What is Medicare plan part N?

Medicare Plan N is a supplemental policy that typically has lower premiums while you pay your Part B deductible, excess charges and some copays for doctor and emergency visits. It has been popular since it was first introduced in 2010. Also called Medigap Plan N, this option was created for consumers who like the idea of paying a lower premium ...

How much does Medicare Advantage plan cost?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

What is the average cost of Medicare supplement plans?

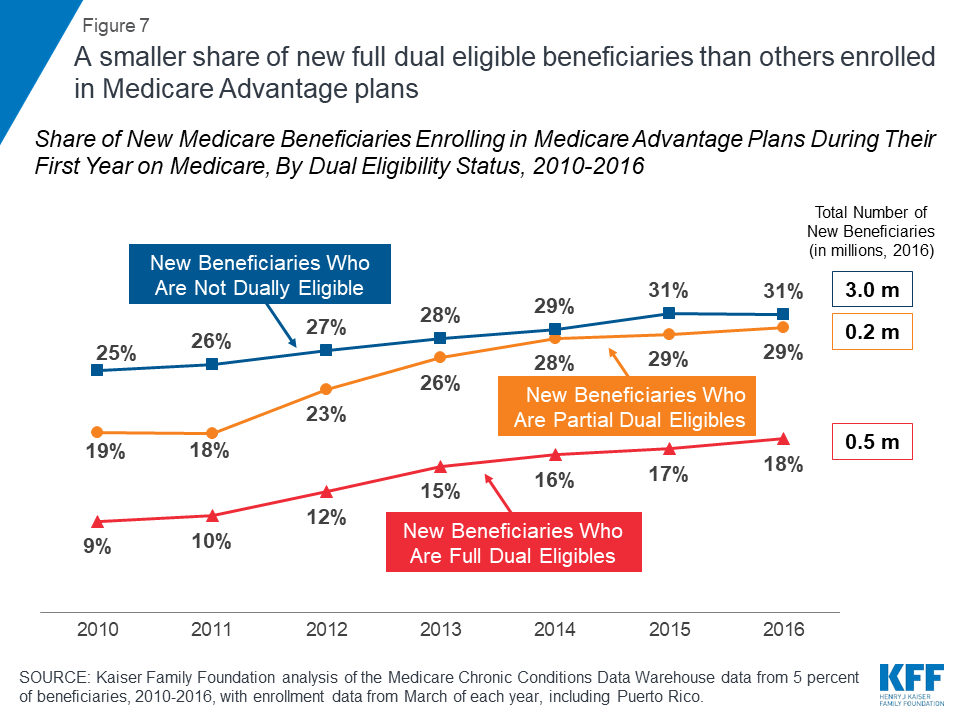

This year, the average Medicare member will have on average thirty-nine plans to chose from in their area. This is the highest number captured in the last ten years, up by more than ten since 2015. This year 3,834 plans are available in total, and almost ninety percent include coverage to reduce the costs of prescription drugs.

What is the best Medicare supplement plan?

- Medicare Supplement Insurance helps you manage out-of-pocket costs for covered services

- Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share

- Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020

What is the average cost of Medicare Plan N?

between $120 and $180Monthly premiums for Plan N can average between $120 and $180, climbing to over $200 in some states and dropping as low as $80 in other states. Rates are determined by location, age, gender and in some instances, current health status. This monthly cost is on top of the cost of Original Medicare (Parts A and B).

What is Medicare Plan N?

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B. It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums.

How much does AARP plan n cost?

Cigna Medicare Advantage Plans ReviewPlan APlan NAARP Premium Estimate$92.11$99.73Part A deductible-100%Part A coinsurance and hospital costs100% after deductible100%Part A hospice coinsurance or copay100%100%7 more rows•Oct 21, 2020

What is the difference between plan G and N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

Is Medicare Plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Does Medicare Part N cover prescriptions?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.

Can I switch from plan G to plan N?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to answer health questions to switch. Your approval is not guaranteed.

What is Aetna plan N?

Aetna Medigap Plan N is Aetna's exclusive Medicare Supplement plan for Medicare that offers a low-cost alternative to more comprehensive policies like G or F. Plan N is a relatively novel provision that debuted in 2010. Since then, enrollment in Plan N has been growing progressively each year.

Why does AARP recommend UnitedHealthcare?

AARP/UnitedHealthcare's PPO plans are a very good deal, with average prices that are far below the industry. Not only are the PPO plans affordable, but they're also desirable because they provide more flexibility about which doctors you use because they cover both in-network and out-of-network health care.

Is plan N cheaper than plan G?

Premiums for each plan can vary by the carrier that offers it, but Plan G is typically more expensive than Plan N because it offers a higher level of coverage. However, while Plan G usually has higher premiums, it could save you money in the long run.

Is plan G better than N?

Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs. Costs of Medigap policies vary by state and carrier.

Is plan G as good as plan F?

Ultimately, Plan G has the same benefits as the Plan F, except for coverage for the Part B deductible ($233 for 2022). Once you pay the Part B deductible, the coverage is the same for both plans.

What is the difference between Plan F and Plan N?

Plan N premiums are typically lower than Plan F premiums, meaning, you spend less out of pocket monthly with Plan N than you will with Plan F. However, Plan F covers more out-of-pocket expenses. If you know that you will have many medical expenses throughout the year, Plan F may be a better choice.

Can I switch from Plan N to Plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to answer health questions to switch. Your approval is not guaranteed.

What is Aetna plan N?

Aetna Medigap Plan N is Aetna's exclusive Medicare Supplement plan for Medicare that offers a low-cost alternative to more comprehensive policies like G or F. Plan N is a relatively novel provision that debuted in 2010. Since then, enrollment in Plan N has been growing progressively each year.

What are plan N excess charges?

With Plan N, you are responsible for copayments up to $20 when you visit the doctor's office (or up to $50 for emergency room visits). You are also responsible for any excess charges, the additional amount a doctor may charge for services above what Medicare covers.

How much does Plan N cost monthly?

Plan N does not have a set premium but ranges from $85 to $200. The premium will depend on several factors such as zip code, gender, age, tobacco u...

What is the deductible for Plan N?

In 2022, the deductible is $233 which is the Part B annual deductible that you are responsible for with Plan N. The Part B deductible is one gap th...

What is the difference between Plan G and Plan N?

Plan N has more out-of-pocket than Plan G, but the premium for Plan N is typically lower. You must pay up to $20 copays for office visits and up to...

Can I switch from Plan N to Plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to ans...

Do people prefer Plan N over Plan G?

Plan N is very appealing as it tends to have lower premiums than Plan G. For those who don’t visit the doctor often, this plan may be a great fit!...

What is Medicare Supplement Plan N?

Medicare Supplement Plan N: Understanding the Costs. Plan N is a Medicare supplement (Medigap) plan that helps cover the costs of medical care. Federal law ensures that no matter where you purchase your Medigap Plan N, it will include the same coverage. The cost for Medigap Plan N may vary based on where you live, when you enroll, and your health.

How long does Medicare plan N last?

Plan N coverage includes: Part A coinsurance and hospital costs for up to an additional 365 days after you use your Medicare benefits.

How long does it take to get Medicare Part B?

This is a 6-month period that begins the month you are both age 65 or older and enrolled in Medicare Part B. A company can not use medical underwriting during this initial enrollment period to sell you a policy. This means they cannot consider your overall health and medical conditions when they sell you a policy.

When to enroll in Medigap Plan N?

The cost for Medigap Plan N may vary based on where you live, when you enroll, and your health. Enrolling in Medigap when you’re first eligible, around your 65th birthday, is the easiest way to get the lowest cost. Medicare Supplement Plan N, also called Medigap Plan N, is a type of supplemental insurance to help cover some ...

Can you still buy a medicaid policy after open enrollment?

This means they cannot consider your overall health and medical conditions when they sell you a policy. The insurance company must sell you the policy for the same price they sell it to people who are in general good health. You can still purchase a Medigap policy after your Medicare open enrollment period.

Is Medigap Plan N a supplement plan?

The takeaway. Medigap Plan N is one example of a standardized Medicare supplement plan. The plan may help you avoid out-of-pocket costs associated with Medicare. You can compare plans through sites such as Medicare.gov and by contacting private insurance companies.

What is Medicare Plan N?

Medicare Plan N is a supplemental policy that typically has lower premiums while you pay your Part B deductible, excess charges and some copays for doctor and emergency visits. It has been popular since it was first introduced in 2010. Also called Medigap Plan N, this option was created for consumers who like the idea ...

How much does Medicare pay for a medical bill?

Medicare pays 80% and then sends the bill to your Medigap plan. If your doctor does not accept Medicare assignment, you will pay a 15% excess charge. Read more about how this would work in our Medigap Plan N Example below.

What is Medicare Supplement Plan N?

Also called Medigap Plan N, this option was created for consumers who like the idea of paying a lower premium in exchange for taking on a small annual deductible and some copays. All Medicare Supplement Plan N policies are the same, no matter which insurance company you choose.

How much is the Part B deductible for 2021?

First, you agree to pay the small annual Part B deductible ($203 in 2021). You will also pay co-payments up to $20 for doctor appointments. Emergency room visits have a $50 copay. Finally, people with Medigap N also pay excess charges to some medical providers. Providers can charge 15% more than what Medicare allows.

What is the difference between Medicare Plan N and Plan G?

People who enroll in Plan N also often look at Plan G as an alternative because Plan G is only slightly more expensive. The primary difference is that Plan G covers the little copays and excess charges so there are less bills showing up in your mailbox.

When is the best time to enroll in Medicare Plan N?

You must also live in the plan’s service area. The best time to enroll in Medicare Plan N is during your Medigap Open Enrollment Period. This six-month window starts with your Part B effective date. It’s your one chance to enroll in any Medigap plan without health underwriting.

Does Plan N cover hospital deductible?

For inpatient care, Medicare Supplement Plan N fully covers her hospital deductible.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N coverage is one of 10 federally standardized options to help fill “gaps” in original Medicare coverage. It’s an option for people who want broad coverage but, to lower their premiums, are willing to pay for some copays and a small annual deductible.

How many Medigap plans are there?

There are 10 different Medigap Plans (A, B, C, D, F, G, K, L, M, N) which all feature different coverage and have different premiums. This selection allows you to choose coverage based on your needs and budget.

How to get a Medigap policy?

Getting a Medigap policy. Once you have original Medicare, you can purchase a Medigap policy from an insurance company. To pick a specific plan and insurance company, many people consult with a trusted family member, friend with a current Medigap policy, or insurance agent.

Is Medigap standardized?

Standardization. Medigap plans are standardized the same way in 47 of the 50 states. If you live in Massachusetts, Minnesota, or Wisconsin, Medigap policies (including Medicare Supplement Plan N coverage) are standardized differently.

Does Medicare Supplement Plan N cover dental?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.

How much is Medicare Supplement Plan N?

On average – and this can change depending on a variety of factors – a Plan N is between $30-$50 cheaper than a Plan F. That means that every month, you pay $30-$50 less ...

How much is a Medigap Plan N copay?

One of its main differences when compared to Plan F or G is the copay. When you have a Medigap Plan N, you pay a small copay when you go to the doctor’s office. However, it’s usually only about $10.

What is a plan N?

What is Plan N? Plan N is one of the Medicare Supplement plan options, which are plans that help pay for gaps Medicare leaves behind. Like the other Medigap plans (such as Plan F or G), Plan N is sold by private insurance companies, such as Accendo Insurance Company or Lumico. Plan N has very similar benefits to Plan F and Plan G, ...

What happens if a doctor doesn't accept Medicare?

If they don’t, you would receive a bill in the form of an excess charge. However, most doctors accept Medicare (they accept Medicare assignment).

How much does a plan N cost?

While the price of a Plan N varies depending on where you live, how old you are, your health, and more, it generally costs between $85-$120 per month.

Does Plan N have copays?

Yes, it has copays and excess charges , but ultimately, it's worth the premium savings for a lot of individuals. For a free, no obligation Plan N quote, call us today at 833-801-7999 or send us an email at help@medicareallies.com.

Is Medigap Plan N worth it?

Overall, we think Medigap Plan N is a great value for the money. It’s a solid plan with good coverage, and if you’ve had traditional health insurance for all of your life, it’ll be a natural transition. Yes, it has copays and excess charges, but ultimately, it's worth the premium savings for a lot of individuals.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.