Does Medicare charge a deductible?

· Medicare Part D, which is a drug plan offered to Medicare enrollees, has different rules for its deductibles. Unlike those offered by employers or through the Marketplace, no plan can have a prescription deductible higher than $480 in 2022. 1 Deductible prices can still vary (with a maximum of $415), and some plans will not have a deductible.

How does a prescription drug deductible work?

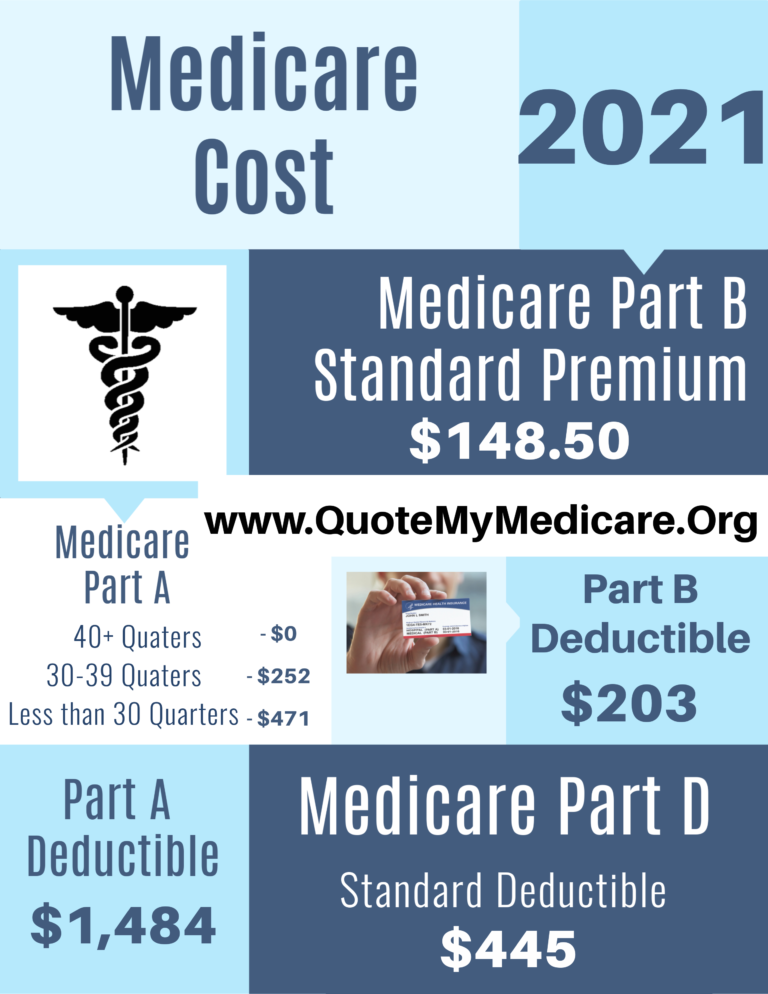

Medicare Deductible: Part A The Medicare Part A deductible 2022 is $1,556 per benefit period. This amount represents an increase of $72 over the 2021 Part A deductible, which was $1,484.

Can I deduct my Medicare premiums on my tax return?

· Medicare Advantage deductibles can range from $0 to several thousand dollars. Medicare Advantage plans that include prescription drug coverage will often have two separate deductibles, one for medical care and another for prescription drug costs. Medicare Part D Deductible. Medicare Part D plans cover prescription medications. Like Medicare Advantage, …

Can I deduct prescription drugs?

Your deductible is the amount of money you have to pay for your prescriptions and healthcare before Original Medicare, other insurance, or your prescription drug plan starts paying for your healthcare expenses. The Medicare Part B deductible for 2020 is $198 in 2020.

What is the deductible for Medicare Part D for 2021?

In 2021, the Medicare Part D deductible can't be greater than $445 a year. You probably know that being covered by insurance doesn't mean you can always get services and benefits for free. You may have various out of pocket costs with Medicare insurance, including copayments, coinsurance, and deductibles.

What is my prescription deductible?

A prescription drug deductible is the amount you pay for drugs before we begin to pay our share. Several of our HMO plans have a prescription drug deductible. A prescription drug deductible is the amount you pay for drugs before we begin to pay our share.

What is the deductible for Medicare Part D in 2022?

$480The initial deductible will increase by $35 to $480 in 2022. After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost (Tier 1 and Tier 2) drugs.

What is the maximum deductible for Medicare Part D?

$445$445 is the maximum deductible that Medicare Part D plans can charge in 2021. Initial coverage. The initial coverage limit for Medicare Part D plans in 2021 is $4,130.

How does Medicare Part D deductible work?

The deductible is the amount a beneficiary must pay for covered drugs before the plan starts to pay. The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible. In other words, one pays the full cost for drugs subject to a deductible until the designated amount is met.

Do prescription drugs go towards deductible?

If you have a combined prescription deductible, your medical and prescription costs will count toward one total deductible. Usually, once this single deductible is met, your prescriptions will be covered at your plan's designated amount. This doesn't mean your prescriptions will be free, though.

Does Medicare Part D cover prescriptions?

Medicare Part D, the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs. Part D is offered through private companies either as a stand-alone plan, for those enrolled in Original Medicare, or as a set of benefits included with your Medicare Advantage Plan.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Are Medicare Part D payments tax deductible?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

What is the Part D premium for 2021?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

Do prescriptions go towards out of pocket maximum?

How does the out-of-pocket maximum work? The out-of-pocket maximum is the most you could pay for covered medical services and/or prescriptions each year. The out-of-pocket maximum does not include your monthly premiums.

What is my deductible for BC PharmaCare?

Beginning January 1, 2019, there is no deductible, so Pharmacare will pay 70% immediately. Once the family's prescription costs reach the maximum $600 (previously $750), PharmaCare then pays 100% of the eligible costs for the rest of the year.

How do you meet your deductible?

Call your insurance company or read your benefits paperwork to verify the deductible you owe. Your deductible will also be listed on your Explanation of Benefits (EOB). You'll want to meet your deductible early in the year, if possible.

Do all Part D plans have a deductible?

Some Medicare Part D prescription drug plans do not have a deductible. If you do have a deductible, you will pay the full price for your medications until your deductible is met.

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to p...

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of...

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

Key Takeaways

Parts A and B of Original Medicare have deductibles you must meet before Medicare will pay for healthcare.

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to pay. A deductible can be based upon a calendar year, upon a plan year or — as is unique to Medicare Part A — upon a benefit period.

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of pocket before your plan starts to pay for your healthcare.

Medicare Advantage (Part C) Deductibles

Medicare Advantage (Part C) is an alternative type of Medicare plan that is purchased through a private insurer. Not every Part C plan is available throughout the country. Your state, county and zip code will determine which plans are available for you to choose from in your area.

Medicare Part D Deductibles

Medicare Part D is prescription drug coverage. People are often surprised to learn that Part D is not included in Original Medicare. This is understandable since prescription medications are very often integral to health.

Medicare Supplement Plan Deductible Coverage

Medicare Supplement Insurance is also known as Medigap. Medigap is supplemental insurance sold by private insurers. It is designed to fill in the cost “gaps” for people who have Original Medicare.

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

What is deductible insurance?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

How much is Medicare Part A deductible for 2022?

In 2022, the Medicare Part A deductible is $1,556 per benefit period. That means when you are admitted to a hospital or other medical facility as an inpatient, you are responsible for paying the first $1,556 of covered care before Medicare Part A begins picking up any costs.

Does Medicare Supplement Insurance cover Part B?

Some Medicare Supplement Insurance (Medigap) plans cover the Part B deductible or the Part A deductible.

How long after your Medicare benefits end do you have to go back to the hospital?

Should you enter the hospital again at least 60 days after your benefit period has ended, you will begin a new benefit period and will once again have to pay the first $1,556 of covered care.

What is Medicare Part A?

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What is the Medicare deductible for 2022?

In 2022, the Medicare Part A deductible is $1,556 per benefit period , and the Medicare Part B deductible is $233 per year. Medicare Advantage deductibles, Part D drug plan deductibles and Medicare Supplement deductibles can vary. Learn more about 2022 Medicare deductibles and other Medicare costs.

Does Medicare Advantage have a deductible?

Medicare Advantage plans are sold by private insurance companies and don’t have a standard deductible. There are thousands of different Medicare Advantage plans sold by dozens of insurance companies, and each carrier is free to set their own deductibles for each of their plans.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

How much coinsurance do you pay for Medicare?

Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year. In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is the coinsurance amount for Medicare?

The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example. Say your treatment cost you $80.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

What is Medicare Part A?

Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage. Transplant drugs can be very costly. If you’re worried about paying for them after your Medicare coverage ends, talk to your doctor, nurse, or social worker.

What is Part B covered by Medicare?

Here are some examples of drugs Part B covers: Drugs used with an item of durable medical equipment (DME) : Medicare covers drugs infused through DME, like an infusion pump or a nebulizer, if the drug used with the pump is reasonable and necessary.

How long does Medicare cover ESRD?

If you're entitled to Medicare only because of ESRD, your Medicare coverage ends 36 months after the month of the kidney transplant.

Does Part B cover drugs?

covers drugs Part B doesn't cover. If you have drug coverage, check your plan's. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. to see what outpatient drugs it covers.

What happens if you get a drug that Part B doesn't cover?

If you get drugs that Part B doesn’t cover in a hospital outpatient setting, you pay 100% for the drugs, unless you have Medicare drug coverage (Part D) or other drug coverage. In that case, what you pay depends on whether your drug plan covers the drug, and whether the hospital is in your plan’s network. Contact your plan to find out ...

Is Part B deductible?

for covered Part B prescription drugs that you get in a doctor’s office or pharmacy, and the Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. applies.

Does Medicare cover transplant drugs?

Medicare covers transplant drug therapy if Medicare helped pay for your organ transplant. Part D covers transplant drugs that Part B doesn't cover. If you have ESRD and Original Medicare, you may join a Medicare drug plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is periodic payment?

The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

How much will Medicare cost in 2021?

In 2021, it costs $259 or $471 each month, depending on how long you paid Medicare taxes. 2 . That doesn’t mean you aren’t charged a deductible. For each benefit period, you pay the first $1,484 in 2021. A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days.

What can influence Part D benefits?

Other types of benefits, insurance, and social services can sometimes influence Part D benefits. 11

How much is Part D insurance in 2022?

Like Part C, each plan has different coverage, deductible, and copayment options. Part D is generally included in your plan premium, but those with reported incomes of more than $88,000 will pay an additional amount. 6 The average Part D premium is expected to be $33 per month in 2022, up from $31,47 in 2021. 9

How long does a hospital benefit last?

A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days . If you re-enter the hospital the day after your benefit period ends, you’re responsible for the first $1,484 of charges again. 3 .

What is the cost of Part B insurance?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. Parts C and D are optional and may cover additional costs, including prescriptions.

What is the Medicare Advantage premium for 2021?

The average plan premium is about $21.00 a month in 2021. 7 . But coinsurance, copayments, premiums, and deductibles may still vary depending on your plan of choice. 3 .

What is a prescription drug deductible?

A prescription drug deductible is the amount you pay for drugs before we begin to pay our share. Several of our HMO plans have a prescription drug deductible.

How much is the deductible for tier 3?

Once you pay your deductible in full, you would just have a copay for any prescriptions. $200 is the total amount of the deductible for Tiers 3, 4, and 5. You will not pay $200 per tier. (The deductible does not apply to drugs on tier 1 or 2.

How to know if you are close to a deductible?

The best way to keep track of how close you are to meeting your deductible is to check your Caremark Explanation Of Benefits, or EOB, which is mailed to members with prescription drug coverage. If you have any questions, you can always give us a call.

What is an example of a HMO value RX plan?

What is an example? For example, if you are in the HMO Value Rx plan and have a prescription for a drug on tier 3, 4, or 5 you would pay the first $200 of your prescriptions before your coverage begins. Once you pay your deductible in full, you would just have a copay for any prescriptions. $200 is the total amount of the deductible for Tiers 3, 4, ...

Is there a deductible for HMO saver?

Our HMO Saver, Basic, and Value Rx plans have a prescription drug deductible for drugs on Tiers 3, 4, and 5. There is no deductible for drugs on Tier 1 and Tier 2.

Does HMO Prime RX have a deductible?

Yes, our HMO Prime Rx and HMO Prime Rx Plus plans don’t have a prescription drug deductible. And, of course, our plans that do not include prescription drug coverage also do not have a prescription drug deductible. Compare our HMO Plans.

How to find out if Medicare covers prescription drugs?

One way to learn about your Medicare prescription drug coverage options is to speak with a licensed insurance agent . You can compare Medicare Advantage plan costs in your area and find a plan that covers the prescription drugs you need.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

How much out of pocket is considered catastrophic?

Once you reach $6,550 in out-of-pocket spending, you are out of the donut hole and enter “ catastrophic coverage ,” where you typically only pay a small copayment or coinsurance payment for the rest of the year.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

Does Medicare Part D have coinsurance?

Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing. Some Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, ...