The exception is Medicare, which reimburses only 85% of the standard fees for PA-provided care. To get around this rule, PAs are able to choose “bill incident to,” which consists of billing under a supervising physician if they are in the office. This brings in 100% of Medicare’s allowable fee instead of 85%.

Full Answer

Can Medicare reimbursements be enhanced or penalized for physician performance?

As a result, depending on physician performance within this program, Medicare reimbursements can be enhanced or penalized by up to 9%, although there is a two-year delay in this application (e.g. provider performance in 2021 will lead to the enhancement or penalty in 2023). CMS is committed to move towards value and away from fee-for-service.

How much does Medicare Part a cost?

Your costs for original Medicare can vary depending on your income and circumstances. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits.

Do Pas get 100% reimbursement from Medicare?

PAs that are able to “bill incident to” will collect 100% reimbursement, but those who do not qualify have to bill under their own Medicare number. This means they will only collect 85% reimbursement for the same service. Many PAs are upset by the 85% rule and feel it is an insult, whereas others do not seem to mind or be offended at all.

How much can you pay out-of-pocket for Medicare?

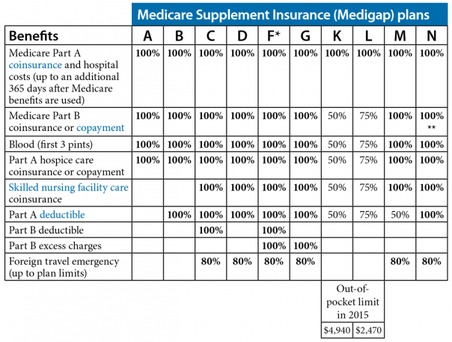

There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance ( An insurance policy you can buy to help lower your share of certain costs for Part A and Part B services (Original Medicare).

Does Medicare pay for PA?

1-4 Medicare, Medicaid, TRICARE, and nearly all commercial payers cover medical and surgical services delivered by PAs. Because of variation in claims filing, it is crucial to verify each payer's specific coverage policies for PAs. PA claims are submitted to Medicare at the full physician charge.

How much does Medicare cost in PA?

Medicare in Pennsylvania by the NumbersPeople enrolled in Original MedicareAverage plan costAnnual state spending per beneficiary1,535,135Plan A: $0 to $499 per month* Plan B: $170.10 per month**$10,149Apr 6, 2022

Did Medicare reimbursement go down in 2022?

A law recently passed by Congress wiped out most of a nearly 10% cut in Medicare payments that family physicians would have otherwise incurred in 2022. The law, signed by President Biden, is called the Protecting Medicare & American Farmers from Sequester Cuts Act, or S. 610.

What is the Medicare Economic Index for 2021?

The 2021 MEI percentage released by CMS on October 29, 2020, lists RHCs at 1.4% while the 2021 MEI percentage released by CMS on December 4, 2020, lists FQHCs at 1.7%. Healthy Blue will update our systems to reflect the new rates by July 30, 2021.

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Does Pa pay for Medicare Part B?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In Pennsylvania, these programs pay for Medicare Part B premiums, Medicare Part A and B cost-sharing, and – in some cases – Part A premiums.

Is the 2021 Medicare fee schedule available?

The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

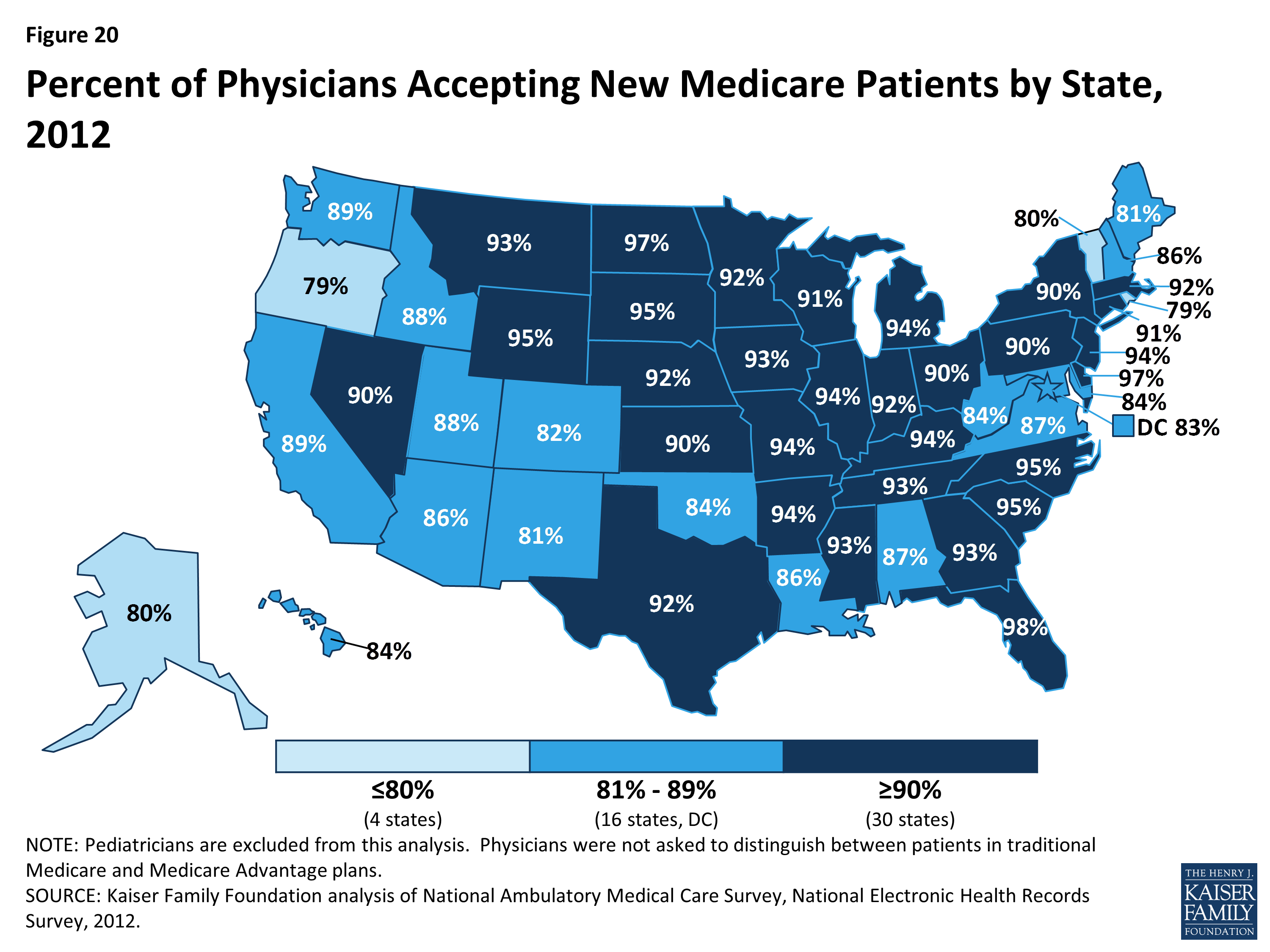

Do Medicare reimbursement rates vary by state?

Over the years, program data have indicated that although Medicare has uniform premiums and deductibles, benefits paid out vary significantly by State of residence of the beneficiary. These variations are due in part to the fact that reimbursements are based on local physicians' prices.

What is a Medicare fee for 2022?

You have Medicare and Medicaid, and Medicaid pays your premiums. (Your state will pay the standard premium amount of $170.10 in 2022.)

Did Medicare Reimbursement go up in 2021?

In the final rule CMS lowered the conversion factor (CF) from $34.89 in calendar year (CY) 2021 to $33.59 for CY 2022, a decrease of $1.30 (-3.7%). This is due in part to the expiration of the 3.75% payment increase provided for in CY 2021 by the Consolidated Appropriations Act of 2021 (P.L.

How Much Does Medicare pay for 99214 in 2021?

$132.94By Christine Frey posted 12-09-2020 15:122021 Final Physician Fee Schedule (CMS-1734-F)Payment Rates for Medicare Physician Services - Evaluation and Management99213Office/outpatient visit est$93.5199214Office/outpatient visit est$132.9499215Office/outpatient visit est$185.9815 more rows•Dec 9, 2020

What is the new Medicare rule?

Law 117-7, requires that, beginning April 1, 2021, already-enrolled independent RHCs and provider-based RHCs in larger hospitals receive an increase in their payment limit per visit over an 8-year period, with a prescribed amount for each year from 2021 through 2028.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

How much is Medicare reimbursement enhanced?

As a result, depending on physician performance within this program, Medicare reimbursements can be enhanced or penalized by up to 9%, although there is a two-year delay in this application (e.g. provider performance in 2021 will lead to the enhancement or penalty in 2023).

When will CMS change the physician fee schedule?

CMS has announced changes to the physician fee schedule for 2021. On December 2, 2020, the Centers for Medicare and Medicaid Services (CMS) published its final rules for the Part B fee schedule, referred to as the Physician Fee Schedule (PFS). Substantial changes were made, with some providers benefiting more than others, ...

When will the CPT code 99201 be revised?

On Nov. 1, 2019, CMS finalized revisions to the evaluation and management (E/M) office visit CPT codes 99201-99215. These revisions will go into effect on Jan. 1, 2021. They build on the goals of CMS and providers to reduce administrative burden and put “patients over paperwork” thereby improving the health system.

What is the definition of time in Medicare?

This now represents total physician/qualified health care professional (QHP) time on the date of service. This use of “date-of-service” time aligns with Medicare’s attempt to better recognize work involved with non-face-to-face services like care coordination. These minimum time definitions would only apply when code selection is primarily based on time and not MDM.

When will CMS update the E/M code?

These revisions build on the goals of CMS and the provider community to reduce administrative burden and put “patients over paperwork.” These revisions will be effective Jan. 1, 2021 .

Is the AMA bill a positive or negative impact?

While there are still winners (primary care/OB) and losers (hospital-based and surgical sub-specialties), the large negative impact to some provider specialties has been averted. Included is a summary the AMA has provided by specialty.

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

Does Medicare have a 0 premium?

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

Does Medicare Advantage cover Part A?

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B (Original Medicare)? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Who sells Medicare Part C?

Medicare Part C plans (also called Medicare Advantage) and Medicare Supplement Insurance plans (also called Medigap) are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What age does QDWI pay Medicare?

The QDWI program helps pay the Medicare Part A premium for certain individuals under age 65 who don’t qualify for premium-free Part A.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Is Medicare plan change every year?

Medicare plan options and costs are subject to change each year. Healthline.com will update this article with 2022 plan information once it is announced by the Centers for Medicare & Medicaid Services (CMS).