What is the maximum premium for Medicare Part B?

Nov 24, 2021 · The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits.

How high will the Medicare Part B deductible get?

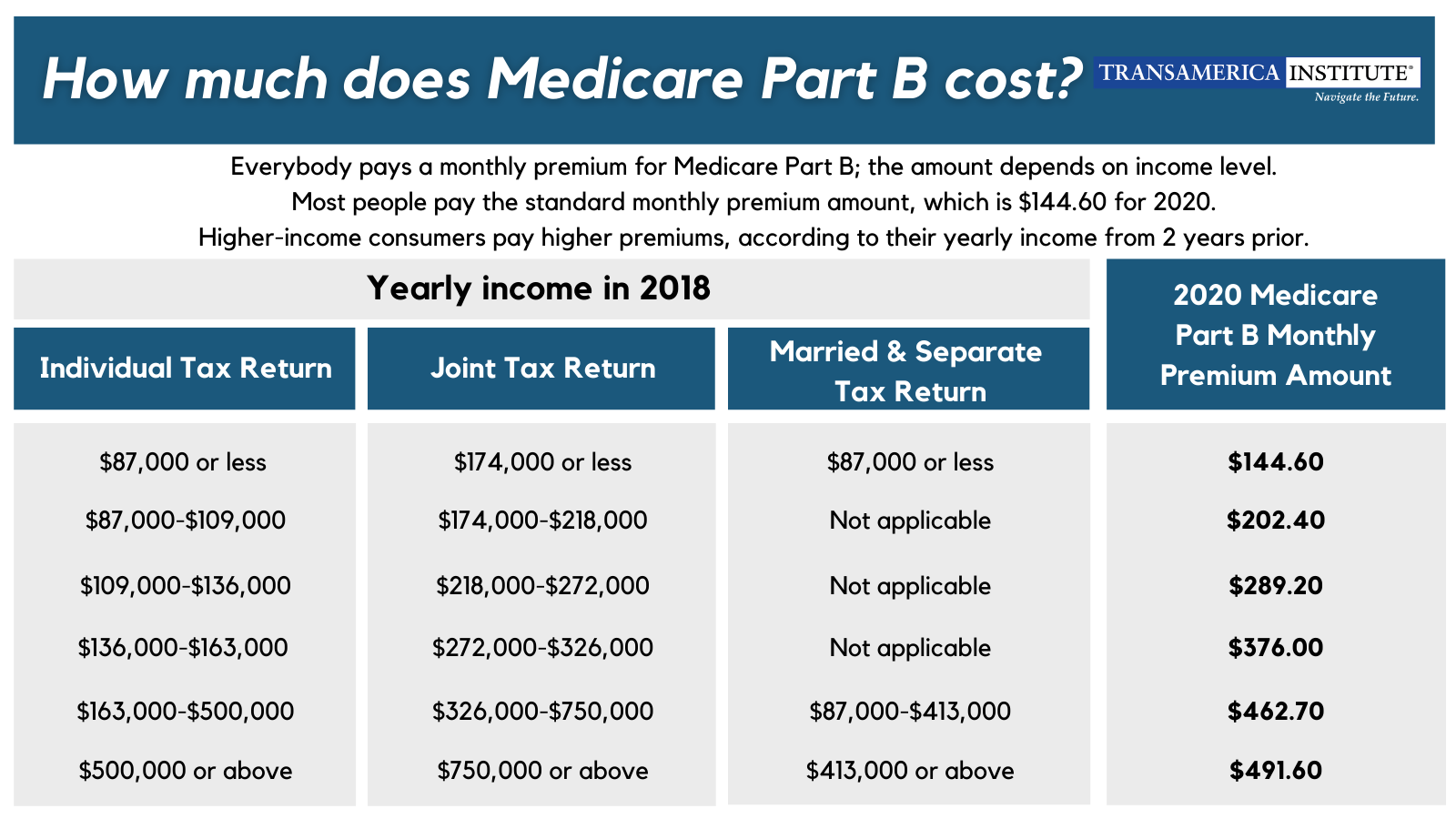

Part B costs: What you pay 2021: Premium $170.10 each month (or higher depending on your income). The amount can change each year. You’ll pay the premium each month, even if you don’t get any Part B-covered services. Who pays a higher premium because of income? How do I pay my Part B premium?

Does Medicaid pay for Part B premium?

Nov 15, 2021 · In 2022, most enrollees will pay $171.10/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2021 ($148.50/month), in 2020 ($144.60/month), and in 2019 ($135.50/month). Some enrollees pay more than the standard premium, if they’re subject to a high-income surcharge(described below).

What are the rules for Medicare Part B?

Nov 03, 2021 · The standard Part B premium in 2021 is $148.50 per month. That's an increase of $3.90 from the 2020 Part B premium. While most people pay the standard Part B premium, other beneficiaries may pay more if they had a higher reported income two years prior (2019).

What is the Part B monthly premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Is the Part B premium going up in 2021?

There's a chance that your Medicare Part B premiums for 2022 could be reduced. Health and Human Services Secretary Xavier Becerra on Monday announced that he is instructing the Centers for Medicare & Medicaid Services to reassess this year's standard premium, which jumped to $170.10 from $148.50 in 2021.Jan 10, 2022

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

What will the Medicare Part B premium be in 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

How much did Medicare go up in 2021?

2021 = $148.50 per month. 2020 = $144.60 per month.Feb 15, 2022

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Why is my Medicare Part B premium so high?

According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much is Part B insurance in 2021?

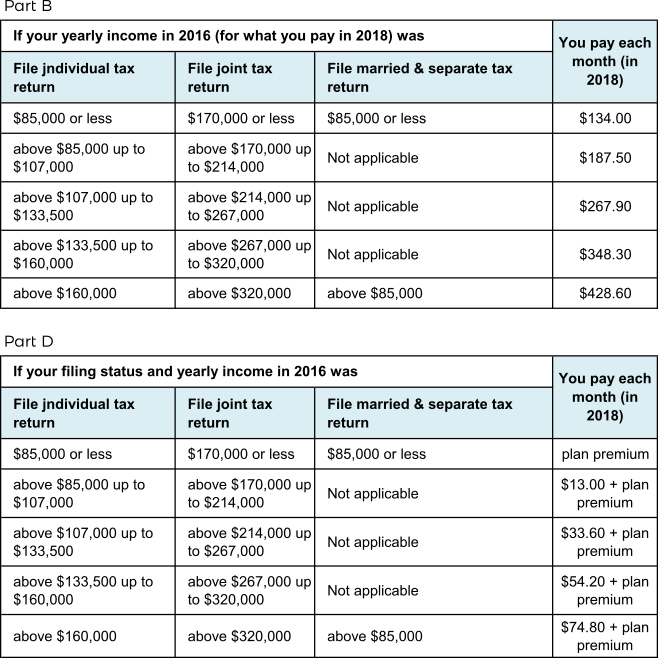

In 2021, most enrollees will be paying $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month).

What is the Medicare deductible for 2021?

Part B deductible also increased for 2021. Medicare B also has a deductible, which has increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20 percent of the Medicare-approved cost for Part B services.

How much is the 2020 Medicare premium?

Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month). But that’s in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium.

What is the income threshold for Part B?

For people with income above $87,000 ($174,000 for a couple) in 2020, Part B premiums for 2020 ranged from $202.40/month to $491.60/month. As explained by the math above, the high-income threshold has increased to $88,000 for a single individual and $176,000 for a couple in 2021.

When do you pay income related premium surcharge?

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. [2019 tax returns were filed in 2020, so those are the most current returns available when income-related premium adjustments are determined for 2021.]

How much is the 2020 Social Security Cola?

But the 1.6 percent Social Security COLA for 2020 increased the average beneficiary’s Social Security benefit by $24/month. Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees have been paying the standard premium in 2020. And for 2021, the 1.3 percent COLA is adequate to cover the increase to ...

Does Medicare cover coinsurance?

But supplemental coverage (from an employer-sponsored plan, Medigap, or Medicaid) often covers these coinsurance charges. For people who became eligible for Medicare before the start of 2020, there are Medigap plans available (Plans C and F) that cover the Part B deductible, in addition to coinsurance charges.

How much is Medicare Part B 2021?

2021 Medicare Part B Costs. The standard Part B premium in 2021 is $148.50 per month. That's an increase of $3.90 from the 2020 Part B premium. While most people pay the standard Part B premium, other beneficiaries may pay more if they had a higher reported income two years prior (2019).

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, provides coverage for certain Medicare Part A and Part B out-of-pocket expenses like deductibles, coinsurance and copayments . This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above.

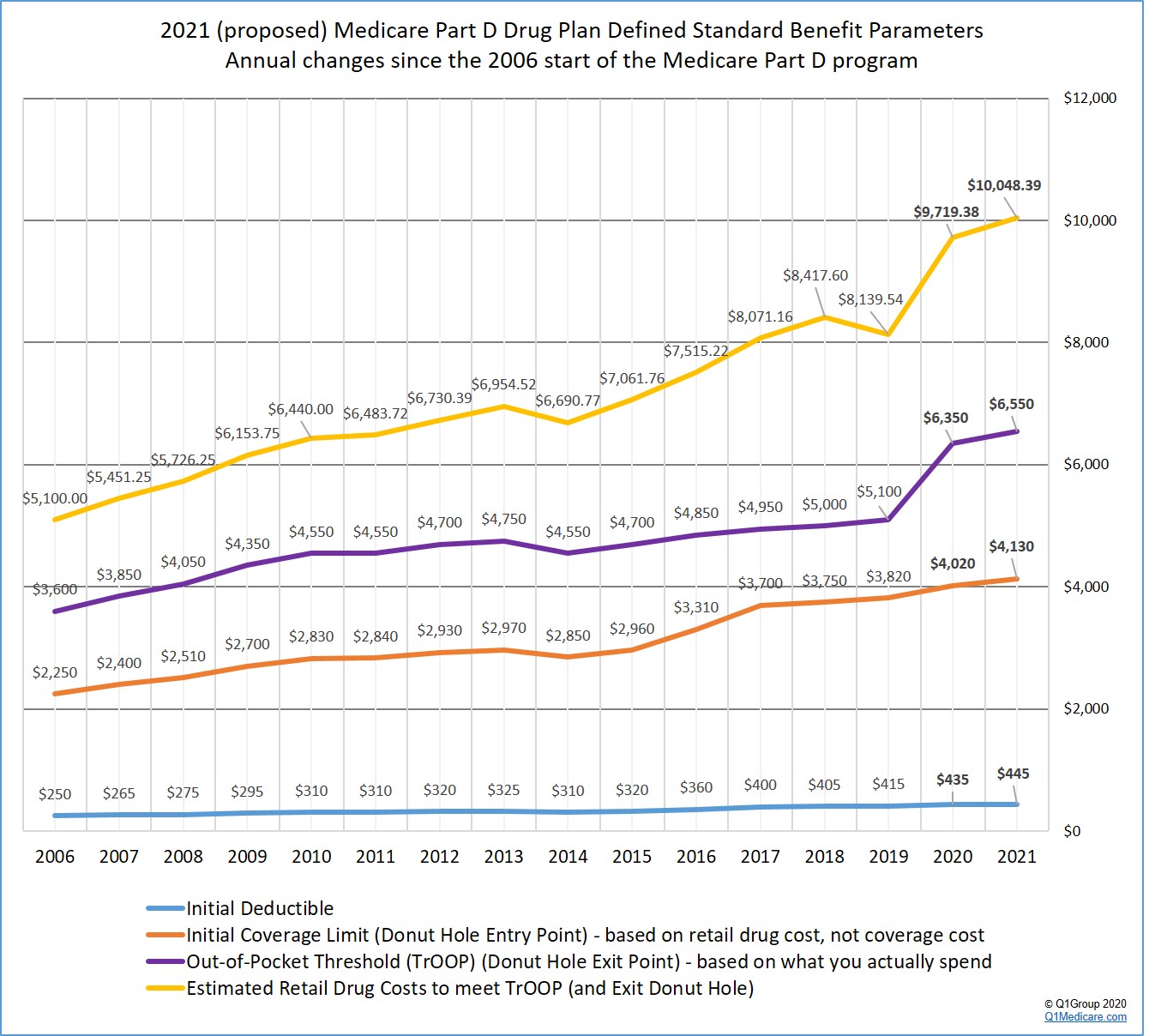

How much will prescriptions cost in 2021?

Through the Extra Help program, prescriptions can be obtained at a significantly reduced cost. In 2021, generic drugs will cost no more than $3.70, while brand-name prescriptions will cost no more than $9.20.

How much does Medicare pay for Part D?

If you earn more than $88,000 but less than $412,000, you’ll pay $70.70 on top of your plan premium. If you earn $412,000 or more, you’ll pay $77.10 in addition to your plan premium. Medicare will bill you for the additional Part D fee every month.

What is SLMB in Medicare?

SLMB, or Specified Low-Income Medicare Beneficiary. If you earn less than $1,296 per month and have less than $7,860 in assets, you may be eligible for SLMB. Married couples must make less than $1,744 per month and have less than $11,800 in debt to qualify. This plan covers your Part B premiums.

Can low income people get Medicare?

Medicare beneficiaries with a low income may be eligible for financial assistance. Low-income individuals may be eligible for help with the costs of original Medicare and Part D. Medicare savings programs cover premiums, deductibles, coinsurance, and other expenses.

What is the income limit for QDWI?

You must meet the following income criteria if you want to enroll in your state’s QDWI program: Individuals must have a monthly income of $4,339 or less and a $4,000 resource limit. A married couple’s monthly income must be less than $5,833. A married couple’s resource limit must be less than $6,000.

Does medicaid cover medical expenses?

If you become eligible for Medicaid, It will cover your expenses. You will not be responsible for premiums or other plan costs. Medicaid qualifying criteria differ from state to state. Use the Health Insurance Marketplace’s tool to see if you qualify for Medicaid in your State.

Will Medicare Part B be paid in 2021?

The majority of consumers will pay the usual Medicare Part B premium in 2021. The premium for the Part D plan you select is your responsibility. Depending on your income, you may be required to pay an additional amount to Medicare. There are different tax brackets for married couples who file their taxes separately.