How much does Medicare Part B costs?

Nov 08, 2019 · For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts. The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019.

What is the monthly premium for Medicare Part B?

Jan 26, 2020 · The minimum premium for Part B coverage in 2020 is $144.60 each month, which is a $9 increase from 2019’s minimum premium of $135.50 each month. In 2020, certain income brackets that determine if high-income recipients pay more for their Part B premium each month were changed for the first time.

How high will the Medicare Part B deductible get?

Nov 15, 2021 · Medicare Part B's standard premium in 2020 is $144.60/month; higher premiums apply if you earn more than $87,000. Part B also has a $198 deductible in 2020.

Does Medicaid pay for Part B premium?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What are the Medicare Part B premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the basic cost for Medicare Part B?

The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

What will Medicare cost me in 2021?

In 2021, the standard monthly premium will be $148.50, up from $144.60 in 2020.Dec 16, 2020

How much will the premium be for Medicare Part B in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How much does Medicare take out of Social Security?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

How much will Part B go up in 2022?

$170.10Part B costs The standard monthly premium for Part B will be $170.10 in 2022, up from $148.50 this year and marking the program's largest annual jump dollar-wise ($21.60).Dec 31, 2021

Will Medicare Part B premium go up in 2022?

California Health Advocates > Prescription Drugs - Blog > Why Did Medicare's Part B Premium Rise 14.5% in 2022? If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022.Jan 26, 2022

Why is my Medicare Part B premium so high?

According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

Is Medicare premium based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How much is Part B premium for 2020?

more than $413,000, you pay $491.60 a month in 2020. The Part B premium can be scaled to the Social Security cost-of-living adjustment (COLA) if the rise in a premium is more than the change in a retiree’s Social Security benefit.

How much is the deductible for Medicare Part B?

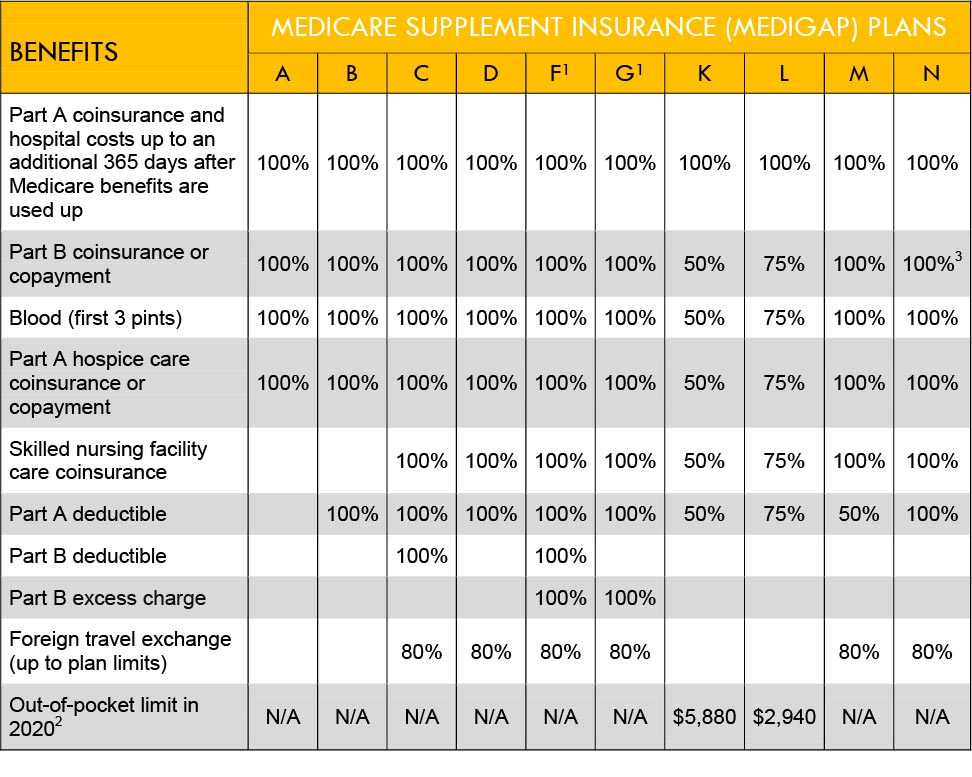

Medicare recipients must meet an annual deductible with Medicare Part B, which is $198 for 2020. If a Medicare enrollee was eligible for a Medigap plan that pays for the Part B deductible prior to 2020, they can still receive that benefit. Medigap plans that pay the Part B deductible are no longer offered as of January 1st, 2020.

What is the minimum premium for Part B insurance?

The minimum premium for Part B coverage in 2020 is $144.60 each month, which is a $9 increase from 2019’s minimum premium of $135.50 each month. In 2020, certain income brackets that determine if high-income recipients pay more for their Part B premium each month were changed for the first time.

How much do you make a month in 2020?

between $109,000 and $136,000, you pay $289.20 a month in 2020. between $136,000 and $163,000, you pay $376.20 a month in 2020. between $163,000 and $500,000, you pay $462.70 a month in 2020. more than $500,000, you pay $491.60 a month in 2020.

What is the COLA for 2020?

For 2020, the COLA is 1.6%; if this change in a beneficiary’s Social Security payment does not cover the rise in their premium cost, their premium will only increase by 1.6% of the prior year’s premium. If you qualify as a dual eligible enrollee with Medicare and Medicaid, your Medicare premium will be $144.60 a month and is paid by Medicaid.

How much is the 2020 Medicare premium?

Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month). But that’s in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium.

How much is Part B insurance in 2021?

In 2021, most enrollees will be paying $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month).

What is the Medicare deductible for 2021?

Part B deductible also increased for 2021. Medicare B also has a deductible, which has increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20 percent of the Medicare-approved cost for Part B services.

What is the income threshold for Part B?

For people with income above $87,000 ($174,000 for a couple) in 2020, Part B premiums for 2020 ranged from $202.40/month to $491.60/month. As explained by the math above, the high-income threshold has increased to $88,000 for a single individual and $176,000 for a couple in 2021.

When do you pay income related premium surcharge?

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. [2019 tax returns were filed in 2020, so those are the most current returns available when income-related premium adjustments are determined for 2021.]

How much is the 2020 Social Security Cola?

But the 1.6 percent Social Security COLA for 2020 increased the average beneficiary’s Social Security benefit by $24/month. Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees have been paying the standard premium in 2020. And for 2021, the 1.3 percent COLA is adequate to cover the increase to ...

Does Medicare cover coinsurance?

But supplemental coverage (from an employer-sponsored plan, Medigap, or Medicaid) often covers these coinsurance charges. For people who became eligible for Medicare before the start of 2020, there are Medigap plans available (Plans C and F) that cover the Part B deductible, in addition to coinsurance charges.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Medicare Part B 2020?

In 2020, the Medicare Part B deductible came in at $198. This is a $13.00 increase from where we were in 2020. That’s a 7% increase year over year and a very similar increase to what we saw (on a percentage basis) with the Medicare Part A deductible. 198 greenbacks including a debut of my 1953 Series A $2 Bill.

Is Medicare Part B deductible more likely to be deductible?

It is much more likely a Medicare beneficiary will get hit with their outpatient Medicare Part B deductible than the inpatient Medicare Part A deductible. A simple clinic visit to a doctor will trigger a bill for it, so we need to plan for it.

How much will Medicare premiums be in 2020?

The premium that most people will pay in 2020 is $144.60 per month, which is up $9.10 per month from 2019's numbers. Those retirees with high incomes might have to pay more for their monthly Part B premiums. Below, you can see how you might owe as much as $491.60 in monthly premiums. For individuals with this income:

How much does Medicare Part B cover?

Once you pay the deductible, Part B typically covers 80% of your costs. However, you're responsible for the remaining 20%. However, there are a few expenses in which Medicare will cover everything, such as preventive visits.

How much do I have to pay for Medicare?

In addition to monthly premiums, you'll also have to pay a couple of extra costs: 1 There's a deductible of $198 in 2020 that you're required to pay before Medicare Part B coverage kicks in. That's up $13 from the corresponding deductible amount in 2019. 2 Once you pay the deductible, Part B typically covers 80% of your costs. However, you're responsible for the remaining 20%. However, there are a few expenses in which Medicare will cover everything, such as preventive visits.

What is covered by Part B?

But there are many other services that Part B covers, such as diagnostic tests, ambulance services, medical equipment, mental-health services, and second opinions under many circumstances. To be medically necessary, the services must help medical professionals address ...

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

What is medically necessary?

To be medically necessary, the services must help medical professionals address a disease or medical condition as they go through the process of detection, diagnosis, and cure. Image source: Getty Images. Preventive services are also often covered.

How much is the deductible for Medicare Part B?

In addition to monthly premiums, you'll also have to pay a couple of extra costs: There's a deductible of $198 in 2020 that you're required to pay before Medicare Part B coverage kicks in. That's up $13 from the corresponding deductible amount in 2019. Once you pay the deductible, Part B typically covers 80% of your costs.

How much is Medicare Part B 2020?

The standard monthly premium for Medicare Part B will be $144.60 for 2020, up $9.10 from $135.50 in 2019, the Centers for Medicare and Medicaid Services announced Friday. The annual deductible for Part B will rise ...

How much is the 2020 Medicare premium?

The standard monthly premium will be $144.60 for 2020, which is $9.10 more than the $135.50 in 2019. The annual deductible for Part B will rise to $198, up $13 from $185 this year. About 7% of beneficiaries will pay extra from income-related adjustment amounts.

How much Medicare premiums are paid in 2019?

In 2019, it was 2.8%. Higher-income beneficiaries, though, have paid more for premiums since 2007 through monthly surcharges. About 7% of Medicare’s 61 million or so beneficiaries will pay more due to those income-adjusted amounts (see table below). The program uses your tax return from two years earlier to determine whether you’ll pay monthly ...

How much is the deductible for Part B?

The annual deductible for Part B will rise to $198, which is $13 more than the $185 deductible in 2019. The increases — both around 7% — are due largely to rising spending on physician-administered drugs, according to CMS.

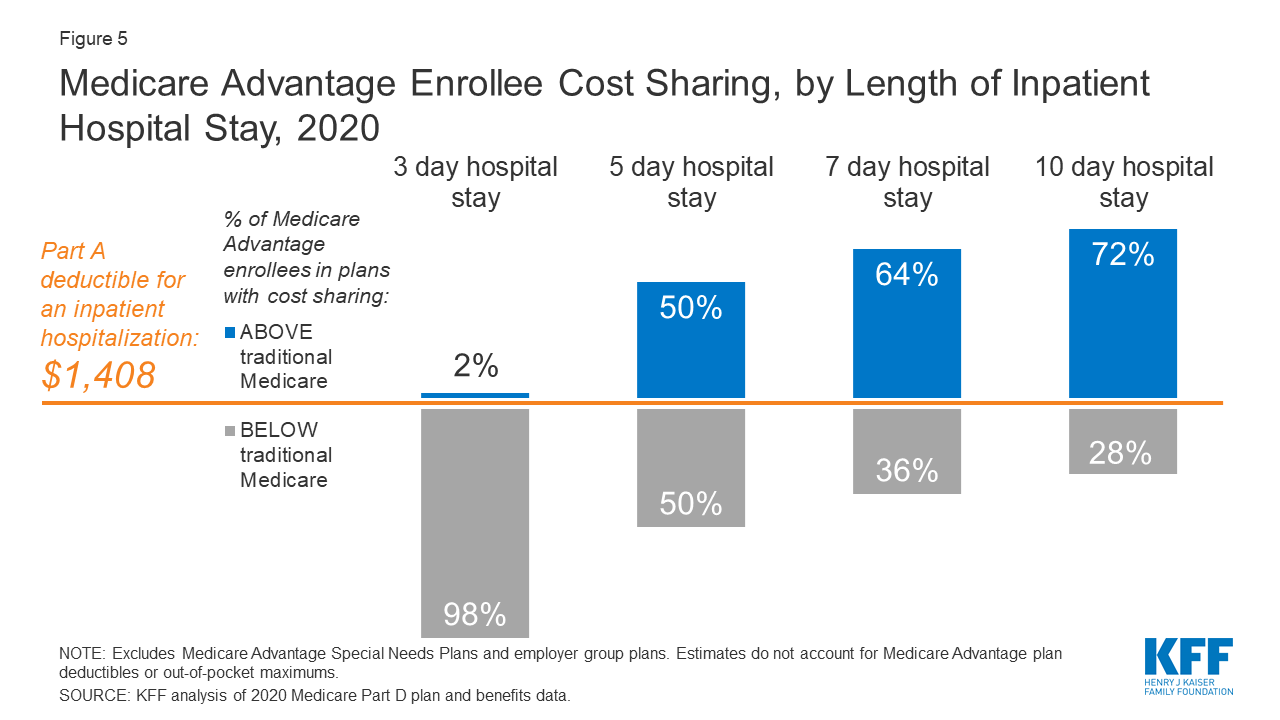

Does Medicare pay for inpatient hospital?

For Part A, which covers inpatient hospital, skilled nursing and some home health-care services, most Medicare beneficiaries do not pay a premium because they have enough of a work history of paying into the system to qualify for it premium-free. However, there are deductibles that go with Part A.