Full Answer

What is the average cost of Medicare supplement plans?

This year, the average Medicare member will have on average thirty-nine plans to chose from in their area. This is the highest number captured in the last ten years, up by more than ten since 2015. This year 3,834 plans are available in total, and almost ninety percent include coverage to reduce the costs of prescription drugs.

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Should you buy supplemental health insurance?

To fill in these gaps in service, many people find it useful to buy Medicare Supplement Insurance ... gender, health status or other factors.” • Issue-Age Rated: Your premium rate depends on your age when you purchase the policy.

What is the best Medicare supplement plan?

- Medicare Supplement Insurance helps you manage out-of-pocket costs for covered services

- Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share

- Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020

How much does supplemental Medicare cost?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

What is the most basic Medicare Supplement plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services.

Why are Medicare Supplement plans so expensive?

Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

What is the monthly premium for plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

What is the difference between Part F and Part G Medicare supplement?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Do Medicare supplement premiums increase with age?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age.

How do I choose a Medicare supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

How much does AARP Medicare Supplement plan G cost?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan G (1)$173Plan K$70Plan L$136Plan N$1676 more rows•Jan 24, 2022

What does plan F Medicare cover?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.

Why is plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

Medicare supplement plan explained

First things first, before we dig deeper into the costs associated with the Medicare Supplement plan, let’s make sure we’re on the same page with what this plan is.

Why should you get Medicare supplement insurance?

Medicare supplement insurance plans bring plenty of benefits to people aged 65 or those with disabilities. And, it all comes down to efficiently tackling increasing healthcare costs. So, if you’re wondering whether or not Medicare Supplement Plans are worth it, find out that the answer is, “Absolutely!”

How much does Medigap policy cost on average?

Now, let’s get to the main question that probably everybody interested in getting Medigap has on their minds, “what is the average cost of supplemental insurance from MedicareWire ?”. The average Medicare Supplement policy premium cost $154.50 per month in 2022.

How Much Does The Average Medicare Supplement Plan Cost In 2021

The table below displays the average cost of Medicare Supplement Insurance Plan G and Plan F by age.1

Is It Possible To Keep My Doctor On Medicare

If you have Medicare Part B coverage, you can go to any health care provider who takes Medicare and is taking new Medicare customers. You should inquire with your doctor about becoming a new Medicare patient.

Compare Medigap Plans Where You Live

1 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

Medicare Advantage Special Needs Plans May Have Lower Costs

A Medicare Special Needs Plan is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

So How Much Does Medicare Cost Per Month

As you can see, Medicare costs are built up out of many building blocks. Theres no way to tell exactly how much you will pay each month, but this should give you the resources to do those calculations based on your own plans, income level, and healthcare needs.

Medicare Part C And Part D

If youre divorced or recently widowed, youll need to budget for your Medicare Advantage plan or Medicare Part D plan premiums, deductibles and copays. Shop around for the best plan for your needs and budget, as coverage and premium prices vary between providers.

Summary Of Medicare Benefits And Cost

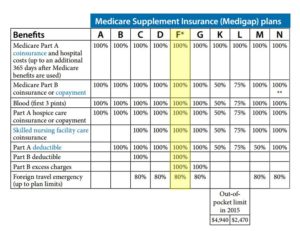

The chart below is a comprehensive list of Medicare Part A and B costs, including premiums, deductibles and coinsurance. Medicare supplemental insurance, known as Medigap, can help cover some of the gaps in coverage and pay for part or all of Medicares coinsurance and deductibles, depending on the policy.

What is the factor that determines the premiums for Medicare Supplement Insurance?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age .

What are the factors that affect the cost of Medicare Supplement?

There may be plans available in your area that cost less than the average listed above for your age. Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates. A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan ...

Why does my Medigap premium increase?

As you age, your Medigap plan premiums will gradually increase each year. Medigap premiums can increase over time due to inflation and other factors , regardless of the pricing model your insurance company uses.

What is the lowest Medicare premium for 2020?

Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

How does age affect Medicare premiums?

How Does Age Affect Medicare Supplement Insurance Premiums? 1 Community-rated Medigap plans#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market. 2 Issue-age-rated Medigap plans#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age. 3 Attained-age-rate Medigap plans#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

How much is the 203 deductible?

The $203 annual deductible equates to around $17.00 per month. This means that a Plan G with a premium of no more than $17.00 per month more than a Plan F option could actually serve as a better value, provided you meet the entire Part B deductible.

When will Medicare plan F be available?

Important: Plan F is not available to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020. If you already have Medicare, you can still enroll in Plan F if the plan is available in your area.