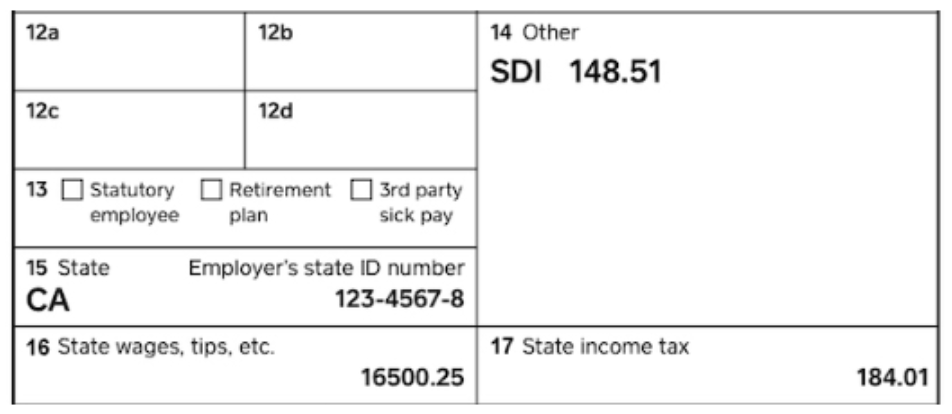

Your Medicare Part B premium will be deducted from your SSDI check. The standard Part B premium for 2021 is $148.50 per month. The deductible for Medicare Part B in 2021 is $203. After you meet the deductible, some services are covered in full. You’ll pay 20 percent of the Medicare-approved amount for other services.

How much does Medicare cost for people on disability?

The amount deducted is your monthly Part B premium ($170.10 or higher in 2022). You likely won't have to pay the Part A premium if you qualify for retirement benefits. The main thing to remember is that the process is not automatic if you have a Medicare Advantage or a Part D plan.

Can I deduct Medicare premiums from my Social Security benefits?

Jun 28, 2021 · Your Medicare Part B premium will be deducted from your SSDI check. The standard Part B premium for 2021 is $148.50 per month. The deductible for Medicare Part B in 2021 is $203. After you meet the...

What costs are automatically deducted from your Social Security benefits?

For those receiving Social Security benefits and enrolled in Medicare , the premiums for Medicare are usually automatically deducted from Social Security payments . How much does Medicare cost on disability? Most people pay a Part B premium of $144.60 each month.

Can I deduct my Medicare Part C or Part D premiums?

Jan 09, 2022 · If you work for someone else, Social Security taxes are deducted from your paycheck. The Social Security tax rate for 2022 is 6.2%, plus 1.45% for the Medicare tax. So, if your annual salary is $147,000, the amount that will …

How much does Medicare take out of my Social Security check?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

How does disability affect Medicare?

The health care services do not have to be related to the individual's disability in order to be covered. There are no illnesses or underlying conditions that disqualify people for Medicare coverage. Beneficiaries are entitled to an individualized assessment of whether they meet coverage criteria.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

How much will be deducted from my Social Security check for Medicare in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

How much money can you have in the bank with Social Security disability?

To get SSI, your countable resources must not be worth more than $2,000 for an individual or $3,000 for a couple. We call this the resource limit. Countable resources are the things you own that count toward the resource limit. Many things you own do not count.

What is the monthly amount for Social Security disability?

Social Security disability payments are modest At the beginning of 2019, Social Security paid an average monthly disability benefit of about $1,234 to all disabled workers.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise?

0:0011:57$200 Raise for Social Security, SSDI, SSI, VA - Now is the Time! - YouTubeYouTubeStart of suggested clipEnd of suggested clip200 per month raise for social. Security including retirement disability ssdi survivors ssi and vaMore200 per month raise for social. Security including retirement disability ssdi survivors ssi and va beneficiaries.

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is the Medicare Part B cost for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Is Medicare premium automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 per month. The deductible for Medicare Part B in 2021 is $203. After you meet the deductible, some services are covered in full. You’ll pay 20 percent of the Medicare-approved amount for other services.

How much is hospitalization for Medicare Part A 2021?

In 2021, hospitalization costs with Medicare Part A include: Deductible: $1,484 for each benefit period. Days 1–60: after the deductible has been met, inpatient stays will be completely covered until the 60th day the benefit period. Days 61–90: $371 per day coinsurance.

How long do you have to wait to get Medicare?

In most cases, you’ll need to wait 24 months before your Medicare coverage begins. There is a 2-year waiting period that begins the first month you receive a Social Security benefit check.

How long does a disability last?

Generally, this means you are unable to work and that your condition is expected to last for at least a year. Medicare doesn’t determine who is eligible for disability coverage.

How much is coinsurance for 61 days?

Days 61–90: $371 per day coinsurance. Day 91 and above: $742 per day coinsurance until you exhaust your lifetime reserve days (60 days for a lifetime) After 60 lifetime reserve days: you pay all costs.

How much is the Part A premium for 2021?

If you’re still younger than age 65 once that 8.5-year time period as passed, you’ll begin paying the Part A premium. In 2021, the standard Part A premium is $259.

When does Medicare start covering ALS?

If you have amyotrophic lateral sclerosis (ALS), also known as Lou Gehrig’s Disease, you’ll be enrolled in coverage in the first month you receive SSDI. If you have end stage renal disease (ESRD), your Medicare coverage normally begins after you’ve received 3 months of dialysis treatment.

Does Social Security disability qualify you for Medicare?

Everyone eligible for Social Security Disability Insurance ( SSDI ) benefits is also eligible for Medicare after a 24-month qualifying period.

What kind of Medicare do you get with disability?

People who meet all the criteria for Social Security Disability are generally automatically enrolled in Parts A and B. People who meet the standards, but do not qualify for Social Security benefits, can purchase Medicare by paying a monthly Part A premium, in addition to the monthly Part B premium.

Do you have to pay for Medicare Part B if you are disabled?

Most of the people who receive Social Security Disability benefits do have to pay a premium for Medicare Part B , but you may choose to opt out of this program if you already have medical insurance. Like Medicare Part B , you will need to pay a premium for Medicare Part D.

Does Social Security pay Medicare premiums?

Medicare Costs Deducted From Social Security Individuals enrolled in Medicare need to pay for the coverage. For those receiving Social Security benefits and enrolled in Medicare , the premiums for Medicare are usually automatically deducted from Social Security payments .

How much does Medicare cost on disability?

Most people pay a Part B premium of $144.60 each month. But some people who have been on Medicare for several years will pay slightly less (about $135) if their Social Security checks are low (due to a hold harmless provision). And some people will pay more.

What is the highest paying state for disability?

At 8.9 percent, West Virginia came in at the top of the list among states where the most people receive disability benefits. Residents there received $122.4 million in monthly benefits. West Virginia’s labor force participation rate was 52.7 percent – the lowest in the country.

Does disability automatically qualify you for Medicaid?

Medicaid is a medical insurance program designed for needy, low income people. While many Social Security Disability recipients do receive Medicaid , the program is not limited to the disabled . In most states, those who are eligible to receive SSI automatically qualify to receive Medicaid .

Not everyone pays for Medicare with their Social Security check

Lorraine Roberte is an insurance writer for The Balance. As a personal finance writer, her expertise includes money management and insurance-related topics. She has written hundreds of reviews of insurance products.

Who Is Eligible for Medicare?

Medicare is a social insurance program available to U.S. citizens and permanent residents 65 years of age or older. It’s also available to some younger Americans who are disabled or diagnosed with End-Stage Renal Disease (ESRD).

When Do You Have To Pay for Medicare?

If you don’t qualify for premium-free Part A coverage, you’ll need to pay a monthly premium. You’ll also have to pay a premium if you sign up for Part B, which is optional.

Medicare Costs You Can Deduct From Social Security

Most people who receive Social Security benefits will have their Medicare premiums automatically deducted. Here’s a closer look at what costs you can expect to see taken out of your checks.

Can You Change How You Pay for Medicare?

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you don’t qualify for Social Security benefits, you’ll get a bill from Medicare that you’ll need to pay via:

What does Medicare pay for?

Medicare pays for many different types of medical expenses. Part A covers inpatient hospital care, surgery, and home health care, among other items. Part B covers things such as preventive care, doctors’ visits, and durable medical equipment. Part D covers prescription drugs.

How much will I pay for Medicare?

The amount you’ll pay for Medicare depends on several factors, including your sign-up date, income, work history, prescription drug coverage, and whether you sign up for extra coverage with an Advantage or Medigap plan. The Medicare Plan Finder can help you compare costs between different plans.

How long does a disability last?

The government has a strict definition of disability. For instance, the disability must be expected to last at least one year. Your work history will also be considered—usually, you must have worked for about 10 years but possibly less depending on your age.

How long does it take to get Medicare if you appeal a decision?

The result: your wait for Medicare will be shorter than two years.

What is ESRD in Medicare?

ESRD, also known as permanent kidney failure, is a disease in which the kidneys no longer work. Typically, people with ESRD need regular dialysis or a kidney transplant (or both) to survive. Because of this immediate need, Medicare waives the waiting period. 2

What to do if your income is too high for medicaid?

If your income is too high to qualify for Medicaid, try a Medicare Savings Program (MSP), which generally has higher limits for income. As a bonus, if you qualify for an MSP, you automatically qualify for Extra Help, which subsidizes your Part D costs. Contact your state’s Medicaid office for more information.

What conditions are considered to be eligible for Medicare?

Even though most people on Social Security Disability Insurance must wait for Medicare coverage to begin, two conditions might ensure immediate eligibility: end-stage renal disease (ESRD) and Lou Gehrig’s disease (ALS).

When will Medicare be available for seniors?

July 16, 2020. Medicare is the government health insurance program for older adults. However, Medicare isn’t limited to only those 65 and up—Americans of any age are eligible for Medicare if they have a qualifying disability. Most people are automatically enrolled in Medicare Part A and Part B once they’ve been collecting Social Security Disability ...

Does Medicare cover ALS?

Medicare doesn’t require a waiting period for people diagnosed with ALS, but they need to qualify based on their own or their spouse’s work record. 3

How to save money on Medicare?

You can often save money on Medicare costs by joining a Medicare Advantage plan that offers coverage through an HMO or PPO. Many Medicare Advantage plans don't charge a monthly premium over the Part B premium, and some don't charge copays for doctor visits and other services.

How much does Medicare cost if you have a low Social Security check?

But some people who have been on Medicare for several years will pay slightly less (about $145) if their Social Security checks are low (due to a hold harmless provision). And some people will pay more. If your adjusted gross income is over $88,000 (or $176,000 for a couple), the monthly premium can be over $400.

How long after Social Security disability is Medicare free?

You are eligible for Medicare two years after your entitlement date for Social Security disability insurance (SSDI). (This is the date that your backpay was paid from; see our article on when medicare kicks in for SSDI recipients ). Medicare isn't free for most disability recipients though.

How much is the Part D premium for 2021?

Part D Costs. Part D premiums vary depending on the plan you choose. The maximum Part D deductible for 2021 is $445 per year, but some plans waive the deductible. There are subsidies available to pay for Part D for those with low income (called Extra Help).

How many quarters do you have to work to be fully insured?

Generally, being fully insured means having worked 40 quarters (the equivalent of 10 years) in a job paying FICA taxes. Many disability recipients aren't fully insured because they became physically or mentally unable to work before getting enough work credits.

Does Medicare go up every year?

There are premiums, deductibles, and copays for most parts of Medicare, and the costs go up every year. Here are the new figures for 2021, and how you can get help paying the costs.

Is Medicare expensive for disabled people?

Medicare can be quite expensive for those on disability who aren't fully insured, but if you are eligible to be a Qualified Medicare Beneficiary (QMB) because of low-income, a Medicare Savings Program will pay your Part A premium, and possibly other costs as well.

Who Pays The Premium For Medicare Advantage Plans

You continue to pay premiums for your Medicare Part B benefits when you enroll in a Medicare Advantage plan . Medicare decides the Part B premium rate. The standard 2021 Part B premium is $148.50, but it can be higher depending on your income. On average, those who received Social Security benefits will pay a lesser premium rate.

Look Closely At Your Bill

The type of “Medicare Premium Bill” you get shows if you’re at risk of losing your Medicare coverage for late payments:

Analyze Medicare Premiums With A Licensed Agent

Deductibles, coinsurance and other out-of-pocket costs may not always be predictable expenses, but premiums will be there month after month.

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

How Much Is Taken Out Exactly

There is no standard amount that is taken out of your Social Security check when you sign up for Medicare. Instead, the amount deducted depends on several factors. Each part of Medicare has a different cost. On top of this, Part C and Part D are offered by private plans, which means their monthly premiums vary even more.

How Do I Know If I Will Have Money Taken Out Of My Social Security Check

If you receive Social Security retirement benefits, your Medicare benefits will be deducted automatically. This means that you do not have to do anything to make this happen it will be automatic when you enroll in Medicare.

Nearly All Medicare Advantage Enrollees Are In Plans That Require Prior Authorization For Some Services

Medicare Advantage plans can require enrollees to receive prior authorization before a service will be covered, and nearly all Medicare Advantage enrollees are in plans that require prior authorization for some services in 2021.

How long do you have to wait to get Medicare if you have Social Security Disability?

Social Security Disability Insurance (SSDI) & Medicare coverage. If you get Social Security Disability Income (SSDI), you probably have Medicare or are in a 24-month waiting period before it starts. You have options in either case.

What is SSI disability?

Supplemental Security Income (SSI) Disability & Medicaid coverage. Waiting for a disability status decision and don’t have health insurance. No disability benefits, no health coverage. The Marketplace application and disabilities. More information about health care for people with disabilities.

Can I enroll in a Medicare Marketplace plan if I have Social Security Disability?

You’re considered covered under the health care law and don’t have to pay the penalty that people without coverage must pay. You can’t enroll in a Marketplace plan to replace or supplement your Medicare coverage.

Can I keep my Medicare Marketplace plan?

One exception: If you enrolled in a Marketplace plan before getting Medicare, you can keep your Marketplace plan as supplemental insurance when you enroll in Medicare. But if you do this, you’ll lose any premium tax credits and other savings for your Marketplace plan. Learn about other Medicare supplement options.

Can I get medicaid if I have SSDI?

You may be able to get Medicaid coverage while you wait. You can apply 2 ways: Create an account or log in to complete an application. Answer “ yes” when asked if you have a disability.

Can I get medicaid if I'm turned down?

If you’re turned down for Medicaid, you may be able to enroll in a private health plan through the Marketplace while waiting for your Medicare coverage to start.

Does Medicare Part A cover hospitalization?

En español | Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit. Medicare Part A, which covers hospitalization, is free for anyone who is eligible ...

Does Social Security deduct Medicare premiums?

In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.