What Medicare Part B costs in 2017

| Single Filer | Married Filing Jointly | Married Filing Separately | 2017 Monthly Premium |

| $85,000 or less | $170,000 or less | $85,000 or less | $134 |

| $85,001- $107,000 | $170,001- $214,000 | N/A | $187.50 |

| $107,001- $160,000 | $214,001- $320,000 | N/A | $267.90 |

| $160,001- $214,000 | $320,001- $428,000 | $85,001-$129,000 | $348.30 |

How much will I pay for Medicare premiums?

Keep in mind that:

- Once you hit certain income levels, you’ll need to pay higher premium costs.

- If your income is more than $88,000, you’ll receive an IRMAA and pay additional costs for Part B and Part D coverage.

- You can appeal an IRMAA if your circumstances change.

- If you’re in a lower income bracket, you can get help paying for Medicare.

How should I Pay my Medicare premiums?

- automatic deduction from your Social Security monthly benefit payment (if you receive one)

- mailing a monthly check to the plan

- arranging an electronic transfer from a bank account

- charging the payment to your credit or debit card (though not all plans offer this option)

How to calculate Medicare premiums?

- Deductions for what you give to charity 8

- Deductions for adoption expenses 9

- Dependent tax credits 10

- The earned income tax credit (EITC) 11

How much are Medicare premiums?

In fact, new data from the Employee Benefit Research Institute reveals that based on 2021 data, a 65-year-old man needs $79,000 in savings for a 50% chance of having enough money to cover Medicare premiums and median prescription drug costs. A 65-year-old woman, meanwhile, needs $103,000. Image source: Getty Images.

What were Medicare premiums in 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What was the cost of Medicare in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What cost are billed to Medicare Part A?

If you don't get premium-free Part A, you pay up to $499 each month. If you don't buy Part A when you're first eligible for Medicare (usually when you turn 65), you might pay a penalty. Most people pay the standard Part B monthly premium amount ($170.10 in 2022).

What were Medicare Part B premiums in 2016?

If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What was the Medicare Part B premium for 2015?

Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.

What was the Medicare Part B premium for 2014?

CMS said the standard Medicare Part B monthly premium will be $104.90 in 2014, the same as it was in 2013. The premium has either been less than projected or remained the same, for the past three years. The Medicare Part B deductible will also remain unchanged at $147.

Does Part A have a premium?

Part A premiums People who buy Part A will pay a premium of either $274 or $499 each month in 2022 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

How much is Medicare insurance a month?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

What was the Medicare Part A deductible for 2016?

The 2016 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $411. The Medicare Part A deductible for all Medicare beneficiaries is $1,288.

What is the Medicare Part B deductible for 2017?

$183 in 2017CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016).

What year did Medicare start charging premiums?

1966President Johnson signs the Medicare bill into law on July 30 as part of the Social Security Amendments of 1965. 1966: When Medicare services actually begin on July 1, more than 19 million Americans age 65 and older enroll in the program.

Why did Medicare premiums go up in 2016?

The Centers for Medicare & Medicaid Services (CMS) cited several reasons for the price hike, including paying off mounting debt from past years and ensuring funding for future coverage. But another important factor was that 2016 saw no cost-of-living adjustment (COLA) for Social Security benefits. For 70 percent of Medicare beneficiaries, this meant that premium rates would stay the same in 2016. The remaining 30 percent — about 15.6 million enrollees — faced higher monthly premiums. And everyone who signs up for Medicare in 2016, regardless of enrollment status or income, will pay a higher annual deductible.

How much does Medicare Part B cost?

Most recipients pay an average of $109 a month for coverage, but certain beneficiaries pay the standard premium of $134 a month. If you meet one of the following conditions, then you’ll pay the standard amount ($134) or more:

What is Part D insurance?

Part D covers prescription drug costs, and it was introduced in 2003 to help seniors afford medication. It’s a popular provision. How much you pay for Part D varies based on the type of coverage you choose, but there are standards in place to limit your out-of-pocket spending. Once again, higher-income enrollees will pay an income-based surcharge on top of their monthly premiums:

What is CMS in healthcare?

Updated 2/25/2016 The Centers for Medicare & Medicaid Services (CMS) is tasked with the nation’s healthcare. Part of the U.S. Department of Health and Human Services (HHS), one major responsibility of this agency is setting insurance costs, including Medicare premiums, for 2016 and beyond. The CMS announced its planned costs for both premiums and deductibles back on November 10, 2015.

What is Medicare Advantage?

Medicare Advantage offers a bevy of benefits to seniors who are looking for more comprehensive coverage. These plans must include at least the same benefits offered through Parts A and B, and many (but not all) plans cover prescription drugs. Because these plans are sold through private insurers instead of directly through the federal government, Medicare Advantage has different costs that vary by plan. As with any insurance plan, costs rise each year. If you want to learn more about this type of coverage, then check out our guide to Medicare Advantage.

What is the CMS's responsibility?

One chief responsibility of the CMS is to set insurance costs, including 2016 Medicare Part B premiums. The agency announced the proposed price increases on November 10, 2015. This was the decision of the Medicare Board of Trustees (the Board), a group of six government and public representatives who oversee the insurance program’s financial operations.

What is SMI in Medicare?

They needed to make sure that there were adequate reserves in the Supplementary Medical Insurance (SMI) Trust Fund. The SMI, which applies to both Medicare Part B and Part D (prescription drug coverage), is funded by beneficiary premiums, Congressional funding and general revenues. Aside from Parts B and D, the SMI pays for Medicare’s administrative costs.

How much will Medicare pay in 2021?

In 2021: If you worked fewer than 30 quarters (7 1/2 years), you’ll typically pay $471 per month. If you worked more than 30 but fewer than 40 quarters (around 7 1/2 to under 10 years), you’ll typically pay $259 per month. There’s also a monthly premium for Medicare Part B, and most beneficiaries do have to pay the premium.

How long do you have to work to pay Medicare?

You generally don’t pay a monthly Medicare Part A premium if you’ve worked at least 10 years (40 quarters) while paying Medicare taxes.

Is Medicare Part A or B?

Medicare Part A is hospital insurance, and along with Medicare Part B (medical insurance) it’s also called Original Medicare. Some people are enrolled in Original Medicare (Part A and Part B) automatically. It depends on whether you’re getting Social Security benefits.

Do you pay Medicare Part B premium?

There’s also a monthly premium for Medicare Part B, and most beneficiaries do have to pay the premium.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What is periodic payment?

The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

How much is Medicare Part B?

Starting January 1, most people with Medicare will see a small increase in their Part B premium, from $104.90 to an average of $109.00 per month. But about 30 percent of people covered by Medicare will see a minimum Part B premium ...

How much is Medicare Part B deductible?

In addition to the updated premium amounts, CMS announced an increase in the Medicare Part B annual deductible, from $166 in 2016 to $183 in 2017.

What is the hold harmless provision in Medicare?

This difference in premium amounts is due to a federal law which is commonly called the “hold harmless” provision. This provision prevents about 70 percent of beneficiaries from seeing major increases in Medicare Part B premiums when Social Security cost of living adjustments (COLAs) are nonexistent or very small.

Can you see a Part B premium increase?

Those who are held harmless will not see their Part B premium increase by an amount that is greater than the dollar amount of their COLA increase. Because the COLA is a percentage of a person’s Social Security benefits, the exact dollar amount of the increase, and the premium, will vary.

Seniors are going to be paying a lot more for their prescription drug plans in 2017

A Fool since 2010, and a graduate from UC San Diego with a B.A. in Economics, Sean specializes in the healthcare sector and investment planning. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Follow @AMCScam

Big prescription drug increases are headed seniors' way

Choosing a prescription drug plan is particularly important for seniors since they tend to be more prone to expensive illnesses compared to younger adults.

How to get the best Medicare drug plan

With rising prescription drug costs looking like a near-certainty moving forward, seniors need to be diligent in their efforts to pick out a PDP that suits their needs best. Here are a few tricks to ensuring you get the best possible value for your Part D plan.

How much is the Part B premium for 2017?

The standard Part B premium amount in 2017 will be $134 (or higher depending on your income). However, most people who get Social Security benefits will pay less than this amount. This is because the Part B premium increased more than the cost-of-living increase for 2017 Social Security benefits. If you pay your Part B premium through your monthly Social Security benefit, you’ll pay less ($109 on average). Social Security will tell you the exact amount you will pay for Part B in 2017. You’ll pay the standard premium amount if:

How much does Medicare pay for Part B?

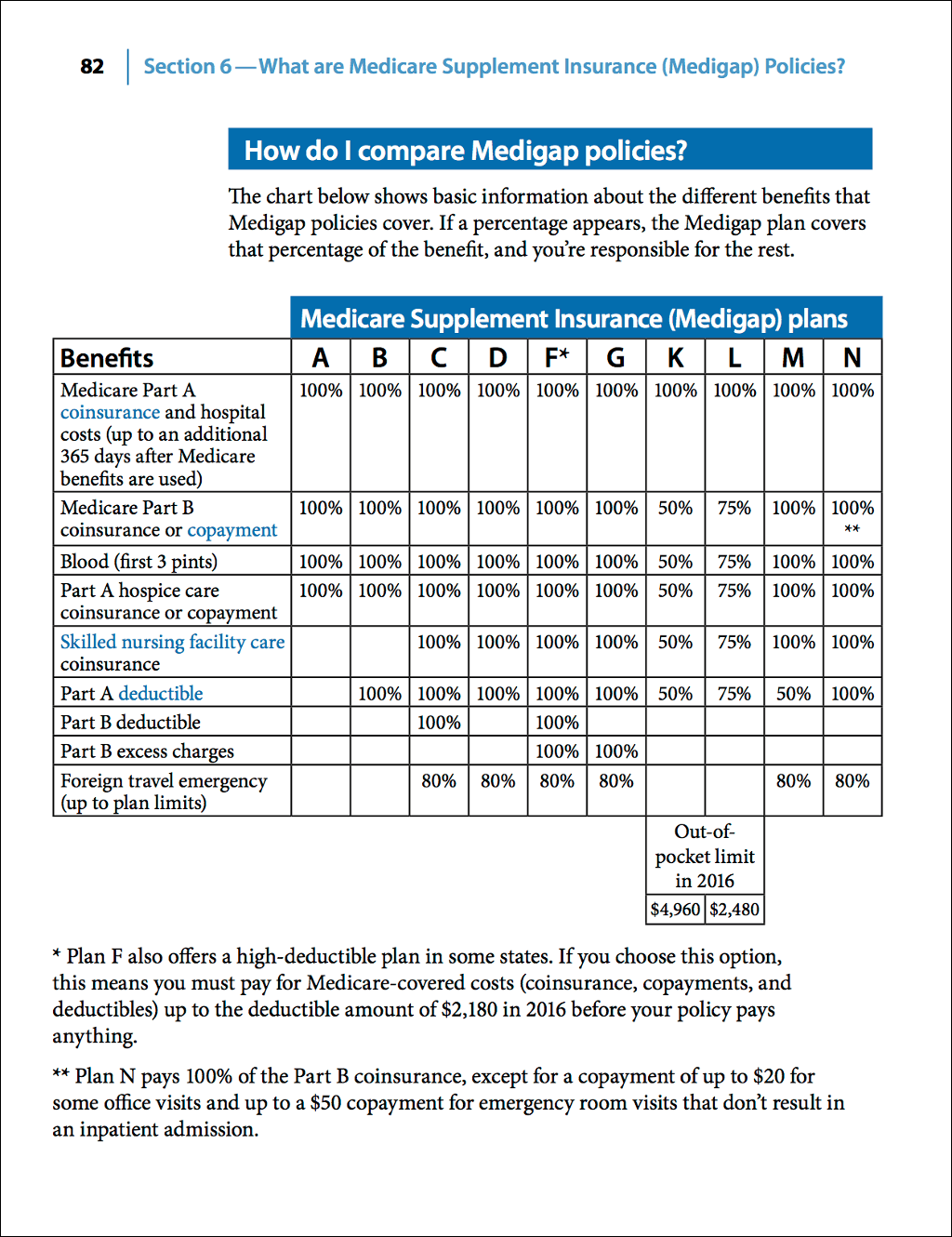

Over 90% of eligible Medicare beneficiaries enroll in Part B and over 70% use Part B services during a year. Part B generally pays 80% of the approved amount for covered services in excess of the annual deductible ($166 in 2016 and $183 in 2017). The beneficiary is liable for the remaining 20%. Many beneficiaries purchase a Medicare Supplement (Medigap) policy to cover that exposed 20%.

What is Medicare for seniors?

Medicare is the federal health insurance program that covers people 65 and older and some younger adults with permanent disabilities and certain medical conditions. When Medicare was established in 1965 about half of American seniors had no health insurance. Today, virtually all Americans over age 65 have at least some health coverage through Medicare.

What is modified adjusted gross income?

Your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount. If so, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is covered by Part B?

Part B covers physician services, outpatient hospital care, and some home health visits. It also covers laboratory and diagnostic tests, such as X-rays and blood work; durable medical equipment, such as wheelchairs and walkers; certain preventive services and screening tests, such as mammograms and prostate cancer screenings; outpatient physical, speech and occupational therapy; outpatient mental health care ; and ambulance services.

Does Medicare cover all medical services?

Medicare does not cover all health care services. For example, Medicare generally does not pay for long-term care services, regular eye exams and eyeglasses, hearing aids, or routine dental care.