The FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2015 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

What is the current Medicare tax rate?

Jan 01, 2015 · 2015 Social Security and Medicare Tax Withholding Rates and Limits. For 2015, the maximum limit on earnings for withholding of Social Security (Old-Age, Survivors, and Disability Insurance) Tax is $118,500.00. The maximum limit is changed from last year. The Social Security Tax Rate remains at 6.2 percent. The resulting maximum Social ...

Did Obamacare cause new tax increases in 2015?

Oct 10, 2014 · Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147. The Medicare Part A ...

What is the wage base limit for Medicare tax?

The numbers below are for this year, 2015. Part A is free for most of us, as we (often unknowingly) paid taxes toward it while working. Those who don't get Part A …

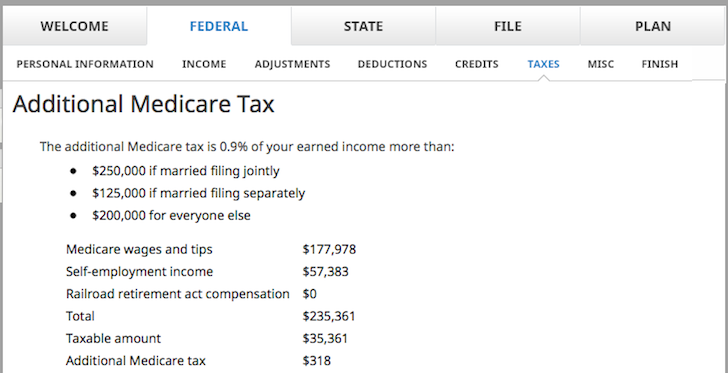

What is the threshold for additional Medicare tax?

What was the payroll tax in 2015?

Again, self-employed individuals are responsible for the entire FICA tax rate of 15.3 percent (12.4 percent Social Security plus 2.9 percent Medicare)....Medicare's Bite.FICA Rate (Social Security + Medicare withholding)20142015Employee7.65%7.65%Employer7.65%7.65%Self-Employed15.30%15.30%1 more row

What was the additional Medicare tax 2016?

2016 Limit Employers are required to withhold the additional Medicare Tax at a 0.9 percent rate on wages and other compensation it pays to an employee in excess of $200,000 in a calendar year.Nov 26, 2015

How do you calculate your Medicare tax?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.Jan 12, 2022

How much is Medicare tax per year?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What is the 2016 Medicare tax rate This rate is applied to what maximum level of salary and wages?

The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings....2016 Payroll Tax Unchanged; Tax Brackets Nudge Up.2016 Tax Rates: Married Filing Joint ReturnIf Taxable Income Is:The Tax Rate Is:Over $466,950$130,578.50 plus 39.6% of the excess over $466,9507 more rows•Oct 15, 2015

What is the Medicare tax for 2021?

1.45%2021-2022 FICA tax rates and limitsEmployee paysEmployer paysMedicare tax1.45%.1.45%.Total7.65%7.65%Additional Medicare tax0.9% (on earnings over $200,000 for single filers; $250,000 for joint filers)1 more row•Jan 13, 2022

Is there a Medicare tax limit?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

Is Medicare tax based on gross income?

The tax is based on "Medicare taxable wages," a calculation that uses your gross pay and subtracts pretax health care deductions such as medical insurance, dental, vision or health savings accounts.Mar 28, 2022

How much do I owe in taxes 2021?

How we got hereFiling status2021 tax year2022 tax yearSingle$12,550$12,950Married, filing jointly$25,100$25,900Married, filing separately$12,550$12,950Head of household$18,800$19,400

What is the Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee's paycheck or paid as a self-employment tax.

Do I have Medicare if I pay Medicare tax?

According to the Internal Revenue Service (IRS), taxes withheld from your pay help pay for Medicare and Social Security benefits. If you're self-employed, you generally still need to pay Medicare and Social Security taxes. Payroll taxes cover most of the Medicare program's costs, according to Social Security.

What is Abacus payroll?

Abacus Payroll, Inc. is a leading provider of payroll solutions for businesses of all sizes. Whether yours is a family-owned small business or a national corporation, we provide payroll, tax and other financial services on time and at an affordable price. Unlike other payroll providers, Abacus Payroll will assign your very own payroll specialist who will understand your payroll needs inside and out. So no more speaking to a different person each time, no more sitting on hold for hours and most importantly no more missed deadlines! Contact us today to see how we can help your business. You can count on us.

Do you have to include employer sponsored health benefits on 2014 W-2?

Employers are required to include the aggregate cost of employer sponsored health benefits on the 2014 W-2’s in Box 12 with code DD. It is for informational purposes only and will not be included in taxable income. Small employers who file fewer than 250 Forms W-2 are exempt.

Does Social Security require W-2s?

Social Security has eliminated the use of magnetic tapes, cartridges and diskettes as a means of filing W-2 reports to SSA. Reports containing 250 or more W-2’s must be filed electronically via the Social Security Business Services Online (BSO).

Do new employees need to file W-4?

All new employees are required to file Forms W-4 and I-9 which are to be kept on file by the employer. A new Form W-4 should be obtained when an employee’s filing status or exemption changes.