Full Answer

How much does Medicare cost per month?

Medicare costs at a glance. If you buy Part A, you'll pay up to $437 each month in 2019 ($458 in 2020). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437 ($458 in 2020). If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240 ($252 in 2020).

How much money can you put on a Medicare flex card?

You must be enrolled in a Medicare Advantage plan that includes a flex card benefit to qualify for a card. The amount of money loaded onto your card depends on the specific health plan in which you are enrolled. On average, you can expect about $500 to be loaded onto most flex cards.

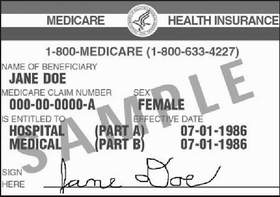

What is a Medicare drug plan card?

If you have a Medicare drug plan or supplemental coverage, carry that plan card with you too. A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare.

How much can you pay out-of-pocket for Medicare?

There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance ( An insurance policy you can buy to help lower your share of certain costs for Part A and Part B services (Original Medicare).

Is Medicare free for anyone?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.

Can I get a Medicare card online?

How to get a Medicare card online. You can get your own Medicare card using: your Medicare online account through myGov. the Express Plus Medicare mobile app.

How long does it take to get Medicare card after applying?

about 3 weeksYou'll receive your card within about 3 weeks from the date you apply for Medicare. You should carry your card with you whenever you're away from home. You can sign in to your MyMedicare.gov account if you need to print a replacement card.

Does Medicare automatically send you a card?

You should automatically receive your Medicare card three months before your 65th birthday. You will automatically be enrolled in Medicare after 24 months and should receive your Medicare card in the 25th month.

How long do Medicare cards last?

Replacing your Medicare card Medicare cards are valid for 5 years. We'll send you a new card before your old one expires. You don't have to do anything unless your address has changed. If it has, update your details so the card gets to you.

What documents do I need to apply for Medicare?

What documents do I need to enroll in Medicare?your Social Security number.your date and place of birth.your citizenship status.the name and Social Security number of your current spouse and any former spouses.the date and place of any marriages or divorces you've had.More items...

At what age do you get your own Medicare card?

15When your child turns 15, they can get their own Medicare card. A Medicare card gives them access to a range of medical services and prescriptions at a lower cost.

When should I get my Medicare card?

Your Medicare card should arrive about three months before your 65th birthday, and your Medicare coverage starts the first day of the month you turn 65.

Can I get Medicare at age 62?

The typical age requirement for Medicare is 65, unless you qualify because you have a disability. 2. If you retire before 65, you may be eligible for Social Security benefits starting at age 62, but you are not eligible for Medicare.

Are you automatically signed up for Medicare when you turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Do you automatically receive a Medicare card when you turn 65?

You should receive your Medicare card in the mail three months before your 65th birthday. If you are NOT receiving benefits from Social Security or the RRB at least four months before you turn 65, you will need to sign up with Social Security to get Parts A and B.

What is a red Medicare card?

Key Takeaways. Medicare will send you a red, white and blue card in the mail. This card will include your unique Medicare number and the start date of your Parts A and/or B benefits. If you are enrolled in Medicaid, Medicare Advantage, Medigap or Part D prescription drug plan, you will receive separate cards.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What Are The Best Prescription Discount Cards

Dont confuse a health insurance card with prescription drug discount cards. A health insurance ID card is proof of insurance to use when you visit a health care provider, physician, or hospital while a drug card helps you fill a prescription at a discounted price.

Medicare Discount Cards From Hell

Beginning next week, Medicare participants can begin using a prescription-drug discount card designed to help anyone over 65 save money on medication.

Can Medicare Patients Use A Discount Card With Part D

Unfortunately, if youre on Medicare, you wont be able to use a manufacturer coupon alongside Medicare. Coupons cannot be paired with any federal insurance program, including Medicaid. Coupons are primarily for patients with commercial insurance or no insurance.

Can I Use A Drug Discount Card With Medicare Advantage

Medicare Advantage plans prove to be helpful. But even if you dont have drug coverage through your Advantage plan, you can still save money on your medications.

When To Use A Prescription Drug Discount Card

Using a prescription drug discount card makes sense for people who do not have insurance, but it can also help those who are covered, too. A discount card cannot be used in conjunction with your insurance, but using one could cost less than a copay or coinsurance for a drug. It may help to talk to your pharmacist to discuss your options.

How To Save Money With Your Medicare Drug Plan

Pick a Network Pharmacy. Your Medicare prescription drug plans may have a pharmacy network. This is a group of pharmacies that offer extra savings and discounts to plan members. Your plan might also have a special arrangement with certain preferred pharmacies that could mean additional savings.

Best Sites About Medicare Discount Card

At CouponsDoom, our top priority is to provide customers with the most up-to-date coupons and discounts available. We run a regular analysis of our coupon database to ensure that users get the best deals with the most recent offers and hott est coupons every time they visit our website.

What is Medicare Advantage over the counter?

What is the Medicare Advantage Over the Counter Drug Card? A Medicare Advantage over the counter drug card is a prepaid card for products. You can use your card to buy most health products, as well as medications. Your insurance carrier is in charge of reloading your card each month. Most major retail stores accept these cards, ...

Do pharmacies accept OTC cards?

Different pharmacies and stores can provide you with the over-the-counter products you need. Most major pharmacies and stores accept OTC drug cards, but of course, will vary.

Does Medicare Advantage cover over the counter drugs?

Medicare Advantage policies will often partner with large retail pharmacies. By doing this, it enables people to use over the counter benefits with their drug card. Some plans even include home delivery of your over the counter drugs. Your drug card balance and benefits will vary depending on your specific plan.

Can I get an OTC card without Medicare?

Can I Get an OTC Drug Card Without Medicare Advantage Coverage? Unfortunately, Medicare doesn’t cover the cost of your over the counter health products. Which means you’ll have to pay for things such as cold and flu medicine. But if you decide that you need help covering over the counter medications, you can buy a Medicare Advantage plan. ...

How much does a medical marijuana card cost in Pennsylvania?

Pennsylvania – In Pennsylvania, the medical marijuana card costs $50 . However, patients who receive assistance through other programs, such as Medicaid, PACE/PACENET, CHIP, SNAP, and WIC, may be eligible for discounted fees. Pennsylvania allows you to appoint two caregivers, and the fee per caregiver card is also $50.

How much does it cost to get a medical marijuana card in Oklahoma?

Oklahoma – The cost of a medical marijuana card in Oklahoma application or renewal is $100, plus a service fee of 4.30. However, if you are a fully disabled veteran or have Medicaid or Medicare, your fee is only $20. You will need to provide proof of your veteran status or your Medicaid/Medicare card during the application process to qualify.

What are the benefits of a medical marijuana card?

This helps ensure that you are receiving a quality product . Plus, one of the best benefits from your medical marijuana card is being able to purchase openly and legally from a knowledgeable cannabis cultivator or distributor. Elevate Holistics can help you find dispensaries near you.

How to reduce medical marijuana card costs?

You can reduce your overall medical marijuana card costs by doing everything at once. If you live in a state that allows cannabis cultivation for personal medical use, then you most likely will also have to complete another application and pay an additional fee for the certification to grow. In that case, you would need to weight the cost ...

When will the caregiver fee increase?

Fee increases are done on an annual basis, so that fee is set until June 2022. The caregiver medical marijuana card fee is the same as the patient card, with the same increase in July. The cultivator fee is $102.30, with an increase to $103.73 scheduled for July 2021.

Is it important to take on a medical marijuana card?

Taking on the medical marijuana card cost is another expense for you, although it can be a very important and crucial investment in your health and peace of mind. The first thing you need to know about working ...

Is marijuana medical card up to date?

Note: One small part of your marijuana medical card costs is making sure that your state identification is up-to-date. With BMV closures during Covid, keeping IDs up-to-date has been a little more complicated in some states. But be sure that your IDs, and your caregiver IDs, are current before you start the process.

Which pays first, Medicare or Medicaid?

Medicare pays first, and. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. pays second.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

Does Medicare have demonstration plans?

Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They’re called Medicare-Medicaid Plans. These plans include drug coverage and are only in certain states.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. . If you have Medicare and full Medicaid, you'll get your Part D prescription drugs through Medicare.

Can you get medicaid if you have too much income?

Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid. The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid. In this case, you're eligible for Medicaid because you're considered "medically needy."

Can you spend down on medicaid?

Medicaid spenddown. Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid . The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid.

Does Medicare cover prescription drugs?

. Medicaid may still cover some drugs and other care that Medicare doesn’t cover.