Security's unbroken string of budget surpluses will come to a permanent end in 2020. From then on, not only will Washington have lost a major source of cheap financing, the money will need to start flowing in ...

When will the rules change for Social Security?

And it will change the rules again sometime around 2020. Congress is a unique risk to which private retirement accounts are largely immune.

Is Social Security privatized?

Expect to see it soon. For decades, economists have called for Social Security to be privatized. Opponents said that privatization would be foolish because financial markets are risky while Social Security is safe because the Social Security trust fund invests only in U.S. Treasury Bills.

Should I opt out of Social Security at 40?

But that's precisely who Social Security should be helping. Allowing Americans a one-shot choice at opting out of Social Security at age 40 would both shrink Social Security to a far more financially prudent size and return its mission to that of a safety net for the poor.

Does Social Security give back money?

That is true, but it turns out that it was only part of the truth. While the law requires Social Security to invest its surplus in Treasury Bills, the law does not require Social Security to give taxpayers their money back. At any point Congress can change the rules of the game.